Your risk perspective and strategy can impact the balance between eluding failure and seizing competitive opportunities.

Risk, Regulatory & Compliance

The intensity of change in today´s business environment requires companies to manage and harness the power of proactive Enterprise Risk Management, combining innovative and active governance, risk and compliance activities (GRC) into a comprehensive Enterprise Risk program that facilitates seizing competitive opportunities and meeting stakeholder’s expectations.

Risk Management and Compliance

The intensity of change in today´s business environment requires companies to manage and harness the power of proactive Enterprise Risk Management, combining innovative and proactive governance, risk and compliance activities (GRC) into a comprehensive Enterprise Risk program that facilitates seizing competitive opportunities and meeting stakeholder’s expectations.

PwC´s Enterprise Risk Management services add value by:

- Assessing your Enterprise Risk Management framework

- Performing enterprise business level or emerging risk assessment

- Analyzing the collaboration between risk and compliance functions

- Designing and reviewing risk migration plans

- Risk management health check and assistance with its set up

- Advisory with set up of the insurance policies

- Outsourcing of the risk management function

- Coaching and training risk managers

Your regulatory response reflects the level of control and maturity you have in your business. The flow of new laws and regulations across regional, national and international borders continues to intensify. No matter how large, small or diversified your organization, almost every part of it is touched by a complex web of constantly evolving regulations and subject to enforcement actions and fines. Not to mention reputational risk.

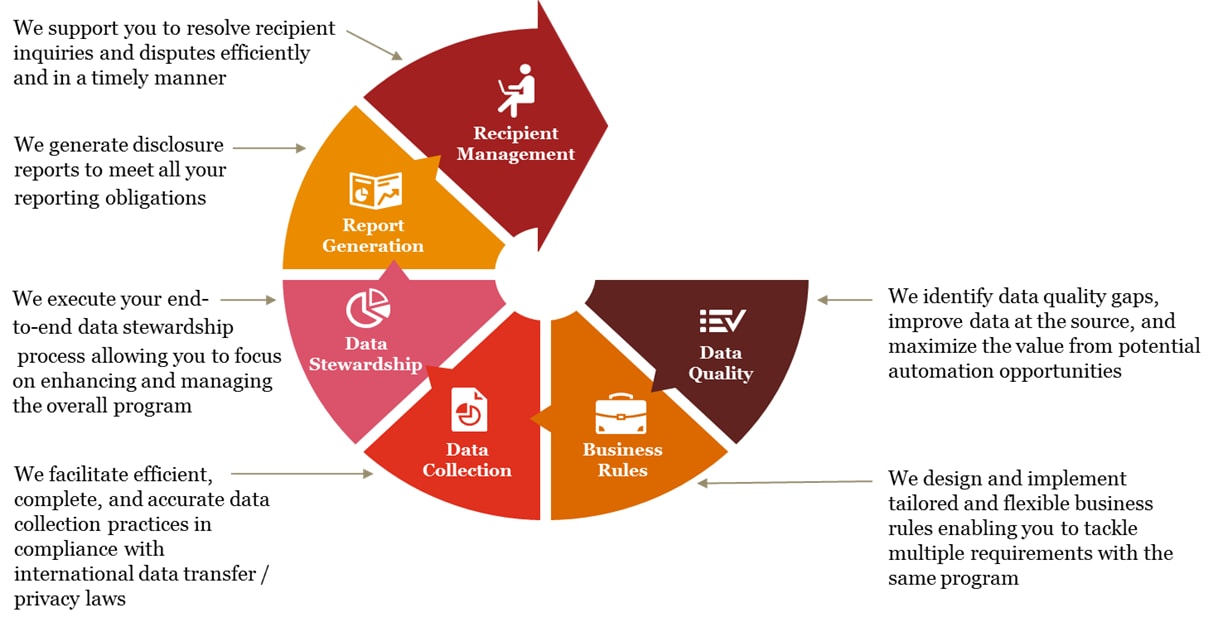

During the past years especially the Life Science Industry felt the impact of growing requirements on transparency in the industry’s interactions with Health Care Professionals and Organizations. As a result of that the PwC Risk Operations Centre has been established on three key pillars People – Process – Technology, to allow Pharmaceutical and MedTech companies to select the right level of support from basic process reviews to entire outsourced solutions of the transparency, not excluding the engage to pay process.

Your regulatory response reflects the level of control and maturity you have in your business. The flow of new laws and regulations across regional, national and international borders continues to intensify. No matter how large, small or diversified your organization, almost every part of it is touched by a complex web of constantly evolving regulations and subject to enforcement actions and fines. Not to mention reputational risk.

During the past years especially the Life Science Industry felt the impact of growing requirements on transparency in the industry’s interactions with Health Care Professionals and Organizations. As a result of that the PwC Risk Operations Centre has been established on three key pillars People – Process – Technology, to allow Pharmaceutical and MedTech companies to select the right level of support from basic process reviews to entire outsourced solutions of the transparency, not excluding the engage to pay process.

Your regulatory response reflects the level of control and maturity you have in your business. The flow of new laws and regulations across regional, national and international borders continues to intensify. No matter how large, small or diversified your organization, almost every part of it is touched by a complex web of constantly evolving regulations and subject to enforcement actions and fines. Not to mention reputational risk.

During the past years especially the Life Science Industry felt the impact of growing requirements on transparency in the industry’s interactions with Health Care Professionals and Organizations. As a result of that the PwC Risk Operations Centre has been established on three key pillars People – Process – Technology, to allow Pharmaceutical and MedTech companies to select the right level of support from basic process reviews to entire outsourced solutions of the transparency, not excluding the engage to pay process.

Compliance is about more than prevention. It’s also about navigating opportunities. Opportunities which can strengthen your organization through strategic, proactive measures such as best practices, employee training, internal controls, and benchmarking appropriate for your industry and size. Measures that can uncover value, even as they help assure compliance.

Transformed global business and operations strategies add new interruption risks to existing risk portfolios. Building resilient and recoverable operations is more difficult to implement when a crisis occurs and time is precious.

Your leadership and board members may be asking questions such as:

- Are we ready to recover from business interruption risk events publicly disclosed to our investors?

- Can we count on our suppliers to have viable continuity plans that protect us in their time of crisis?

- How well can our suppliers pivot to support us in our time of crisis?

- Does our IT disaster recovery program support our operational recovery and resiliency requirements?

What can we help you with?

- Business Continuity Management implementation and maintenance

- Business Continuity as a Service (BCAAS)

- Threat and Risk Assessment (TRA) and Business Impact Analysis (BIA)

- DR Strategy and Recovery Arrangements

- Plans, testing and training

- Awareness Programs

- Benchmarking and Assessments

Our approach is unique as we are capable of delivering international Business Continuity best practice expertise locally to our clients. Our Centre of Excellence (BCAAS) enables you to effectively outsource your Business Continuity Management activities. We provide Crisis Management Training using trainers that are proficient in training Corporate Boards and C-Suite Managers

PwC’s Treasury Solutions specialists can work with you at every stage of your treasury project, from assessment and design through to implementation and beyond. We can address your individual challenges, opportunities and perspective with a customised approach to:

- Cash and banking management

- Liquidity management and forecasting

- Funding and trade finance

- Accounting and valuations support

- FX, credit and interest rate risk management

- Investment and debt management

- Commodity risk management

- Working capital management

- Treasury management systems - selecting implementation

- Set up of treasury function

Changing your perspective on Regulatory Response

Changing your perspective on Regulatory Response

Businesses need to be encouraged to take a fresh look at regulation, to see it as a benefit and not just a burden, and to grasp opportunities that were not always in view. Now, more than ever, trust and transparency are highly prized, and getting on the front foot with your regulatory response can bring significant

Risk Assurance provides a robust framework to allow for defensive tactics as well as value creation through offensive activities.

Contact us

Risk and Credit Modelling Advisory Services, PwC Cayman Islands

Tel: +1 (345) 914 8678

Risk and Credit Modelling Advisory Services, PwC Cayman Islands

Tel: +1 345-927-9378