Domestic companies affected by the global minimum tax rules are subject to a notification obligation regarding the MNE group within 12 months from the start date of the tax year beginning in 2024 - by December 31, 2024, for calendar-year companies- as per the rules set forth in the Minimum Tax Act.

Please note that, based on the rule’s wording and the basic logic of the regulation, MNEs applying the Transitional country-by-country reporting ("CbCR") Safe Harbour for Hungary are still required to fulfill the notification obligation.

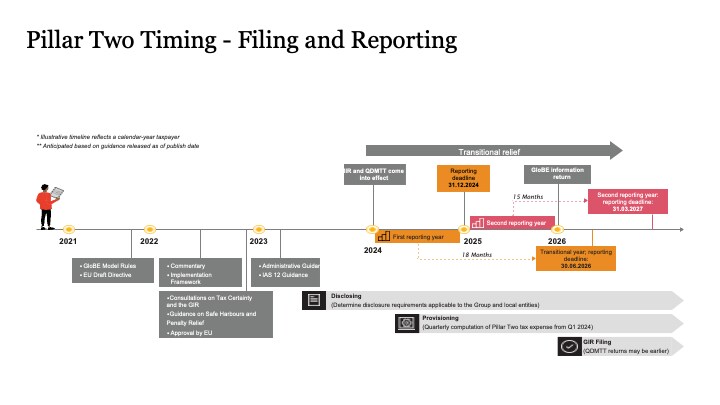

1. December 31, 2024: Deadline for the notification obligation.

2. January 2025: Preparation of transitional CbCR Safe Harbour tests and/or full calculations.

3. January–May 2025: Disclosure of any top-up taxes payable.

4. (Proposed legislation) November 20, 2025: Filing and payment of QDMTT advance payment. This obligation is not yet part of the current legislation, but the Government has proposed its introduction in the tax amendment bill submitted to the Parliament.

5. June 30, 2026: Filing of the GloBE Information Return (or potentially reporting) and QDMTT return.

We asked Bálint Gombkötő, a director of PwC Hungary, about the topic.

Affected taxpayers

Domestic members of MNE groups whose consolidated financial statements show revenues exceeding €750 million in at least two of the four tax years preceding the examined tax year.

Who is required to submit the report?

Subject to the provisions of the Minimum Tax Act

- a domestic group member; or

- a designated local group member acting on its behalf.

Content of the notification

The notification must be submitted on a form provided by the National Tax and Customs Administration via the usual electronic method; this form is currently unavailable.

Based on the draft autumn tax package published on October 17, companies subject to the Minimum Tax Act must include in the notification:

Identification details of group members (e.g., company name, tax number),

Their classification under the Minimum Tax Act, which requires considerations from a global minimum tax perspective. This classification is expected to include classifications such as joint venture, flow-through entity, permanent establishment, or excluded entity status of group members.

Additionally, the notification must include information on the ownership relationships among group members.

With the release of the form for the Notification, it should be further analyzed the exact information to be submitted on the form.

Consequences of failing to submit the notification

Failure to submit the notification or submitting it late may result in the tax authority imposing a penalty of up to 5 million HUF on the affected companies.

Additional tasks

Transitional CbCR exemption

It should be taken into consideration that domestic group members can only apply the transitional CbCR Safe Harbour exemption if the CbC report itself meets certain conditions prescribed by the Pillar II rules.

Deferred taxation

Deferred taxation can have a significant impact on the global minimum tax position, therefore assessing the upsides (or downsides) of applying deferred taxation under HUGAAP will be needed as early as 2024, considering the specific transitional rules of the global minimum tax.

Disclosure and provisioning of top-up taxes

It’s worth noting that while the first return for the global minimum tax is due 18 months after the end of the first tax year, any payable top-up tax must already be included in the financial statements of the financial year in question. This is contingent on the company making prior elections based on the global minimum tax legislation, including elections on GloBE income, covered taxes, or the allocation of QDMTT.

QDMTT tax advance declaration and payment obligation

In the autumn legislation package, the legislator introduced the reporting and payment system for QDMTT tax advances. For the domestic top-up tax, the group member must submit a tax advance declaration by the 20th day of the eleventh month following the last day of the tax year affected by the QDMTT and must pay the top-up tax.

The amount of the QDMTT advance payment must match the expected total amount of QDMTT for the tax year.

The proposed legislation also includes a provision stating that no late payment interest, tax penalty, or default penalty will be imposed on the QDMTT advance if the taxpayer has acted as expected in the given circumstances as the member of the MNE group.

How PwC Hungary can help

The experts at PwC Hungary have extensive, up-to-date knowledge in the field of global minimum tax.

Our services in global minimum tax include:

Assessing the applicability of the global minimum tax rules and determining related tax obligations

Modeling and calculation of the top-up tax

Providing administrative/technical support and guidance for reporting obligations

Applying deferred taxes in the Hungarian accounting system

Comprehensive support in compliance tasks, including the preparation of tax calculations and tax returns

The list is for informational purposes only. In addition to the services listed above, PwC Hungary also provides customized services tailored to individual client needs.

If you have any questions regarding the topic please don’t hesitate to contact one of our expert colleagues below, or your usual PwC contact.

Gábor Halmosi

Partner

Email: gabor.halmosi@pwc.com

Gergely Juhász

Partner

Email: gergely.juhasz@pwc.com

Gergely Czoboly

Senior manager

Email: gergely.istvan.czoboly@pwc.com

Contact us