SAF-T in Lithuania

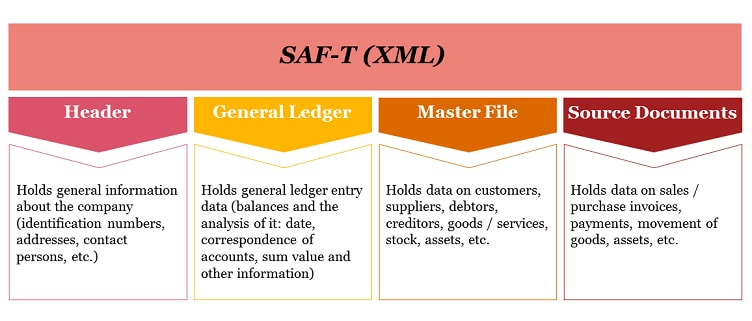

SAF-T (Standard Audit File for Taxes) is a standard file of detailed accounting data of a Lithuanian entity to be submitted to the Lithuanian Tax Authority upon request for the purpose of auditing the entity’s taxes. SAF-T must be prepared following official requirements to the file and submitted in XML format.

Who and when should be ready to submit SAF-T

| Local entities with net sales income of a financial year | Ready to submit SAF-T for periods starting from | |

| 2015 | EUR 8 million | 1 January 2017 |

| 2016 | EUR 700 thousand | 1 January 2018 |

| 2017 | EUR 300 thousand | 1 January 2019 |

Apart from the Tax Authority, SAF-T may be requested by the Customs, Financial Crime Investigation Service, Social Security Service.

Current status of the Tax Authority’s readiness for SAF-T

When to expert a request to submit SAF-T

The Tax Authority is currently in the process of implementing i.SAF-T – the system where SAF-T of companies will be submitted and analysed.

i.SAF-T implementation with the Tax Authority

- started in October 2017

- should end by 31 December 2018

The 3rd quarter of 2018 is the actual point when the Tax Authority could start requesting for SAF-T from tax payers (more likely – January 2019).

Since the Lithuanian SAF-T is much more detailed than the Portuguese or Polish files, implementation of IT solutions for SAF-T XML generation may take 4 – 6 months or even longer in practice.

SAF-T Type Tables

There are four type tables for mapping to the company’s ERP system’s tables:

- General Ledger accounts table (in Lithuania, there is no statutory chart of accounts)

- VAT type table

- Corporate income tax type table

- Analysis type table ‘Profit’

Work to be done in order to implement SAF-T

Companies have a task to implement IT solutions which will enable them to generate SAF-T in XML based on requirements of the Lithuanian Tax Authority.

The main tasks:

- analyse SAF-T requirements and understand which ERP systems’ data will be needed (as a rule, SAF-T might have to be generated not only from data of the core accounting system, if, for instance, the company uses a separate billing, payment, stock accounting system)

- perform data mapping tasks (map systems’ table fields to SAF-T structure and type tables)

- program IT solutions

- test SAF-T (XSD validation, data quality)

- get familiar with own SAF-T in order to be prepared to answer the Tax Authority’s questions

Contact us

Director, Digital Transformation & Innovation Leader, PwC Lithuania

Tel: +370 620 71559