No time to lose

Welcome to Fast forward or fall behind: Caribbean Digital Readiness Survey 2024

When we last surveyed Caribbean businesses about their digital readiness in 2021, respondents were keenly aware of how digital transformation could help them to boost productivity, drive innovation and sharpen competitive differentiation. But there was a big gap between the ‘transcenders’ (top 5%) who were reaping the digital dividend and a trailing pack that were struggling to realise their ambitions.

Cut to 2024 and digital readiness has moved from future goal to pressing necessity – businesses can either fast forward or risk falling perilously behind their competitors.

- In this report, we look at how far Caribbean businesses have come and how to move further and faster in driving transformation and becoming a digital leader.

%

of Caribbean businesses surveyed

are seeing a return on their digital investments. How can your business pick up the pace of change and make sure you’re in this leading pack?

The impetus to reinvent is intensifying

Our latest Caribbean Digital Readiness Survey highlights the growing sense of urgency within boards and business teams as they strive to keep pace with advances in technology and shifting customer expectations.

Artificial intelligence is sharpening the focus – creating a catalyst for innovation and business model reinvention on the one side, and a high degree of uncertainty and fear on the other.

As PwC’s 2024 M&A Outlook highlights, digitalisation remains a strategic priority for businesses as they need to address consumer expectations and build market position.

Well-targeted investments in systems and skills are clearly critical. But they’re not enough on their own to accelerate transformation and move out in front.

The businesses reaping the digital dividend are marked by the boldness of their ambition, the readiness of their workforce to embrace new possibilities, and their agility and resilience in the face of continual disruption and change.

Seven key takeaways

- 1. Thriving in an age of continuous reinvention

- 2. CEOs take ownership of transformation

- 3. Artificial intelligence is accelerating the pace of change

- 4. Digital IQ rising, but this isn’t translating into innovation

- 5. While some Caribbean businesses are thriving, others risk falling behind

- 6. Cyber vulnerabilities are increasing

- 7. Legacy systems are biggest barrier to progress

1. Thriving in an age of continuous reinvention

Nearly half of Caribbean businesses surveyed (47%) see a return on their digital investments in delivering value or transformative effects, including:

- Creating better customer experiences (65%)

- Improving decision making (54%)

- Enhancing brand (47%)

2. CEOs take ownership of transformation

The number who see their chief executive as a champion for digital transformation highlights the growing strategic importance and urgency of operational modernisation and business model reinvention.

3. Artificial intelligence is accelerating the pace of change

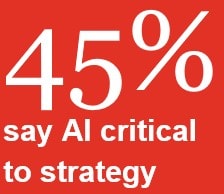

45% of respondents in the Caribbean see artificial intelligence (AI) as the most critical technology to their company's strategy today. That grows to 52% in three years as the transformational impact of AI gathers pace.

4. Digital IQ rising, but this isn’t translating into innovation

Average Digital IQ has risen to 67/100, up from 63 in 2021. Respondents were asked to rate their organisation's Digital IQ on a scale of 0 to 100, where 0 = weak and 100 = strong. However, while IQ has risen, just 25% of respondents believe their business strongly encourages digital innovation and adaptability.

5. While some Caribbean businesses are thriving, others risk falling behind

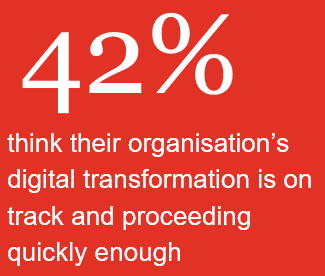

More than a third of respondents believe their organisation faces a survival-level threat from digital disruption. Only a quarter see their organisations as digital leaders, while 42% think their company’s digital transformation is on track and proceeding quickly enough.

6. Cyber vulnerabilities are increasing

55% say their cybersecurity needs improvement

Digital transformation and data proliferation are ramping up the cyber risks and need for effective protection. But over half of respondents acknowledge their ability to safeguard sensitive data and defend against emerging threats need improvement.

7. Legacy systems are biggest barrier to progress

This highlights the urgent need to clear away the legacy systems and step up the pace of modernisation.

Human-led, tech-powered: Digital agents and skills

Assessing whether Caribbean businesses have the tech skills and business acumen to drive digital transformation.

The survey highlight the step-up in investment in workforce upskilling. The benefits can be seen in the rise in Digital IQ – how well an organisation understands and captures the value of digital investments in tools, business processes and culture.

The risks of underestimating the importance of upskilling are further highlighted in PwC’s Global Hopes and Fears Survey, which finds that the majority of workers do not appear to have clarity on how their job requirements may change. What’s more, workers whose jobs don’t require specialised training appear the least likely to see change coming.

- Only 15% of these respondents say the skills required to do their jobs will change in the next five years, compared with 51% of their counterparts whose jobs are more specialised.

Encouragingly, 68% of Caribbean respondents see their leader as a champion for digital transformation. However, only 59% believe their leadership is sufficiently digitally savvy and helps the workforce think in new ways.

When respondents were asked about the barriers to upskilling their workforce, the top three were: Lack of time (40%), lack of budget (36%) and lack of strategic focus on training (28%).

Equipped to compete: Digital tools and applications

Assessing whether Caribbean businesses have the necessary software, applications and online platforms to improve customer experience, sharpen process efficiency and drive down costs.

The survey highlights the importance of digital technology – especially AI – in meeting key business objectives in areas ranging from cost reduction to improved customer experience. Many also see emerging technology as a platform for meeting future needs as their markets evolve and new opportunities open up.

- A surprisingly high proportion of respondents (55%) are still not fully utilizing data tools across all operational activities, even though this is key to cost control and improved productivity.

- Similarly, only 17% report that data analytics plays a central and critical role in guiding decision making and processes.

- In addition, only 59% of the businesses taking part in our survey are able to leverage their use of digital technologies to differentiate their products and engage with customers.

Empowered, connected and collaborative: Digital systems and infrastructure

Assessing whether Caribbean businesses have the connected digital systems and infrastructure they need to power transformation, strengthen communication and collaboration; This power and connectivity are critical in their ability to operate, grow, innovate and respond to demands.

Among the trickiest questions facing businesses as they look to accelerate digital transformation and realise the return is how and how quickly to retire and replace their legacy systems.

Only 53% have been able to prioritise the technology and infrastructure changes that will have the biggest impact on their business. Only 37% have implemented design thinking and/or agile methodologies for technology upgrades.

Concerns over cybersecurity further highlight the challenges of creating and running a digitally-powered organisation.

- More than half of the respondents (55%) acknowledge that their ability to safeguard sensitive data and defend against emerging threats needs improvement.

Ready to respond: Digital ecosystem and culture

Assessing Caribbean businesses’ strategy and culture and gauging how well they’re integrated with necessary stakeholders and their technology and systems. Getting this right enables organisations to reward innovation, promote resilience and respond rapidly to change.

When asked which companies are setting the digital pace, familiar global names such as Apple, Amazon and Microsoft are at the fore. But respondents also cite an encouraging number of national and regional champions.

Asked to compare their organisations to the digital leaders, most respondents acknowledge a significant and sometimes glaring divide. Only a quarter consider their businesses to be digital leaders. But more encouragingly, over a third believe that they are keeping pace with the digital front-runners on a number of key fronts. Chief among these is realising value from new digitally enabled ways of working (50%); a further 18% believe they are ahead of them.

- More than 40% also believe that their ability to attract workers with the right skills for the digital era, encourage rapid innovation across their organisations and realise value from new technologies is on a par with the leaders.

- And when we look at which companies are going to be challenging the leaders in the future, it’s encouraging to see that 79% believe they have a culture that promotes innovation; 25% strongly agree while 54% say their organisation somewhat encourages innovation and adaptability.

Delivering the digital dividend

Threats and opportunities in an age of continuous reinvention

When we asked businesses where they expect to see the most value from their digital investments, most point to creating better customer experiences, improving decision making and enhancing their brand.

But some organisations are more successful than others in realising this value potential. What’s clear from our experience of working with a range of businesses in the Caribbean is that digital leaders have the human-led, tech-powered insights to get closer to customers, understand their needs and develop the increasingly innovative, sustainable and personalised products and services needed to meet fast-changing demands.

The leaders are also building on firm systems foundations including full migration to the cloud and harnessing the latest advances in AI – generative artificial intelligence (GenAI) in particular. We’re seeing how this is enabling them to boost productivity, carve out new revenue streams and develop solutions to pressing problems like climate change, rising costs and supply chain disruption.

The opportunities and risks of Gen AI are highlighted in PwC’s 27th Global Annual CEO Survey. In the next year, nearly 60% of CEOs expect GenAI to improve product or service quality.

Within the next three years, nearly seven in ten anticipate that GenAI will increase competition, drive changes to their business models and require new skills from their workforce.

Five ways to speed up digital transformation

Caribbean Digital Readiness Survey 2024

Fast forward or fall behind

About the survey

From November 2023 to January 2024, PwC surveyed 76 senior executives across the Caribbean, including in Anguilla, Antigua and Barbuda, The Bahamas, Bermuda, Barbados, Jamaica, Trinidad and Tobago, and Turks and Caicos Islands.

Among the executives who participated in the survey:

- 43% were CEO/CFO

- 57% were CIO/CRO/Other

- 24% lead organisations with revenues of US$100m to more than US$500 million

- 41% lead organisations with revenues between US$2 million and US$99 million

Contact us