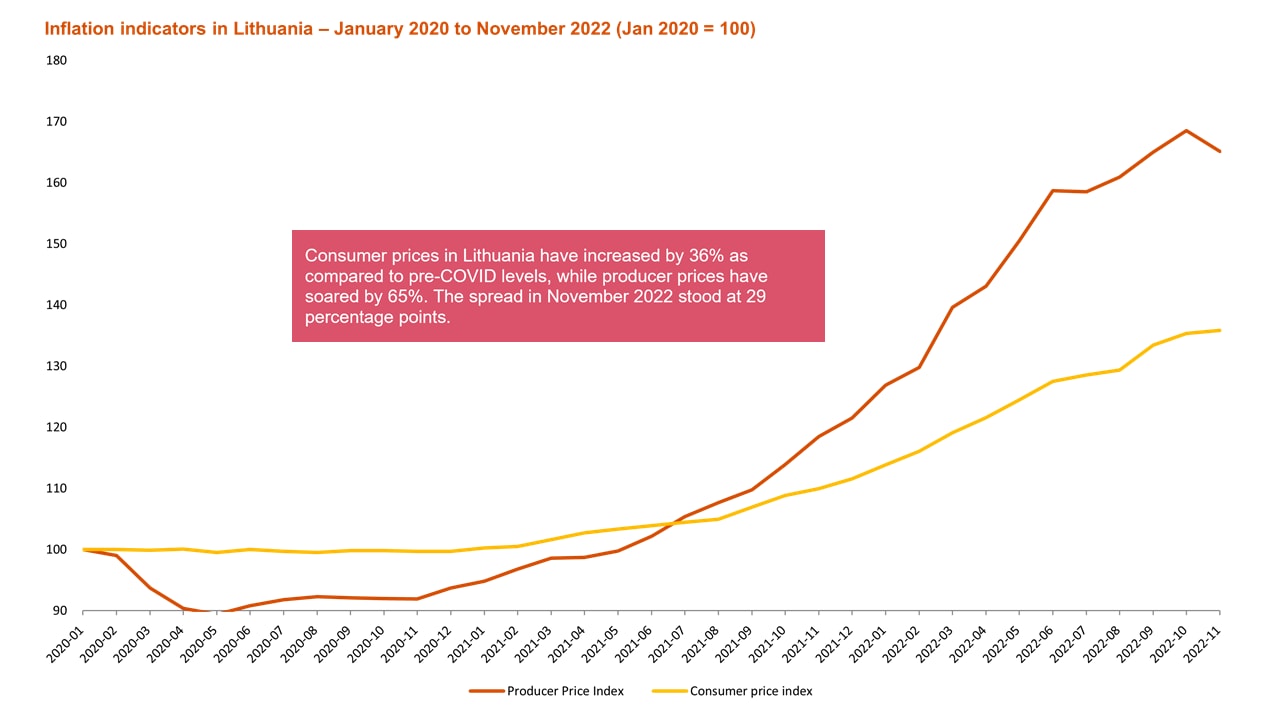

Consumer prices in Lithuania have increased by 36% as compared to pre-COVID levels, while producer prices have soared by 65%. As a result, the historical financials of companies have become less reliable indicators of the actual profitability. Additionally, an economic downturn could cause further stress on margins due to lower sales volumes resulting from depressed customer demand. There is also a high risk that deal valuations have not yet caught up with the reality of increasing producer prices. Therefore, all the deal makers should consider in full the impact of the current inflationary environment to the underlying target profitability, and properly assess how this will be reflected in the reported figures.

Source: Eurostat, PwC analysis

Mergers and acquisitions (M&A) are a common corporate strategy used to expand a company's operations, diversify its product or service offerings, or enter new markets. Inflation, which is a sustained increase in the general price level of goods and services in an economy, can have a significant impact on M&A deals. In this article, we will examine the anticipated impact of inflation on M&A deals and the importance of reflecting on a new reality in the financial due diligence process.

Inflation impact on M&A deal value

One way in which inflation affects M&A deals is through the valuation of the target company. When valuing a company, the acquirer frequently takes into consideration the future cash flows that the target company is expected to generate. Inflation can affect these cash flows because it can increase the cost of goods and services that the target company needs to purchase, thereby reducing its profits. Furthermore, margins could deteriorate as all the costs cannot be passed through to customers. This would make the target company less attractive to potential acquirers, as the expected return on investment would be lower due to the expected inflation-induced increase in costs. On the other hand, the valuation of the target could be too low if the company’s services or products price level is backed by historical figures. For example, businesses engaged in long-term projects and software-as-a-service (SaaS )activities are especially vulnerable to order backlogs and future service contracts being priced at yesterday‘s price levels. Therefore, during the due diligence process, the target’s EBITDA should reflect the new reality by including adjustments to the historical and future figures for forward-looking price levels after inflation, considering the target’s ability to pass through an increase in costs to customers.

Moreover, demand uncertainty, increased costs, and a limited ability to pass on rising costs of raw materials to end customers may result in increased levels of working capital due to the piling up of inventory or increased outstanding levels of accounts receivable and as a result, decrease the levels of capital expenditure in many industries. Capital-intensive sectors, such as construction and industrials, are at the most risk. During the due diligence process, we should investigate the new “normal” level of net working capital and capital expenditures and consider the adjustments in view of a long-term perspective.

“Overall, deal makers need to consider both the present and expected future inflation levels in their valuations. This involves forecasting different inflation scenarios and using real-time analytics to assess the impact of inflation on the target company’s operations and earnings. Pricing, cost management, and cash flows are a part of a company’s response to an inflationary environment. It requires an understanding of a wider range of implications on the market share, price elasticity, customer and supplier relationships, and employee compensation and retention.”

Inflation impact on M&A deal activity

Inflation can also have impact on M&A deals through its effect on the financing of the deal. When acquiring a company, the acquirer often needs to raise financing to cover the purchase price. Inflation has affected the cost of the financing, as the interest rates on loans and bonds have already increased and may further increase if inflation expectations will keep rising. This can make the M&A deal more expensive for the acquirer or more difficult to finance, which in turn may discourage them from proceeding with the deal. Thus, the credibility of 1–2-year cash flow forecasts becomes even more important as a more solid business case will have to be presented to the lenders to ensure funding. Nevertheless, the funding costs and yield requirements will increase.

In addition to the above-described direct effects on the valuation and financing of M&A deals, inflation can also have indirect impacts on the level of M&A activity. For example, if inflation is high and expected to remain so, companies may be less likely to engage in M&A activity as they may be more focused on managing the impact of inflation on their own operations. Thus, the importance of current customer relationships, orders and lead times increase relative to the importance of new customers, ventures and proposals that are in the pipeline. This can lead to a slowdown in an overall M&A activity level.

On the other hand, in some cases, high inflation can actually lead to an increased level of M&A activity. For example, if a company's profits are being eroded by high inflation, they may look to acquire another company as a way to diversify their operations and reduce their exposure to inflation. Similarly, if a company's competitors are struggling due to high inflation, they may see an opportunity to acquire them at a discounted price and expand their market share.

In conclusion, the anticipated impact of inflation on M&A deals is complex and can vary depending on the specific circumstances of the deal. Inflation can have a direct impact on the valuation and financing of M&A deals and indirectly affect an overall level of M&A activity. While high inflation can discourage some companies from pursuing M&A deals, it can also create opportunities for others to acquire struggling competitors or diversify their operations.

“As economic circumstances impact both the deal value and financing costs of M&A, the returns are more sensitive to the cash flow assumptions. Therefore, a proper due diligence should take place to confirm if these assumptions held true in the past and what is their likelihood in the future.”

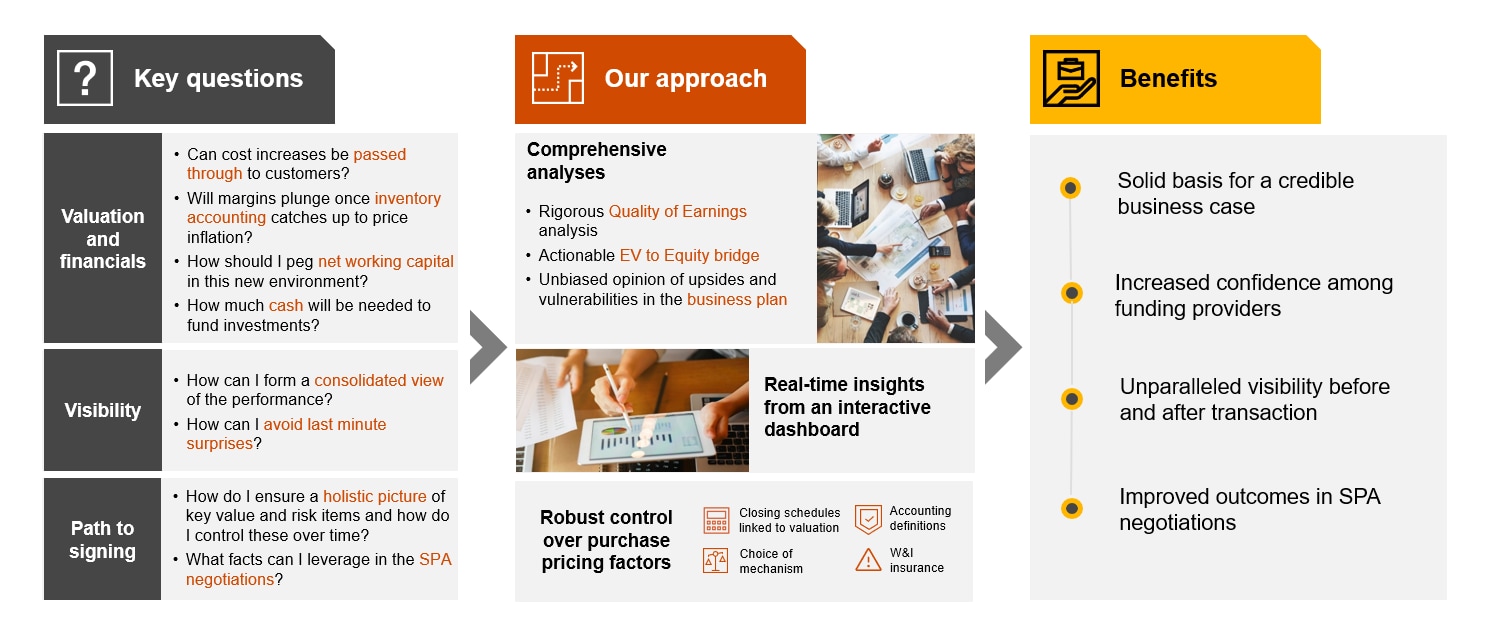

A smart buyer approach to incorporate the new reality

PwC has developed an approach for investigating the impact of inflation during the M&A process. This approach includes key questions to consider, a due diligence approach, and the benefits it offers. Some of the key questions to consider include how inflation affects financial performance (such as margins, net working capital, and capital expenditures) and the business's ability to pass through increased costs to customers. It is also important to ensure the accuracy of financial information and understand how inflation is reflected in the historical results and forecasts. Additionally, it is important to identify key value and risk items and determine how to control them over time, as well as a possible leverage to use in SPA negotiations.

During the due diligence process, PwC focuses on three key areas: a rigorous Quality of Earnings analysis, an actionable EV-to-equity bridge, and an unbiased opinion on the upsides and vulnerabilities in the business plan. We also suggest using interactive dashboards to provide real-time insights and help spot any potential last-minute surprises. To ensure robust controls over purchase price factors, we recommend using schedules linked to valuation, accounting definitions, choice of mechanism, and for larger deals considering W&I insurance.

The benefits of this approach include a solid basis for a credible business case and increased confidence among the funding providers. It also offers unparalleled visibility before and after the transaction, which can lead to improved outcomes in the SPA negotiations.

Real case example: Due diligence of inflation-affected company performed by PwC

PwC Lithuania has recently performed financial due diligence of a company engaged in the design and manufacturing of interior goods (the Target). During the due diligence process, we discovered that the Target's year-to-date trading results were behind the budget, largely due to the rising costs of raw materials. According to the Target’s management, in the last months under our review, the Target started actively passing through increased raw material prices to the customers in an effort to meet the budget projections. As our client was basing their deal valuation on the projected results, we focused on analysing the budget's achievability given the actual cost pass-through rate. After analysing the current year trading and projected outcomes, comparing historical and actual margins during the periods of high inflation, we determined that the projected EBITDA was not achievable as budgeted, and we adjusted it accordingly. The insights we shared with our client were used as a leverage during the negotiation process to adjust the purchase price accordingly.

Contact us