Collision and fusion within fintech

After years of tracking the competition and collaboration between Financial Services (FS) and Technology, Media and Telecoms (TMT) companies, PwC is now seeing pockets of convergence, driven by fintech.

What does PwC mean when we say fintech? Ultimately, fintech is a combination of technology and financial services that’s transforming the way financial businesses operate, collaborate and transact with their customers, their regulators and others in the industry.

Speaking with industry leaders, it’s evident that the lines between FS and TMT companies have blurred. Today, many TMT companies are applying for licences to operate in the FS sector. At the same time, FS organisations are starting to call themselves technology companies.

Emerging technologies have given companies a low-cost way to create convenient, personalised, data-intuitive products and services. Fintech has also lowered the barriers to entry for firms—from established FS groups, to startups, to TMT entrants—and has therefore created a complex web of cooperation, competition, collision and fusion.

Collision and fusion can be complicated. In the near future, although there may be growing overlap between TMT and FS in certain areas, such as payments and regulation, TMT and FS firms may also remain distinct in other areas. Staying on top of these trends is critical to companies that want to make the most of this convergence. PwC’s recent Global Fintech Survey, which polled more than 500 executives across both FS and TMT sectors, provides a compelling joint analysis.

So, who’s ahead in leveraging fintech?

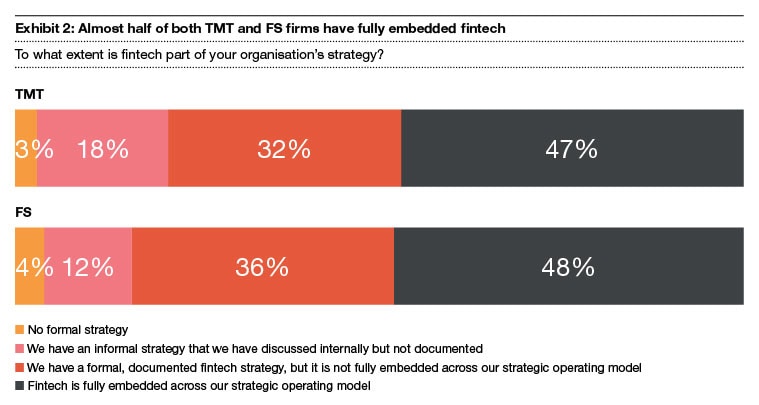

Almost half of all companies we surveyed in both FS and TMT have embedded fintech fully into their strategic operating model, and many have fintech-based products and services. In certain sectors, including personal finance and payments, the numbers are even bigger. More than half of banking and capital markets (BCM) organisations have incorporated emerging technologies into commercial banking and personal loans, and an additional 20% plan to do so in the next two years.

The survey indicates that Chinese companies are among those out in front in terms of embedding emerging technologies into their products and services. More than three-quarters of CEOs surveyed have insurtech-supported products and services, and almost two-thirds offer robo-advice.

This is part of an effort to promote fintech-enabled innovation in order to improve competition and bring services to unbanked consumers. Businesses in China have also been able to act quickly on emerging technology—such as facial recognition, which can facilitate customer identification and virtual banking.

Among organisations that are planning to pursue an acquisition, strategic alliance or joint venture to drive growth via fintech, 78% of TMT and 76% of FS firms are targeting businesses within their own sectors, according to the survey. Fewer than half (44% of TMT and 47% of FS organisations) are targeting a company specialising in fintech.

At a time when FS firms are striving to sharpen their technology capabilities and TMT needs product and regulatory expertise to compete in the FS market, firms may miss opportunities if they don’t pursue more cross-sector fusion.

Convergence is starting to become commonplace within the fintech sector

Organisations that ignore the convergence shake-up not only risk falling short of customer expectations, but also open the door for aggressive entrants to move in and claim market share and customer relationships.

In China, convergence is gaining momentum. At the top of the market, regulators are seeking to match up the big four TMT companies with the big four banks and get them to work together—you could call it an arranged marriage. The TMT company provides the technology enablement and the FS firm delivers the end product.

The introduction of restricted virtual banking licences for digital businesses in Hong Kong SAR could take convergence to a new level there, too. TMT companies are cooperating with established FS groups and other companies in applying for the licences and are set to roll out these operations soon. This could severely disrupt the traditional banking industry in Hong Kong SAR, because digital banking is more efficient and less expensive.

Globally these moves are mirrored in different ways. Australia offers similar restricted licences to Hong Kong SAR for its ‘neobanks,’ which also conduct all operations online. Europe is seeing disruption as a result of digital banks which are raising the bar for customer expectations and cost-efficiency, unencumbered by the legacy complexity and cost structures of their long-established counterparts.

The bottom line remains the same. Companies that have embraced fintech are reshaping the marketplace, and those that haven’t are being left behind. Three-quarters of the FS and TMT executives we surveyed said they’re stepping up their fintech investment in the next two years. More than 90% are very or somewhat confident that fintech will deliver revenue growth over the next two years.

What’s clear from the survey analysis is that the winning companies within the fintech sector are likely to be those that embrace fintech-driven business models, with approaches that make the most of both FS and TMT companies’ combined strengths, according to the survey analysis.

For more insights into the fintech sector, and the steps that organisations can take to put themselves in the best position to lead, read the report here

Wilson Chow

Global Technology, Media and Telecommunications Leader, Partner, PwC China

Contact us