CEE Insights from the 2022 Global Risk Survey

Embracing risk in the face of disruption

Introduction

Executives in Central and Eastern Europe are more concerned than their global peers about the risks facing business today, with 36% forecasting a decline in revenue, compared with just 15% globally. And yet they’re doing less to respond to these risks. Why?

A look into the data shows that while global business leaders worry about risks across the board, concerns in Central and Eastern Europe are more of a patchwork. It seems that the problem is one of knowledge: we believe that if executives in our region had access to a full view of the risk landscape, concerns would be much more widespread.

Our conversations with CEE clients also lead us to conclude that the lack of action on risk may be driven primarily by a lack of empowerment: decisions are oftentimes made at a central HQ level outside our region in the case of multinationals, leaving local executives unable to act on their concerns.

Navigate the report:

Expected change in revenue Responsibility for risk management Challenges to managing risk Technology spending change Extent of Spending Change Views and practices Negative impact of policy developments Disruptive technologies impact

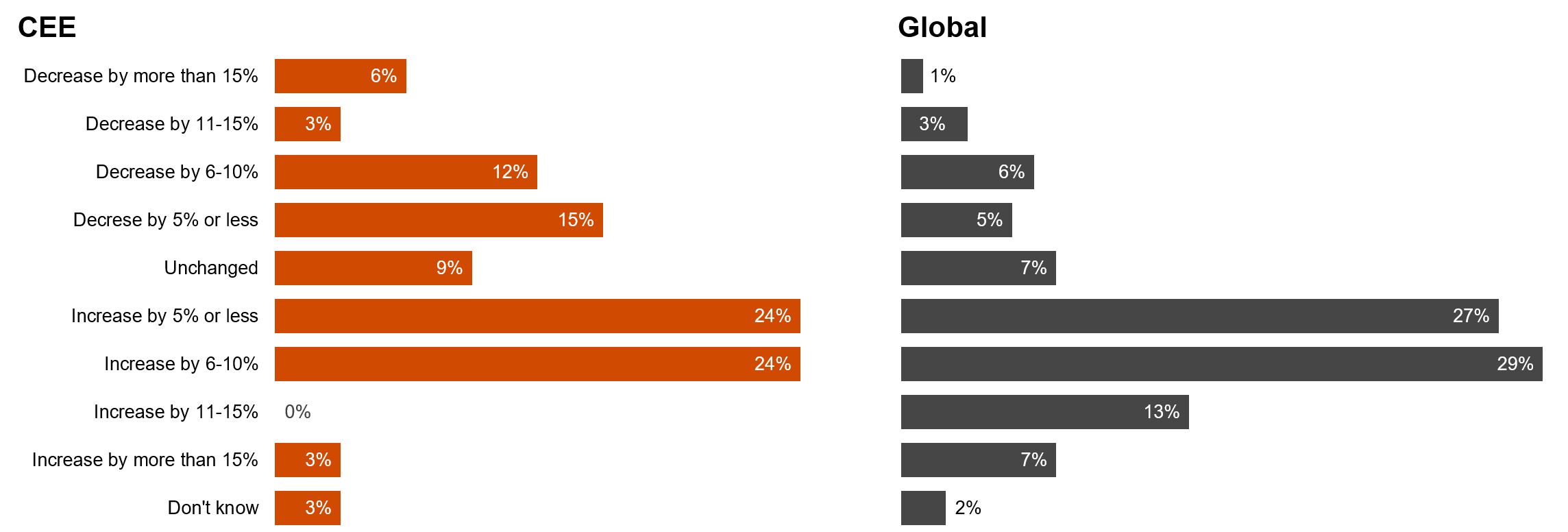

Expected change in revenue

As many as 36% of executives in Central and Eastern Europe expect revenues to decline – more than double the 15% share of global business leaders. This figure is all the more startling in light of inflation, which is affecting our region no less than the rest of the world.

Question: How do you expect your organisation's revenue over the next 12 months?

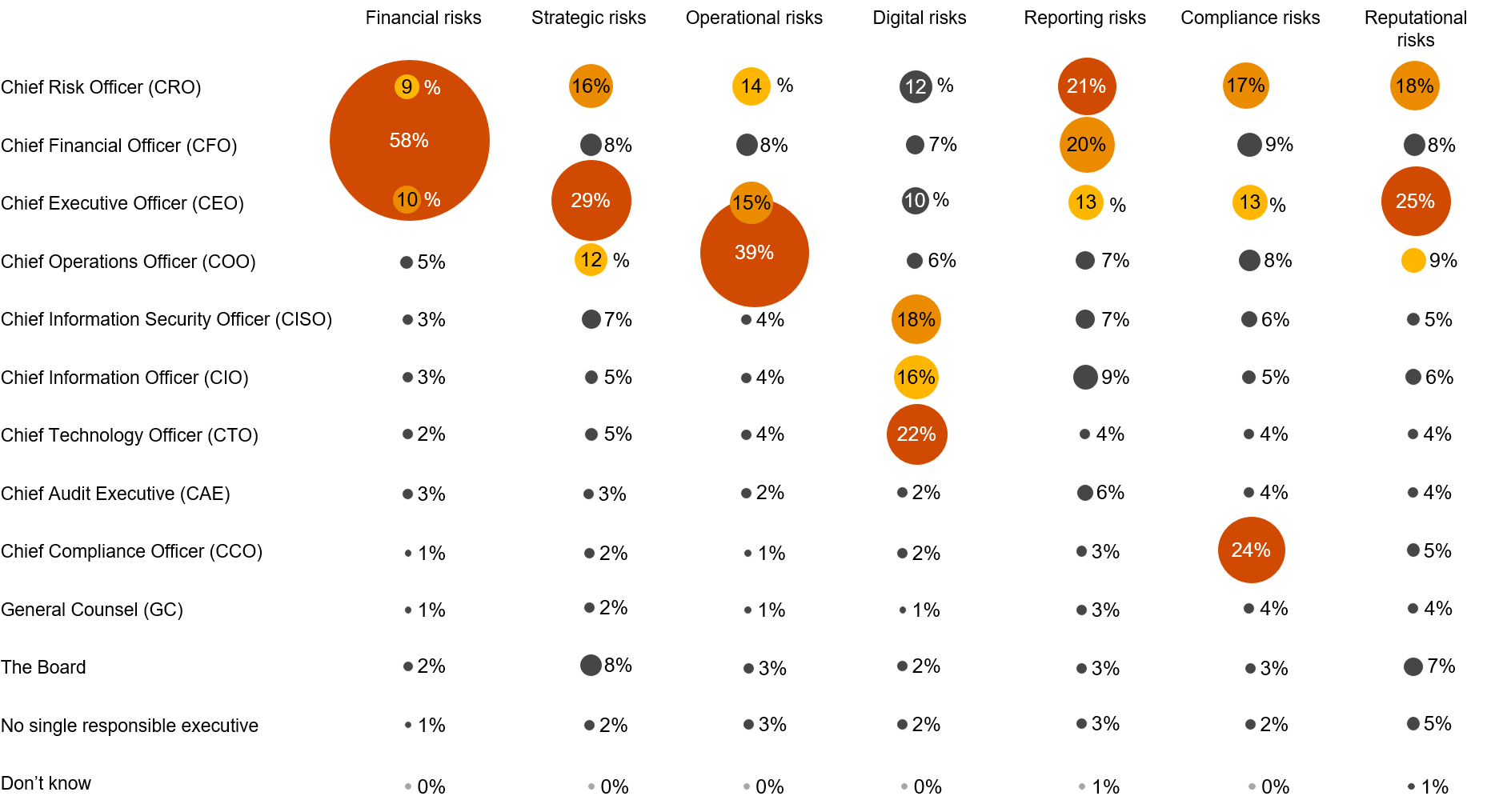

Responsibility for risk management

In our region, responsibility for risk is distributed among executive team members in roughly the same way as elsewhere around the world. (We believe the one significant outlier, operational risk, is the result of differences in terminology and definitions.) That means the lower level of planned action in response to risk can’t be written off by saying different people are in charge of the problem in our region.

Question: Who is primarily responsible and accountable for risk management in your organisation?

The three roles receiving the highest share of responses within each type of risk have been highlighted in the table below.

CEE

Global

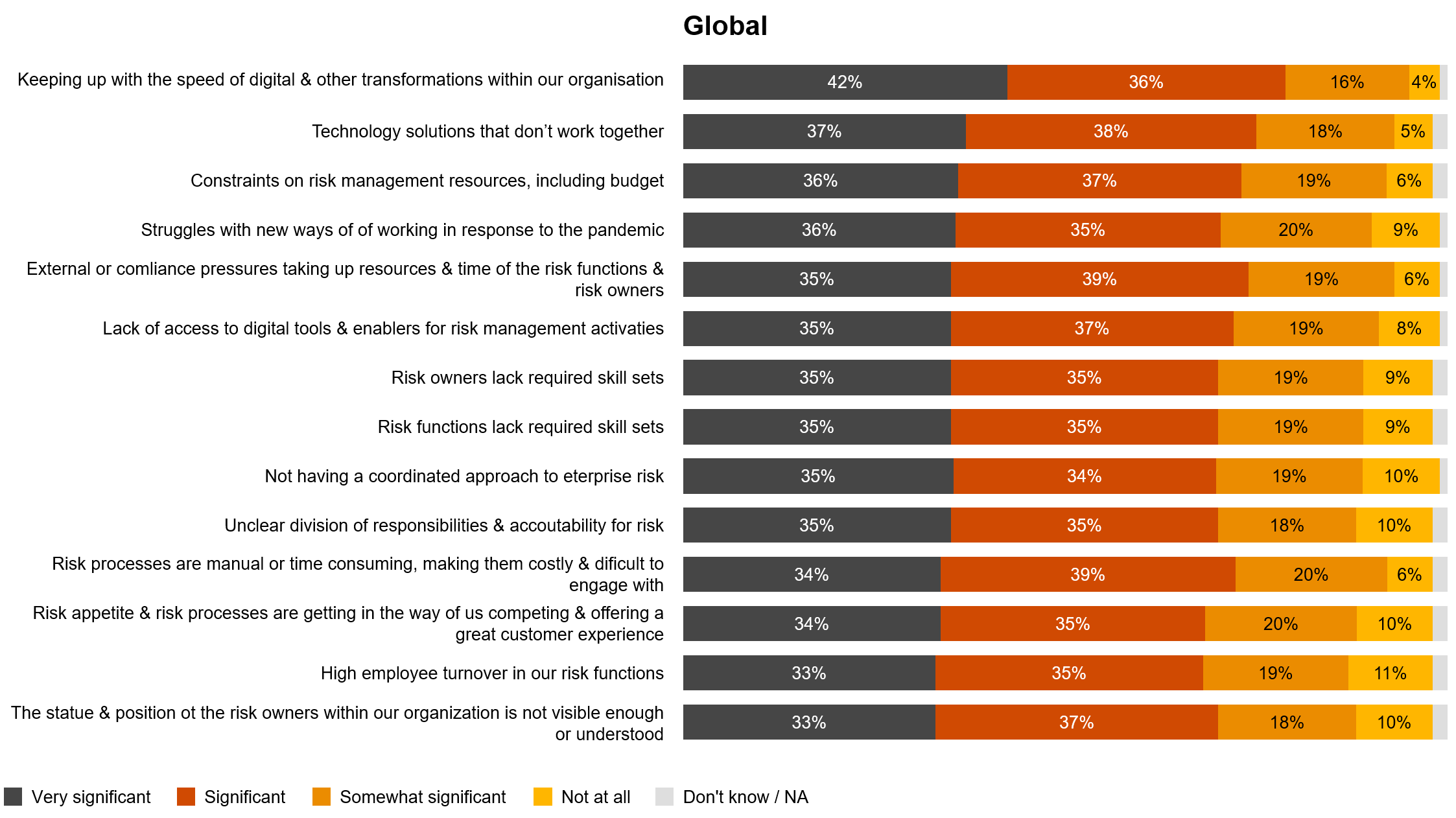

Challenges to managing risk

Global leaders are concerned about a broad range of risks, right across the board; in our region, the picture is much choppier. Based on our conversations with clients, we believe CEE executives need to work harder to develop a complete view of the full risk landscape.

Question: How significant are the following challenges in managing risk in your organisation in 2022?

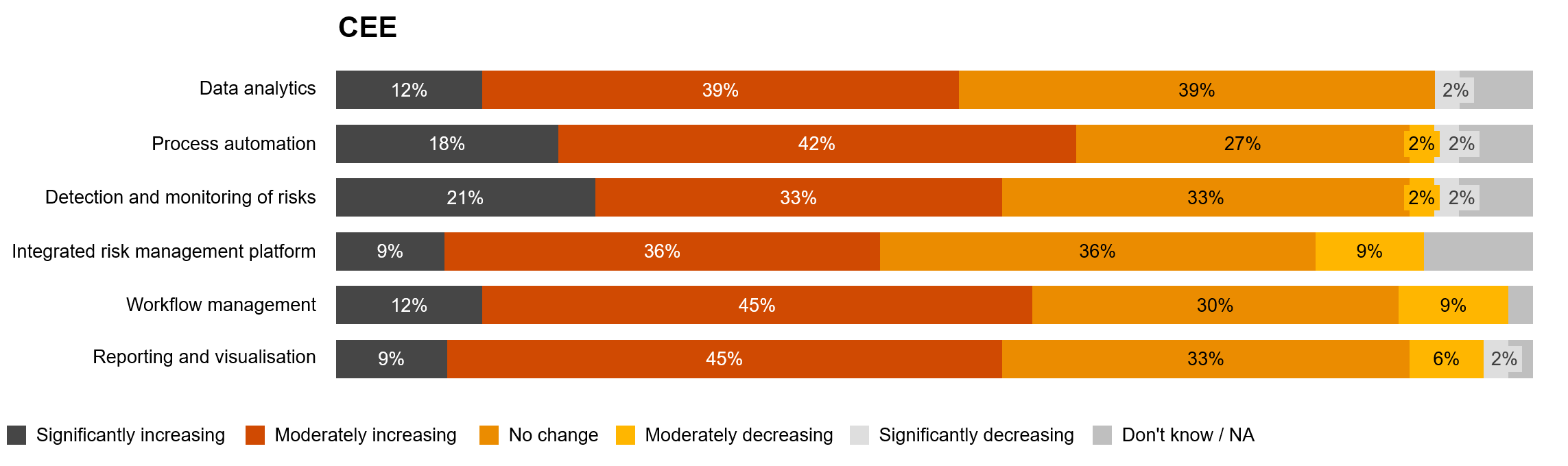

Technology spending change

In every area of risk management technology, CEE executives are less likely to increase spending than their global peers. This seems to be driven at least in part by centralised decision-making: executives in our region may not be sufficiently empowered to direct resources in this area.

Question: To what extend are you changing your spend on the following technology areas to better manage risks in 2022?

R&D Tax Incentives

CEE executives are less motivated by R&D tax incentives when making decisions on risk-management technology investments. In addition to the phenomenon described above, where technology decisions are made on a global level (and thus not considering local tax rules), there’s another reason: corporate income tax in our region is generally low already, reducing the incentive power of tax relief in any one area.

Question: How important are R&D tax incentives in your decision-making to invest in technologies for risk investment in the following areas?

Extent of Spending Change

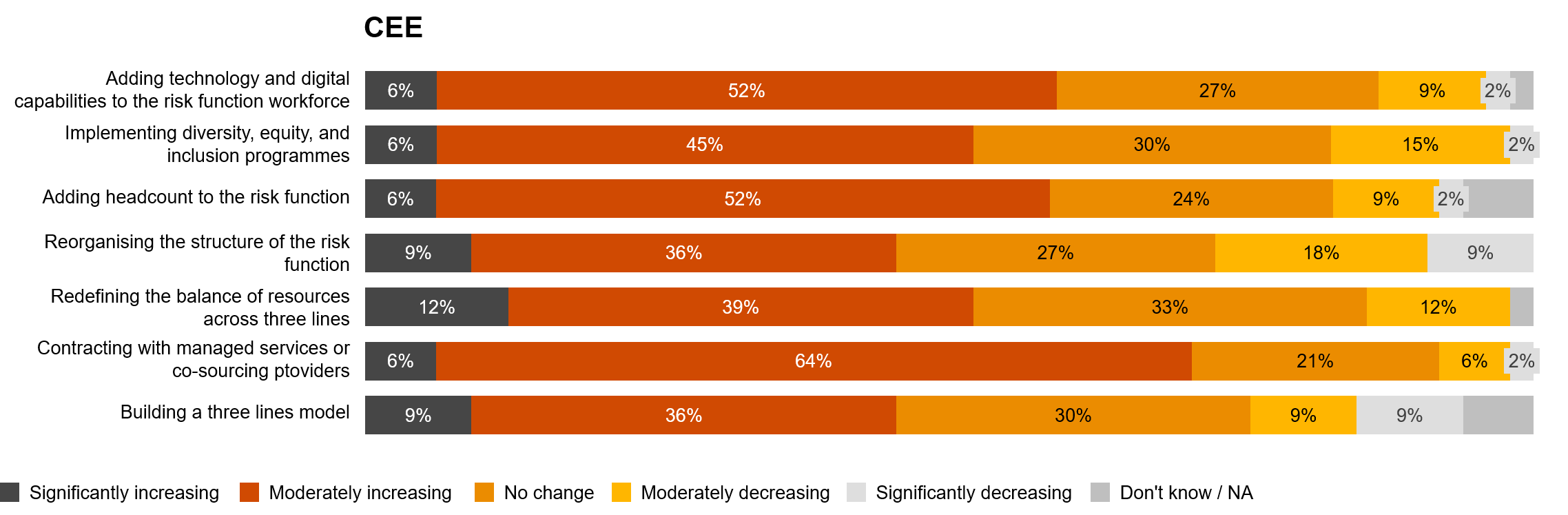

Here too we see fewer executives planning to increase spending, with two exceptions: the same number of leaders in CEE and globally (57%) plan to increase headcount in the risk function, and more of them (74% versus 57%) expect to increase spending on managed services or co-sourcing.

Qustion: Thinking about the practices affecting the risk management workforce, to what extent is your spend changing on the following in 2022?

Risk management - views and practices

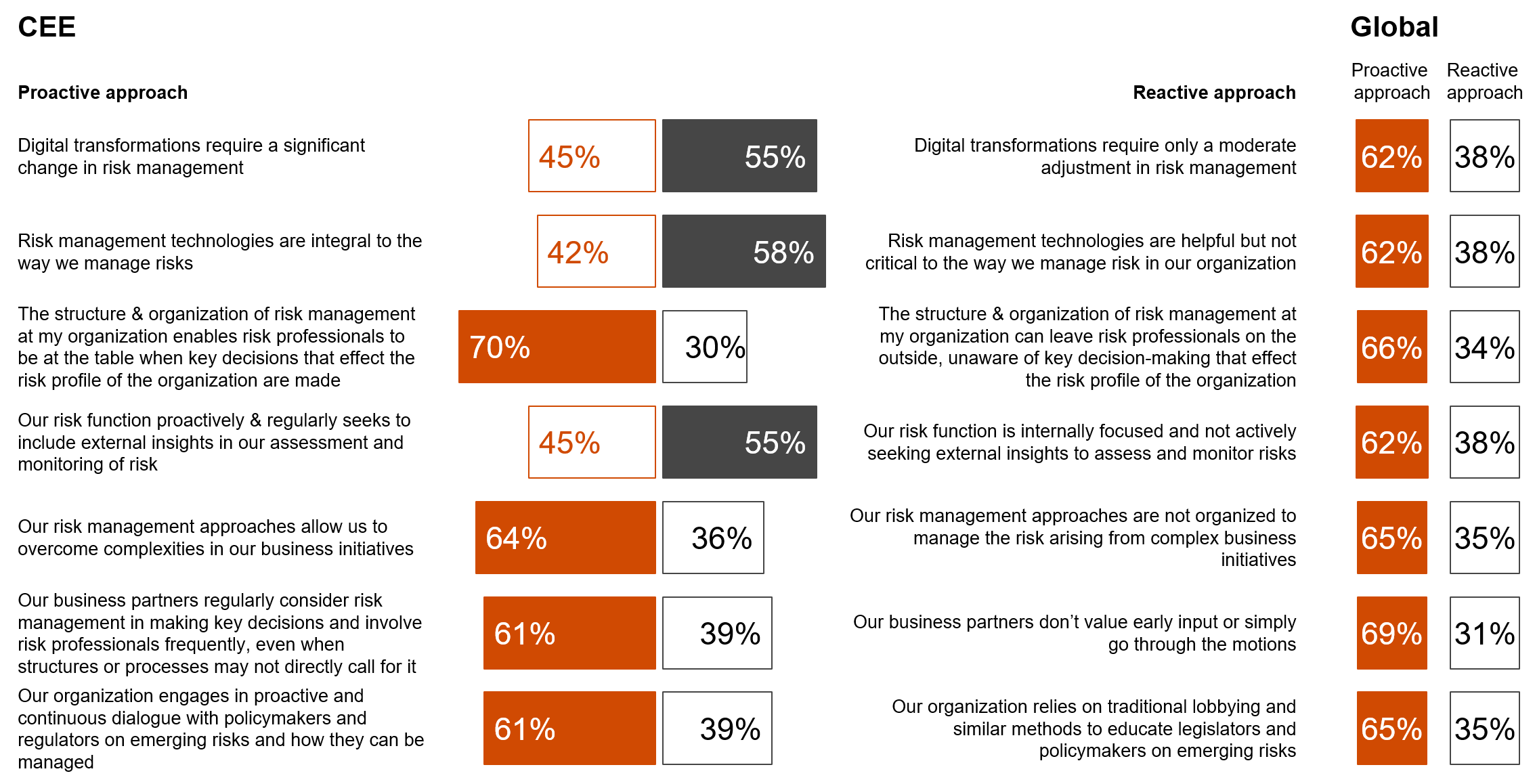

There’s only one area of risk management practice where CEE executives report a more proactive approach than their global peers: the structure and organisation of the function.

Question: For each pair of statements, please indicate which one best represents your organisation's view and practices with regard to risk management.

Negative impact of policy developments

Managers in our region are less concerned about policy changes than their peers around the world. We see two explanations for this: first, CEE executives are used to rapidly shifting regulations. And second, some of the areas mentioned, e.g. cryptocurrency, are very lightly regulated in our region.

Question: How concerned are you about the negative impact of the following policy and regulatory developments on your business in 2022?

Disruptive technologies impact

With a couple of exceptions, here in CEE executives’ thinking is more closely aligned with the rest of the world. This speaks well for the pace of technology adoption in CEE economies as a whole.

Question: Thinking about the next three years, which of the following disruptive technologies does your organisation expect to have a significant impact on your business?

About the survey

The 2022 Global Risk Survey is a survey of 3,584 business and risk, audit and compliance executives conducted from February 4 to March 31, 2022. Business executives make up 49% of the sample, and the rest is split among executives in Audit (16%), Risk management (24%), and Compliance (11%).

Fifty-eight percent of respondents are executives in large companies ($1 billion and above in revenues); 19% are in companies with $10 billion or more in revenues.

Respondents operate in a range of industries: Financial services (23%), Industrial manufacturing (22%), Retail and consumer markets (16%), Energy, utilities, and resources (15%), Tech, media, telecom (13%), Health (9%), and Government and public services (2%).

Respondents are based in various regions: Western Europe (30%), North America (29%), Asia Pacific (21%), Latin America (12%), Central and Eastern Europe (3%), Middle East (3%), and Africa (3%).

The sample for Central and Eastern Europe consists of responses from Czech Republic, Poland and Romania (base: 33).

PwC Research, PwC’s global Centre of Excellence for market research and insight, conducted this survey.

Executives in Central and Eastern Europe are more concerned than their global peers about threats to their revenue from the many risks our world is facing – but at the same time, they’re doing less, and spending less, to attempt to mitigate those risks. That’s the main conclusion from this year’s edition of the Global Risk Survey, which for the first time includes a section devoted to our part of the world. The results raise some key questions about how companies in CEE are doing business. They also suggest some ways we need to change.

Let us know how we can help:

Contact us

Partner, CEE Tax Reporting and Strategy Leader, PwC Poland

Tel: +48 22 746 7449