CEE in the spotlight

Macroeconomic insights for decision making in Central and Eastern Europe

Piotr MichalczykPwC CEE Entrepreneurial and Family Business Leader

How private entrepreneurs can transform CEE

By Piotr Michalczyk

Dr. Irena Eris founded her company in 1983 when Poland was still part of the socialist bloc. She quit her job in a state-owned institute and opened a cosmetics "factory" in a 50-square-meter commercial space near Warsaw. At that time, the company produced only one type of cream, which was prepared in a metal pot and applied into the jars with a small spatula. Irena's husband, Henryk Orfinger, then distributed the cream to clients in his small private car, a Fiat 126p. Today, Irena Eris is one of the most influential and recognized businesswomen in Poland. Her company employs about 850 people, has annual sales revenues of about EUR 65 million, and sells cosmetics to more than 70 countries around the world.

There are many more successful family-owned companies in the whole CEE region. Many of them were founded during the communist era and managed not only to survive but also thrive in the last 30-40 years. The key reasons for that were their owners’ creativity, thinking out of the box, hunger for success and hard work. That entrepreneurial spirit also played a significant role in the economic transformation of the region in the 1990s.

Today, family businesses are the backbone of the CEE economy. They contribute meaningfully to the region’s economic growth, development and employment – accounting for 40–50% of all jobs in the private sector. And according to our recently published CEE edition of PwC’s Family Business Survey, 83% of family firms in the region experienced growth over the last financial year. And their growth plans are even more ambitious over the next two years – as many as 80% of CEE family businesses expect to see growth.

But our survey also shows that family businesses in CEE and globally have two weak points that could jeopardize these growth projections and their legacies. In a world where environmental, social, and governance (ESG) credentials and strong digital capabilities are becoming determinants of success, family businesses need to improve on both counts.

Yet family businesses in CEE might have an advantage here. Many of them are in the course of the first succession wave, and this generational change might speed up digitalisation and put a greater focus on ESG. These two transformations will also have a direct impact on the whole region.

1. Digital transformation can’t wait

If any business owners had some doubts about investing in digital capabilities, those were swept away during the pandemic. The lockdowns prompted many businesses to try new digital tactics to reach and serve customers, and family businesses were no exception. Those businesses with an established digital presence generally fared better during the pandemic; those without one struggled and fell further behind if they didn’t have an online sales option.

The digital trends that were accelerated by COVID-19 are likely here to stay. According to CBRE's forecasts, in 2016-2021, the share of e-commerce in CEE-EU increased by 9 percentage points, from 6% to 15%, and is expected to amount to 20% in four years. Poland and the Czech Republic are the leaders in online shopping growth in the region. In these countries, in 2026, the e-commerce market share may reach up to 23% and 24%, respectively. And according to Eurostat, in some CEE countries, the percentage of enterprises engaged in e-sales is as high (or higher) as the EU average.

Digital infrastructure in CEE has also significantly improved over the years. Access to the Internet in the region is almost as widespread as in high-income countries.

Yet according to our 2023 Family Business Survey, only 42% of CEE family firms (the same as the global average) feel they have strong digital capabilities. The good news is that improving digital capabilities (CEE: 47%, global: 44%) and investing in innovation and R&D (37% in CEE vs. 27% globally) are among key priorities for CEE family businesses over the next two years.

This is increasingly important because, empowered by technology, consumers in CEE and globally are seeking and demanding seamless in-store and online experiences that better suit their lifestyles—and pocketbooks, as is revealed by the 2023 PwC Global Consumer Insights Pulse Survey.

Figure 2. Question: Which, if any, of the following are the company’s top five priorities for the next two years?

Source: 2023 PwC’s Family Business Survey, Central and Eastern Europe

Engaging digitally savvy next-generation family members might help companies improve their digital capabilities and lead to conversations about digital transformation that those currently running the business haven’t yet considered. In our 2022 Global NextGen Survey, almost half of respondents (44%) were actively engaged in adopting new technologies. For one in five of them, the pandemic accelerated their engagement with the business in this area.

For Hristo Hristov, CEO of the Bulgarian Darik Group and a next-generation family member, digital transformation is crucial for the family business. He says that it allows the company to stay competitive, improve customer experience, and optimize operations. For example, the company is already implementing ChatGPT in its day-to-day business and exploring more ways to integrate AI or to automate some jobs/processes.

In today’s fast-evolving and dynamic market, harnessing the power of digital transformation is indispensable for our business. It plays a crucial role in making well-informed decisions, streamlining our production processes, enhancing the safety and traceability of our products, and facilitating communication within the company. By leveraging technology, we can better adapt to market changes, improve our competitiveness, and continue delivering high-quality products to our customers.

What’s more, digital transformation not only allows family businesses to achieve efficiencies and save money but also attracts top talent. A number of surveys show that people are increasingly making career choices based on the opportunities to upskill and keep pace with emerging technology.

According to our CEO Survey, as many as 70% of the CEOs in CEE are planning to invest more in automation, 56% of them want to increase investments in AI, cloud and other advanced technology, and 65% plan to upskill their workforce. If family businesses stay behind the curve and don’t improve their digital capabilities, it will threaten their legacy.

2. ESG matters

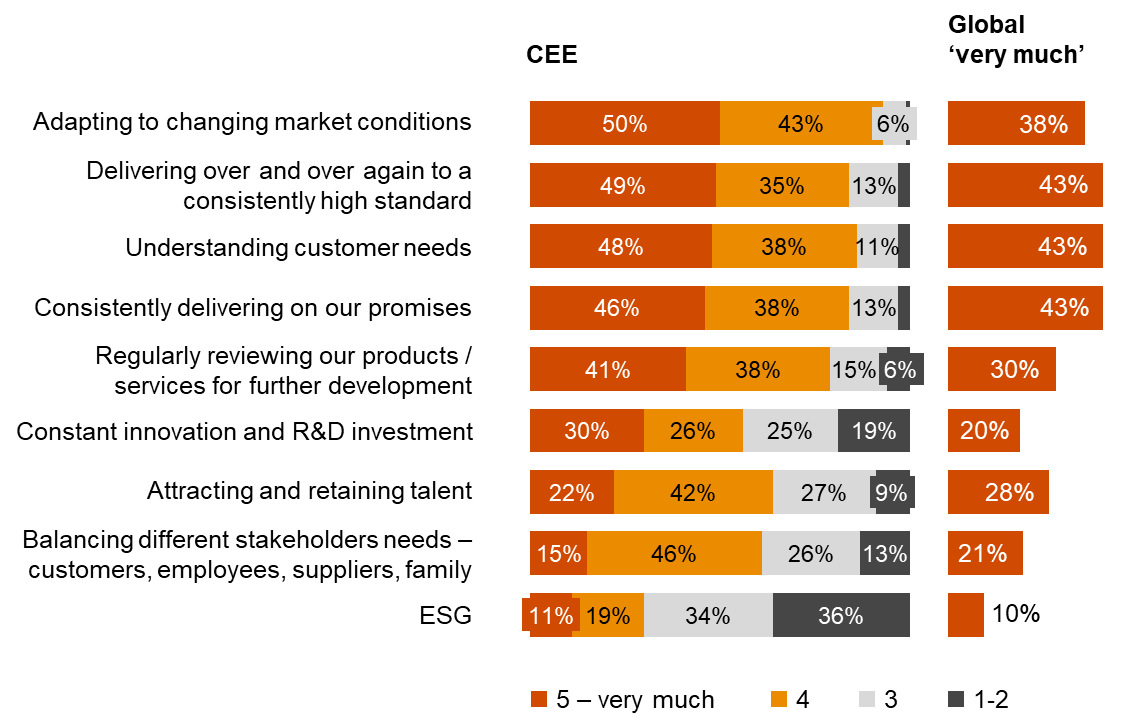

Most family firms in our region and globally admit that issues related to ESG are not among their top current priorities (CEE: 11%, global: 10%). Only 43% of global and 35% of CEE family firms have a person or team in place responsible for ESG. And only a minority set goals and targets for diversity, inclusion and social impact.

Figure 3. Question: For each of the following, how much focus, energy, investment and resource do you put into it right now

Source: 2023 PwC’s Family Business Survey, Central and Eastern Europe

Yet family businesses executives should bear in mind that due to powerful demographic shifts, most of today’s customers and employees hail from generations—millennials and Gen Z—whose values differ from those of older generations. In PwC’s 2023 Global Consumer Insights Pulse Survey of more than 9,000 consumers in 25 territories, 70% of respondents said they would be willing to pay more for food produced in an ethical way. In the 2022 edition of the survey, half of consumers said ESG considerations influenced their trust in a company and their decision to recommend it or its brands to others. Gen Z and millennials were substantially more likely to express this opinion.

Again, this is an area in which younger family generations could hold the key. Our 2022 Global NextGen Survey revealed that 72% of next-generation members in family businesses around the world expect to play a role in increasing their family enterprise’s focus on investing in sustainability in the future.

Family businesses have also a significant potential to lead the real change in ESG across sectors and regions. In the automotive sector, just 36 families control companies that account for 55% of the total global market. Large family-owned businesses dominate retail clothing, engineering and construction.

In the CEE region, some family businesses are already stepping up to lead on ESG.

We have implemented and continuously recertified quality and food safety management systems, complying with the highest standards, such as ISO and IFS. Sustainability helps us maintain our customers' trust and align with global safety initiatives. Additionally, we make conscious efforts to minimize our environmental impact by using packaging with less plastic and opting for easily recyclable materials. This commitment to sustainability ensures that we operate responsibly and contribute positively to our community and the environment.

Family businesses that take a strategic and collaborative approach to ESG will get much more than recognition. Research by Family Capital shows that in recent years, publicly listed corporations that prioritise ESG and have better ESG risk ratings as a group than family businesses have begun to outperform family businesses in terms of market capitalisation. These results indicate that family businesses are losing their trust premium. As ESG has climbed up the investor agenda, family businesses have begun to lag behind, and investors have taken note.

Furthermore, our PwC survey shows that 72% of investors screen target companies for ESG risks and opportunities at the pre-acquisition stage. Private sector commitments are therefore translated into pressure on business partners up- and downstream. For many businesses in CEE, actions on ESG will be crucial to maintain business relationships and secure a place in global supply chains. Thus, family firms need to show they have already started on their ESG journey. That means developing a clearly articulated ESG strategy with explicit milestones and transparent reporting.

Still, the digital and ESG transformations might not be possible without the cooperation of all generations. And for that family-owned companies need good succession planning to lay a solid foundation for their path forward.

Although only 69% of them have some form of governance policy in place within the business (vs. 81% globally), we’ve noticed at PwC that family businesses are more and more aware of the importance of proper succession planning. And they are ready to organize it in a structured way, often with the help of external advisors.

The process is not only focused on simply passing the ownership to the next generation or securing wealth by establishing a proper legal structure, but covers establishing rules of communication, setting up proper family governance and passing knowledge, experience and values to the younger generation. The professionalization of succession planning in the region proves that family businesses in CEE are maturing. And now is the best time for their leaders to build a resilient and dynamic future for their company and the region by focusing also more on digitalisation and ESG.

Sign up to receive new articles from the CEE in the spotlight series

Contact us

Partner, Entrepreneurial and Family Business Leader, PwC Central and Eastern Europe

Tel: +48 502 184 294

Jeffery McMillan

CEE Director of Brand, Marketing & Communications, PwC Central and Eastern Europe

Tel: +48 519 506 633