Greece, coming out recently from a period of financial stress, showing positive signs of returning to social and economic normality. The pandemic, however, drastically changed the country’s momentum, having a significant impact on health, social cohesion and the economy as a whole. This report documents and analyses the effects of the pandemic on the Greek economy and more specifically on listed companies that are undoubtedly an integral part of country’s production process.

Τhe impact of the pandemic

The pandemic crisis “found” Greece in a better condition

The period prior to the outbreak of the pandemic, Greece was in a completely different level of readiness compared to the debt crisis in 2009. Having completed the adjustment programs, the pandemic found Greece’s economy in a situation with positive fiscal figures, improved levels of trust and easier access to international markets.This gave Greece the ability, in combination with the necessary support from the European Union, to create sufficient fiscal space for the support of businesses and employees who were exposed to the pandemic’s effects.

Greece showed a remarkable resilience to the pandemic. In contrast to the general negative climate that followed the virus’s outbreak, the country demonstrated quick reflexes in regards to managing the health crisis. The digitisation of critical public administrative operations was accelerated, enhancing the state's modernisation process and creating the base for next day. At the same time, a significant part of Greek businesses, despite their digital deficit, successfully adapted techniques to confront the pandemic, like the remote working model and other digital solutions required, such as e-commerce.

The business response to the pandemic crisis

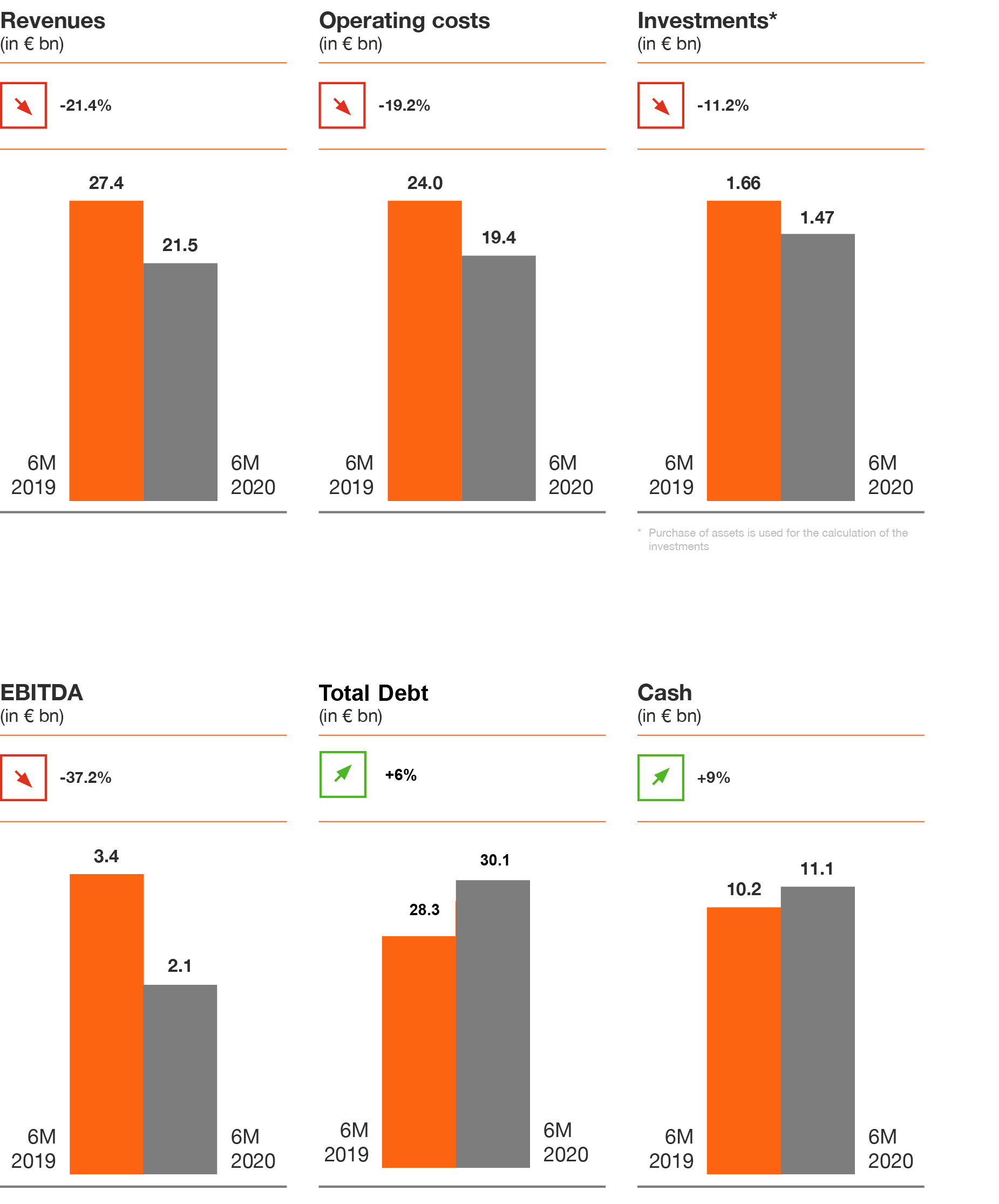

The listed companies have reacted immediately to the lower demand by decreasing their operating costs and restraining their investments

The effect of the pandemic on the sectors of the economy

Total revenues of the listed companies shrank by almost € 6bn (-21.4%) in the first half of 2020 compared to the same period in 2019.

The largest decline, in absolute terms, was recorded in the Industry sector (€ 3.5bn), with the Services sector following (€ 1.5 bn). This decline was expected as Industry and Services sectors were among the sectors of the Greek economy that were directly affected from the pandemic.

It is worth noting that the revenues of the listed commercial companies did not collapse, but fell by 16%, supported by the increase in e-commerce during the 1st lockdown onwards, as well as the ability of large companies to trade online.

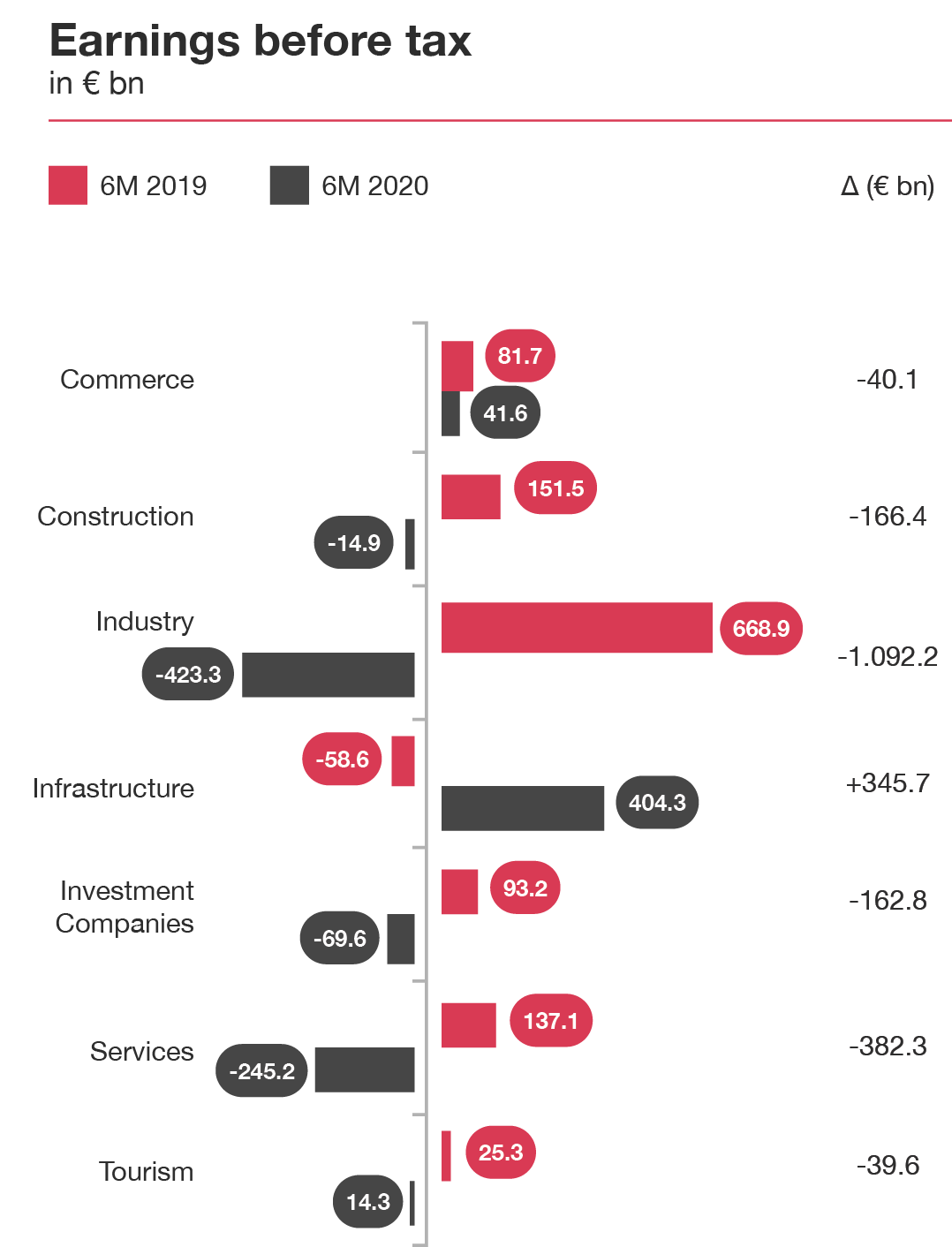

All sectors,with the exception of Trade and Infrastructure, were deeply affected by the pandemic crisis exhibiting significant losses.

In total, during the first half of 2020, listed companies experienced pre-tax losses of € 321mn.

Like in revenues, Industry had the largest decline in profitability which exceeded € 1bn, with the Services sector following again with losses of about € 400mn.

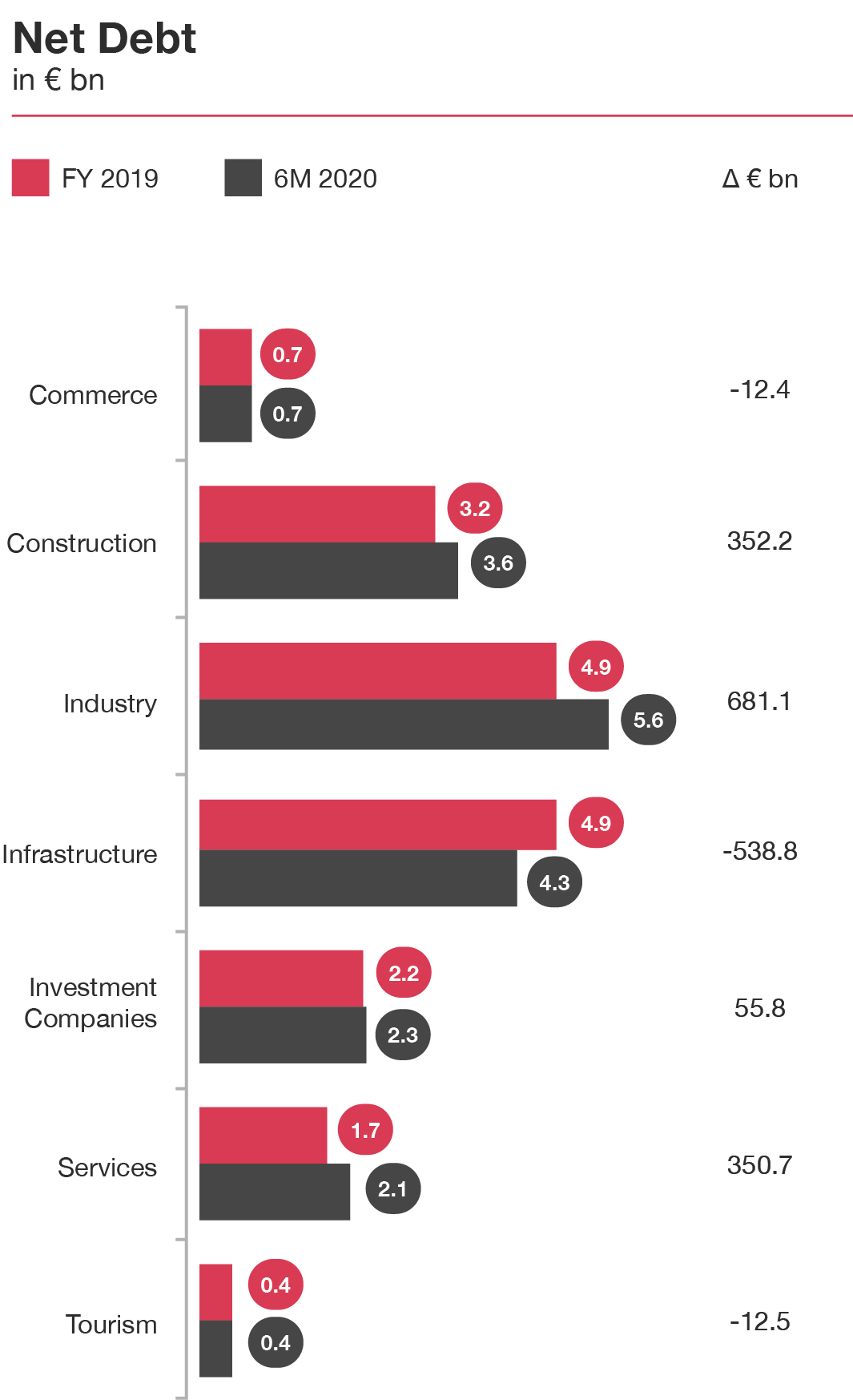

The need for liquidity in the economy due to the pandemic measures increased the net borrowing of the sample companies.

Net debt of all listed companies rose by € 850mn. The Infrastructure sector managed to reduce its net debt by € 540mn mainly due to a large increase in cash reserves from OTE and PPC.

Most debt exposures, after the first wave of pandemic, appeared in the Services (+ € 351mn) and Industry (+ € 681mn) sectors, while Tourism did not increase its net debt levels overall.

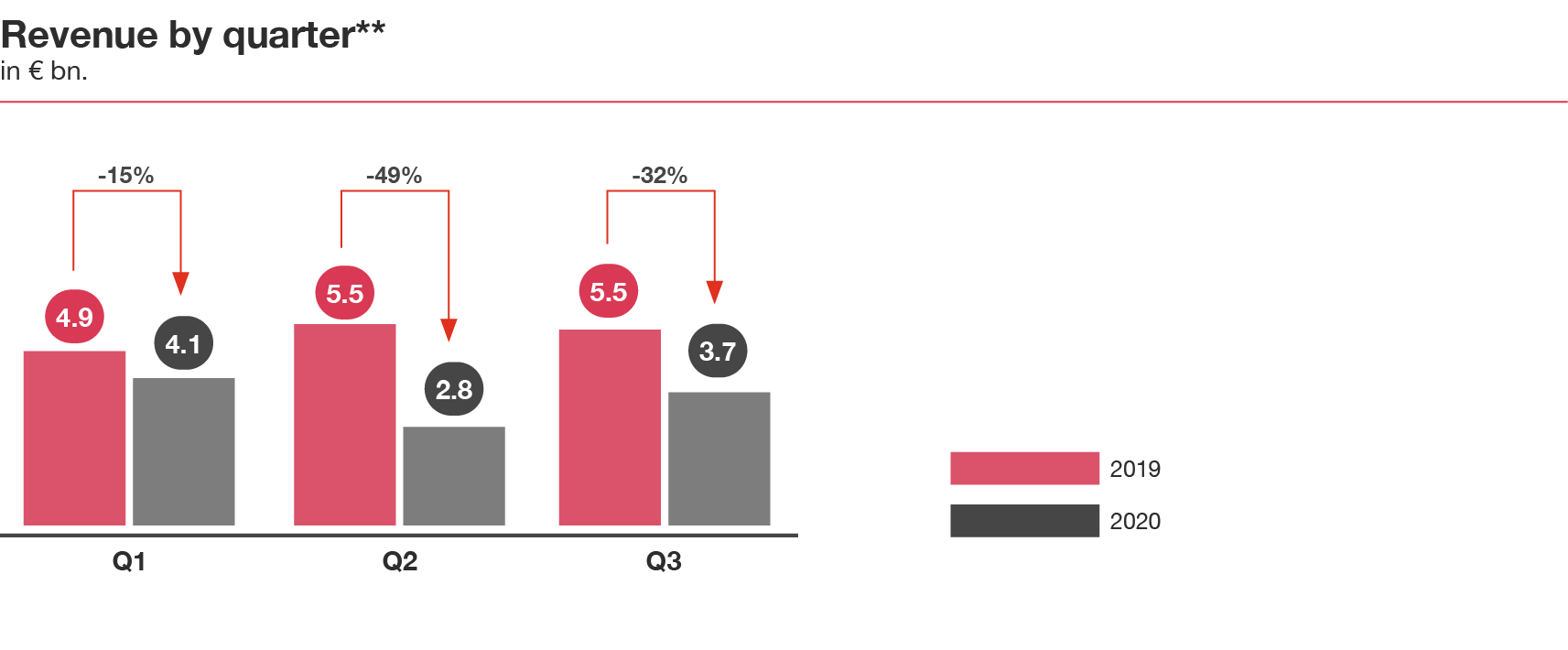

Company revenues continue to show a negative trend in the first nine months of 2020

From the analysis of the turnover of listed companies that published nine-month results, it appears that their revenue drop continued in the third quarter of the year. Specifically, in Q3 2020, their revenues shrank by 32% (- € 1.8 bn) compared to the corresponding quarter of 2019. During the second quarter of 2020, where full measures for the pandemic were in place, revenue reached its lowest level, almost 50% compared to the same period in 2019, while in the first quarter of the year there was a drop of 15%. Overall, the 9M 2020 turnover is reduced compared to the corresponding period of 2019 by 33%.

Challenges and Risks

Responding to emerging challenges is crucial for the country’s growth path in the upcoming years

Contact us

Director, Internal Firm Services, Marketing & Communications, Athens, PwC Greece