Building rebalanced and resilient supply chains

Not only is Asia Pacific’s booming middle class getting larger and wealthier – it is also becoming more demanding.

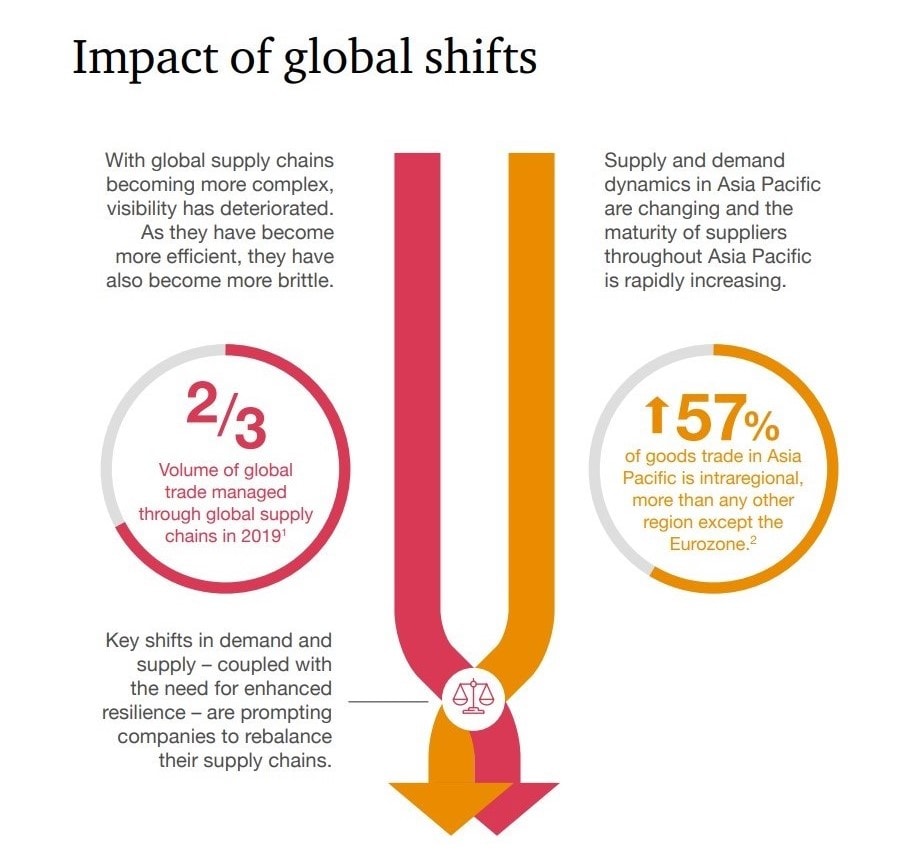

The drive towards higher efficiency and lower costs has driven supply chains to be stretched worldwide in recent decades.

As supply chains have grown broader and more complex, visibility has reduced, making it harder for businesses to monitor and react to emerging risks, ranging from trade tensions to sustainability expectations to sudden shocks. Uncertainty and unpredictability in global trade has increased rapidly in recent years, with COVID-19 proving a final warning for many companies on the weaknesses of traditional globalised supply chains.

The time to act is now. Asia Pacific’s production and supplier landscape is maturing, in conjunction with the fast growth of the middle class coupled with a stronger recovery from COVID-19 than more developed global markets. These factors are pushing multinational companies to rebalance their global supply networks by bolstering their Asia Pacific networks.

As well as reducing the potential impact from supply chain disruptions, this approach also means businesses can better serve the rapidly increasing ranks of middle-class in Asia Pacific by being more agile and price-competitive.

For multinationals accustomed to sourcing from traditional production hubs, the success of this shift depends upon choosing the right Asia Pacific suppliers.

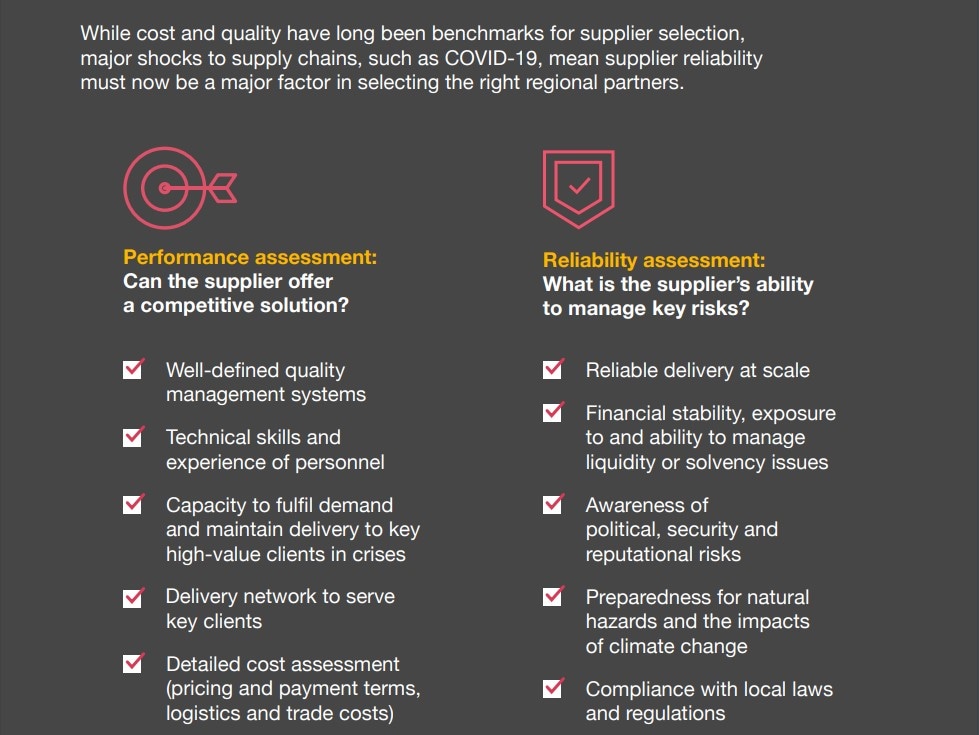

While cost and quality have traditionally been key benchmarks for supplier selection, COVID-19 disruptions have demonstrated the importance of reliability.

This means businesses need to broaden supplier selection to also understand a supplier's ability to anticipate and mitigate business risks.

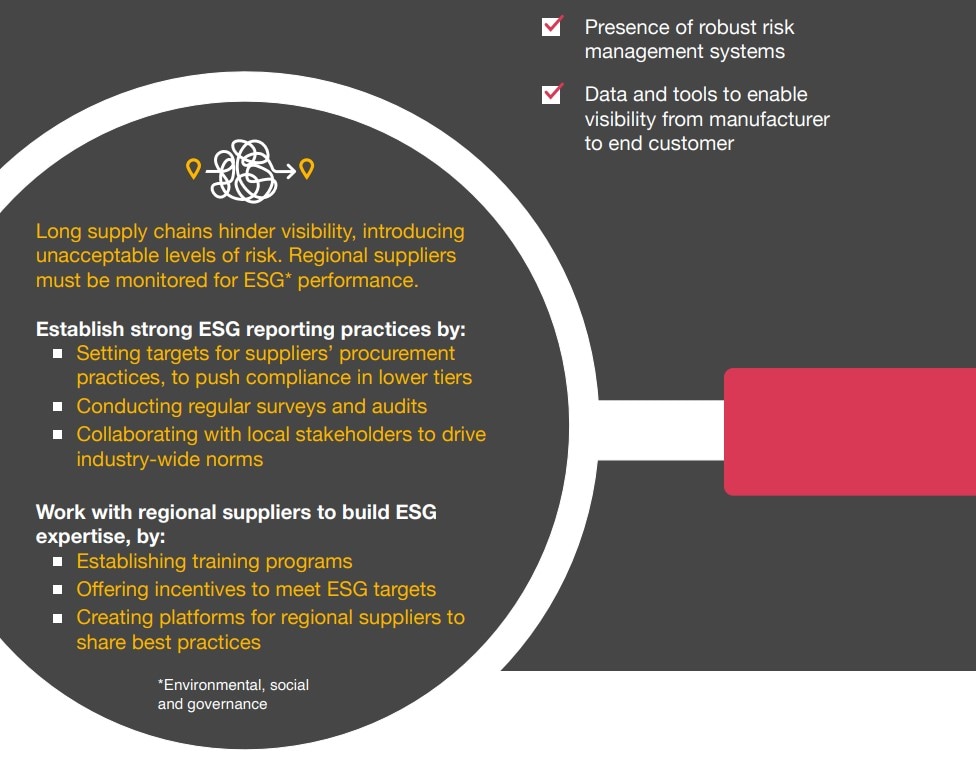

Once selected, businesses should also be developing stronger supplier management practices, strengthening visibility throughout the supply chain. Such visibility does more than give forewarning of possible disruptions and operational, financial or reputational risks – it also gives an ability to monitor the entire supply chain for ESG risks.

As regulators, consumers and staff become more concerned with ESG issues, businesses should establish stronger ESG monitoring and reporting practices, as well as work with regional suppliers to build their ESG expertise.

As multinationals look to expand their regional supply chain footprints, suppliers in Asia Pacific must also prepare themselves to meet the needs of these potential new partners.

This requires paying attention to fundamentals like implementing the required quality standards but also moving away from cost being the core value proposition.

Alternate selling points might include product leadership (offering more specialised product lines), engineering excellence (strengthening internal systems to minimise defects or recalls) or offering value-added support (services such as design expertise, innovation and R&D expertise or marketing support). Given the increased importance for visibility and responsiveness to supply chain issues, multinational companies will also expect strong digital and data-sharing capabilities from their suppliers.

These capabilities all support strong crisis planning which manufacturers will be prioritising in order to ensure all partners are able to support guaranteed service to high-value customers in good times as well as bad.

Many governments in the region are offering digitalisation initiatives that can give less mature suppliers an opportunity to strengthen their skills in these areas. However, as their ICT capabilities improve, suppliers should also pay particular attention to their cybersecurity infrastructure, to ensure they are prepared for inevitable cyber attacks.

Similarly, partnerships with universities, research centres and funding agencies in many locations can also help suppliers build their innovation capabilities.

Not only is Asia Pacific’s booming middle class getting larger and wealthier – it is also becoming more demanding.

Pressures have long been mounting on businesses to review the globalisation of their supply chains. But the COVID-19 pandemic has presented both a final warning and an opportunity for Asia Pacific to rethink and rebuild.

The unacceptable levels of risk in long and fragile supply chains are not new, nor are they products of the COVID-19 pandemic. However, the experience of the past year has confirmed the time is now to introduce more resilience into supply chains.

Several urgent matters are solved by companies realigning their supply chain and manufacturing footprint across Asia Pacific. One is the need to stay closer to the region’s growing middle class so as to increase the chances of capturing more of the market and also to respond quickly to their evolving expectations.