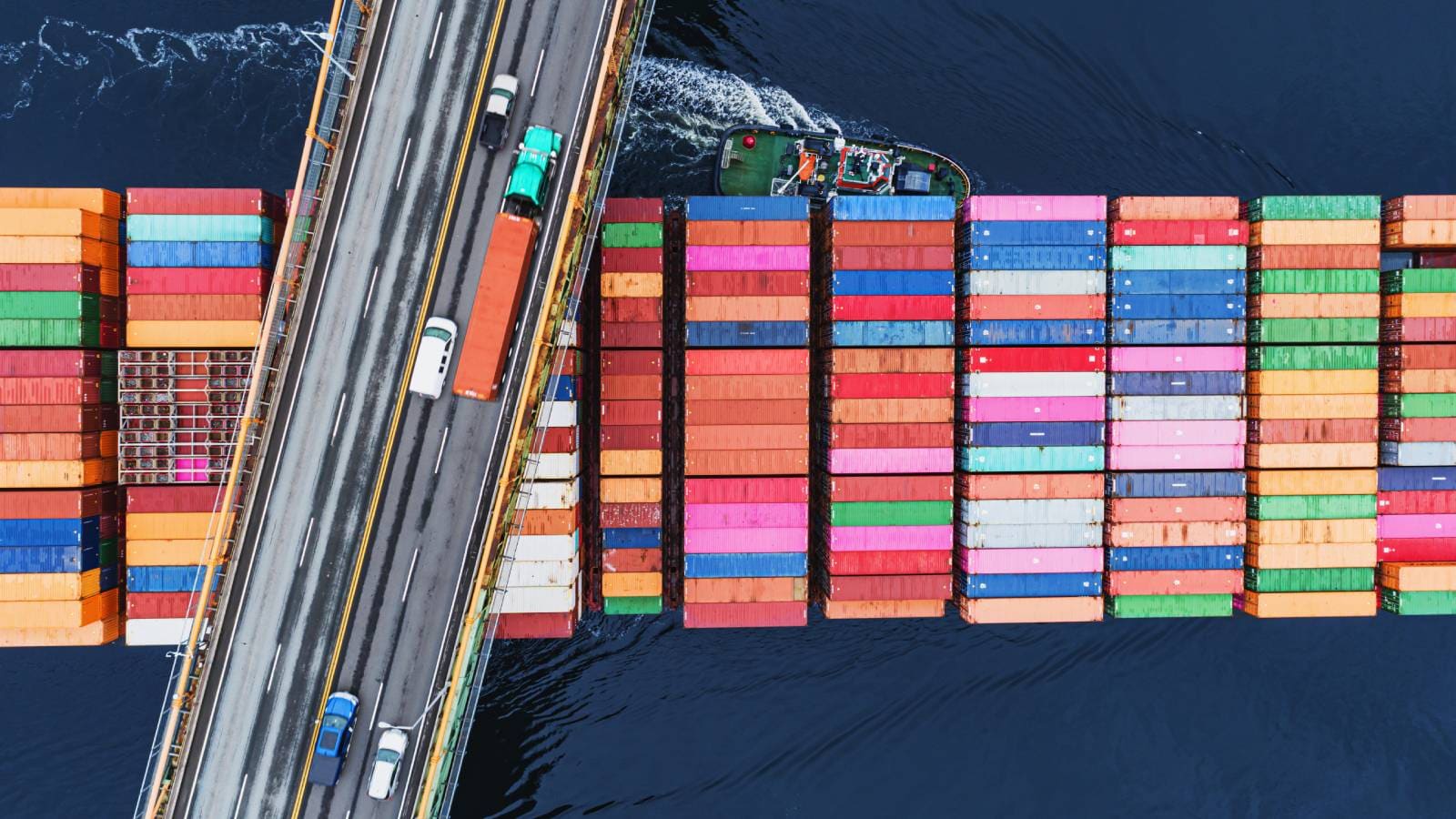

As the EU Carbon Border Adjustment Mechanism (CBAM) comes into effect, the time to invest in your supply chain operations is now. Organisations who proactively engage with CBAM may achieve future competitive positioning against their peers and avoid potential fines, as well as prevent a loss of market share.

What is the CBAM

Enacted in October 2023 as part of the EU's Fit for 55 package[1], the CBAM complements the existing EU Emissions Trading System (‘EU ETS’). The CBAM effectively places a price on certain greenhouse gases (‘GHG’) emitted in the production of selected imports, which aligns with EU GHG reduction goals, preventing ‘carbon leakage’ and levelling the playing field for EU and non-EU producers. Carbon leakage refers to the relocation of industry due to differences in carbon pricing policies between jurisdictions.

The CBAM currently covers the import of certain cement, iron and steel, aluminium, fertilisers, electricity, and hydrogen products. The EU is planning to assess and potentially expand coverage of the CBAM by 2030, aiming to include over half of emissions in the EU ETS sectors by the full phase-in of CBAM in 2034.

For now, CBAM importers face reporting obligations, with the first quarterly CBAM reports due on 31 January 2024. However, due to difficulties with actual filing of the report, the Commission has published that companies can file a request for delayed submission, giving them an additional 30 days to submit their CBAM report. Thereafter, starting from 1 January 2026, the Authorised CBAM Declarants must submit annual CBAM reports and purchase/surrender CBAM certificates (e.g., the financial implications start as of 1 January 2026). The price of these CBAM certificates will be pegged to the average price of allowances under the EU ETS, thereby equalising carbon pricing costs between the EU and non-EU producers.

Why does the CBAM matter and who is responsible

Compliance with CBAM is mandatory for the ‘Authorised CBAM Declarants’[2] and indirect customs representatives during the transitional period. The CBAM applies on all in-scope imports, where the shipment value is equal to or greater than EUR 150 (which is also the EU customs declaration threshold). The low value de minimis means many organisations will fall under the scope of CBAM upon the first importation of an in-scope good.

These entities must ensure the timely lodgement of their quarterly CBAM reports during the transitional period, and will need to have established access to credible embedded emissions data for their CBAM goods by no later than July 2024. The importers of CBAM goods should intimately understand the embedded emissions profile of each imported product, as it directly affects costs and administrative burdens. Depending on cost pass-through possibilities, consumers or importers may bear these costs.

Companies who do not innovate to reduce their embedded emissions will face an additional cost for the production of their goods, as CBAM certificates will need to be purchased based on the carbon emissions embedded in the imported product. This cost, whilst not directly borne by the manufacturer of the goods, will increase the indirect production cost for the customer. Where a company innovates to reduce their embedded emissions, they may face lower (or no) CBAM certificate cost, in which case they may be eligible to claim a price premium for their goods.

When CBAM enters into the ‘definitive phase’ (from 1 January 2026), a credit will also be available for carbon taxes paid in the local jurisdiction of production of the CBAM goods. In effect, this achieves the goal of CBAM, in that it would equalise the price associated with the carbon emissions between the EU (via CBAM) and the local country of production.

Suppliers of CBAM goods may have already received information requests from EU customers for emissions data. Failure to comply may result in a loss of market access and demand shift away from their products. CBAM will mandatorily apply to EU customers, so they will have no choice but to shift away from non-cooperative suppliers (due to the financial and non-financial burdens of non-compliance with CBAM).

What information is necessary and what if it is wrong?

During the first year of implementation (through to 31 December 2024) companies will have the choice of reporting in three ways:

- full reporting according to the new CBAM methodology (the EU method);

- reporting based on equivalent third country national systems; and

- reporting based on reference/default values (minimum).

As of 1 January 2025, only the EU method will be accepted. Under this method:

- Direct emissions are considered to be emissions from the production processes of goods, including emissions from the production of heating and cooling that is consumed during the production processes, irrespective of the location of the production of the heating or cooling.

- Indirect emissions are emissions from the production of electricity which is consumed during the production processes of goods, irrespective of the location of the production of the consumed electricity.

The emissions reported must be specified for each supplier, for each type of imported good in scope of CBAM and will include data on the quantity of CBAM goods imported and any equivalent carbon price that was paid abroad. Importantly, the CBAM information will need to be provided on a per-product and per-production installation basis.

Failure to fulfil these reporting obligations and make a genuine effort to accurately disclose embedded emissions can lead to a financial penalty ranging from EUR 10 to EUR 50 for each tonne of unreported embedded emissions. The exact amount will be dependent on the gravity and duration of the failure to report, with higher penalties to be applied where the duration of failure exceeds 6 months. The quantum of ‘unreported embedded emissions’ will be determined by the authority issuing the penalty.

What does the world post 2026 (potentially) look like?

The phase in of CBAM certificates, coupled with the phase out of the EU Emissions Trading System (EU ETS) free allowances, may raise prices for CBAM goods in the EU market, also affecting downstream products and finished goods. Theoretically these changes are already priced into the current market price of the EU allowances, however we suspect all impacted organisations are not yet fully aware of CBAM and how this applies to them. This could lead to a short-term shift in international trade, with EU imports favouring lower-emission products to avoid CBAM costs. Initially non-EU producers of high-emission goods may find opportunities in non-EU markets with less stringent carbon policies. However, the incentive to invest in decarbonising technologies and gain a competitive advantage in a low-carbon demanding EU market could drive global movement towards decarbonisation. Several other jurisdictions (such as the US) have already indicated an intention to implement their own CBAM equivalents (the UK already confirmed that they will implement an UK CBAM by 2027), further removing potential customers for high-emission goods.

Additionally, the prospect of new or more aggressive carbon pricing in other jurisdictions, especially export-heavy ones, may increase. Countries could update climate policies to mitigate carbon leakage risks, preserving market access and competitiveness for their own domestic markets and industries. The credit available for equivalent carbon taxes applied in other jurisdictions in the EU CBAM may further motivate countries to update their carbon policies to gain the economic benefits domestically.

The CBAM: Supply chain implications

So far we’ve talked about the CBAM, responsibility, the enforcement mechanisms and how this regulation might evolve and be implemented. While the CBAM has carbon tax implications, it also has significant supply chain implications.

The CBAM: Getting started now

- Determine boundaries: Map out your high-level, global product value-chain, pinpointing key activities with the EU and tracing the flow of goods into the region. Engage your procurement, tax, operations and/or logistics teams to effectively determine which activities fall under the scope of CBAM. This assessment should include the indirect tax / customs team due to the link to EU customs regulations.

- Enable legal / contract framing and terms: Revise standard contracts for CBAM suppliers by incorporating clauses that mandate accurate and timely embedded emissions data for CBAM goods, require collaboration on data improvement, clearly define supplier responsibilities for CBAM compliance, specify the party responsible for carbon certificate costs, and outline consequences for non-compliance. Additional clauses with respect to confidentiality and data storage should also be considered.

- Evaluate and identify impacted supply chain: Thoroughly map your supply chain to identify CBAM goods suppliers, analysing from raw material sourcing to end-product distribution, to capture the use of precursors. Assess suppliers' compliance with CBAM regulations and their capability to provide lower carbon-intensive goods. Consider engaging alternative suppliers based on this evaluation.

- Determine training, knowledge and data/tooling requirements: Identify key value drivers, enablers, constraints, barriers & ambitions (with timelines) for CBAM reporting. To improve efficiency, assess across the reporting ecosystem to identify areas of overlap and synergies in data collection, management and analysis (for example, some of the data points of CBAM may already be identified as part of the EU CSRD, US SEC disclosures or other sustainability reporting). Address any gaps by improving data collection systems, providing training to affected personnel and suppliers, and establishing guidelines and protocols to ensure CBAM compliance.

- Create proliferation and engagement plan, including “help lines” with expert knowledge: CBAM will require involvement across functional teams, from sustainability through to procurement, tax, finance, supply chain operations and logistics. Ensure roles, responsibilities and expectations (i.e. data requirements) are clearly communicated early. Investigate opportunities to partner with industry or organisations that specialise in carbon pricing to exchange ideas, best practices and insights

How can we help?

Within PwC we can assist from global trade and customs matters and address the impact for your supply chain. Our team of professionals can support you through your CBAM journey, from the impact assessment to helping set up a governance framework to ensure you are in control.

If you have any questions on CBAM or the impact on your supply chain, please feel free to reach out.

[1] Under the European Climate Law, the EU committed to reduce its net greenhouse gas emissions by at least 55% by 2030. The 'Fit for 55' package of legislation makes all sectors of the EU's economy fit to meet this target.

[2] Authorised CBAM Declarant is defined in the CBAM regulation, but broadly this is taken to be the importer of record for the CBAM goods which are imported into the EU Customs Union

Tax and sustainability services

Tax is a value driver in delivering on the business’s environmental, social and governance (ESG) goals.

The Corporate Sustainability Reporting Directive

Sustainability data and insights are becoming increasingly important for investors and stakeholders’ decision-making. Rethink your business with the CSRD to grow trust, value and performance.

Contact us

Claudia Buysing Damsté

Partner, International Trade, Customs, Sustainable supply chains, PwC Netherlands

Tel: +31 (0)65 103 04 63

Global Sustainability, Sustainable Supply Chains, Managing Director, PwC Hong Kong

Tel: +852 6331 6254