Introduction

Change in the asset and wealth management industry (the ‘AWM industry’) is now accelerating at an exponential rate. Although the industry is set for growth over the next ten years, asset and wealth managers must become business revolutionaries, even disruptors, if they’re to survive and prosper. Now is the time for action.

Mike Byrne

Partner

Asset & Wealth

Management Leader

PwC Channel Islands

In our recent report, Asset & Wealth Management Revolution: Embracing Exponential Change (AWM2025), we predicted that assets under management (AuM) globally will have almost doubled by 20251.

The AWM businesses that make the most of the opportunities ahead will be those that are best prepared for change. They must become business revolutionaries, even disruptors, if they are to prosper – recognising a new world where the buyer is in charge, making intelligent use of digital technology, and adapting their products and strategies to reflect a reinvented industry.

Jurisdictions, too, must be agile and responsive. The expected growth in AuM will be uneven in consistency and timing; the slowest growth, in percentage terms, will be in developed markets. This is a highly competitive environment where margins are squeezed and new entrants, especially those with technology and analytics expertise, will fight hard for their share of business.

This is an exciting time for the thriving AWM industry in Jersey and Guernsey, but we must be sure that we’re ready for the opportunities ahead. The Channel Islands have a long and proud history of reinventing themselves; this is our next challenge. Jersey and Guernsey are ideally placed to capitalise on the AWM boom that’s underway and to cement their reputation as world leaders in alternative investments. But we can’t afford to be complacent.

In this report, we look at how the interconnected trends driving the AWM revolution apply to Jersey and Guernsey, and recommend some next steps for fund managers, service providers, regulators and policymakers.

The report draws on input from our AWM team in the Channel Islands and interviews with a number of leading figures within the Islands’ AWM industry – we would like to thank them for sharing their valuable time and insights. If you would like to discuss any of the issues raised in this report, please feel free to get in touch.

1. All views in this document are based on PwC opinions, supported by third-party verified information. See Global report here.

A time of growth and change

In 2014, PwC’s Asset Management 2020: A Brave New World1 (AM2020) anticipated a huge rise in investable assets worldwide, reaching US$102trn by 2020.

That prediction is on track to be not only met, but exceeded. Our latest report, AWM2025 2 , predicts that global AuM will reach US$111.2trn by 2020 and US$145.4trn by 2025 (see figure 1).

“The growth predicted in our AWM2025 report represents a tremendous opportunity for the Channel Islands. I’m very positive that we can be innovative and evolve our proposition to continue to be relevant in this changing world.”

Figure 1: Global assets under management by region (US$trn)

Alternative investments in the spotlight

AM2020 predicted a number of game-changers for the sector, including a shift from active management to passive, the rise of exchange- traded funds (ETFs) and, critically for Jersey and Guernsey, a much more prominent role for alternative asset management.

In AM2020, we also forecasted that global alternative assets would increase to US$13.0trn by 2020, driven principally by increasing investment by high net worth investors and sovereign wealth funds.

This prediction too, is on course to be not only met, but exceeded. Our AWM2025 report expects alternative asset classes – in particular real assets, private equity and private debt – to increase sharply, as investors diversify to reduce volatility and achieve specific outcomes. We estimate that alternatives’ share of global AuM will increase from 12% in 2016 to 15% in 2025 (see figure 2).

A recent PwC report also found that Sovereign Wealth Funds (SWFs) now allocate almost a quarter of their AuM to alternative investments. Despite many SWFs facing adverse conditions in recent years, total AuM still grew to US$7.4trn in 2016. This strong appetite for alternatives adds further fuel to the opportunities present.

Figure 2: Global AuM by type (US$ trillion)

What does this mean for the Channel Islands?

The projected growth of the AWM industry, and particularly the growing interest in alternatives, is excellent news for Jersey and Guernsey, which have unparalleled knowledge and experience in close-ended, long tail investment strategies. This niche is the Islands’ greatest asset.

Recent decades have also highlighted the Channel Islands’ capacity for strategic agility and innovation. This is continuing with the establishment of a leading position within the structuring and management of technology funds, with fresh investment horizons now opening through innovations such as blockchain. Building on the latest FinTech and RegTech developments, Jersey and Guernsey businesses are also harnessing digital technology to extend fund management capabilities, enhance client interaction and service, and improve the speed and cost efficiency of compliance3. Beyond technology, businesses are extending their global footprint through initiatives such as 2017’s ‘Ten Years in China’ anniversary event4 and investor roadshows in Kenya and South Africa5.

“The competitive landscape within which we operate is transforming rapidly – consolidation is driving competitiveness and my conviction is that scale and geographical reach are, and will, become increasingly important.”

“The smartest people in the room get what the Channel Islands offer in terms of specialist expertise, user-friendly service and regulatory stability. That’s why we’ve been able to attract flagship launches such as the SoftBank Vision Fund and CVC Fund VII.”

We’re already seeing the Channel Islands capitalising on worldwide growth in asset management. Funds in Jersey grew from £163bn to £265bn between September 2009 and September 20176; in Guernsey, the total value of funds increased from £132bn to £269bn over the same period7.

The Channel Islands also have a well-deserved reputation as a quality jurisdiction with robust but fair regulation. This will serve us well in the coming years of change. In short, Jersey and Guernsey are ideally placed to take full advantage of the developing boom in AWM. But there is also work to do to make sure the Channel Islands’ funds, regulation and infrastructure are in the best possible shape to adapt to a rapidly changing industry.

3. FinTech’s impact on AWM and emerging opportunities for innovation are explored further in our report, ‘Redrawing the lines: FinTech’s growing influence on financial services’, PwC, 2017 (https://www.pwc.com/gx/en/industries/financial-services/fintech-survey/report.html)

4. We are Guernsey media release, 2 October 2017 (https://www.weareguernsey.com/literature/2017/opportunities-for-investment-funds-in-china/)

5. Jersey Finance media release, 14 December 2017 (www.jerseyfinance.je/news/jersey-s-evolving-partnership-with-african-continent-highlighted-at-latest-roadshow-series#.Wm2dOUx2tD-)

6. Jersey Finance

7. Guernsey Financial Services Commission

What’s our vision for the future, what’s driving change and what do we need to do to respond?

Adapting to exponential change

Our AWM2025 report makes the important point that while the AWM industry is growing rapidly, it’s also in the midst of a fundamental transformation.

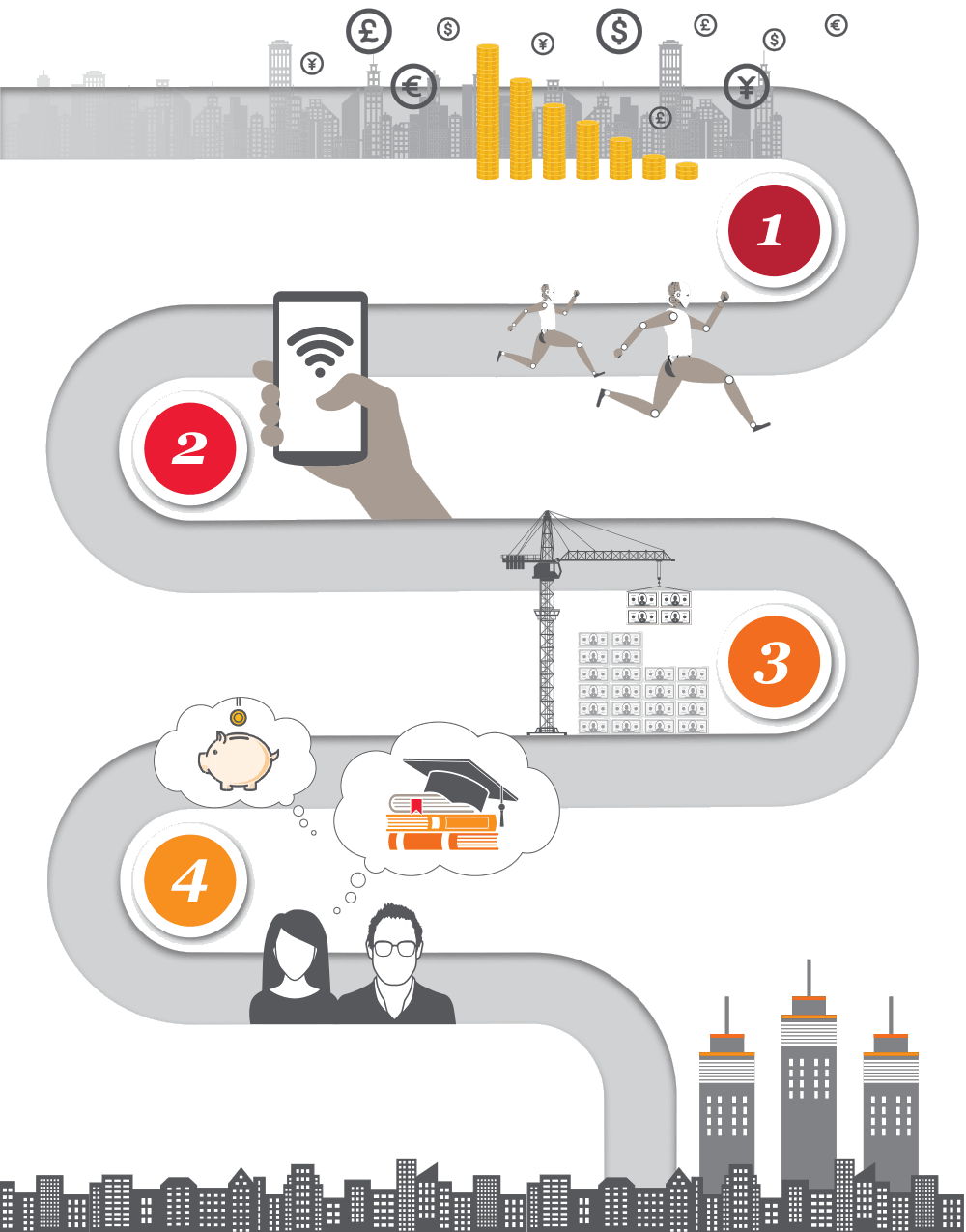

The report identifies four interconnected trends driving a revolution in the AWM sector. Between them, they will squeeze industry margins, which will in turn require firms to develop a clear strategy for the future, make scale and operational efficiency far more important, and integrate technology in all areas of the business.

Each of these trends has important implications for Jersey and Guernsey’s service providers, regulators and government:

- Buyers’ market

- Digital technologies: do or die

- Funding the future

- Outcomes matter

It’s difficult to predict how quickly these trends will play out. But they’ve been under way for some time and are accelerating. The difference is that the AWM industry must act now to fully understand them and adapt their business strategies accordingly.

We expand more on these and the implications for the Channel Islands in the following sections.

Change in asset and wealth management is accelerating. Although the industry looks set for rapid growth over the next ten years, asset and wealth managers must become business revolutionaries, even disruptors, if they’re to increase profits and prosper.

Now is the time for action.

Four trends will revoluntionise the industry:

Buyers’ market

Fees are being pushed down by investors and regulators. Increased regulation, competition and new entrants are disrupting value chains. As low-cost products gain market share, and larger players benefit from scale economies, there will be further consolidation and new forms of collaboration.

Digital technologies: do or die

The industry is a digital technology laggard. How well firms embrace technology will help to ones determine which prosper in the years ahead. The race is on ...

Funding the future

Asset and wealth managers have been filling the financing gaps resulting from the Global Financial Crisis. Their involvement in niches such as trade finance, peer-to-peer lending and infrastructure will dramatically increase. Helping individuals to save for old age, as governments step back, will also support growth.

Outcomes matter

Active, passive and alternative strategies have become building blocks for multi-asset, outcome-driven solutions. Firms must either have the scale to create multi-asset solutions or be content as suppliers of building blocks.

Since the 2008-2009 GFC, the forces of regulation, technology and fierce competition have begun to usher in transformational change. This period of reinvention will accelerate rapidly in the years ahead, forcing the industry to re-imagine itself. In five to ten years, fewer firms will manage far more assets significantly cheaper. Technology will be vital across the business and the industry will have found some new opportunities to create alpha, and restore margins.

It’s time to act.

Conclusion

Throughout history, Jersey and Guernsey have adapted to changing times. We’ve transformed our economy to meet demand, from ship-building, agriculture, tourism and now finance. When we need to change, we do – and our talent, infrastructure, laws and regulations have moved with us.

If the predictions set out in our AWM2025 report come true, we’re set for a significant period of global growth in Alternatives. However, there is no guaranteed right to share in this growth and we must ensure that we take all necessary action to capture our fair share.

Headwinds are present in the form of BEPS, AIFMD and general pressure on offshore jurisdictions. The uncertainty created by Brexit continues to be unhelpful.

Clear vision: We must continue to develop clear propositions and solutions and respond to the evolving market place, innovatively developing new products and refreshing existing solutions.

Telling our story: Our high level of regulatory compliance and tax transparency will serve us well going forward, but we must ensure that we tell our story in a clear and compelling way.

Business models: Detailed reviews of existing business models and products may be required to ensure that tax structuring, transfer pricing and governance remains fit for purpose.

Markets: We’ve a low penetration rate in key markets, specifically in North America (over 50% of global AWM) and Asia (highest predicted growth rates). We must focus on these opportunities, together with retaining focus on our key existing markets of the UK & Europe.

In respect of new markets, we must develop a clear market entry study and present a coordinated and compelling proposition on the relevance of our jurisdiction and how we can add value.

Access: The ability to distribute under private placement regimes has served us well post- AIFMD and we must ensure that we continue to evolve our regulatory frameworks and to invest in new and existing relationships with overseas governments and regulators to protect market access.

Invest: In response to fee pressure and investor expectations, we need to ensure that we invest in technology and automation to allow us to decouple AuM growth from cost increases. This focus clearly aligns with each Island’s population policies and the need to ensure good, sustainable growth.

Innnovate: We’ve the opportunity to be an “innovation sandbox” for many of the large multi-national service providers that operate in our jurisdiction and the ability of government to offer incentives (e.g. tax credits) to stimulate and support such investment is compelling.

“This is potentially a time of great opportunity for the Channel Islands, but all organisations need a strategy that’s relevant for the future. A relentless focus on technology and talent is absolutely critical and will separate the winners and losers.”

The ‘no regrets’ moves for organisations

Organisations are faced with an array of choices when looking at the future and considering how to respond to the key messages in AWM2025. This requires an understanding of the possibilities – both desired and undesired – to plan accordingly. No matter what the future holds, we believe there are some ‘no regrets’ moves that apply universally: