The European Banking Authority (EBA) has published its guidelines on the resubmission of historical data under the EBA reporting framework

The aim of these guidelines on the resubmission of historical data is to provide guidance on how banks should correct errors, inaccuracies, or other changes in their reported data. The guidelines set out a general approach to resubmission based on the frequency of the original report and the reference data affected by the errors. The guidelines will be applicable three months after the outstanding publication on the EBA’s website in all official languages of the EU. Technically, the application is still subject to the decision of the respective competent authorities within the regular comply-or-explain process. However, there is currently no indication that the authorities will not apply the guidelines.

So far, there are no standardised regulations in place for the submission of correction reports. According to EBA’s technical standards on Supervisory Reporting under the Regulation (EU) 2021/451 banks would formally need to correct their reports for any deviation in their reporting data, but there is especially no clarity regarding the extent of corrections (one error mostly effects various templates given the strong interconnection of the underlying EBA data point model) and the time horizon for historical data resubmissions (in most cases, the error was identified with some delay and has not only an impact on the current reporting period but also on past reference dates ).

That’s why in practice the supervisory requirements for corrections and resubmissions often vary from bank to bank which leads to inconsistencies in both banking and supervisory procedures. Against this background, the new EBA guidelines apply to all types of financial institutions and aim to ensure consistency across the EU by explicitly defining resubmission requirements for regulatory reports.

Resubmission of current and historic reference dates

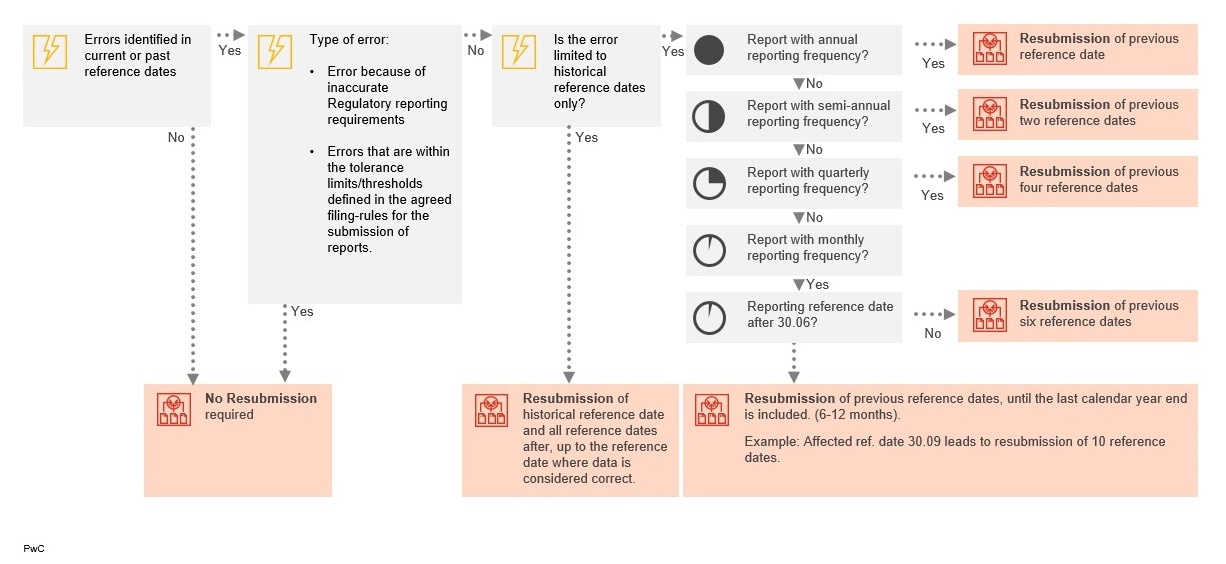

Depending on the reporting frequency of the affected report, the new EBA guidelines define a clear procedure on how to resubmit regulatory reports. Institutions are expected to resubmit the corrected data for the current reference date and the historical data affected by the errors or inaccuracies for past reference dates going back at least one calendar year (except for monthly reported data), as follows:

- For monthly reporting, six past reference dates must be resubmitted in addition to the current data. If no year-end is covered by the six previous months, institutions are also expected to resubmit all reference dates up to the end of the previous calendar year.

- For quarterly reports, four past reference dates must be resubmitted in addition to the current data. For half-yearly reports, two past reference dates must be resubmitted in addition to the current data.

- For semi-annually reported data, two previous reference data must be resubmitted in addition to the current data.

- For data reported with annual frequency, one past reference date must be resubmitted in addition to the current data.

EBA does not provide any specific proportionality concepts for the resubmission requirements beyond those facilitations that are already applicable according to the ITS on Reporting.

Resubmission of past reference dates only

Additionally, where errors, inaccuracies and the related corrections only affect the historical data and not the current data, financial institutions are expected to resubmit corrected historical data for the reference date where the error has occurred and for all reference dates up to the current data or until the reference date when the data is considered as correct. Those retroactive resubmissions are expected maximum for the historical data going back one calendar year from the current data. However, the EBA does not rule out that the competent authorities or the EBA itself may require further reports to be corrected that go beyond the one-year period.

Exceptions from resubmission procedure

By derogation from this general expectation, the guidelines state that institutions may refrain from correcting historical data in certain situations.

Where the questions and answers to the EBA Single Rulebook clearly indicate that regulatory or reporting requirements have been deemed inaccurate and clarifications to those regulatory requirements require changes to the reported data, financial institutions should only make relevant changes for future data from the publication date of the answers.

The guidelines are not considering materiality thresholds, nor any specific measures to reflect proportionality. However, the guidelines propose to change the precision requirements of the EBA filing rules from 1,000 to 10,000 for monetary amounts, i.e. errors that fall within the tolerance limits defined by the filing rules do not need to be corrected.

The new resubmission requirements are depicted in the following graphic:

Impact and next steps

We believe that most stakeholders highly appreciate EBA’s approach to clarify and harmonise the correction and resubmission requirements. However, because of the new guidelines, there is a high chance that many institutions will have to correct significantly more reporting data than they have done to date following their individual consultation with the respective supervisory authority. This is mainly due to the new definition of the minimum time horizon for the resubmission of historical data and will not only lead to higher efforts but also to increasing complexity for institutions. With the increased precision requirement, the guidelines try to give some degree of relief to reporting institutions, as less errors will be detected, nevertheless this only reduces the resubmission effort for smaller (monetary amount <=10.000) errors.

To better grasp the dimension of change, one must recall that institutions must submit tens of thousands of data points every reporting period. Hence, in practice, it is a huge challenge for institutions to report each data point fully accurately and consistently across the different reporting formats and templates. The identification of errors is therefore part of the daily reporting processes for many institutions. Now, with the introduction of the new EBA guidelines, it might become necessary for all institutions to even implement and maintain a standardised correction and resubmission process for historical data. What seems reasonable at first glance can be very complex and costly at second glance. Particularly in the light of the strong interconnections between different reporting formats and templates and given the constantly evolving taxonomies, data point models and thus bank-internal reporting solutions, the new standard requirement to correct and resubmit historical data calls for clear governance, policies, processes, and controls similar and in parallel to the regular reporting cycle. In other words: Kicking off the resubmission process only on an ad-hoc basis does not seem to be appropriate anymore. This becomes even more evident when looking at some of the open issues:

- As Data Point Models (DPM) and validation rules keep on evolving, it is not yet clear from the guideline which one must be used when resubmitting historical data, i.e. it remains unclear which version of the DPM and validation rules have to be used.

- Depending on the answer to this question, it might become necessary to adjust the existing data retention and archiving policies and to “freeze” the old reporting infrastructure to be able to reconstruct historical data in a standardised and efficient manner.

- One can imagine many relevant scenarios where even non-material inaccuracies in one template can lead to complex and burdensome second-round effects, e.g. errors in a reporting template of a subsidiary which lead to subsequent errors in the reporting templates of the whole group. Hence, institutions might still be forced to define their own thresholds and procedures to be able to cope with the strong interconnectedness.

- Given the direct link between reporting and disclosures, the question arises if and to what extent the pillar 3 disclosure report must be adjusted following a resubmission of reporting data. Furthermore, as regulatory KPIs (e.g. CET1 ratio, RWA, Leverage Ratio, LCR) reflect aggregated reporting data, also the notes to the IFRS financial statements might be affected by the resubmission of historical data which would even trigger some accounting- and audit-related questions.

- Beyond the interdependencies of regulatory reports, there can also be an impact on the supervisory assessment of an institution, as Common Reporting Framework (COREP) and Financial Reporting( FINREP) data points are also being used for the Short-Term Exercise (STE), Stress Testing, Internal Capital Adequacy Assessment Process (ICAAP) or Internal Liquidity Adequacy Assessment Process (ILAAP). This new resubmission procedure can lead to further inconsistencies when reference dates of the respective inspections or inquiries are affected.

Which advantages and challenges do you see for your reporting processes? We are very keen to discuss with you the impact of this long-awaited EBA initiative. We at PwC have extensive experience in establishing, reviewing, and optimising regulatory reporting processes. We can support you with the development and rollout of an extended correction and resubmission process that is in line with the new EBA requirements and that does not overstrain your organisation. Please do not hesitate to contact us.