Introduction

On 19 February 2024, the European Central Bank (ECB) published its revised guide to internal models (the Revised Guide). This blogpost sets out the background of the changes, the key changes and their potential impact on institutions and concludes with a brief analysis.

Background

The Capital Requirements Regulation (CRR) mandates the ECB to authorise the use of internal models for credit risk, counterparty credit risk, and market risk by institutions, provided that a set of requirements outlined in the CRR are fulfilled.

The ECB’s guide to internal models was published in October 2019 (the Original Guide) with the main objective to ensure consistent application of high supervisory standards across directly supervised institutions, fostering uniform understanding and adherence to regulations governing internal models.

The Original Guide's chapters align with the CRR requirements and provide a clarification of the ECB’S interpretation of these requirements and publications of the European Banking Authority (EBA) relevant to the internal ratings-based (IRB) approach (e.g., EBA guidelines (GL) on probability of default (PD) and loss given default (LGD) estimation, and EBA GL on definition of default, EBA regulatory technical standards on assessment methodology, etc.).

The Original Guide has served as a valuable resource for both institutions and supervisors, offering transparency on the ECB’s expectations for implementing regulatory requirements related to internal models. Nevertheless, the ECB deemed a revision necessary due to the following reasons:

- To accurately incorporate evolving developments in regulatory requirements.

- To introduce refinements to topics covered in the previous version, informed by past experiences.

- To address additional topics requiring further clarification of existing regulatory requirements, as identified through past experiences.

On 22 June 2023, the ECB launched a consultation on its proposed revisions to the Original Guide (the Consultation Version) which ended on 15 September, 2023.

During this period, a total of 20 respondents submitted 625 comments to the Consultation Version. The ECB has reviewed these comments and, together with the Revised Guide, issued a feedback statement, offering a comprehensive summary of the comments and the ECB's evaluations thereof.

The major revisions to the Original Guide were implemented in the Consultation Version, with the Revised Guide primarily incorporating clarifications arising from the consultation feedback.

The Revised Guide has retained the same structure as the Original Guide, with a general topics chapter followed by three risk-type-specific chapters.

In the table below we have included a description of the key changes to the Original Guide, their impact, and the required actions for institutions because of these changes.

Key change topic |

Description of change |

Impact |

Required actions |

Overarching principles for internal validation |

|

Medium high |

|

Roll-out and permanent partial use

|

|

Medium |

|

Reverse the use of less sophisticated approaches |

|

Medium high |

|

Definition of default |

|

Medium high |

|

Probability of default |

|

Medium low |

|

Loss given default |

|

Medium |

|

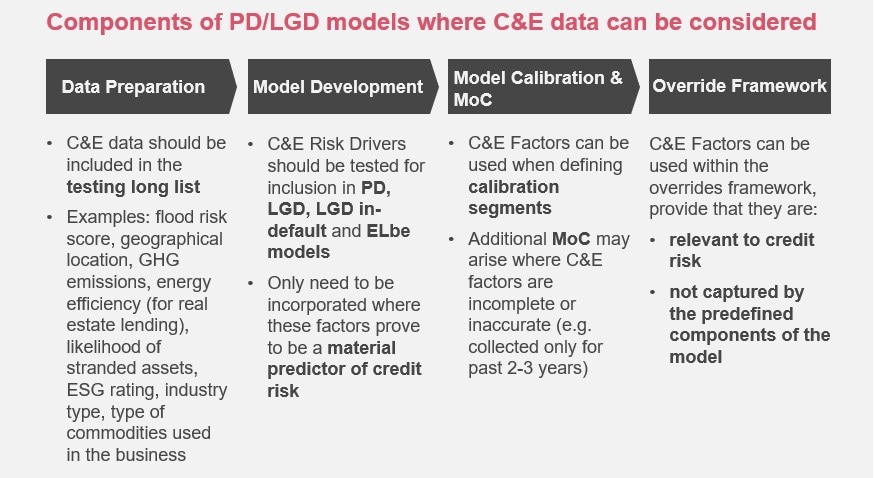

Highlighted: Climate-related and environmental risk

The Revised Guide specifies that banks should include material climate-related and environmental (C&E) risks in their models. The graphic below sets out the components of the PD/LGD models where C&E data can be considered and what banks should do to be able to meet this criterion.

On the back of this, banks should take the following action:

1) Banks should start collection of Climate & Environmental data

- The next generation of models should consider C&E factors across the entire modelling process

- In order to fulfill this requirement, the collection and analysis of relevant C&E factors needs to start now

- This will pose a significant challenge to each insititution in the identification and sourcing of data that satisfy regulatory requirements on data quality

2) Banks should refine override frameworks to include C&E risk

- This should be done now — since including drivers in models directly is not feasible for most banks yet

- Clear guidance is needed for credit officers who are responsible for rating assignment and loan approval

Conclusion

Clearly for several banks, the Revised Guideline introduces challenges that might require substantial investment and resource allocation.

The key challenges are related to the new path laid out to revert to the less sophisticated methods and the adjustments to the existing roll out plans in the pillar 1 modelling space. All related challenges with this reversion to the less sophisticated methods, starting with the new segmentation, the calibration, and the default trigger identification several technical methodological issues, should be addressed . To be able to address some of these challenges, the relevant IT infrastructure should be improved or upgraded.

The additional clarifications provided regarding the introduction of climate-related and environmental risks in the IRB space are clearly welcome, but still have room for progress in near future.