The average annual greenhouse gas (GHG) emissions during 2010-2019 were the highest in history. Asia Pacific’s share of global emissions is increasing, most of it from urban centres.

Global warming is predicted to reach 3.2°C by the end of the century if we don’t strengthen current policies. Further delay in climate transition can be severely disruptive for Asia Pacific.

Companies and regulators in Asia Pacific are acting on climate change and opportunities exist to scale up climate mitigation solutions and technologies.

The Intergovernmental Panel on Climate Change (IPCC) has recently released the third section of the Sixth Assessment Report (AR6) by Working Group Three (WGIII) on the mitigation of climate change.

Prior to its public release, government representatives and scientists were locked in intense negotiations on how to phrase its key points, as the report contained some of the most difficult messages to deliver within the IPCC series.

What it says, and doesn’t say, will lend weight to climate discussions and negotiations (in forums such as COP27) as well as how much and how fast governments and businesses are likely to act.

Here are three key takeaways for government and business in Asia Pacific to consider and act upon from this recent WGIII report.

2. Increased likelihood of a delayed transition in Asia Pacific can be severely disruptiv

The report underscores that this is a decisive decade to restrict warming, where the gap remains significant to limit global warming to 1.5°C. A key graphic in the report summarizes this well (see chart below).

Without strengthening policies beyond those implemented in 2020, GHG emissions will continue to rise [red line], with median global temperature projected to reach 3.2°C by the end of the century.

The emissions pathway based on the latest Nationally Determined Contribution (NDC) policies [purple line] will remain significantly above both the 2°C and 1.5°C pathways [green and blue line] over the coming decade (2020 - 2030).

Trying to ‘force’ the pathway down towards the 1.5°C or 2°C scenario means rapid acceleration of mitigation efforts required from 2030 onwards [purple line].

It will be harder after 2030 to limit global warming to below 2°C

Chart: Projected global GHG emissions

Source: IPCC WGIII report (simplified)

The longer we delay emissions reductions, the more difficult it will be to stay within the 2°C target. This delayed transition risk can be more pronounced for Asia Pacific for two reasons:

The burden of emissions reduction will increasingly shift from the developed West to Asia Pacific, as consumption-based emissions rise, and urban areas grow. There are strong risks of being locked into future urban GHG emissions if we do not drive net zero emission pathways for urban areas.

The relatively slower pace to act. In Code Red - Asia Pacific’s Time To Go Green, we counted fewer than 25% of Asia Pacific governments that have a firm net zero commitment. Many governments are still navigating, and perhaps, in the early stages of planning and considering the appropriate actions to meet societal expectations.

The combination of bearing higher burden and being a later mover means that governments and businesses in the Asia Pacific region could bear a disproportionate amount of risks in delayed transition scenarios, and face the brunt of the most disruptions.

3. Window of opportunity for Asia Pacific to lead global climate action

Despite the lack of concerted policy targets, there is evidence that more businesses and regulators are acting. We find in PwC’s 25th Global Annual CEO Survey - Asia Pacific that Asia Pacific CEOs are ahead of global peers in net zero and carbon-neutral commitments:

60% of respondent companies have made, or are progressing towards, a net zero commitment (vs. 51% globally)

77% have had their target setting approach independently assessed and validated (vs. 66% globally)

Other sources also corroborate with our finding, for example:

There are more than 600 companies within Asia Pacific that have signed up to the Science Based Targets Initiative (SBTi).

The latest Task force on Climate-Related Financial Disclosure (TCFD) Status Report shows that 42% of Asia Pacific companies who adopted TCFD reporting in 2020 have measured their Scope 1, 2 and 3 emissions. Although this is still behind European companies (at 64%), it is significantly ahead of other regions.

TCFD has also helped regulators and markets in Asia Pacific to spearhead better climate disclosure. Hong Kong SAR, Japan, New Zealand and Singapore are just a few early movers on mandatory climate risk disclosure; China, Indonesia, Malaysia and others are closely following suit.

Scaling up climate mitigation solution and investment

Markets and technologies have been in favour of carbon reduction in the last decade. Unit costs of solar energy and wind energy have fallen by more than half over 2010-2019. This led to larger scale deployment of renewable energy, with around 10% of global electricity production.

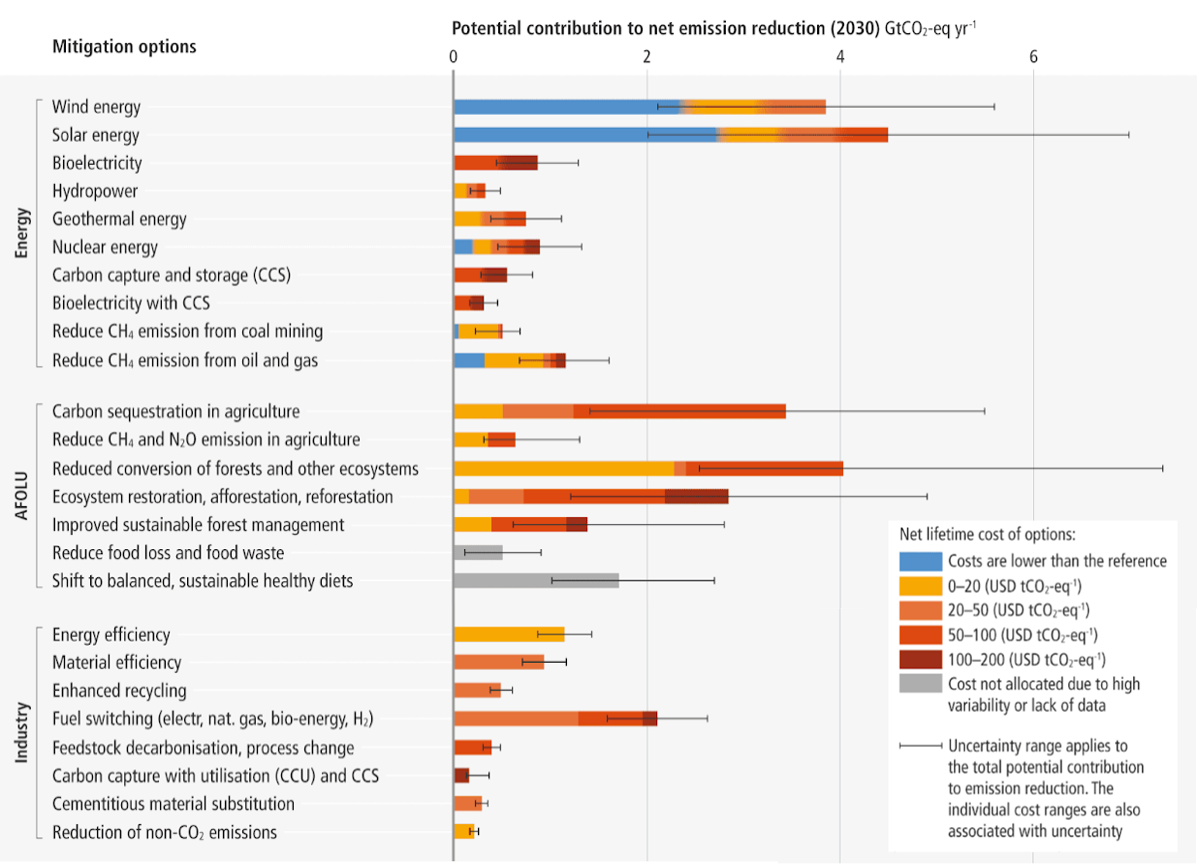

Reallocation of investment flows are expected to continue as industries consider options that can offer substantial potential emission reduction. Many options available now in all sectors are estimated to offer substantial potential to reduce net emissions by 2030. Relative potential and cost will vary across countries and in the longer term compared to 2030.

Chart: Emission reduction options (tools) for selected industries

Source: IPCC WGIII report (simplified)

While uncertainties remain, Asia Pacific will play a role in these developments. For example, research on the green hydrogen economy estimated that global hydrogen production costs will decrease by around 50% through 2030. By 2050, green hydrogen production costs in some parts of the world including China, Indonesia and Australia will be in the range of €1 to €1.5/kg.

Regional cooperation can also help scale up technology in cost effective ways. The multi-billion “clean energy project development agreement” to connect solar power in the north of Australia to Singapore and eventually Southeast Asia is one example.

There are major risks in the failure to act on climate change. For Asia Pacific economies, this is not just about the physical risks but also the transition risks, particularly in a delayed transition scenario. But the opportunities to act are also promising in the region for businesses, both in terms of managing its own net zero transition but also capitalising on the emergence of new and developing low carbon technologies.