Three years after climate tech investing’s peak, investors and start-ups are finding it ever tougher to make deals. In the 12 months through September 2024, capital flows and transaction volume continued to trend downwards, dropping below levels recorded in 2019, before the market had taken off.

Yet the past year also brought opportunities for savvy investors. Climate tech investment held up strongly in the United States, buoyed by the Inflation Reduction Act and other policy measures. Start-ups operating in the energy sector increased their share of climate tech funding. And AI-centred climate ventures raised US$1 billion more in the first three quarters of 2024 than they did in all of 2023, as investors recognised AI’s power to drive productivity and efficiency improvements of all kinds. Technology for climate adaptation and resilience stood out as a theme, featuring in more than one-quarter (28%) of climate tech deals.

New analysis also highlights the role that big companies are playing as climate tech investors. Their venture capital funds and other investment units have participated in about a quarter of climate tech deals for several years running. What’s more, bigger firms tend to get involved in mid-stage and late-stage deals, a key to helping climate ventures reach scale. In sectors in which climate tech start-ups attract relatively little funding—industrials, food and agriculture, and the built environment—large, established companies could help drive the innovation that’s needed to reach global emissions targets.

The scope of this year’s study

The market’s changing mood

Over the past year, as higher borrowing costs and uncertain economic conditions weighed on the broader deal-making market, a decline in climate tech investing has played out. Climate tech financing dropped 29%, from US$79 billion between Q4 2022 and Q3 2023, to US$56 billion in the ensuing four quarters. Venture capital (VC) and private equity (PE) financing flows also decreased across the same time frames, from US$799 billion to US$673 billion. Against this backdrop, climate tech funding contracted from 9.9% of VC and PE investment to 8.3%.

To investors, these conditions placed a greater premium on discipline. ‘The market has matured over the past year,’ says Hampus Jakobsson, general partner and co-founder of Sweden-based venture capital fund Pale Blue Dot. ‘There is more acceptance and belief around climate change, and this is combined with a strong conviction on the need to invest with a real focus on returns.’

Yair Reem, a partner at Berlin-based Extantia Capital, agrees: ‘With some of the hype gone out of the market, more mediocre propositions are no longer attracting the interest they did previously. Truly exceptional companies, with clear and compelling value propositions that extend beyond simply being green, are still securing funding, but there is a lack of money generally.’

Signs of market tightness also emerged from data on deals, both by stage and by level of investor experience. As fewer IPOs and exits took place, action continued to shift from early-stage transactions to mid-stage ones, which together with late-stage deals accounted for 37% of all climate tech deals in the first three quarters of 2024, up from around 20% in 2019. Meanwhile, investors with less climate tech experience—those who had participated in five or fewer deals—made up a shrinking share of this year’s dealmakers.

‘A couple of years ago, there were some very charismatic people who raised US$100 million or more for VC funds or start-ups, almost on a speculative basis,’ says Pale Blue Dot’s Jakobsson. ‘Those kinds of plays cannot work in the current market, because the money just isn’t there.’

In an exception to the slowdown, investment in US climate tech start-ups held steady: US$24.8 billion between Q4 2022 and Q3 2023, and US$24.0 billion between Q4 2023 and Q3 2024. Investors credited the market’s resilience to policy initiatives such as the Inflation Reduction Act (IRA), though it remains to be seen what will become of the IRA under the next US administration. ‘The IRA has been magical in the US,’ says Christian Hernandez Gallardo, co-founder and partner at VC firm 2150. ‘The amount of dollars deployed because of it is extraordinary.’

The Asia-Pacific region, meanwhile, has seen a reversion to the longer-term mean, with its funding share falling from 19% in 2023 to 7% in the first three quarters of 2024.

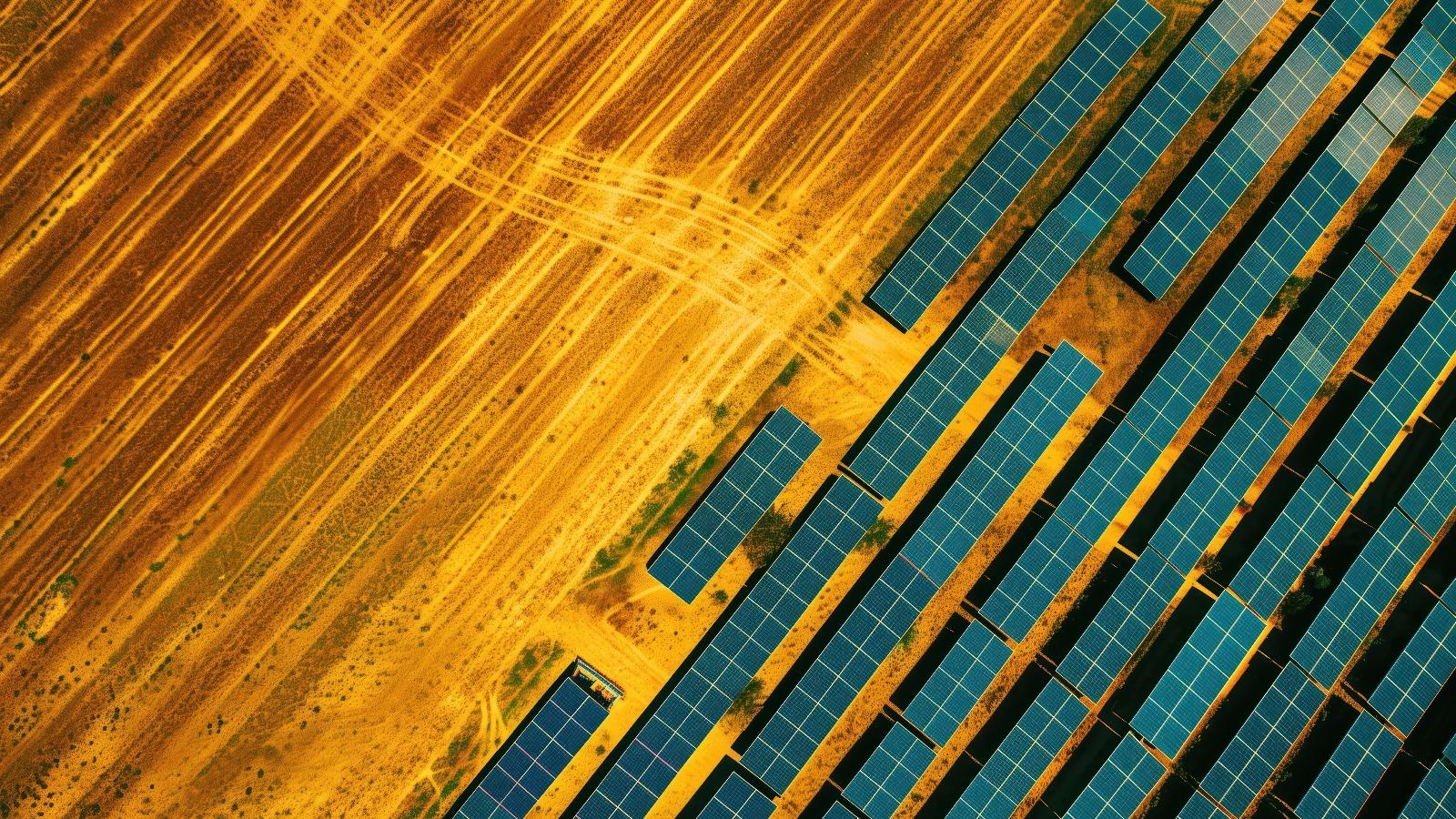

Energy tech comes to the fore

The distribution of climate tech investment across sectors has changed. During the first three quarters of 2024, energy-related start-ups took in a slightly greater share of climate tech funding—nearly 35%—than they did in 2023 (30%). Two ventures working on green hydrogen and alternative fuels raised more than US$1 billion each, and more than 30 other clean-energy ventures raised at least US$100 million each. The number of mid-stage deals in energy-related start-ups almost equalled the number of late-stage deals, a shift that tracked the broader market.

Meanwhile, climate tech start-ups in the industrials sector (which comprises industry, manufacturing and resource management) posted a relative decrease in financing. Their share of investment capital fell from 17% in 2023 to 7% in the first three quarters of 2024. And the investment remains disproportionate to the problem: although the 2024 percentage is close to the sector’s historical average, it is much smaller than the 34% of global greenhouse gas (GHG) emissions produced by the industrials sector.

For executives at industrial companies, the need for climate solutions remains urgent. Irina Gorbounova, vice president of M&A and head of the XCarb Innovation Fund at ArcelorMittal, a large steel producer, observes: ‘You need a lot of steel for almost any energy transition technology, from renewables to nuclear, electric vehicles and even data centres. So it’s vital that greenhouse emissions from steel are addressed.’

Other sectors face similar, if smaller, gaps between their share of emissions and level of funding. The food, agriculture and land use (FALU) and built environment sectors account for large quantities of greenhouse gases and comparatively small portions of climate tech investment. But some bright spots do appear within those sectors that are underfunded, relative to their emissions. Increasing shares of capital have gone to start-ups working on green hydrogen and on carbon capture, utilisation and storage (CCUS), two technologies with high potential to deliver emissions reductions.

AI-powered solutions gain appeal

For several years, AI has been an especially busy segment of the venture investing market—and investors’ enthusiasm for AI has carried over into climate tech. In 2023, start-ups working on AI-related technology accounted for 7.5% of all climate tech investment, amounting to US$5 billion. In just the first three quarters of 2024, they raised US$6 billion, or 14.6% of the climate tech total. The key funding segments were autonomous vehicles (62% of AI-related investment) and industrial applications across agriculture, smart homes and smart energy solutions (20%).

Time will tell whether this AI surge pays off. Investors told us they believe AI’s capabilities in data analysis, predictive modelling and optimisation can power breakthrough applications in both emissions reduction and climate resilience. Enki Toto, a principal with the Salesforce Ventures Impact Fund, frames it this way: ‘In climate tech, where you often have too much data to process it efficiently or you don't have enough data, AI can offer solutions to help you better manage resources.’

Recent research from PwC Germany, Microsoft and the University of Oxford describes AI’s potential to enable energy efficiency gains, emissions reductions and other improvements in environmental performance across many sectors. Examples include optimising cooling in buildings, repositioning wind turbines to generate more energy, adjusting electric vehicle charging to balance power demand and supply, and fine-tuning manufacturing processes.

Start-ups are also creating AI-driven systems to support climate resilience. Some of these ventures employ deep learning and computer vision to spot, verify and classify wildfires using data from satellites or on-the-ground sensors. In agriculture, autonomous tractors could allow farming operations to continue even when it is too hot for people to work outside.

The level of AI’s energy intensity has prompted some concerns about whether the supply of electricity can grow quickly enough to keep up with demand from data centres, and also whether increased power generation will cause a spike in GHG emissions. Some start-ups are working on technologies that address these problems, such as immersion cooling or heat recycling.

An adaptation priority emerges

Recent years have brought marked increases in the frequency and intensity of extreme weather events—think of the storms that have battered cities and coastlines, and the heatwaves that have threatened countless lives. And climate perils could continue to grow: average temperatures in 2023 rose to 1.45°C above pre-industrial levels, and 2024 is on track to be the hottest year ever recorded.

Venture investors have taken notice of the need to invest in solutions. Our analysis shows that in the first three quarters of 2024, about 28% of climate tech deals supported start-ups working on adaptation and resilience (A&R) offerings. (A&R businesses create products and services, such as insurance or urban cooling, that help with managing heat, wildfires, floods and other climate stresses.) That 28% is a higher proportion than is often reported. About 10% of these deals supported pure A&R plays. Another 18% of deals addressed both A&R and emissions mitigation. And all together, these A&R-related deals accounted for 12% of climate tech investment value. (A&R’s investment share is small relative to its deal share, because around two-thirds of deals were early-stage, which have lower ticket sizes than later-stage deals.)

To some investors, the global policy dialogue has helped focus attention on adaptation and resilience. According to Jay Koh, a co-founder and managing director of the Lightsmith Group, ‘Adaptation is reaching the mainstream because of the Dubai COP [climate change conference] last year. That’s where the investor community really started to show up on the adaptation side for the first time.’

Now some big financial players are getting behind A&R. JPMorganChase, Nuveen, Wellington and others have embedded adaptation plays in their climate investing and impact investing programmes. BlackRock has said it is working on a product focused on adaptation.

‘There has been an explosion in A&R investing,’ says Pale Blue Dot’s Jakobsson. ‘Five years ago, nobody was talking about it—mainly because they were concerned about missing net-zero targets. This is no longer such an issue.’

Other investors make A&R deals without identifying them as such. Emilie Mazzacurati, co-founder and managing partner of Tailwind, an A&R innovation studio, says, ‘There are “accidental investors” who see a great story and invest but may not think in terms of whether the deal is an adaptation-and-resilience deal.’ Recognising A&R deals can also be a challenge, because a standard taxonomy for the segment has yet to be defined.

The FALU sector accounted for 44% of A&R-orientated deals in the first three quarters of 2024, more than any other sector. One start-up in this sphere is using AI to aid in the identification of crop genes that promote resistance to threats such as drought and extreme heat; another is working on technologies to detect stress in plants.

Investors also say they see a need for A&R solutions related to insurance and risk management, given the mounting costs of weather catastrophes. Matthew Grant, CEO of InsTech, an insurance information provider, says, ‘We are certainly seeing insurance companies starting to incentivise their clients to think about adaptation.’

Risk management could also be a source of innovation. ‘There is a lot of room for education about how MRV [monitoring, reporting and verification] technologies can make a real difference to financial outcomes,’ says Charlie Pool, head of carbon insurance at insurer Howden. ‘No one asks whether it would reduce their insurance premiums if, for example, they change tree species mix,’ a variable that can reduce exposure to risks from natural catastrophes such as droughts and wildfires, thereby bringing down insurance costs.

Looking ahead, A&R investors will want to watch for developments on two fronts. One is geographic diversification, to find and fund more start-ups in developing countries. Such countries have generally been more exposed to the impacts of climate change, but about 85% of A&R investment was allocated to start-ups in North America and Europe in the first three quarters of 2024.

The second noteworthy sign of progress in A&R tech would be a major exit from a start-up investment. ‘There haven’t been too many VC success stories in adaptation yet,’ says Mazzacurati. ‘A lot of A&R companies are not going to IPO. They will be acquired and be part of the portfolio of solutions for larger corporations. But so far, there hasn’t been a billion-dollar A&R acquisition.’

Nevertheless, some investors are confident that the need for A&R solutions will grow. Lightsmith’s Koh asks, ‘Will there be an immediate increase in demand? Absolutely. Look at the impact of these air quality events from wildfires. The demand for air purification at the consumer level exploded last year.’

Big companies are driving scale

Corporations that operate outside the financial sector make up a vital part of the climate tech ecosystem. They purchase and use climate technologies. They license technologies or acquire start-ups to tap into the growth opportunities associated with demand for climate solutions. And they provide financing to climate tech start-ups, investing through their own balance sheets and through corporate venture capital (CVC) units. Over the past few years, large, non-finance companies have taken part in around a quarter of climate tech deals: 28% of deals in the first three quarters of 2024, in line with 26% in 2023.

As dealmakers, large companies can offer climate tech start-ups forms of support they may not get elsewhere: deep industry expertise to inform business decisions; networks, supply chains and customers interested in climate solutions; and a willingness to make the sort of sizeable investments that can bring start-ups to scale. Toto of the Salesforce Ventures Impact Fund explains: ‘CVCs can invest on a longer time horizon, which is often better for alignment. They can support start-ups as they test and iterate on product, run pilots and earn contracts en route to building an impactful business.’

Even as corporate participation in climate tech deals has stayed relatively steady for several years, it has shifted towards the later stages of the investment life cycle. In the first three quarters of 2024, 61% of corporate deals were either mid-stage or late-stage—more than twice the percentage in 2018 (and considerably higher than the 33% share among finance-sector investors in 2024). This shift may reflect companies’ growing interest in scaling up proven climate technologies rather than placing bets on technologies that are less developed.

Relatively speaking, large companies focused more of their investment activity on energy and mobility solutions in the first three quarters of 2024 when compared with financial entities. For example, large companies backed energy-related ventures with about 45% of their total funding flows. By comparison, financial firms supported energy-related ventures with 38% of their funding.

This distribution partly reflects the tendency of corporate players to concentrate their climate tech plays in their own sectors, whether that tendency is designed to take advantage of their sector know-how or to speed the creation of solutions to problems affecting their own organisations, their customers and their supply chains. Analysis shows that the bulk of the capital from deals involving energy companies flows to climate tech start-ups serving the energy industry. Likewise, a large share of the money from deals involving industrial firms—a category including vehicle manufacturers—goes into start-ups in the mobility sector.

‘We face challenges around low-carbon, high-heat applications that we are looking to resolve,’ says Jonathan Williet, manager of external ventures, Europe, at NOVA, the venture fund of Saint-Gobain, a large manufacturer. ‘Finding solutions to these challenges can be difficult, so we look for investments in start-ups with breakthrough innovations in this field.’

The sector focus that companies bring to their deal-making means that capital from the deals they join is distributed differently than the capital from other deals. Start-ups operating in underfunded sectors and requiring specialised capital might therefore benefit from looking to CVCs as potential backers, alongside VC and PE investors.

If the last three years have shown us anything, it’s that investors are unlikely to increase funding for climate tech start-ups strictly for the sake of the planet. Yet it’s also apparent that the shift towards a low-carbon economy is underway—and that investors and companies can create significant value if they get ahead of this shift. Exploring the climate tech opportunities highlighted in this report—in AI, in adaptation, in climate solutions for high-emissions sectors—is one way to find an edge.

Methodology

Emma Cox, a partner with PwC UK, is PwC’s Global Climate Leader.

Will Jackson-Moore, a partner with PwC UK, is PwC’s Global Sustainability Leader.

James King, a senior manager with PwC UK, is a leading practitioner in sustainability.

Rebecca Osmaston, a manager with PwC UK, specialises in sustainability services.

The authors thank Ferdinand Agu, Olivia Byrne, Ludo Findlay, Mahima Jethani, Flora Lonie, Georgina Lawson and Shreekumar Rakshit for their contributions to this report.

Sustainability and climate change services

Make your climate actions count with targeted, tailored solutions.

The CEO’s sustainability checklist

Reinventing your business for a sustainable future starts with four mission-critical actions.