The CRR 3 introduces new requirements for ESG (Environmental, Social and Governance) especially in Pillar 1 and Pillar 3 for all institutions. The following graph from our Whitepaper provides an overview of the current and new requirements.

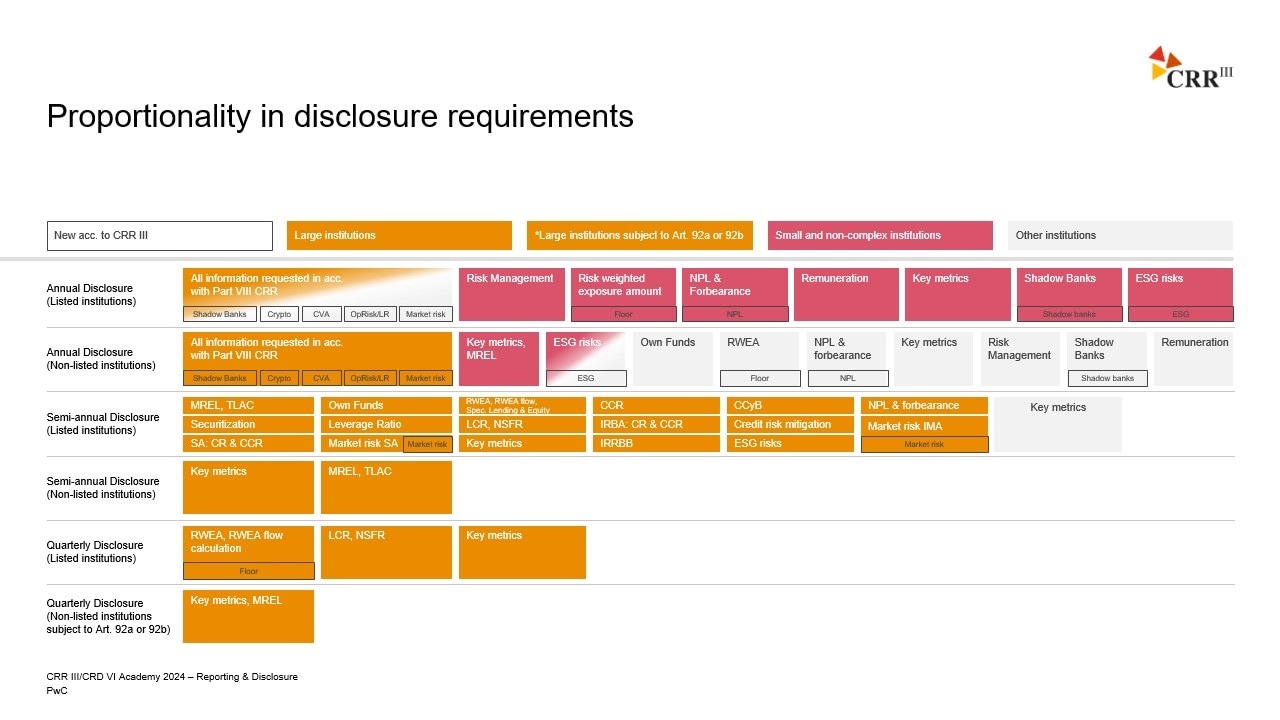

The amended Articles 433a to 433c CRR 3 require all institutions, including subsidiaries acc. Article 13 CRR 3 to disclose information on ESG-Risks at different frequencies in their Pillar 3 reports. Large institutions will have to disclose information on ESG-Risks semi-annually, whereas other and small and non-complex institutions can resort to a disclosure of ESG-Risks on an annual basis. All disclosure requirements are shown in the illustration below.

The disclosure should distinguish between environmental, social and governance risks to provide among others a deeper understanding on the impacts of physical as well as transition risks within the environmental risks. Further, institutions are required to include information on how ESG-Risks are integrated into their business strategies, processes, governance, and risk management.

The EBA is mandated to publish a draft ITS during the fourth quarter of 2024, which shall provide guidance on the reporting and disclosure requirements taking proportionality into account. Overall, the EBA once again emphasises the strategic objective of promoting the harmonisation and integration of reporting and disclosure requirements.

Between transparency and sustainability: The ESG Pillar III Disclosure Study

In a recent study PwC Germany has analysed and evaluated the 2022 disclosure reports published by 25 large, listed EU banks on their ESG disclosures planning to update the study with the 2023 disclosure reports and extend its scope to include the new requirements.

The Benchmarking analyses carried out in the study, indicated that, among other things, clear market standards could be identified in some areas of ESG-disclosure. Further, the study shows that the banks take the disclosure of ESG-Risk seriously. However, the study also revealed that there is still room for improvement and that the requirements have not yet been implemented 100% by the institutions.

Some key facts from the study with the disclosure reports from 2022 are shown below:

Implications for Institutions and Conclusion

As the world changes and the effects of climate change affect more and more of our daily businesses and lives, the inclusion of extensive information on ESG-Risks marks a significant milestone in the reflection of climate related effects on the banking sector in the prudential framework.

However, the new disclosure requirements for ESG-Risks and the extension of the disclosure requirements of ESG-Risks to all institutions impose a substantial workload and cost for the institutions. New data points must be collected, portfolios must be analysed and data from third-party providers must be connected.

And therefore, to take part in increasing the transparency on ESG-Risk induced effects on the banking sector, the institutions are advised to familiarise themselves with the new requirements of CRR 3 at an early stage.

© 2017 - 2025 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.