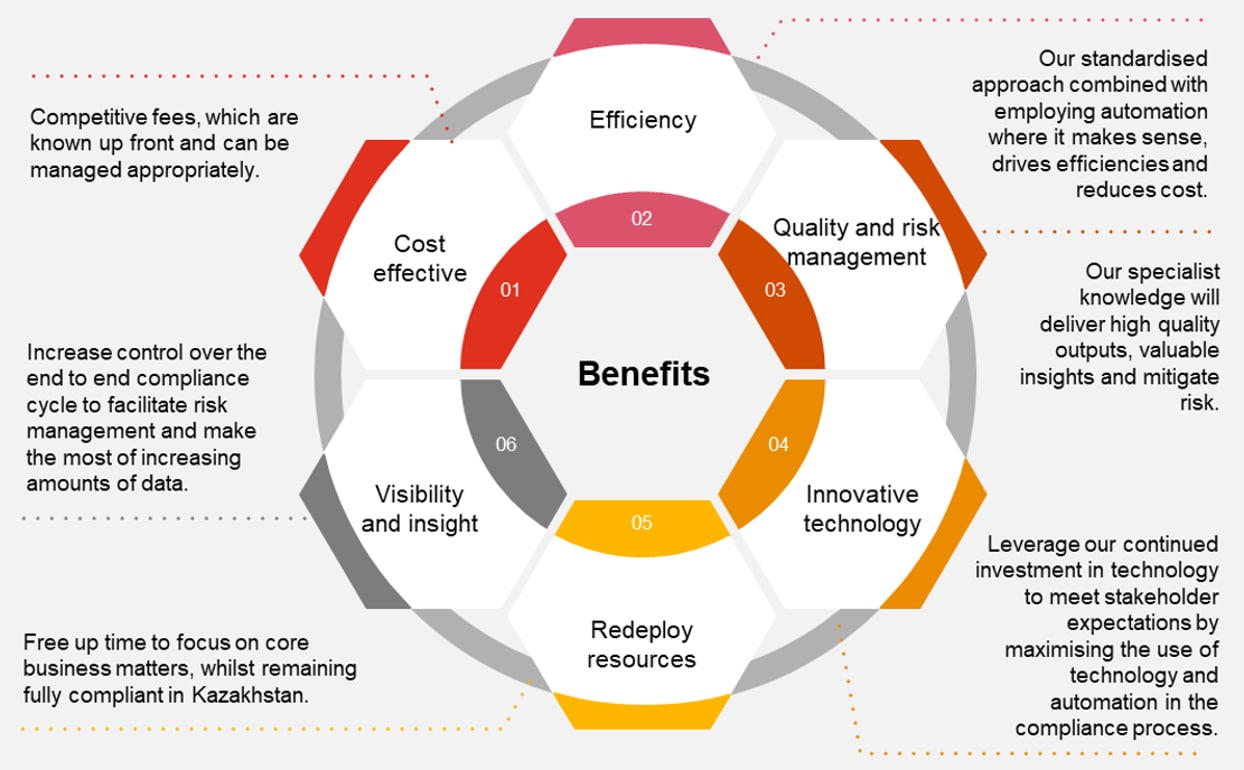

All services are performed after tailoring them to your individual needs and expectations. Combining bookkeeping and tax compliance services is a very efficient and cost effective way for PwC to assist your business from inception and throughout the life of the Company’s operations.

- Bookkeeping services

- Tax compliance services

- Bookkeeping and tax review services

- Other services

Bookkeeping services

Utilise your data sources and our technology to deliver an increasingly automated bookkeeping, whilst our dedicated bookkeeping compliance specialists provide valuable insights on business and bookkeeping matters.

Our services include:

- set-up of bookkeeping database;

- recording of documents received from you;

- reporting of financial data for management and group purposes, in accordance with your requirements;

- preparation of statutory financial statements;

- cooperation with statutory auditors.

Tax compliance services

Leverage our experience and technical knowledge of compliance to understand the reporting requirements and implement a commercially appropriate approach to the local compliance, whilst mitigating the risk of non-compliance. Tax compliance services include:

- preparation of the necessary tax returns (CIT, VAT, WHT, other);

- preparation of reports to the National Bank and Statistics Committee of Kazakhstan;

- preparation of responses to tax notifications, tax reporting corrections, communication with state authorities.

Bookkeeping and tax review services

This service is recommended to all companies willing to:

- confirm the correctness of bookkeeping records and tax settlements prepared by you/your external service vendors;

- optimize tax compliance by identifying potential tax savings and effective tax planning;

- prepare for the expected bookkeeping and tax audit.

We offer review of bookkeeping records and tax treatment applied by the Company to certain transactions, review of calculations and submitted tax returns, preparation of a report with summary of tax risks and potential optimizations together with our recommendations and ideas. Identified sensitive tax issues are discussed with the Company during the meeting summarizing our reviews.

Other services

- registration (de-registration), application for digital signature, set-up of electronic invoicing system and opening of a bank account, VAT registration, dormancy status obtainment;

- restoration of bookkeeping data;

- preparation/review of the tax and bookkeeping policy

- preparation/review of additional tax returns;

- advice on the compliance issues;

- corporate training on bookkeeping and tax compliance.

Our people

You get access to a team of dedicated PwC bookkeeping compliance specialists, up to date with laws and regulations and with significant experience of PwC and industry best practice. They are well equipped to deal with a wide range of bookkeeping complexities and any ad hoc bookkeeping requests that arise.

Our approach

Our three-phase approach 'Planning, Execution and Completion' increases the efficiency of the bookkeeping and tax compliance processes by bringing standardisation and discipline and supports interaction with our team. It is underpinned by strong, proactive, relationship based project management, supported by technology.

Our technology

Strong bookkeeping compliance forms a strong foundation for other areas of compliance, such as corporate income tax. We recognise the synergies a single compliance solution provides to organisations, and offer a single compliance platform. This platform creates a single compliance data set and automates data sharing and workflows between you and our compliance specialists.

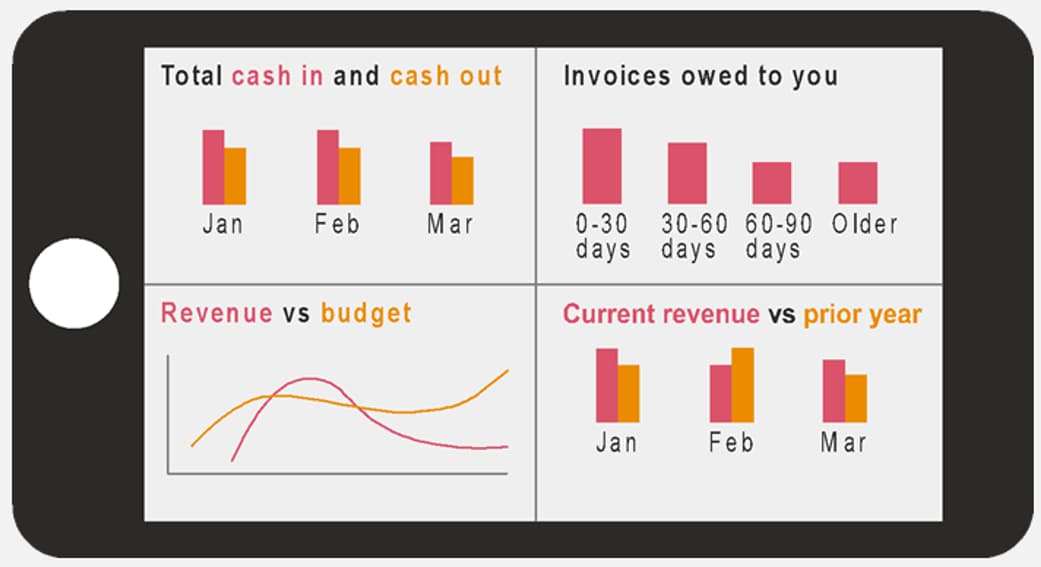

Monitor your cash flow, keep on top of outstanding invoices or track specific parts of business using our interactive dashboards.

Контакты

Elena Kaeva

Aigul Alimbayeva

Gulnaz Issatova

Aiya Shintayeva