Valuation & Strategy Services

Our valuation specialists can assist businesses to achieve an in-depth understanding of the value of each business or asset in a transaction.

Samil PwC has a team of dedicated professionals specializing in valuations with a wide range of expertise and experience who can perform independent valuations of all businesses, divisions of businesses or infrastructure projects. Our leading-edge technical knowledge combined with our in-depth industry knowledge allows us to understand the specific factors driving each individual deal.

Our main advisory

- Compliance valuation

The valuation of the accounting firm is required for M&A, partition merger, stock exchange, and transfer / acquisition of business and assets under The Securities and Exchange Act and Financial Investment Services and Capital Markets Act.

Samil PwC provides the valuation service required by the regulations, based on the experience of participation in various transactions.

- Financial reporting valuation

Samil PwC has undertaken various purchase price allocation projects for business combinations and also valuation for impairment testing in accordance with IFRS or US GAAP. The increasing use of Fair Value measurement under IFRS and US GAAP in financial reporting has raised the profile of valuations and it is increasingly expected for corporate to need to prepare valuation work for the assessment of fair value for financial reporting purposes.

- Deal valuation

Our professionals provide valuation services of corporates, business divisions, and intangible assets in various types of transactions, such as M&A, restructuring, and readjustment of the business within the group.

- Strategy service valuation

We provide insights and solutions in relation to business portfolios, investments, non-core assets, intellectual property and capital structuring, with the key objective being to assist management teams to make value-enhancing decisions.

- Dispute valuation

We have numerous experiences when there are a wide range of circumstances in which an independent opinion of value is required, such as commercial or shareholder disputes, and each different scenario requires specialist knowledge and the application of specific skills.

- Tax valuation

Samil PwC provides robust valuations tailored to our clients’ requirements that can be used to support the terms of related party and other taxable transactions. Where necessary, we team with tax specialists to optimize the advice that we provide to our clients and reduce the risk of potential challenges by tax authorities.

- Acquisition Strategy for Growth Opportunity

- Post-Deal Services

Acquisition Strategy for Growth Opportunity

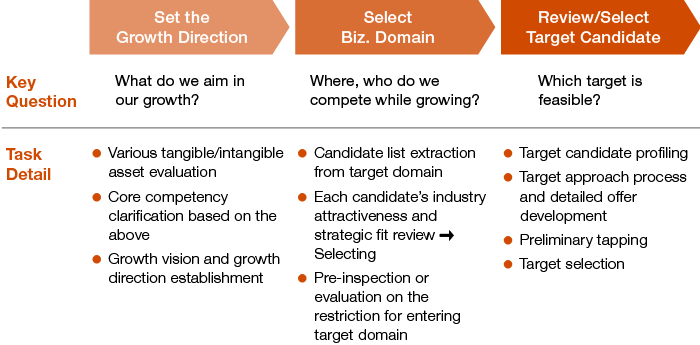

Acquisition strategy is often considered as a means to achieve sustainable growth - a core mission of every company. However, companies tend to solely focus on the 'success of M&A' without a specific direction or target analysis. Such an approach can often lead to a lack of synergy with existing businesses, failing to achieve the intended goals.

Therefore, Samil PwC's Deal strategy teams provide a series of tasks starting with specifying the direction of growth, selecting the business domain, and choosing the specific deal target. Throughout this process, in collaboration with the M&A Advisory service team, our teams discover the best target by taking 'feasibility' into account, maximizing the client's chances of a successful deal, and realizing 'Delivering deal value'

Post-Deal Services

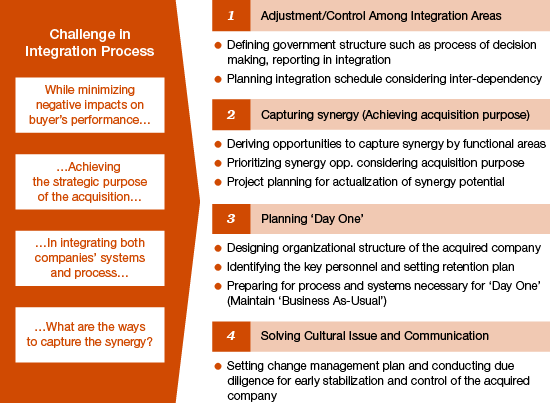

The integration process after the acquisition or merger (PMI) is mainly about the day-to-day activities of the company such as strategy, organization, human resources, finance/accounting, etc. However, the reason why PMI is difficult is that the time pressure of being ‘Day One’, and complicated conditions as various topics simultaneously have causal relationships and cause issues.

Therefore, the area-specific experts in Samil PwC work to deliver the deal value that clients intend by providing area-specific insight and smooth adjustment/control processes.

Through this process, we design various programs to enhance the financial performance of the acquired company and further provide options to explore new acquisition opportunities as part of an expansion strategy for top-line growth.