Discover PwC tax reliefs and State aid application services

The application of tax reliefs and State aid have close connections which are not always clearly visible. As PwC professionals we have many years of experience in the areas of tax reliefs and State aid, therefore we fully understand what opportunities can be gained by the synergy of these two areas.

Considering the potential benefits of the synergy, the PwC tax and PwC Legal law firm's State aid teams now offer clients comprehensive tax reliefs and State aid advice services.

Webinar “Combining financing instruments and corporate tax reliefs: case study” (Lithuanian language)

Our team

Combining many years of experience gained in the fields of State aid and European Union funding, tax reliefs and other areas regulating investment promotion, our experts offer complex services based on the one-stop shop principle for the implementation of your ideas.

Our results

Selected projects data for 2017 - 2023

Types of tax reliefs and financial incentives

- Investment project incentive

- R&D relief

- Patent box relief

- Large-scale investment project incentive

- FEZ benefit

- Filmmaking benefit

- Foreign investment promotion tool

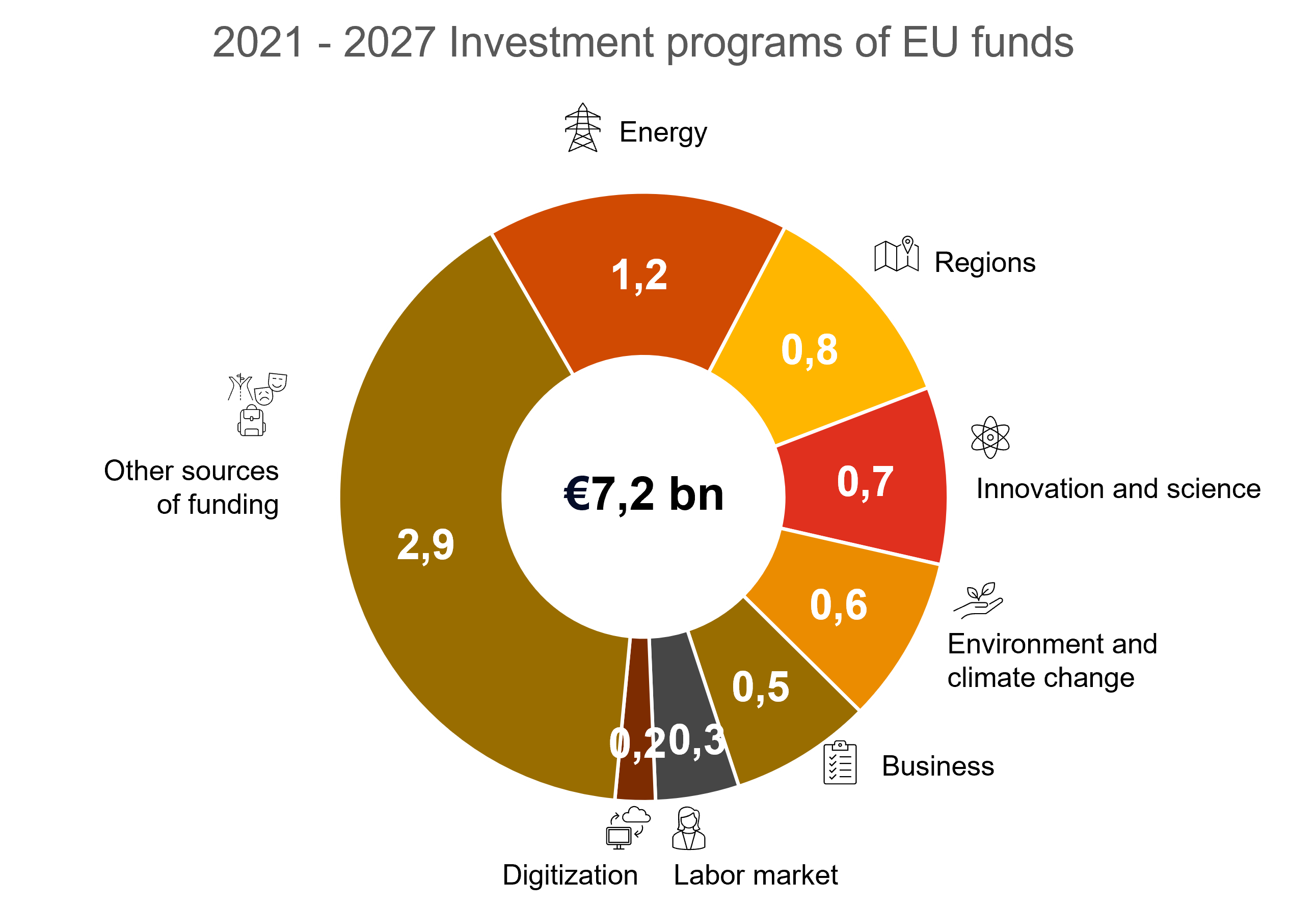

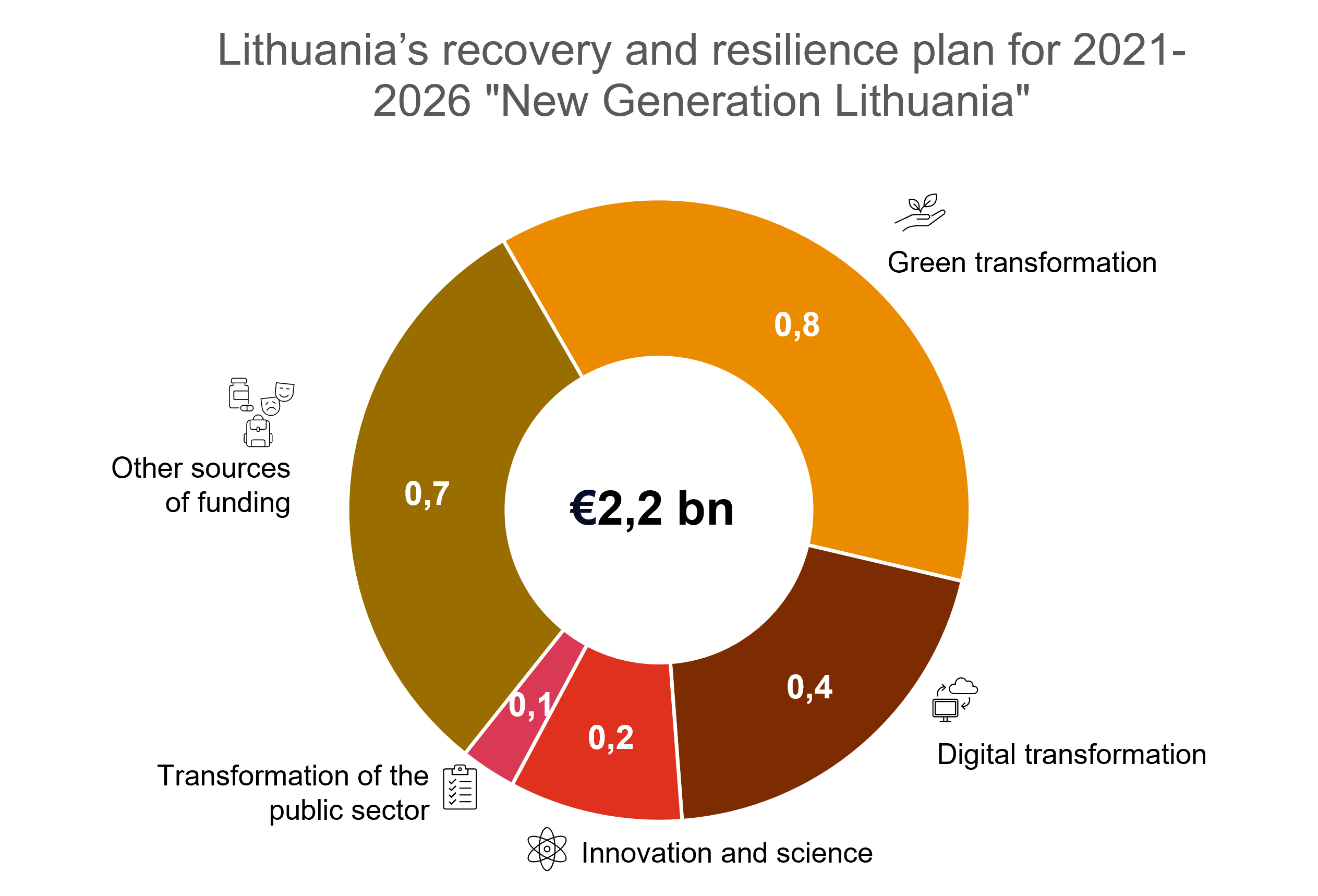

- Other sources of funding

Investment project incentive

What is the type of benefit? Tax relief.

Who is it for? For companies investing in long-term assets.

How does it work? A company investing in long-term assets can reduce its taxable profit by deducting the costs of the acquisition of long-term assets that meet the requirements listed in The Law on Corporate Income Tax.

What is the benefit? Up to 100% reduced taxable profit over 4 tax periods.

R&D relief

What is the type of benefit? Tax relief.

Who is it for? For companies investing in research and development (R&D) activities.

How does it work? A company carrying out R&D projects can reduce taxable profit by incurred R&D costs (except for depreciation or amortization costs of long-term assets).

What is the benefit? Up to or more than 100% reduced taxable profit by deducting 3 times R&D costs for the tax period in which they are incurred.

Patent box relief

What is the type of benefit? Tax relief.

Who is it for? For companies investing in R&D activities and receiving profit from the use, sale or other transfer of ownership of assets created while performing R&D activities.

How does it work? For companies investing in R&D activities and receiving profit from the use, sale or other transfer of ownership of assets created while performing R&D activities.

What is the benefit? Preferential 5% (where the standard is 15%) corporate tax rate for profits obtained from the use, sale or other transfer of ownership of assets created while performing R&D activities.

Large-scale investment project incentive

What is the type of benefit? Tax relief and reduction of the administrative burden.

Who is it for? For companies implementing large-scale investment projects.

How does it work? When implementing a large-scale investment project, the company must invest at least EUR 20 million in long-term assets and create at least 150 new jobs. During the implementation of the project in Vilnius, no less than EUR 30 million must be invested and at least 200 new jobs created.

What is the benefit? The company may not pay corporate tax for up to 20 years, a large-scale investment project is assigned with a project coordinator and is granted with the status of a project of state importance. Also, the processes of territory planning, issuance of construction permits, related infrastructure development, decision-making processes of public administration entities are accelerated, and migration processes are simplified.

FEZ benefit

What is the type of benefit? Tax relief and reduction of the administrative burden.

Who is it for? For companies registered in Free Economic Zones (FEZ).

How does it work? The relief can be used by a service company registered in the FEZ, which invests at least 100 thousand euros in long-term assets and whose annual average number of employees in the current tax year is at least 20. The relief can also be used by a service or manufacturing company registered in the FEZ, investing at least 1 million euros to long-term assets.

What is the benefit? The company may not pay corporate tax for the first 10 years, and pay a 50% reduced corporate tax rate for the next 6 years. Also, the company is exempt from real estate tax and can receive a "discount" for land tax. If needed, companies can take advantage of the services offered by FEZ management companies, which speed up and facilitate company establishment processes.

Filmmaking benefit

What is the type of benefit? Tax relief.

Who is it for? For companies that want to provide funds to a Lithuanian film producer free of charge.

How does it work? Lithuanian companies that want to provide funds to a Lithuanian film producer free of charge are given two options to reduce the profit tax:

1. through the reduction of taxable income (75% amount of funds);

2. through the reduction of the amount of profit tax (full amount of funds).

What is the benefit? The benefit guarantees a profit tax saving equal to 111.25% of funds allocated to the Lithuanian film producer.

Foreign investment promotion tool

What is the type of benefit? Subsidy.

Who is it for? Companies with foreign capital of any size, which operate in the field of services or manufacturing and which intend to establish a new or expand an existing business in Lithuania.

How does it work? When establishing a new or expanding an existing business in Lithuania, a foreign investor must create at least 20 jobs, the average monthly gross wage of which would not be lower than the wage of the municipality where the activity will be carried out. Private investments must be at least EUR 1.5 million.

What is the benefit? The foreign investor is compensated up to 50% of expenses (but not more than EUR 37.5 million) related to wages or acquisition of long-term assets.

Other sources of funding

Contact us