2023 marked a milestone year for the Greek economy. Despite international challenges, the economy demonstrated resilience, recording the fourth-highest growth rate in the eurozone. The Athens Stock Exchange ranked among the top performers globally, with the general index registering an annual increase of 38.2%. Additionally, Greece returned to investment grade after 13 years

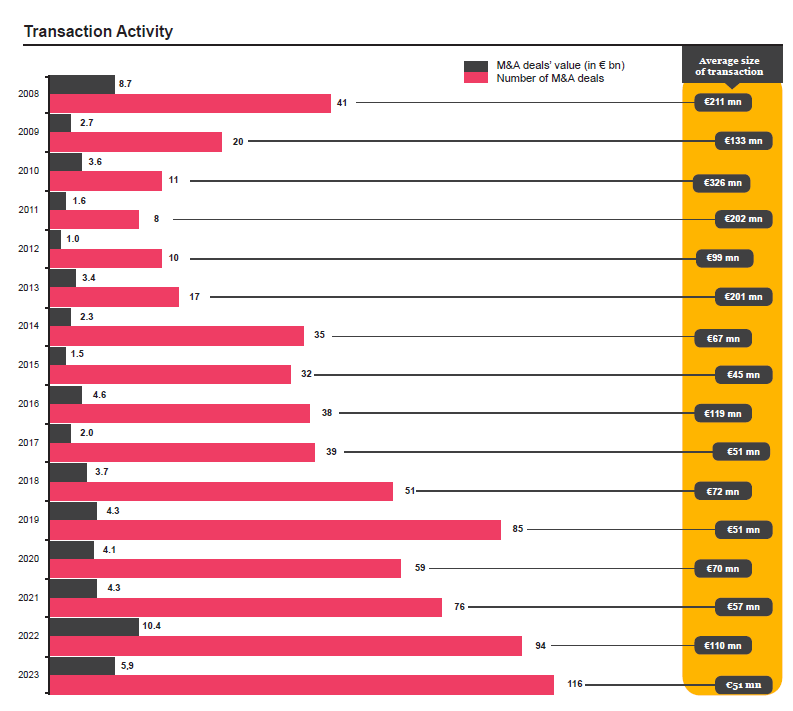

The increase of 22 in the total number of transactions during 2023 signifies signs of stability and transformation of the Greek economy.

The number of R&D has increased significantly reaching 2019 the 85 transactions, while the total value of trading increased by € 0.6bn compared to 2018

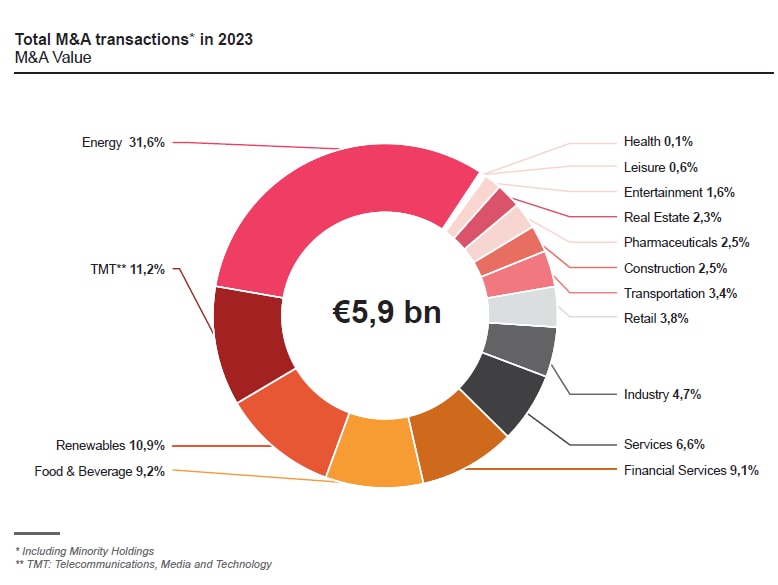

10% of the total deal value involves minority holdings

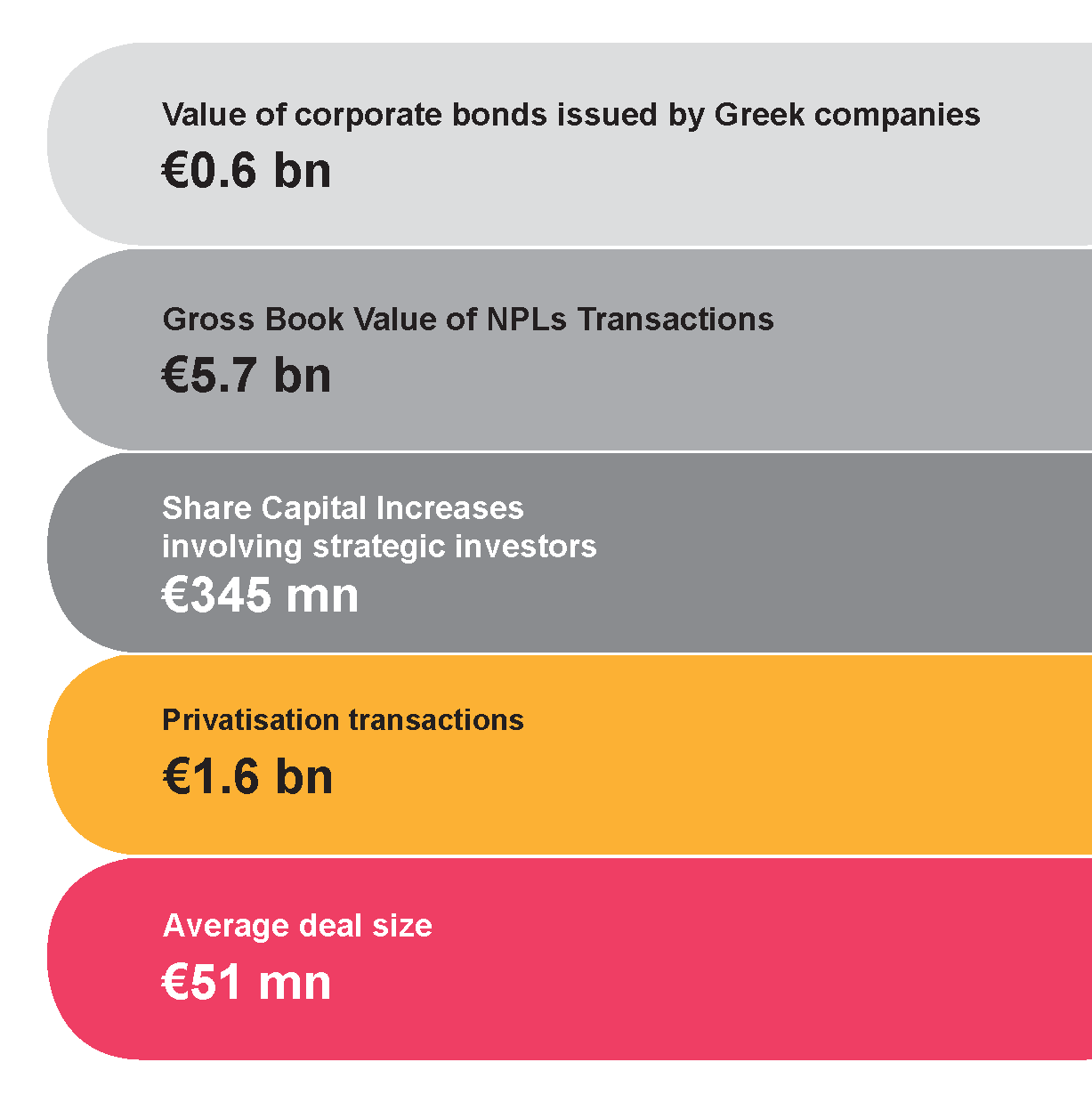

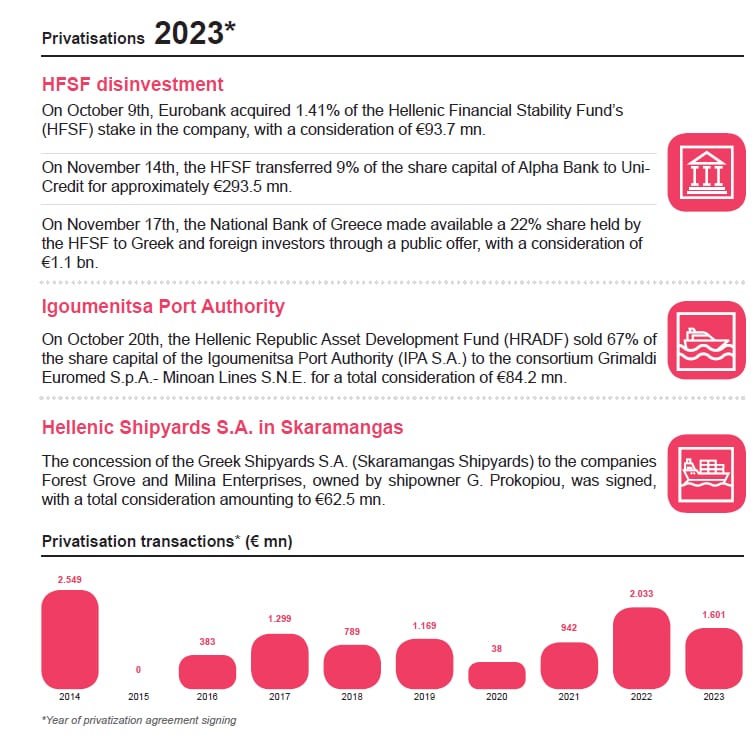

The privatisation transactions concluded within 2023 amounted to €1.6bn. It is expected that in 2024, they will exceed €6bn

The number of R&D has increased significantly reaching 2019 the 85 transactions, while the total value of trading increased by € 0.6bn compared to 2018

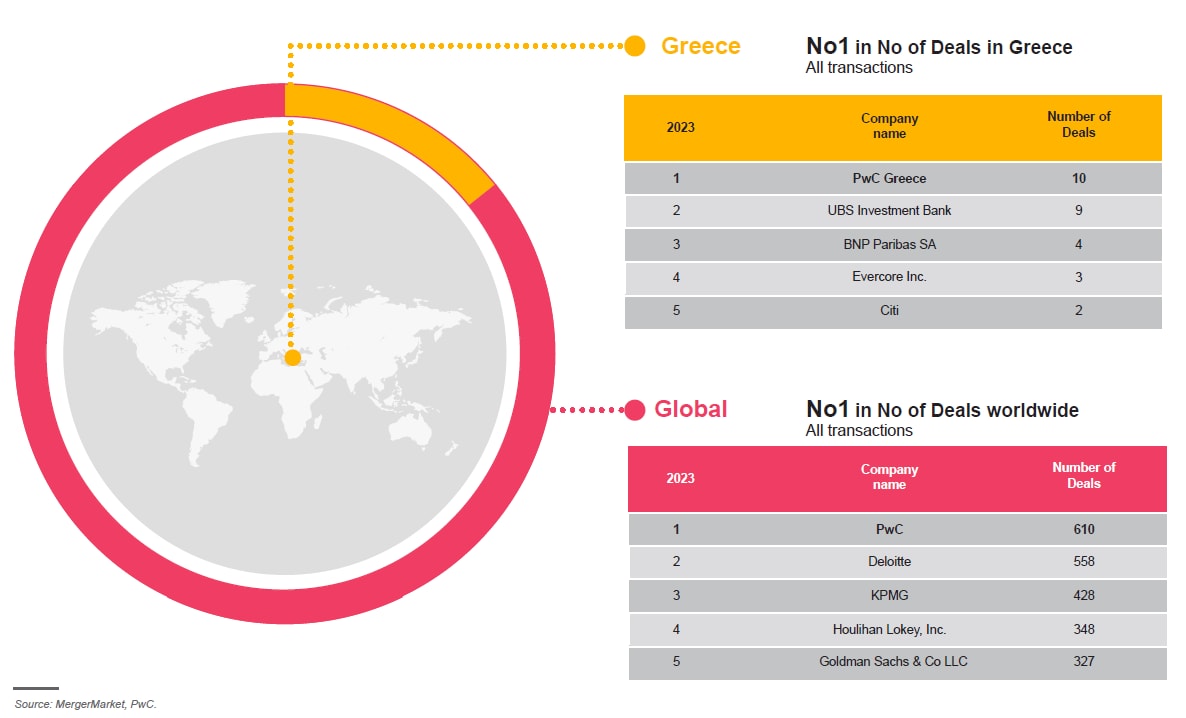

PwC Greece is the top M&A financial advisor in terms of the number of deals in Greece for the second consecutive year

and the top M&A financial advisor globally in terms of number of deals for the fourth consecutive year

Contact us

Director, Internal Firm Services, Marketing & Communications, Athens, PwC Greece