Last year, global sales in the automotive industry declined by around 14%. The electric vehicle market, however, recorded outstanding growth of 46% globally. Why is the electric vehicle market more resilient to the negative impacts of the pandemic?

Is the pandemic an accelerator, a blocker or both for e-mobility?

Our Driving to tomorrow webcast series addresses these questions. We kicked off the series on 23 March with a scene setter for the sessions to come. Hosted by PwC CEE Automotive Industry Leader Jens Horning, panelists discussed the state of the industry and the challenges and opportunities that lie ahead.

Upcoming conversations will focus on the supply chain ecosystems, the manufacturers (OEMs vs upstarts) and consumer trends.

The future is electric. There are a lot of challenges and obstacles, but that’s the right direction.

Many thanks to our panelists:

- Maciej Mazur, Managing Director, Polish Alternative Fuels Association

- Jonas Seyfferth, Director, PwC Strategy& Germany

- Jens Hörning, Automotive Industry Leader, PwC Central & Eastern Europe

Missed the event? Watch the highlights or read the recap below.

Watch the 15-minute executive summary of the webcast

Watch the teaser video from the webcast

Recently, several European countries sent a letter to the EU Commission and demanded to announce a date of stopping registrations for ICEs (so classic combustion engine cars), and currently the year 2035 is being discussed in that respect. However, it is not that easy to simply stop selling combustion engine cars, because both the manufacturers and the suppliers highly depend on the cash flows generated out of the classic combustion engine segment, specifically when you think about SUVs and luxury cars. They need those cash flows in order to be able to finance the investment needs that are needed to scale up the electric vehicle segment.

Scenario planning by Jens Hörning, Automotive Industry Leader, PwC Central & Eastern Europe

As a result of the pandemic, 2020 was the weakest year for automotive production and sales since 2009. Despite the industry’s global decline, e-mobility is emerging at an accelerated pace. While China still remains the largest market for electric vehicles, Europe is the driver for growth.

Why is the electric vehicle market resilient to the negative impacts of the pandemic? It is difficult to tell whether the pandemic is an accelerator or blocker, or both, for e-mobility.

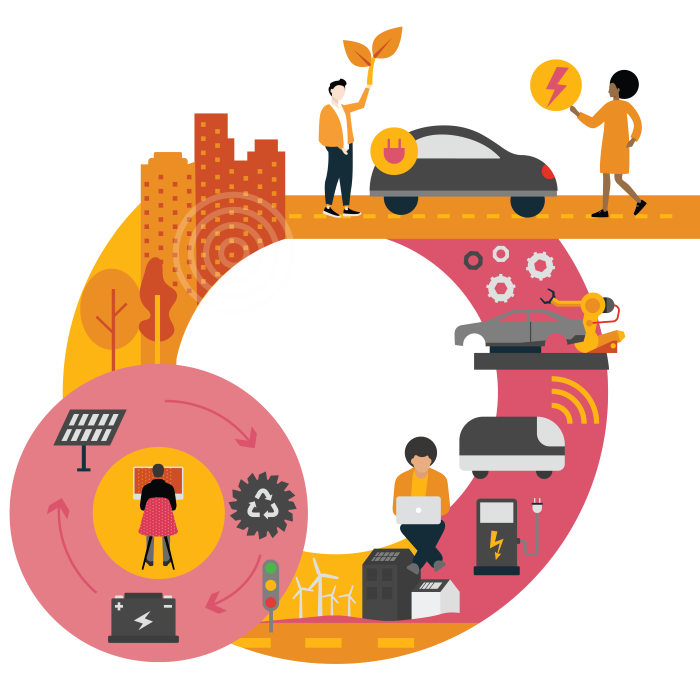

Some of the key drivers to electrification include CO2 emission targets, consumer demand and supply chain development.

On the production side, the battery electric vehicle segment has strong potential for growth in Central and Eastern Europe.

Status of e-mobility transformation, insights from PwC Strategy&’s Digital Auto Report by Jonas Seyfferth, Director, PwC Strategy& Germany

What are the key drivers which accelerate or decelerate market dynamics in the post-Covid era?

Market drivers will include how the overall car parc is developing overtime, vehicle segments and consumer preferences. In light of COVID-19, we are seeing a consumer preference to own a personal vehicle. On the other hand, a lot of OEMs and start-ups are pushing for car subscription models.

Digital enablement programmes, doubling down on a target investment area and joining a platform-based business model will be key for automotive players over the next 10 years.

Register for the full Digital Auto Report here.

There is not one specific point in time where electric vehicles will dominate all markets, but it very much depends on the vehicle segment and the range you’re looking at.

I believe on one hand, there is great potential for the industry, on the other hand there is a challenge coming from the consumers who want more with less money, so to say. So I guess the challenge will be specifically in the battery segment and in the software connectivity segment to scale that up to be competitive going forward and to be attractive from the price perspective.

The e-mobility transformation journey in CEE - Poland in focus by Maciej Mazur, Managing Director, Polish Alternative Fuels Association

Focusing on Poland, there are two key challenges for the transportation sector: the reduction of greenhouse gas emissions and the reduction in the number of the most emission intensive vehicles. Raising environmental awareness and promoting energy efficient vehicles can help.

Poland has already seen some changes, such as an electromobility act in 2018. There are incentives for battery electric vehicle owners and green registration plates for those vehicles. But subsidies for both the vehicles and infrastructure are still needed.

Increase in emissions in the transportation sector is growing all over the world. But it’s growing quite fast in a country like Poland, much faster than the EU levels.That’s the sign that we have to do something to change the situation.