Welcome to PwC’s European Life Insurance Mergers, Acquisitions and Restructuring Outlook 2023

Despite a period of unprecedented economic and geopolitical uncertainty, the European life insurance M&A and restructuring market remains active. We expect deal volumes to continue at pace across all of the core markets in Europe as insurers focus on their core markets, examine capital deployment and simplify operations.

We have surveyed a wide range of participants across the life insurance industry and the broader M&A community to canvas views on the outlook for mergers, acquisitions and restructuring within the life insurance market. We are extremely grateful to everyone who has taken part in this survey and contributed their insights. Learn more about some of our key findings below.

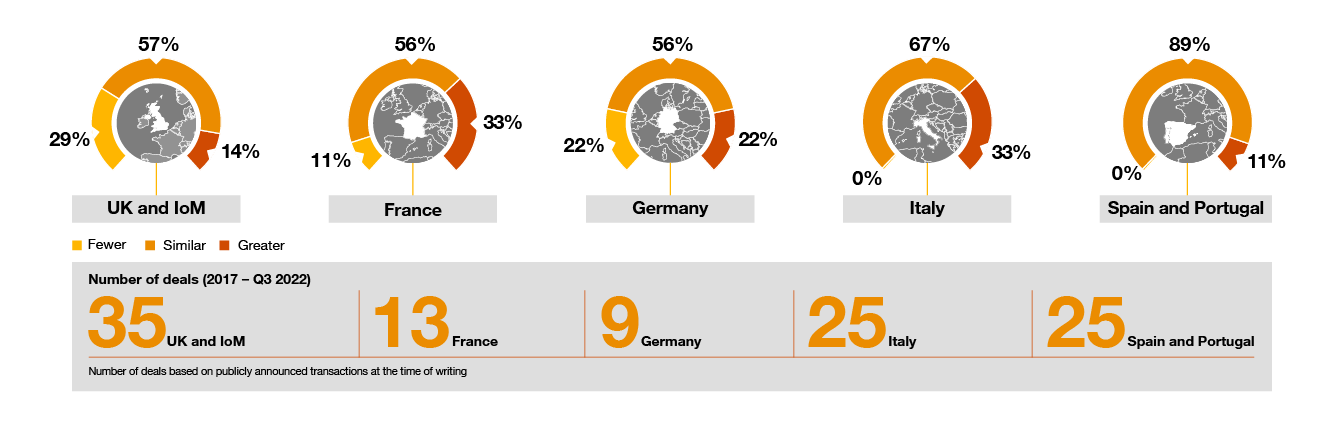

Deal Activity

The results support our view that deal activity across continental Europe is unlikely to see any real slowdown. Notably France, Germany and Italy have been identified as key markets for greater activity in the near term and more mature markets, such as the UK, identified as markets where a high level of activity is expected to continue.

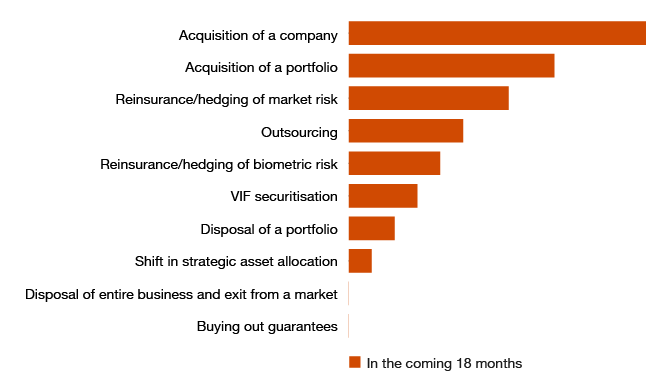

M&A and restructuring activity

Our survey suggests participants are more likely to engage in M&A activity than any other restructuring activity over the next 18 months. The majority expect to be involved in acquisitions, with reinsurance and hedging activities also being high up on the agenda.

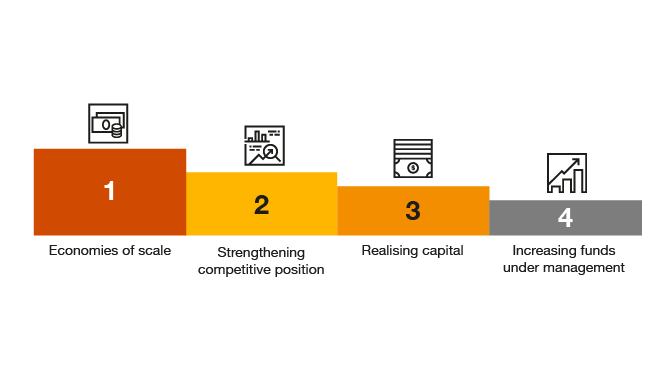

Drivers of deal activity

Economies of scale were identified as the most important driver of deal activity, followed closely by capital release and strengthening of competitive position. This is not surprising given the current macroeconomic environment.

Rates of return

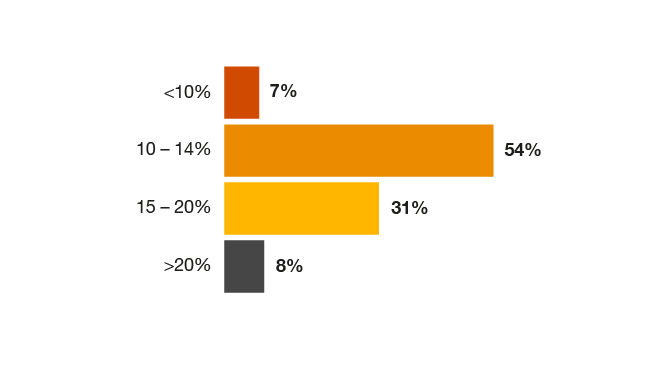

Survey participants expect to price life insurance transactions at a target IRR of between 10% and 20%, with the majority of participants selecting figures in the 10% to 14% range.

While variability among responses is expected, these target returns are consistent with our experience of investors’ return expectations. Such high returns and long time horizons present an attractive opportunity for investors.

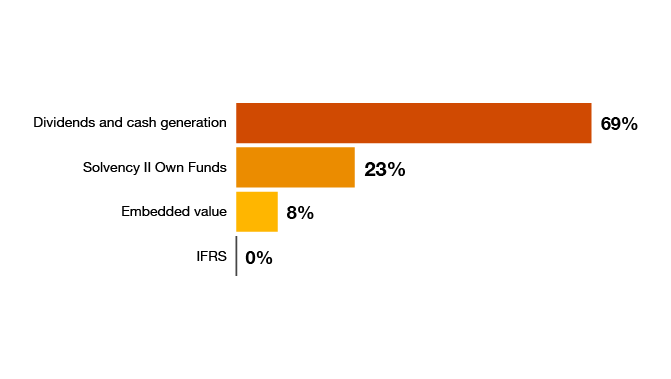

Deal pricing

Dividends and cash generation is the primary metric in determining the price of a life insurance transaction for most participants.

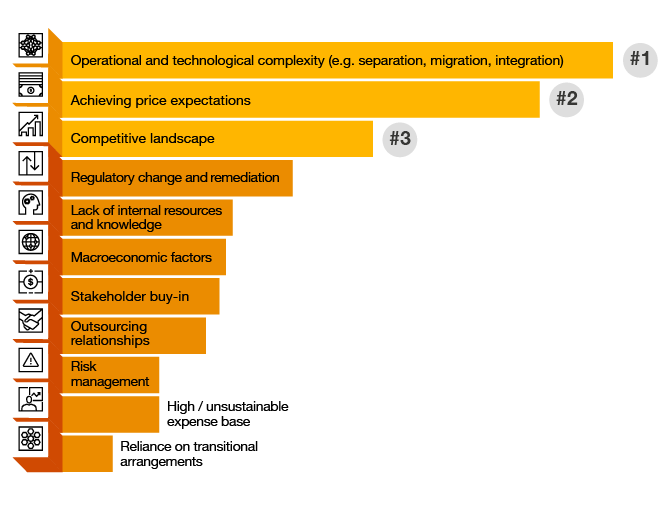

Transaction challenges

The success of a transaction is intrinsically linked to the ability of a management team to actually execute the transaction. Participants rank operational and technological complexity as their top challenge when completing a transaction; with achieving price expectations and a competitive landscape not far behind.

ESG

ESG is a new area of focus as part of any diligence exercise for life insurance transactions, due to the long-term nature of investments. Whilst ESG is not currently affecting deal price, it is and is likely to become more prominent in pricing exercises.

Get in touch with us

If you have any questions or would like to discuss the survey or life insurance market in general, please do not hesitate to reach out to the PwC team.

“In agreement with our survey participants, we expect the life insurance market to continue to see high levels of activity in the coming years, despite the tumultuous economic climate, with market participants focusing on achieving economies of scale, efficiently deploying finite capital resources and strategic portfolio reviews.”