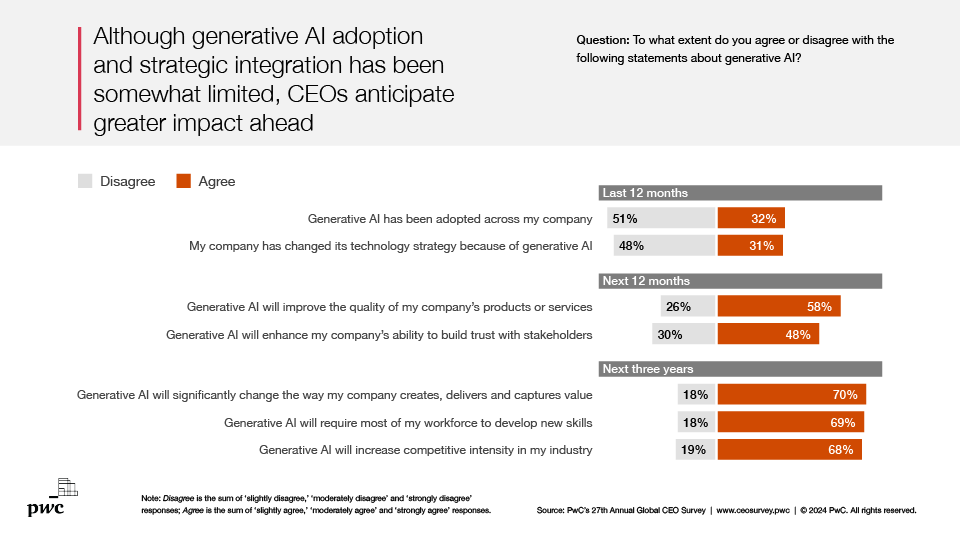

If you can’t keep pace, you can’t survive. Nearly half of the business leaders (45%) taking part in PwC’s 27th Annual CEO Survey believe that their company won’t be viable in ten years’ time if it stays on its current path. The result is an acceleration in the pace of innovation, modernisation and competitive reinvention, with transformational technologies like GenAI leading the charge. Seven in ten global CEOs believe that GenAI will significantly change the way their company creates, delivers and captures value over the next three years.

The impact of GenAI

Banking and wider financial services (FS) is one of the industries where this value potential is most marked. PwC’s AI Jobs Barometer has found that sectors with the most exposure to AI, which include FS, are seeing 4.8 times greater growth in labour productivity. Looking at retail banking in particular, research carried out by PwC found that GenAI could generate a potential 4.6% increase in operating profit margin.

Closer to customers

Within the front office, the key advantage is the ability to offer a full range of customers the kind of tailored advice, service and financial solutions that would previously only have been available to high-net-worth (HNW) clients. We’re seeing the results in areas ranging from personalised investment recommendations to virtual assistants that learn from each interaction, engage in a human-like way and relay the resulting data to inform and enrich individual customer insight.

More for less

In the mid- and back-offices, the benefits include tackling some of the labour-intensive pain points that raise costs and tie-up time that could be more valuably used elsewhere. Properly deployed technology can reduce the overall cost of compliance by 30%-50%, for example, with specific benefits in areas ranging from workflows and reporting to data-driven decision-making.

Further applications include fraud protection. We’re seeing how GenAI’s ability to analyse vast datasets and spot anomalies and unusual patterns in real-time can not only boost detection, but also filter out false positives, so bank professionals can concentrate on genuine threats.

Gold mine of data

Do neobanks and fintechs have a head start in capitalising on this potential? Not necessarily. Where traditional banks have a decisive edge over more recent entrants is the ‘gold mine’ of customer data at their disposal. But outdated core banking systems can often hold back their ability to make the most of this data, leaving the door open to institutions – traditional as well as neobanks and fintechs – with more agile and modern operating platforms.

Human-led, tech-powered

What also marks out the banks out in front are their GenAI-focused talent and skills. People not systems drive innovation and make the most of the tech potential. In relation to GenAI, this human-led, tech-powered edge not only centres around specialist developers and trainers, but also the organisation-wide capabilities needed to frame the requests (‘prompts’) and use the outputs to enhance decision-making and customer outcomes.

Recognising the risks

This ‘human-in-the-loop’ understanding is also critical in recognising and managing the risks opened up by GenAI. If data feeds are incomplete or the training, prompting and monitoring aren’t up to scratch, the technology can slip into bias, hallucinations (false answers) or toxicity (harmful language). In banking, these risks can manifest themselves in areas ranging from an inaccurate basis for decision-making to discrimination against particular population groups. These lapses can not only cause severe reputational damage, but also lost opportunity costs. In particular, boards may be reluctant to use GenAI-generated analysis in their decision-making or sign-off AI use cases because they don’t have sufficient confidence in the outputs.

Five ways to realise the GenAI potential

So how can your bank make the most of the GenAI value potential, while guarding against the risks? Drawing on my work with a range of banks, five priorities stand out:

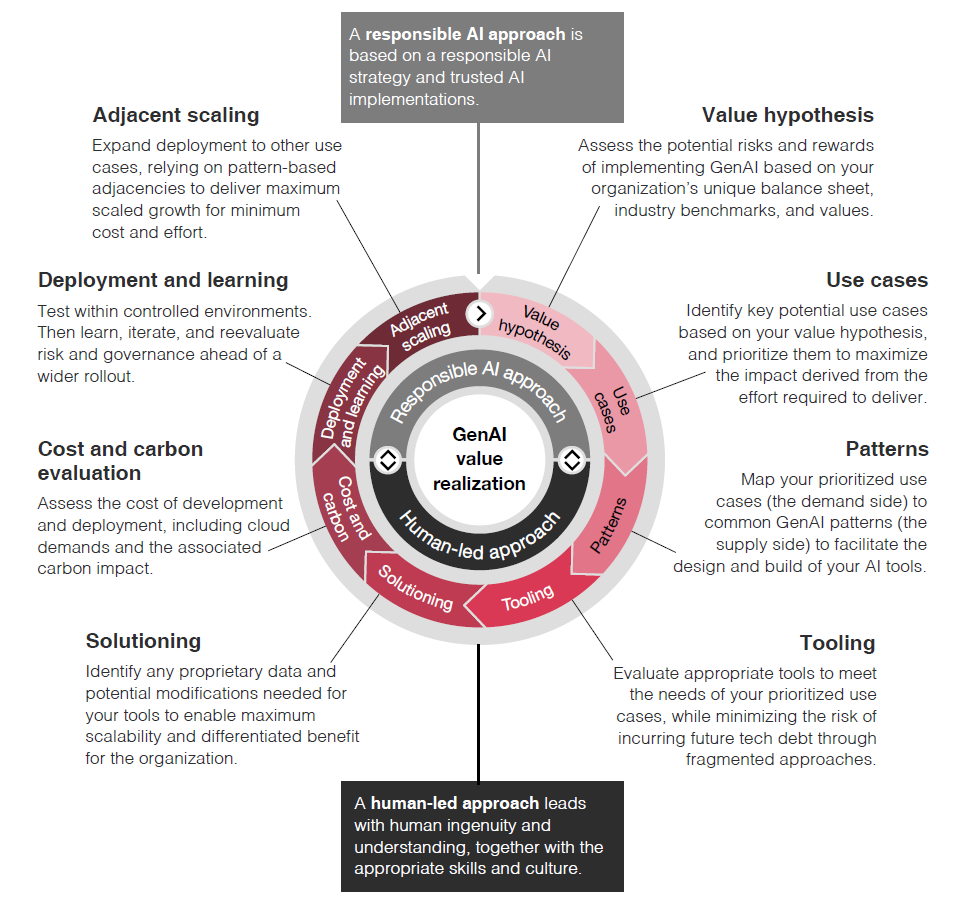

The GenAI value-realization flywheel

All industries can benefit from the value created by generative AI. By prioritizing GenAI deployments through the flywheel concept shown below, businesses can focus on efforts that will accelerate that value creation over time, helping them better position themselves to capture, realize, and maximize GenAI's value and benefits.

Clearing a path forward

GenAI will keep advancing, opening up opportunities and risks. Forging the right balance between capability, responsibility and value creation can help build confidence in your GenAI strategy and enable your organisation to move out in front.

If you’d like to know more about how GenAI could benefit your bank and how to realise the potential, please feel free to get in touch.