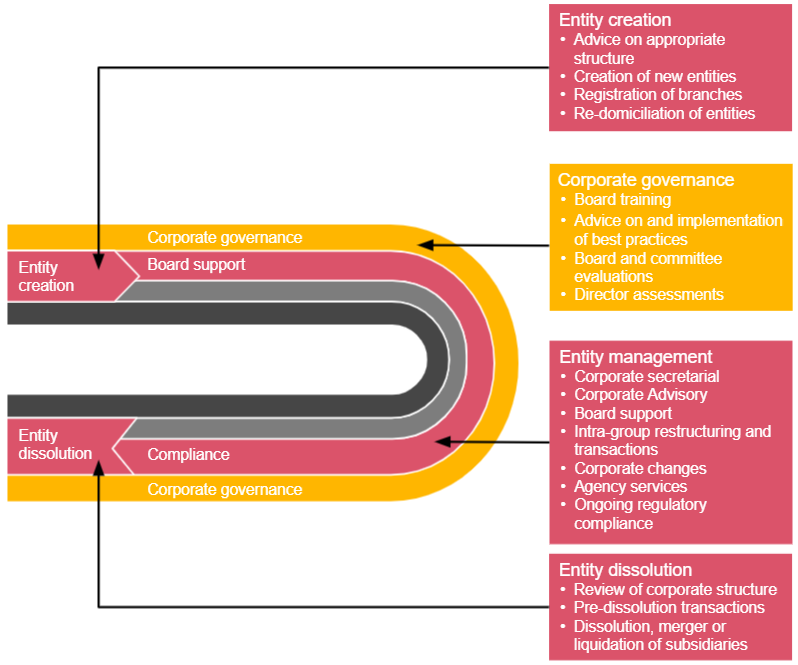

Entity creation, governance and management

New corporate entities must be established in strict compliance with relevant law. If you’re forming a new company, we’ll work with your tax advisors and legal counsel to achieve compliance with all relevant laws and regulations and advise you on how to structure your business. We structure the relevant corporate instruments in a manner that meets the practical goals of the investors within the framework applicable law and practice, advising of the share structure best suited to your needs and taking the relationships of family members, individual investors, multinationals and other subsidiaries into account. Where necessary, we will also work closely with you and your other advisors as you consider the practical matters associated with the establishment of mind and management, tax residency and economic substance, and provide ongoing support and guidance in this regard.

For a public company, we’ll help you develop articles of incorporation, bylaws, a prospectus and attend to any required regulatory requirements, including registrations and licenses.

We’ll then help you address the vital issue of governance. We can assist with the development of a fit for purpose governance framework, ongoing board training, advise on board and committee structures and best practices, and evaluate board and director effectiveness. To help you manage your business, we provide corporate secretarial and board support, agency services and compliance guidance.

Legal services

- Entity formation and licensing

Company secretary/registered agent

Share registration and transfer agency

Corporate restructuring

Intellectual property protection

Franchises

Corporate governance

Trust administration

Corporate mobility

Liquidations and dissolutions

Board and shareholder meetings coordination and minutes taking

Contact us

Ronaele Dathorne-Bayrd

Tax and Legal Services Leader, PwC East Caribbean, PwC Barbados

Tel: +1 246 626 6652