Government estimates that the deficit will amount to 3.5% in 2025, down from 4.0% in 2024 and 4.5% in 2023. While still high from a historical perspective, the deficit is expected to continue to decline, with the aim of reaching the 3.0% target by 2026.

The government deficit remains above the 3.0% level, but appears to be on a downward trajectory, having declined from 4.5% last year to 4.0% in 2024. In fact, according to the budget’s estimates, the deficit as a percentage of GDP is set to fall by another 0.5 percentage points year-on-year, with the government aiming to ultimately meet the 3.0% criteria in 2026, with a further reduction to 2.6% anticipated in 2027. This trajectory, while lagging behind the EA average, remains ahead of some of Europe’s largest economies, including France and Italy.

Budget balance projections

Source: Government of Malta, European Commission economic forecast (Spring 2024)

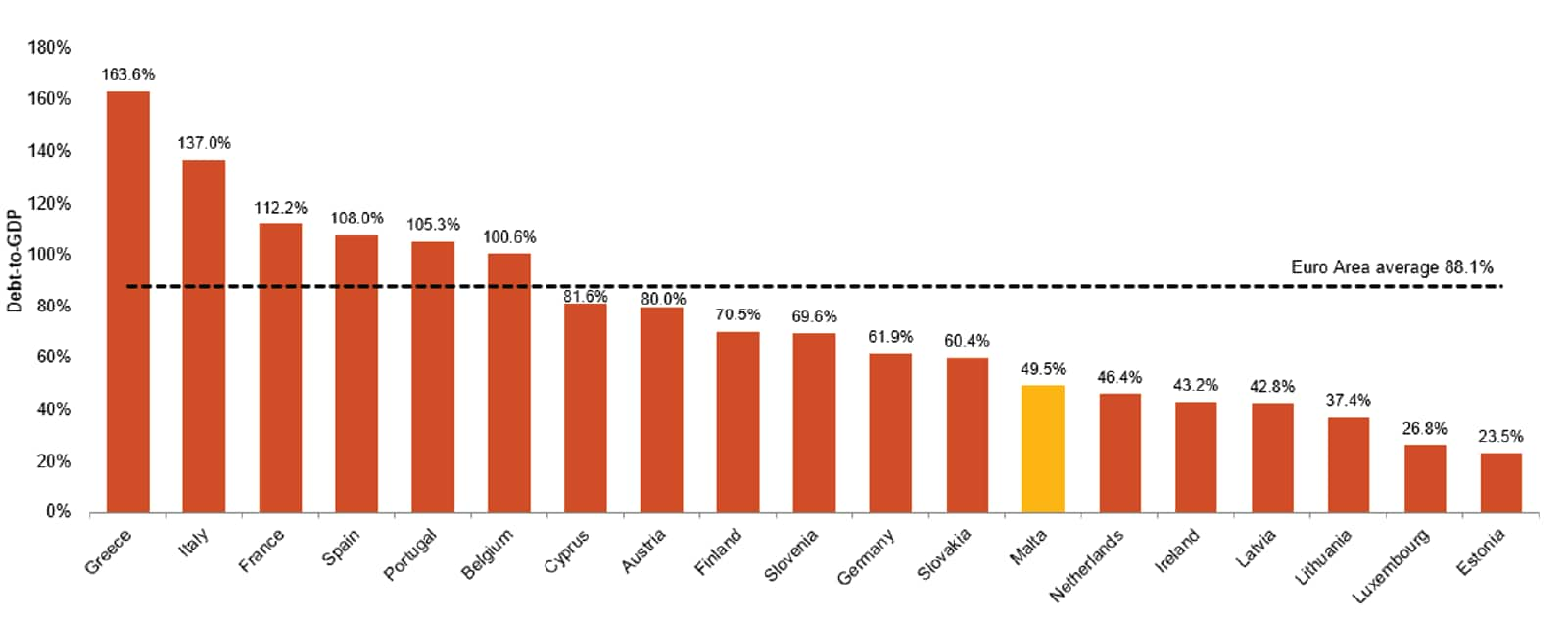

As a result, the Government’s debt-to-GDP ratio is set to increase from 49.5% in 2024 and 50.1% in 2025, all the while remaining below the 60% Maastricht criteria threshold.

Debt-to-GDP Ratio

Source: Government of Malta, Eurostat (Q2 2024)

Although the debt-to-GDP ratio has increased slightly from 47.4% in 2023 to 49.5% in 2024, this remains well below the Euro Area average of 88.1% and the 60% Maastricht criteria threshold.

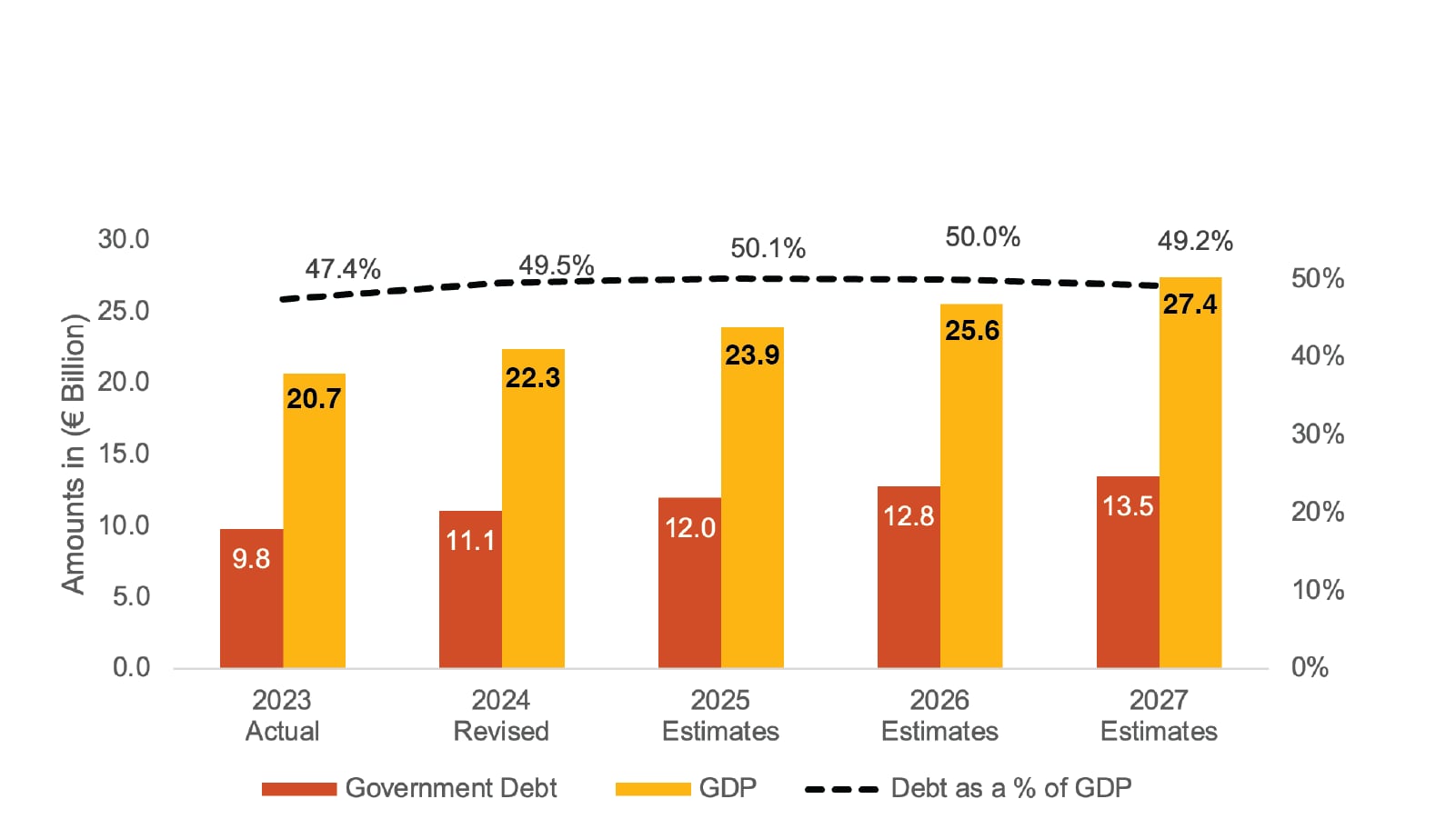

In absolute terms, Malta’s overall debt continues to increase, rising from €9.8bn in 2023 to €11.1bn in 2024. Debt is expected to amount to €12.0bn in 2025 and reach €13.5bn by 2027.

Government Debt-to-GDP

Source: European Commission, Government of Malta

Malta's debt-to-GDP ratio is forecast to peak at 50.1% in 2025, reflecting a substantial increase in government debt, which is projected to rise from €9.8bn in 2023 to €11.1bn in 2024 and further increase to €12.0bn in 2025. By 2027, total government debt is expected to reach €13.5bn. This increase in debt highlights the government's ongoing financial commitments, including investments in infrastructure, public services, and social programs, which are crucial for driving economic growth and development.

Despite this rising debt, it is important to note that it is anticipated to be matched by forecasted GDP growth, which is projected to increase from €20.7bn in 2023 to €27.4bn by 2027. This significant economic expansion implies that while debt levels are high in absolute terms, the growing economy can help absorb the impact of this debt.

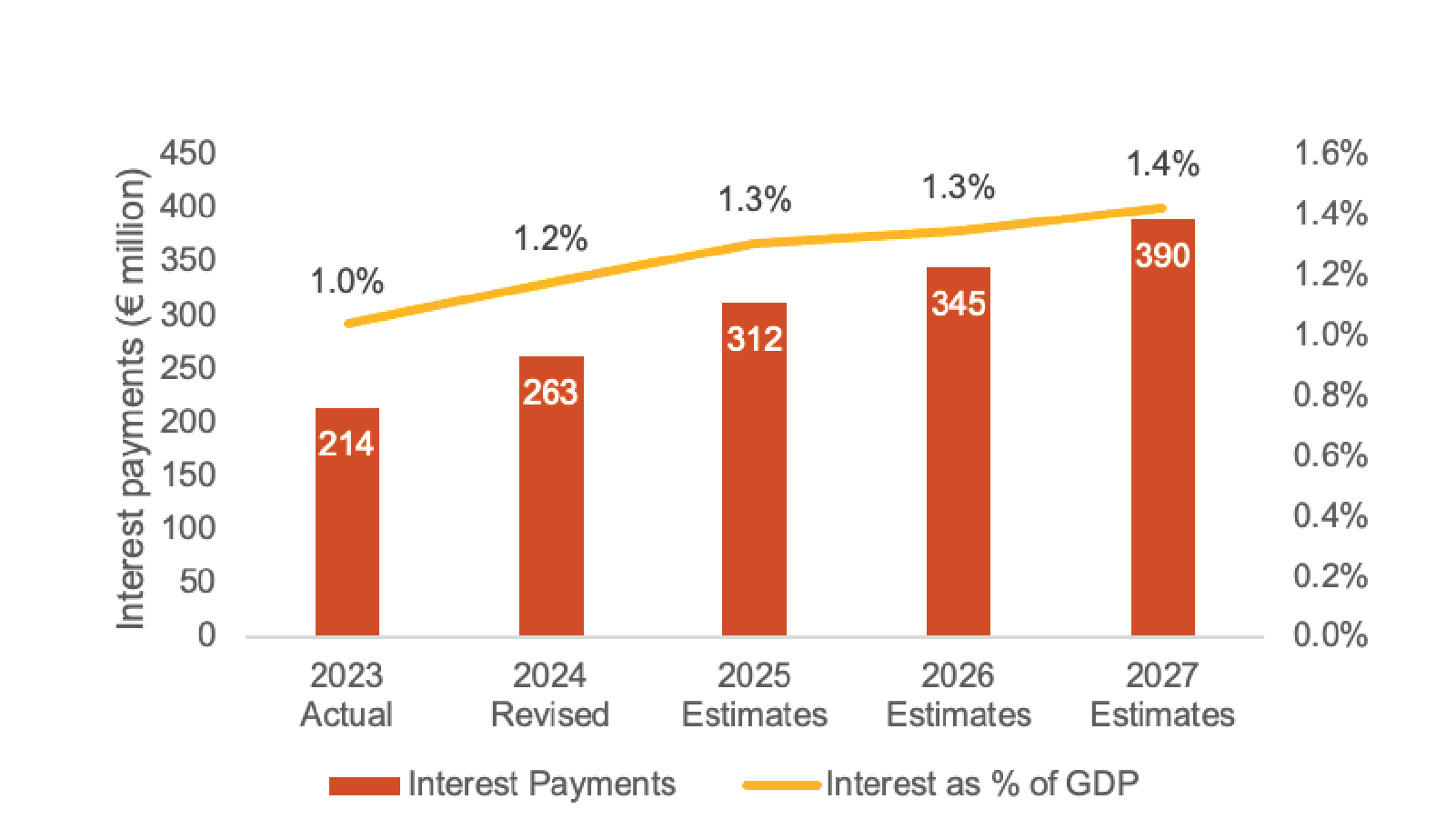

Interest payments on such debt are not immaterial, increasing from €0.2bn in 2023 to €0.3bn in 2024 and reaching €0.4bn by 2027 – equivalent to around 1.1% to 1.4% of GDP.

Government interest payments

Source: Government of Malta

In 2024, Malta’s interest payments on government debt are estimated to increase to €263 million, up from €214million in 2023. In 2025, with Government projecting to issue €1.7bn in bonds, interest costs are set to rise further to €312m, equivalent to 1.3% of GDP. Interest costs are expected to continue rising, reaching €390million by 2027, implying almost a doubling of annual national debt servicing requirements since 2023.

These estimates suggest that interest payments do not represent an immaterial expense to the government, and by 2027, at 1.4% of GDP, would be close to the EA average of 1.8%. This increase in debt servicing requirements reflects both the significant increase in accumulated debt envisioned over the next 3 years and also the prevailing elevated interest rate environment.

Government revenue increased from €6.4bn in 2023 to €7.2bn in 2024, as income taxes and VAT collections rose significantly. Revenue is expected to continue to increase in 2025, at a slightly slower rate, to €7.5bn.

Government recurrent revenue

Source: Government of Malta

From 2024 to 2025, the government’s total recurrent revenue is projected to rise from €7.2bn to €7.5bn, reflecting an increase of approximately €329 million (4.6%), compared with an increase of €775m (12.1%) in 2024 vs 2023. The expected growth in 2025 is primarily driven by substantial increases in income tax revenue (despite the widening of the tax bands), social security contributions, and VAT collections. Specifically, income tax revenue is expected to climb from €2.7bn to €2.8bn, up from €2.5bn in 2023. Similarly, VAT revenue is forecasted to grow from €1.5bn to €1.6bn, up from €1.3bn in 2023. Overall, total recurrent revenue is anticipated to expand at a compound annual growth rate (CAGR) of 8.3% over the 2023-2025 period.

Expenditure increased largely in line with revenue, from €7.0bn in 2023 to €7.8bn to 2024, mostly reflecting increases in recurrent expenditure as capital outlay remained broadly similar. In 2025, government is expecting to spend €8.0bn, with the €0.2bn increase also coming from the recurrent side.

Government expenditure

Source: Government of Malta

Total government expenditure is projected to rise from €7.2bn in 2023 to €8.1bn in 2024 (12%), more or less in line with revenue growth. This increase is primarily driven by recurrent expenditure, which has increased from €6.0bn in 2023 to €6.7bn (12%) in 2024, while capital expenditure has increased from €1.0bn to €1.1bn in 2024 (9.5%).

In 2025, total expenditure is estimated to reach €8.3bn, with a further increase of €0.2bn primarily attributed to recurrent spending, as capital expenditure remains broadly unchanged at €1.1bn. In fact, Government is budgeting to maintain this level of capital expenditure over the 2024-2026 period, however, is expecting to increase the allocation to capex substantially in 2027, to reach €1.4bn.

A high-level sensitivity assessment suggests that should the average real growth rate over the period not reach the assumed 4.5%, but, say 3%, the deficit would remain elevated and would not reach the 3% target over the period.

Malta’s debt-to-GDP ratio is projected to reach 50.0% by 2026 if the Government achieves its target of growing the size of the economy to €25.6bn. To assess Malta’s ability to sustain its public finances, we considered a scenario where Malta’s economy had to underperform (i.e. GDP growth slows and also, as a result, less tax revenue is collected). For example, if GDP grows by 3.0% instead of 4.5%, the debt-to-GDP ratio would still remain below the 60% threshold in 2026.

However, any decline in GDP growth would also lead to a fall in the income tax revenue collected, resulting in an increase in the deficit. An increase in the deficit coupled with lower GDP growth consequently implies that the deficit as a percentage of GDP would increase, moving further away from the 3% rule. For example, a scenario of a 1.5pp deviation downwards from the forecasted GDP growth could result in a deficit of around 4.0% of GDP over the 2025 – 2027 period.

In conclusion, the government’s expectation of its fiscal sustainability is dependent on its assumed strong projected GDP growth, which not only allows for a larger base to support the increasing debt, but also implies continued increasing tax revenue. In fact, despite the widening of the income tax bands (resulting in savings for income earners and less tax revenue per person collected), total tax recurrent revenue is still expected to increase, on the back of continued overall economic activity.

However, the sustainability of these projections relies on achieving a consistent real GDP growth rate of over 4% over the short to medium term. Any downward deviation in expected GDP growth below this ambitious assumption would impact the budget deficit and could mean not achieving the 3% deficit-to-GDP target within the medium term.

Contact us