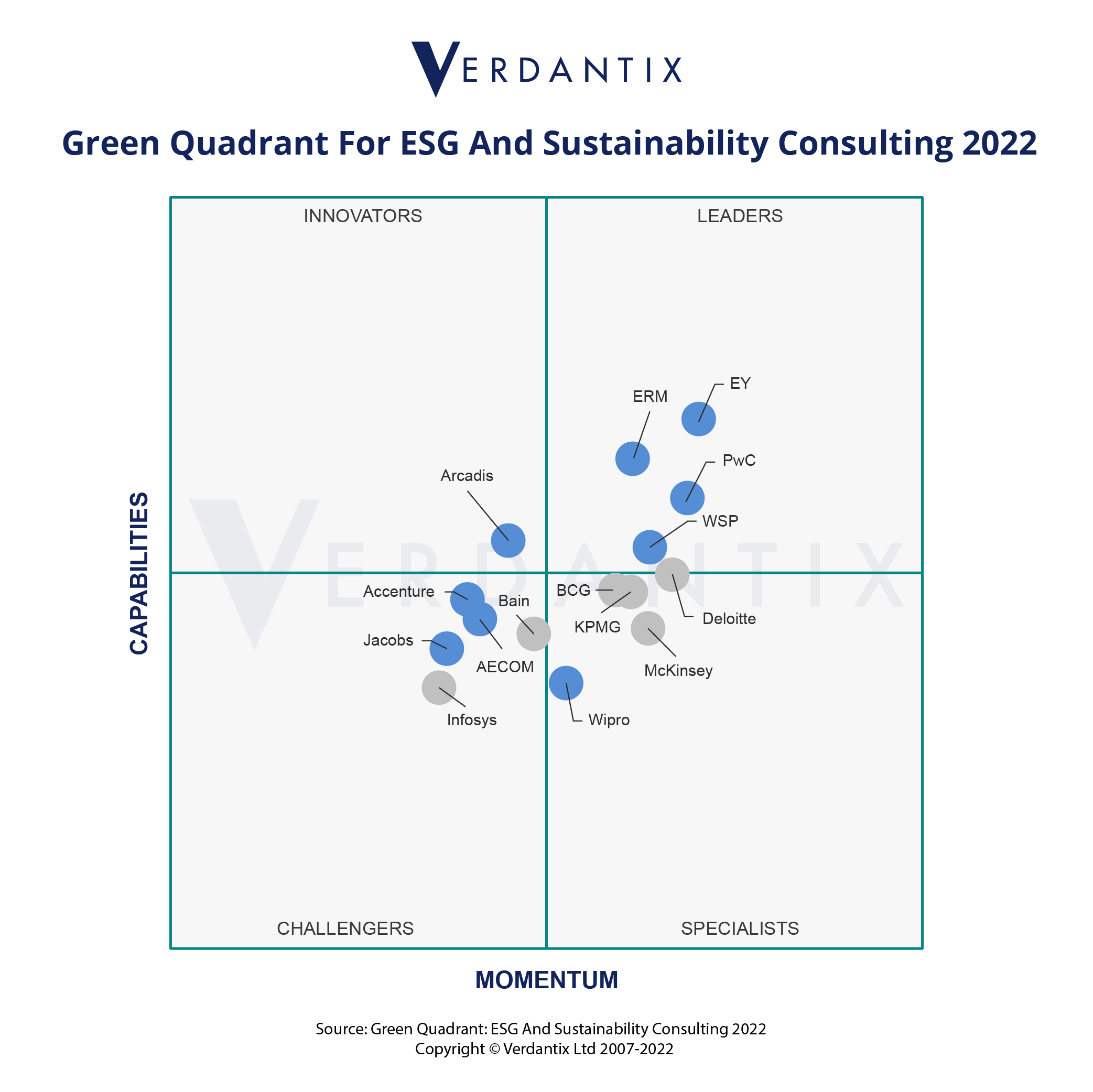

PwC Named a Global Leader in Sustainability and ESG Business Services by Independent Analyst Firm

January 18, 2022

Building Trust and Delivering Sustained Outcomes

According to the report titled Verdantix Research: Sustainability/ESG Business services Green Quadrant, “PwC has integrated, end-to-end ESG and sustainability consulting services. PwC has engaged with clients on sustainability and climate change for more than 20 years, with consulting on ESG and sustainability becoming a strategic priority for the PwC network in 2020. The services [network] has over 3,000 ESG and sustainability clients, with half of engagements from the Europe, Middle East and Africa (EMEA) region and a significant presence displayed globally. PwC enhanced its ESG digital solutions and services available for client engagements through licensable products including ESG Pulse and other intellectual property as part of its delivery platform.”

The report states that, “PwC has market leading capabilities in ESG reporting and target setting. PwC utilizes its extensive regulatory expertise across its global [network] to keep abreast of regulatory changes - ensuring clients are aligning with the diverse set of disclosure requirements within multiple jurisdictions.”

Casey Herman, US ESG Leader, Partner, PwC US says, “On behalf of PwC, we are extremely proud to serve the ESG services and technology needs of our clients, and to add this recognition by Verdantix to our industry leading positions. Our commitments to sustainability and the ESG initiatives of our clients are deeply rooted in PwC’s purpose and our mission to build trust and sustained outcomes for society at large”

According to Verdantix, “To provide analysis of the client’s investment portfolio with an ESG lens, PwC creates a bespoke ESG portfolio assessment review and an impact measurement framework. Additionally, PwC’s sustainable value creation approach can quantify ESG-linked value erosion or creation over time if the portfolio is maintained in its current state, helping to identify strategies capable of creating value through a sustainable transition.”

Verdantix also states that, “PwC’s proprietary physical and transitional risk modelling toolkits [quantify] the financial value at risk from climate change. Utilising in-house experts, PwC is able to leverage the data points and an in-house Task Force on Climate-related Financial Disclosures (TCFD) gap assessment tool to develop a strategic framework to accelerate climate risk mitigation efforts.”

Peter Gassmann, Global Leader of PwC’s Strategy& and Global ESG Leader, Partner, PwC Germany, says, “One major takeaway from our 2021 research is that investors are paying more attention to the ESG risks and opportunities facing the companies they invest in and are poised to take action. Nearly 80% of the executive response to this research said ESG was an important factor in their investment decision-making, almost 70% thought ESG factors should figure into executive compensation targets, and approximately 50% expressed willingness to divest from companies that didn’t take sufficient action on ESG issues. Our goal at PwC is to help guide our clients through these risks and opportunities with advice, strategy, transformation, and reporting solutions.”

Contact us

Contact us