Finance function

Today‘s finance function is faced with an increasing number of issues driven by changes, pressures and challenges to which there is no single “best answer”.

All areas of the finance function are concerned and CFOs are looking for methodologies to help make their activities more effective and efficient.

Your challenges

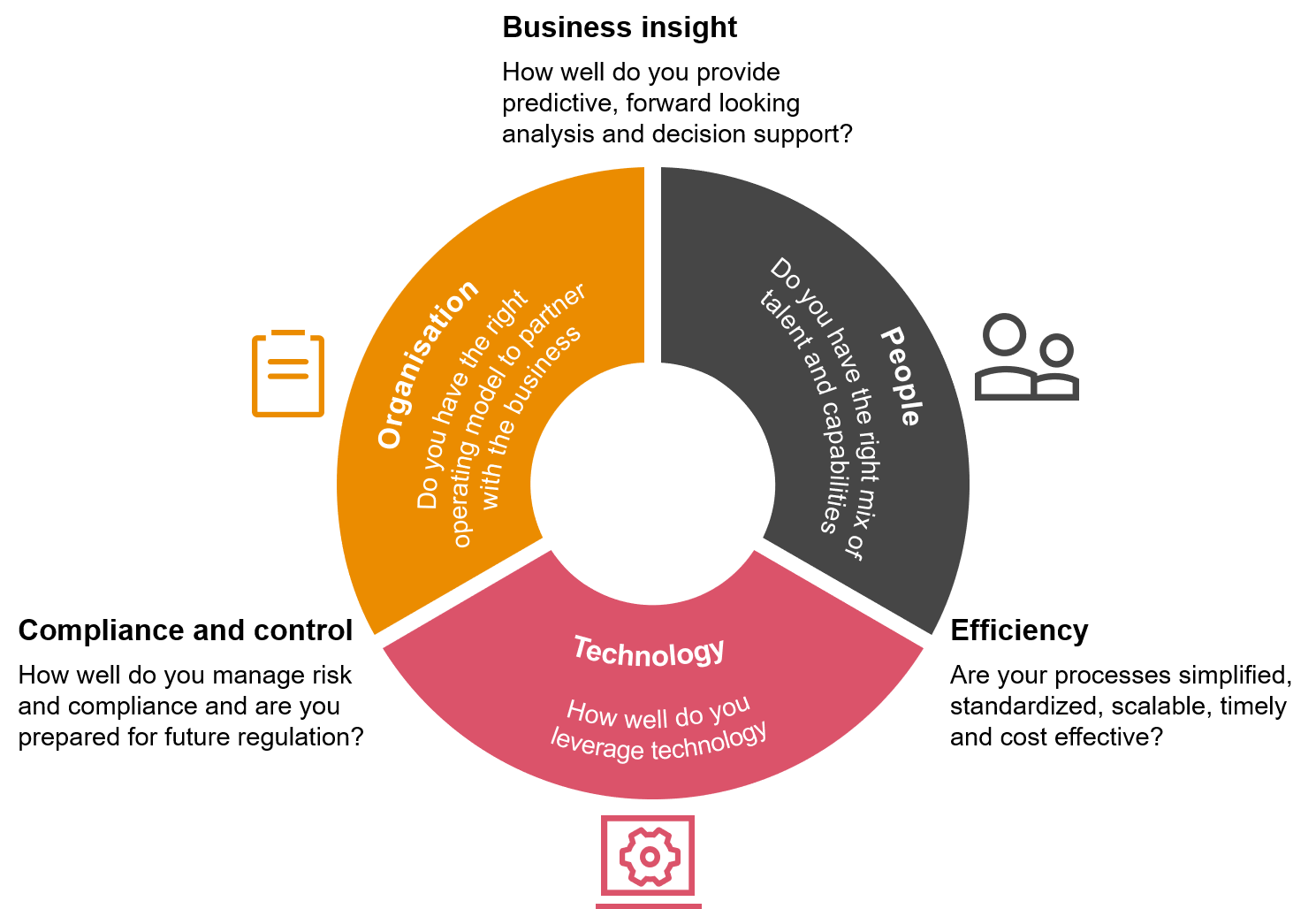

How does an effective finance function balance all three objectives – control, efficiency and insight?

The answer is likely to change depending on the organisation.

No two companies have the same drivers and needs; therefore, concepts like consolidation, centralisation, simplification and standardisation may not suit every business model.

Finance has to balance its resources across three core areas

How we can help?

Our Finance Function Assessment solution will help to provide key insights about the priority actions that should be considered for establishing a forward-looking strategy and a change plan.

This will help to support further initiative to define and implement a new and enhanced target operating model for the organisation’s finance function.

Your benefits

We first understand your unique situation and requirements, and then use our team’s significant knowledge and experience to help you realize your finance transformation goals, so you get:

- Reduced risk of errors in financial statement and tax filings

- Diminished risk of ‘regulatory’ entanglements and improved ability to address tax audits

- Stronger tax control framework, equating to lower financial tax risks

- New analytical capabilities, adding to the organisation’s ability to plan, forecast and collaborate on new business opportunities

- A more empowered, strategically placed workforce, enabling quicker change

Contact us