Supervisory Stress testing: The EBA / ECB’s biannual stress testing exercise

Let’s get ready to stress test

All significant institutions are subject to supervisory stress testing, both as part of the Comprehensive Assessment as well as - on a biannual basis – as part of ongoing supervision by the ECB.

Key facts at a glance:

- The stress test follows the methodology and templates used by the EBA exercise, but with added proportionality

- The stress test consists of two scenarios (Baseline, Adverse), both of which cover a 3-year-timespan

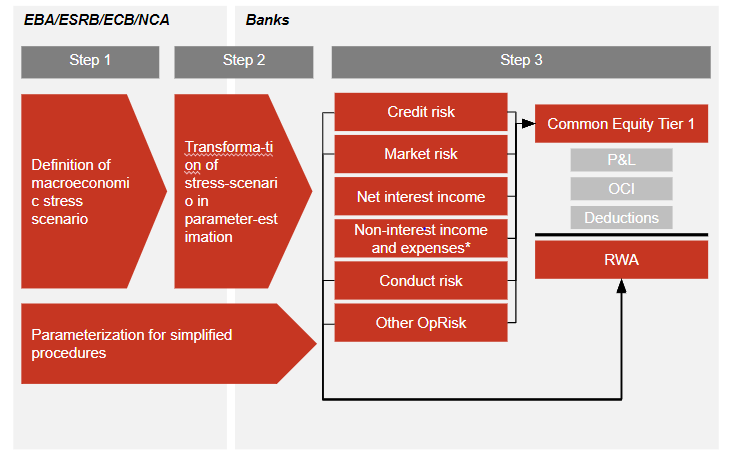

- Banks are provided with a macroeconomic scenario which they need to translate into stressed risk parameter (e.g. PD, LGD), stress their portfolios based on these parameters and calculate a stressed CET-ratio

- The results of the stress test provide information to the ECB in the context of setting of the pillar 2 guidance (P2G)

What needs to be done?

The challenges posed by the stress test concern not only a bank’s capital

PwC has extensive experience in supporting banks participating in the stress test exercise

In our experience, banks need to master the following challenges to successfully participate in the stress test:

As the stress test exercise impacts many departments within a bank (risk, finance, treasury, IT, etc.), a coordinated approach with clearly defined responsibilities is indispensable. This means not only allocating responsibilities for the different aspects covered, but also ensuring consistency across all these areas. Finally, communication with the ECB, often characterised by short deadlines, must be managed.

No stress with stress testing!

PwC has supported banks since the first EBA/ECB supervisory stress test in 2014 and has extensive experience and experienced staff within our international global network. Our experts cover all relevant topics, from risk to accounting, and can provide key insights from cross-client benchmarking. Our expertise helps you calculate stress impacts, aggregate figures in ECB templates and review data quality and consistency in COREP and FINREP reporting.

Understanding and applying the ECB’s methodology is a challenge in itself, as the “one-size-fits-all” provisions by ECB need to be aligned with bank-internal models and methodologies. Secondly, the ECB’s focus on alignment of all data with COREP and FINREP values may not be in the DNA of a risk or treasury department. And finally, only a very thorough understanding of the methodology allows organisations to apply it in an optimised way.

The stress test exercise requires banks to combine data from supervisory reporting with internal data and model outputs in a consistent manner across departments. Granular data, segmented according to supervisory definitions (exposure classes, product or counterparty breakdowns), in an environment that allows flexible but replicable calculations is a key ingredient for successful stress testing.

The last point in particular points to the necessity to have in place adequate systems and tools that allow manipulating data, being able to take into account last minute changes resulting from the quality assurance process by ECB and filling them into the Excel templates provided.

Contact us