What is DORA?

The “Digital Operational Resilience Act”, commonly known as “DORA”, is a European Union regulation that aims to strengthen the digital operational resilience of the financial sector in a context of deep digital business transformation and an increased exposure to cyber and IT risks. The regulation came into force on 16 January, 2023 and will be applicable from 17 January, 2025 across all EU member states. Operational Resilience is a challenge for financial service firms and the sector as a whole. Given the increase in cyber attacks and the interconnected nature of the financial system the profile of digital operational resilience has been elevated significantly.

DORA introduces very specific and prescriptive requirements that are homogenous across EU member states. Organisations need to be able to withstand, respond and recover from the impact of ICT incidents, thereby continuing to deliver critical and important functions and minimising disruption for customers and for the financial system. This is only achievable by establishing robust measures and controls on systems, tools and third parties, by having the right operational continuity plans in place, while testing their effectiveness on a continuous basis. Five core pillars of the regulation play an important role: ICT risk management, management of ICT incidents, digital operational resilience testing, management of third parties and information exchange.

Supporting Your DORA Transformation: Build trust to power

In a rapidly evolving digital landscape, businesses face the challenge of ensuring operational resilience. PwC's EMEA DORA Team is here to guide you through the Digital Operational Resilience Act (DORA) and support your transformation journey from now to January 2025 and beyond.

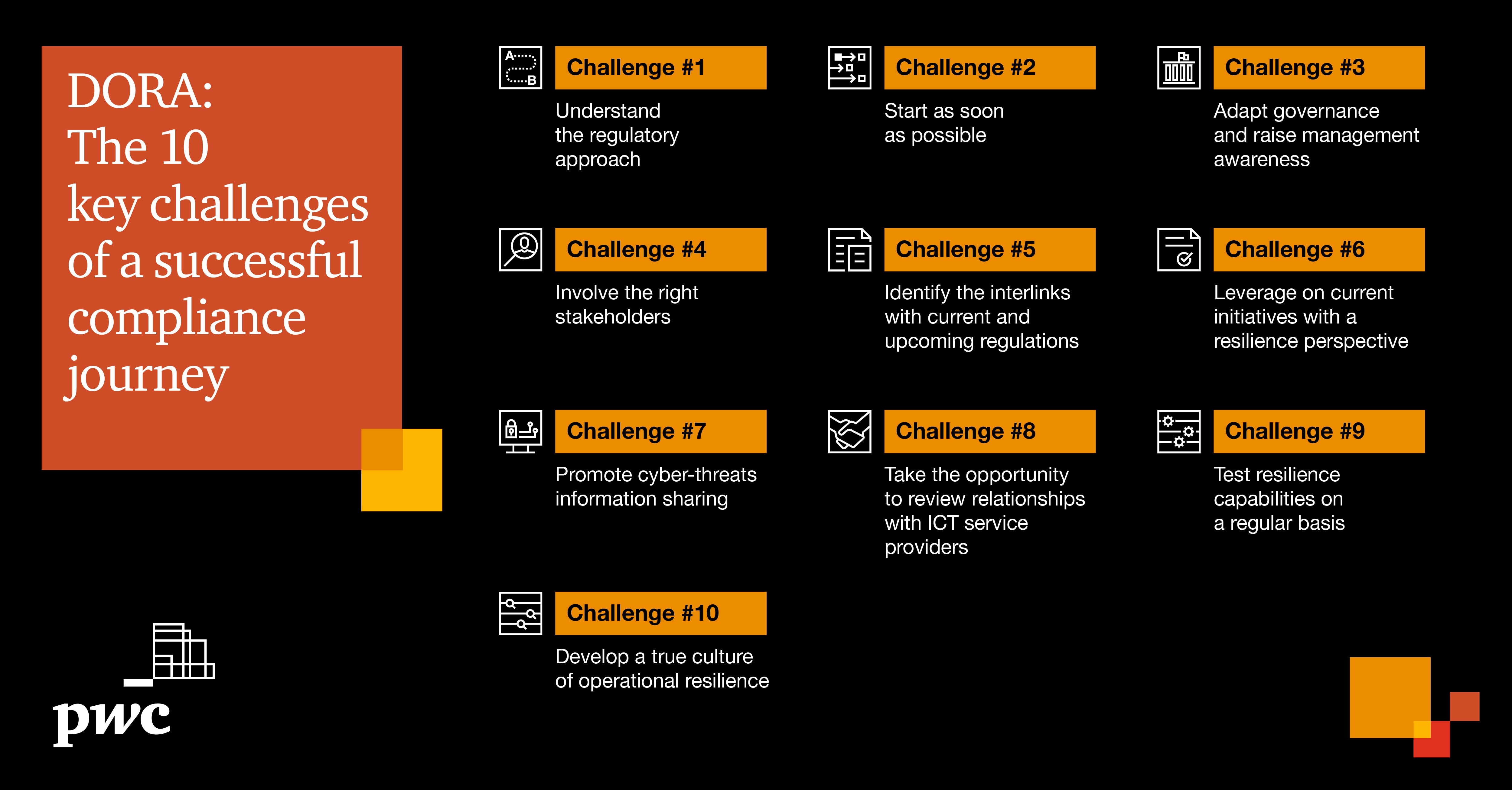

The 10 key challenges of a successful compliance journey

The 10 key challenges presented below come from the main messages and testimonies of the conference “DORA Regulation: Decryption, issues and sharing of experiences” organised on 24 November, 2022 by PwC France and Maghreb.

These challenges are all avenues to help you prepare for the requirements of the DORA regulation. They constitute benchmarks that will need to be adapted to each business environment in order to make DORA an opportunity for financial services institutions, not an additional regulatory constraint.

Download the white paper

DORA: The 10 key challenges of a successful compliance journey

Contact us

Rami Feghali

Partner, Global Risk Services FS Leader, Risk Services Leader, PwC France

Tel: +33 (0) 1 56 57 71 27

Grant Waterfall

Partner, EMEA and Germany Cybersecurity & Privacy Leader, PwC Germany

Tel: +49 170 1553647

Contact us

Shaun Willcocks

Partner, Global Risk Markets Leader, Global Internal Audit Leader, PwC Japan

Tel: +81 (0)90 6478 6991

John Sabatini

Partner, Clients and Markets Leader, Cyber, Risk & Regulatory, PwC US

Tel: (646) 471-0335

Greg Unsworth

Partner, Digital and Data Services, Risk Services Leader, PwC Singapore

Tel: +65 9848 6025

Dr. Robert Paffen

Partner, Global Risk Services Digital Leader, Germany Risk & Regulatory Leader, PwC Germany

Rami Feghali

Partner, Global Risk Services FS Leader, Risk Services Leader, PwC France

Tel: +33 (0) 1 56 57 71 27

Darren Henderson

Partner, National Risk Assurance Leader and Finance Managed Services Leader, PwC Canada

Tel: +1 416 941 8379