For directors across the Caribbean, 2023 remained another challenging year in the boardroom with the change imperative top of mind. From the diversity of the board to oversight of increasing ESG risks, directors are still coming under increasing pressure to rethink governance and decision making processes. Stakeholders are looking to corporate leaders to address major social issues including global conflicts and extreme weather events. Turning words into actions took a ‘pulse’ of directors from private and public sector organisations across the region.

Snapshot

ESG lacks sufficient scrutiny and understanding

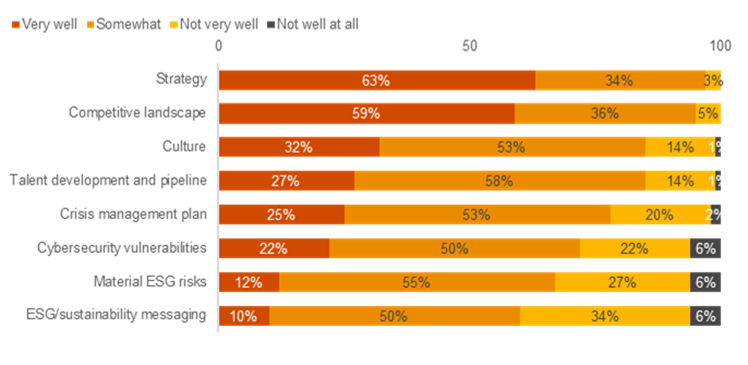

More than 50% of respondents now consider ESG within their strategy and risk management to at least some extent. 10% strongly agree that ESG is regularly on the boardroom agenda or that they have a defined process for ESG oversight. The impact of ESG on their companies is also the area that boards acknowledge they know the least about.

How well do you think your board understands the following as it relates to the company?

%

Believe that diversity brings unique insights to the boardroom.

The dial on diversity isn’t moving fast enough

70% strongly agrees that diversity brings unique insights, while 44% strongly agree that diversity improves the board. 30% strongly agree that diversity improves the companies performance but nearly a quarter report that they’ve taken no action to boost boardroom diversity in the last two years. A further third has engaged in discussions, but got no further.

Board assessments miss opportunity to improve performance

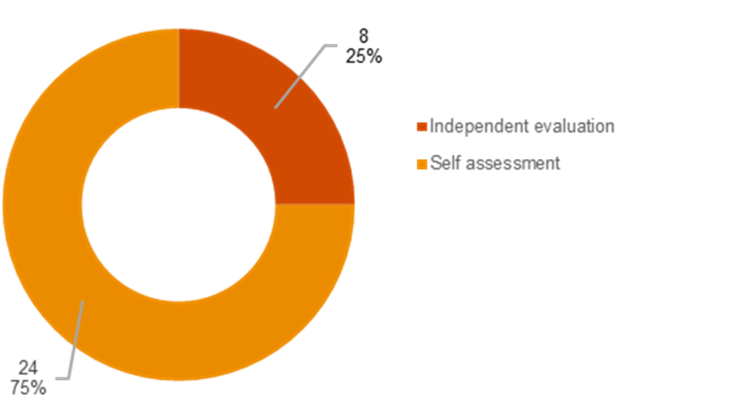

More than 40% of the organisations don’t conduct regular board assessments. Of the nearly 60% who do, most are evaluated internally rather than independently. In this case reviewers may lack sufficient knowledge to evolving best practice and be reluctant to criticise their bosses.

If your board has done an assessment, was it a self assessment or independent evaluation?

%

respondents spending less than 100 hours on oversight

Time spent on oversight

The proportion of respondents spending less than 100 hours on oversight (43%) has actually risen since 2022, despite the mounting complexity and change their organisations face. Insufficient oversight of key strategic areas is putting organisation at risk. Boards need to be clear about how much time they should be spending on oversight.

Struggling to make headway

Is Corporate Governance in the Caribbean keeping pace? It is strongly recognised that change is needed, from boardroom diversity to the management of climate-related risk. The problem is that the good intentions aren’t being translated into meaningful action.

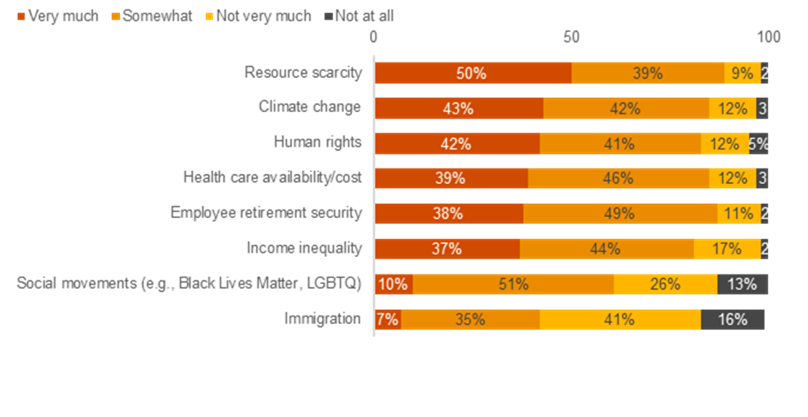

To what extent do you think your company should take the following issues into account when developing company strategy?

%

agree that companies should have a social purpose

Looking at the S in ESG

The importance of a company’s social purpose and reporting on performance against this. This is important since our people want to know that these enterprises are working to do well financially, while doing good by our close-knit societies and our environment.