Inflation in the Euro Area reached 8.6% in June, something that we have not seen in Europe since the 1980s and a record high since the Euro area was formed.

The two general causes of inflation are cost-push and demand-pull inflation. In this case, the global economy is experiencing a strong mix of the two, which is partly why we are seeing such high numbers.

On the one hand there are the demand side issues, stemming from the recovery of the pandemic. This created a situation of pent-up demand, building up over periods of lockdowns, that led to savings being spent in a shorter time frame and on fewer available goods and services due to slowdowns in production.

Furthermore, in order to combat the decline in economic activity caused by the pandemic, central banks eased monetary policy in 2020. The Federal Reserve in the US lowered interest rates from 1.75% to 0.25% and the ECB maintained its asset-buying, thereby pumping in lots of liquidity into the market.

This made it easier for consumers and businesses to take loans and stimulate economic activity, which lead to a situation of “too much money chasing too few goods”, which was Milton Friedman’s definition of what inflation really is.

On the other hand, there is the cost-push side, which is likely the larger contributor to this recent significant spike in inflation. This has arisen due to two reasons:

- a) supply-chain disruptions, which have pushed up the costs of international trade in goods, and

- b) Russia’s war with Ukraine, which has increased the price of oil, gas and unprocessed foods significantly.

The general feeling is that the current high inflationary environment will generally begin to ease as we go into 2023, as interest rate hikes will reign in economic activity and specifically price pressures in the services industries and certain consumer goods.

On the other hand, food and energy price inflation depends largely on geopolitical events which are notoriously harder to forecast, however.

The European Commission is forecasting that inflation in the Eurozone will be 7.6% in 2022 but will then ease considerably in 2023 to 4%.

….which has triggered a significant shift in monetary policy across major economies, as central banks seek to increase interest rates and tighten credit

This has ushered in what can be called a new economic era for the global economy. After decades of low inflation and decreasing interest rates, inflation is now the foremost priority, as it is eating away consumers’ purchasing power. Central Banks are increasing rates, after what has largely been a decade of monetary policy easing and cheaper lending.

The implications of this on the market are significant. Government bond yields are higher across the globe, making the return on savings more attractive as opposed to investing in risky projects. This suggests that people are being encouraged to save rather than invest in projects or invest in companies (stocks), which explains why the stock market has been largely underperforming recently.

This also has implications for corporate finance and valuations since higher interest rates mean that the risk-free-rate is now much higher. This in turn implies that discount rates are higher and therefore, ceteris paribus, valuations would be lower as the opportunity cost of any project is higher.

Bank |

Current Interest Rate |

Next expected change |

Federal Reserve |

Ranges between 2.25 – 2.5% |

Increased by 0.75 basis points at the end of July. An increase of 0.5 basis points is expected in September, though the chances of a 0.75 basis points hike are increasing. This will be followed by further hikes in November and December, bringing the rate to a range of 3.25% to 3.5% by the end of 2022. |

ECB |

0.5% (main refinancing rate)

|

Increased by 50 basis points with effect on the 27th of July |

Bank of England |

1.75% |

Next review due on 15th September. Forecasts indicate that UK interest rates may rise up to 2.5% by the end of 2022. |

Bank of Japan |

-0.1% |

No expected changes |

The Euro has hit parity with the dollar for the first time since 2002, reflecting a combination of factors…

On the one hand, this reflects a generally pessimistic outlook for the euro area economy, overshadowed by the fear of facing an energy crunch in winter. Fears of “gas-rationing” in Europe would mean higher costs for consumers and producers, which would negatively impact output and consumption and therefore dampen economic activity. Some speak of an “impending recession”, but most publicly available official forecasts are not projecting this.

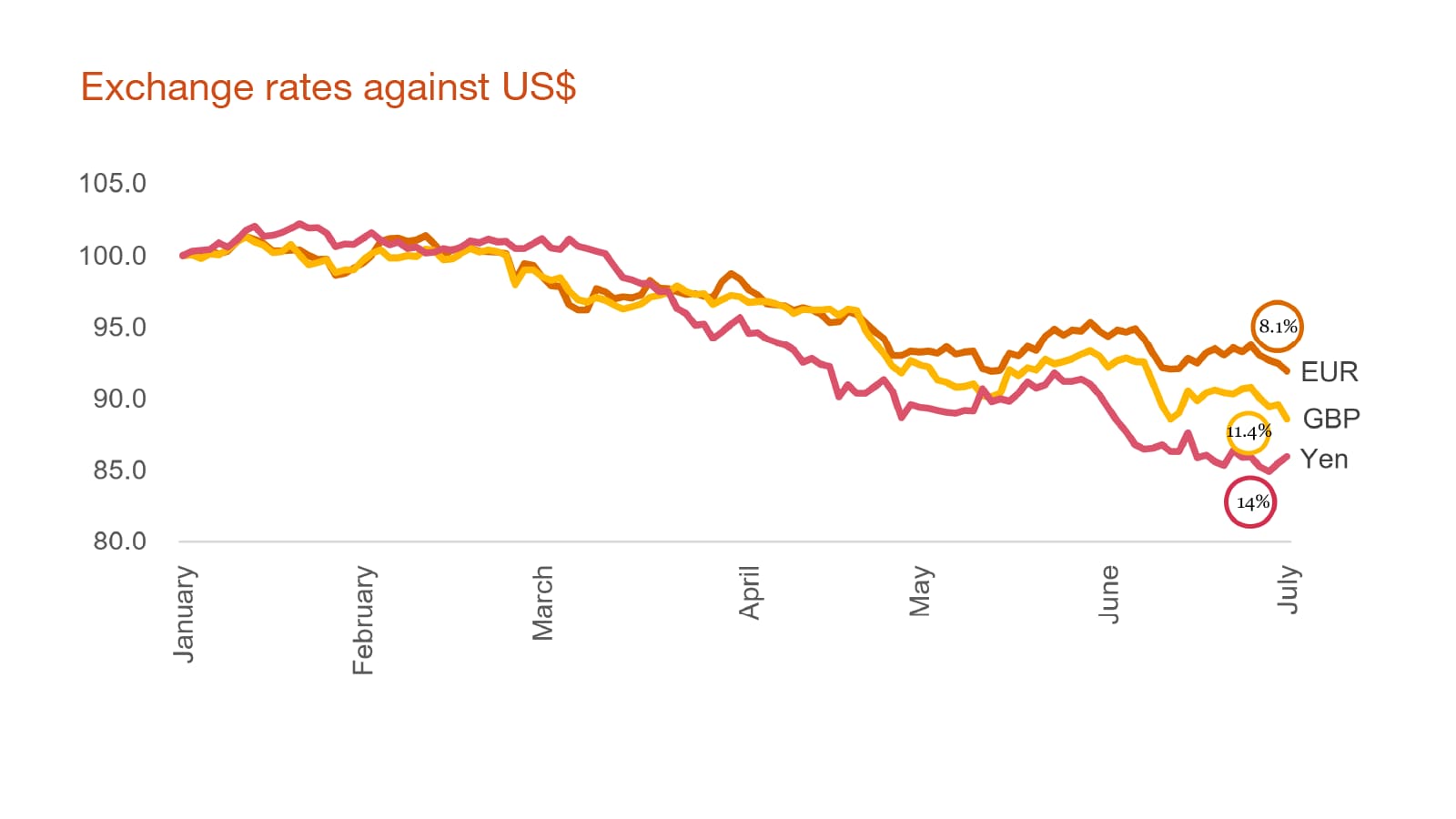

However, it is not only the euro which has depreciated against the dollar – all other major currencies have, including the Sterling and the Yen. This implies that the story of the weakening euro could just as well be seen as a story of an appreciating dollar. In times of heightened uncertainty, currency traders tend to flock to the dollar, which is the largest global currency. The US economy has recovered more quickly from the pandemic. Furthermore, the Federal Reserve has raised interest rates more quickly than the ECB – thereby making it a more attractive currency for investors.

Despite this, a weakening currency is not necessarily a bad thing. One benefit is that European exporters become more competitive, as foreigners pay less for European goods and services. It would be a welcome boost to tourism operators after years of lockdowns. Such increased export activity would then, in theory, help the currency appreciate somewhat. On the contrary, it is bad news for importers within the eurozone.

Governments around the world have had to increase expenditure as a result of the pandemic

One could argue that after inflation, the next big topic in economics is going to be around government debt, for three reasons: the amount is increasing, GDP growth is slowing, and the cost to service that debt is also increasing, due to the recent increase in interest rates by major central banks.

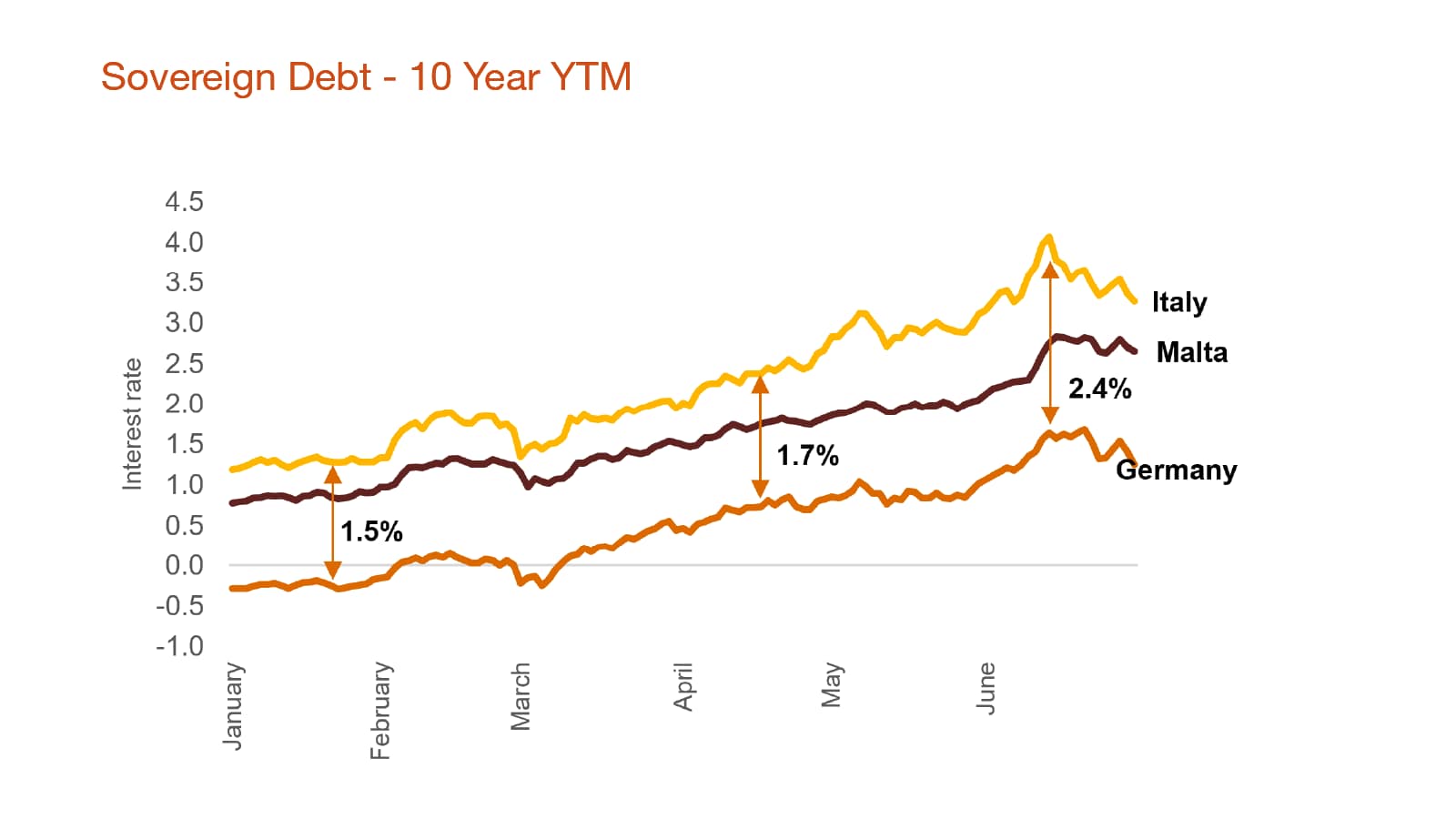

A case in point is Italy, where, to compound matters, the prime minister has recently resigned. Taking a look at the Government Bond yield spread between Italy’s bonds and Germany’s, one may note how this spread has increased significantly over the past month or so. This means that Italy’s debt, which stands at a considerable 152.6% of GDP in the first quarter of 2022, is becoming more and more expensive to pay back – note how the interest rate on 10-year Italian bonds has increased from 1.2% to a high of 4% since the start of the year, and the spread over the German Bund has increased from 1.5% to a high of 2.4%.

But even besides Italy, all countries are experiencing higher debt and higher interest rates, which makes it harder to service and more of a fiscal policy headache.

Malta’s economy is not immune to the clouds hovering over the international economy, but remains relatively resilient with robust GDP growth and below average inflation

Malta’s economy is definitely not immune to international developments. A small, open economy, where combined imports and exports are higher than its GDP, the Maltese economy is vulnerable to external shocks, in this case primarily imported inflation from higher international oil and gas prices.

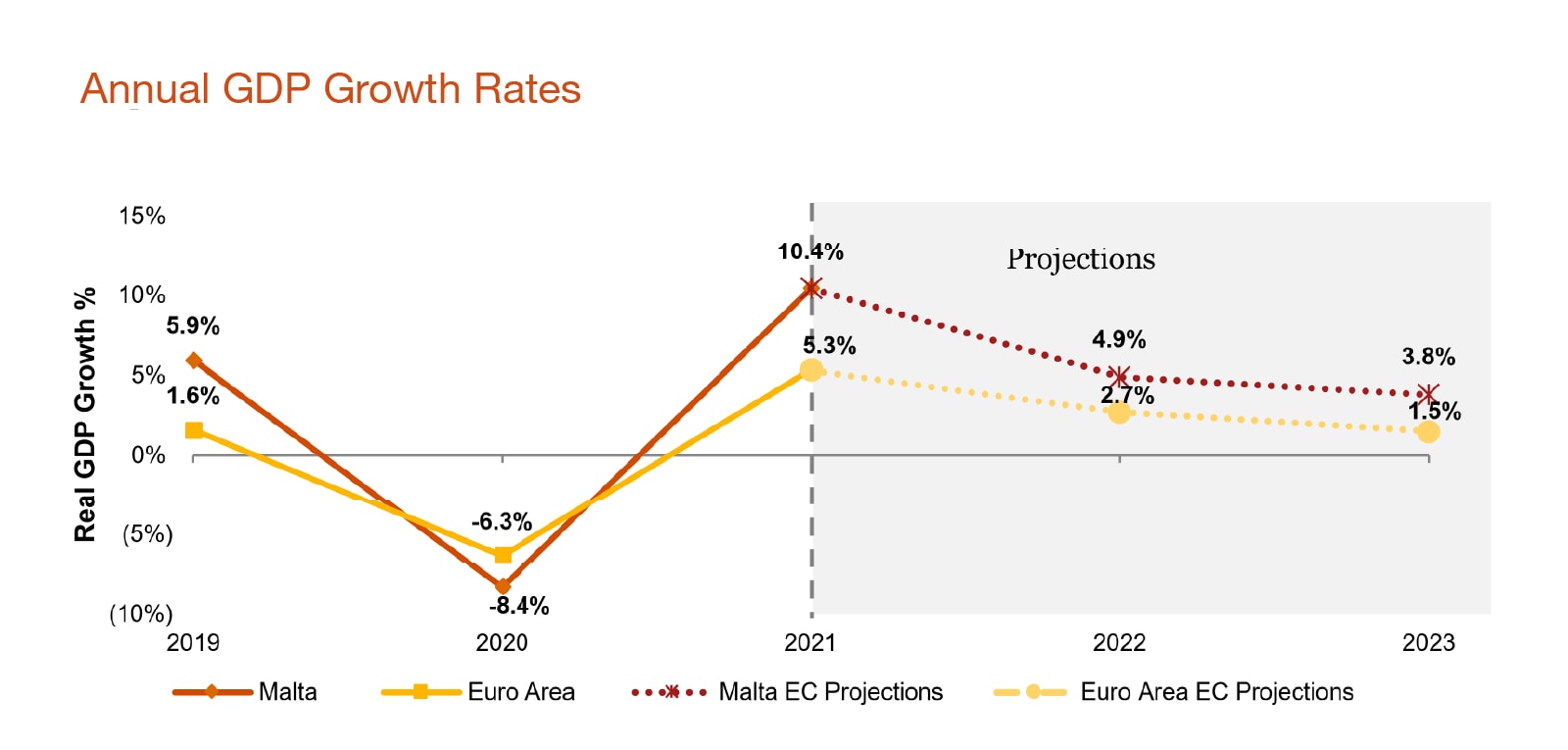

Meanwhile, GDP growth remains robust, with the first quarter of 2022 seeing 7.6% real growth in GDP against the same quarter of 2021. This follows from a 10.4% annual growth in the year 2021. The European Commission forecasts growth of 4.9% and 3.8% in 2022 and 2023, with the main drivers being exports and domestic consumption.

Inflation in Malta, although high from a historical perspective, is one of the lowest in Europe, and has been driven mainly by food and services….

The main reason why Malta’s inflation rate has stayed the lowest in the eurozone so far is that fuel and electricity prices remain fixed as a result of state intervention. The big question is how long can the State sustain such low prices.

In fact, when analysed more closely, Malta’s inflation rate excluding energy has been higher than the euro area average over the first half of 2022, as can be seen in the chart below.

In summary these are definitely challenging times, but the Maltese economy remains characteristically resilient…

The Maltese economy has a funny habit of maintaining its resilience during challenging times, for various reasons. During the financial crisis and ensuing global recessions a decade ago, Malta’s economy outperformed most of its European counterparts due to, amongst other things, its strong banking system, sound service exports and targeted government measures.

This time round, the challenges are somewhat different, with inflation and interest rates being raised. However, opportunities remain – first of all, in the tourism sector.

In 2021, Malta received 969,246 visitors, a 47% increase over the previous year (however, amounts to only 39% of the pre-pandemic amount). This represents a massive opportunity and space for growth, as a rising number of arrivals will help fuel growth going forward. In fact, 2022 has already shown promising signs, with the cumulative tourist arrivals as at June 2022 representing 75% of the same period in 2019.

Furthermore, the banking sector remains well capitalised and profitable, two ingredients which are important for withstanding international shocks in the financial system.

On the fiscal side, although the deficit is set to continue to increase in 2022, the Government still maintains adequate fiscal manoeuvrability with a debt-to-GDP ratio currently standing at 57.6% and projected to remain below the 60% threshold over the medium term.

In conclusion, it’s clear that we are entering a new era in terms of economic landscape – against a backdrop of 4-decade high inflation, government debt is rising and so are interest rates, as economies slowly recover from two years of disrupted activity. This makes the need for caution, fiscal responsibility and efficiency crucial.

Contact us