{{item.title}}

{{item.text}}

{{item.text}}

In the best of times, the strengths of family businesses are often overlooked. But when times get tough, the strong fundamentals that are the hallmark of local family-owned business - commitment to values, business acumen, and sensible leverage shine.

The 2009 financial crisis and more recently the COVID-19 pandemic, signal the resilience of family business and testify their innate ability of adaptation and transformation and this is one of the many reasons why local family business leaders carry a strong reputation and respect in the business community.

Recent statistics published by NSO indicate that almost 70% of active business units in Malta were sole proprietors and partnerships, a metric that continues to signal the relevance of local family-owned business in the economy.

In the context of the ever dynamic competitive market which continues to be influenced by international developments, particularly through supply chain and inflationary pressures, local businesses need to continue embracing the digitalisation of their operations whilst securing key talent, enhancing internal governance models, and rationalising the cost-base and internationalising business.

Our mission is to help your business at any stage in its lifecycle grow, prosper and professionalise, while also ensuring continuity for future generations. We are a connected team dedicated to helping you in every aspect of your work – from business and ownership, to private wealth and legacy-building.

At PwC we seek to develop innovative solutions to help you balance a long-term perspective with a fast-changing world to meet the requirements of your family business.

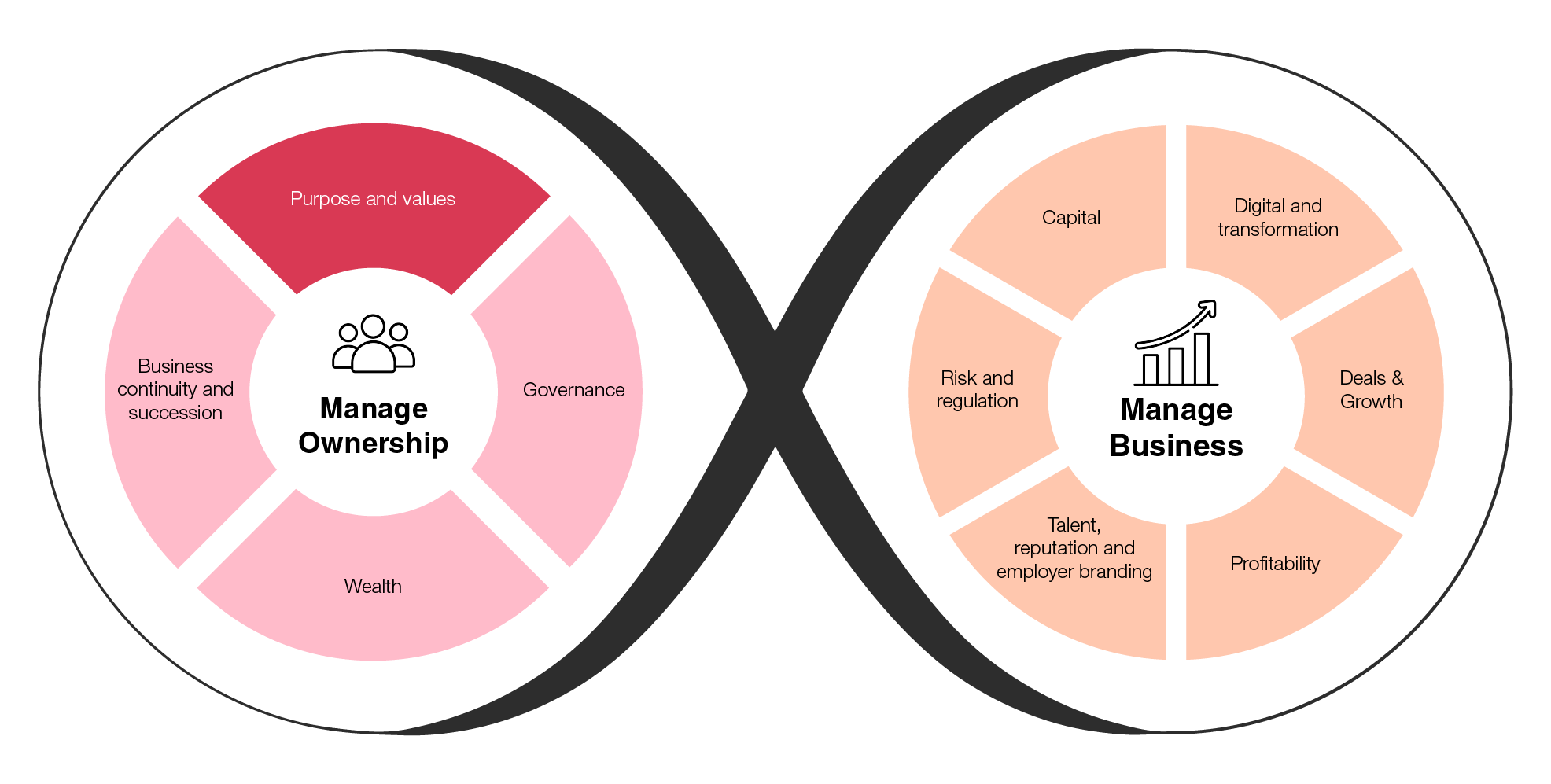

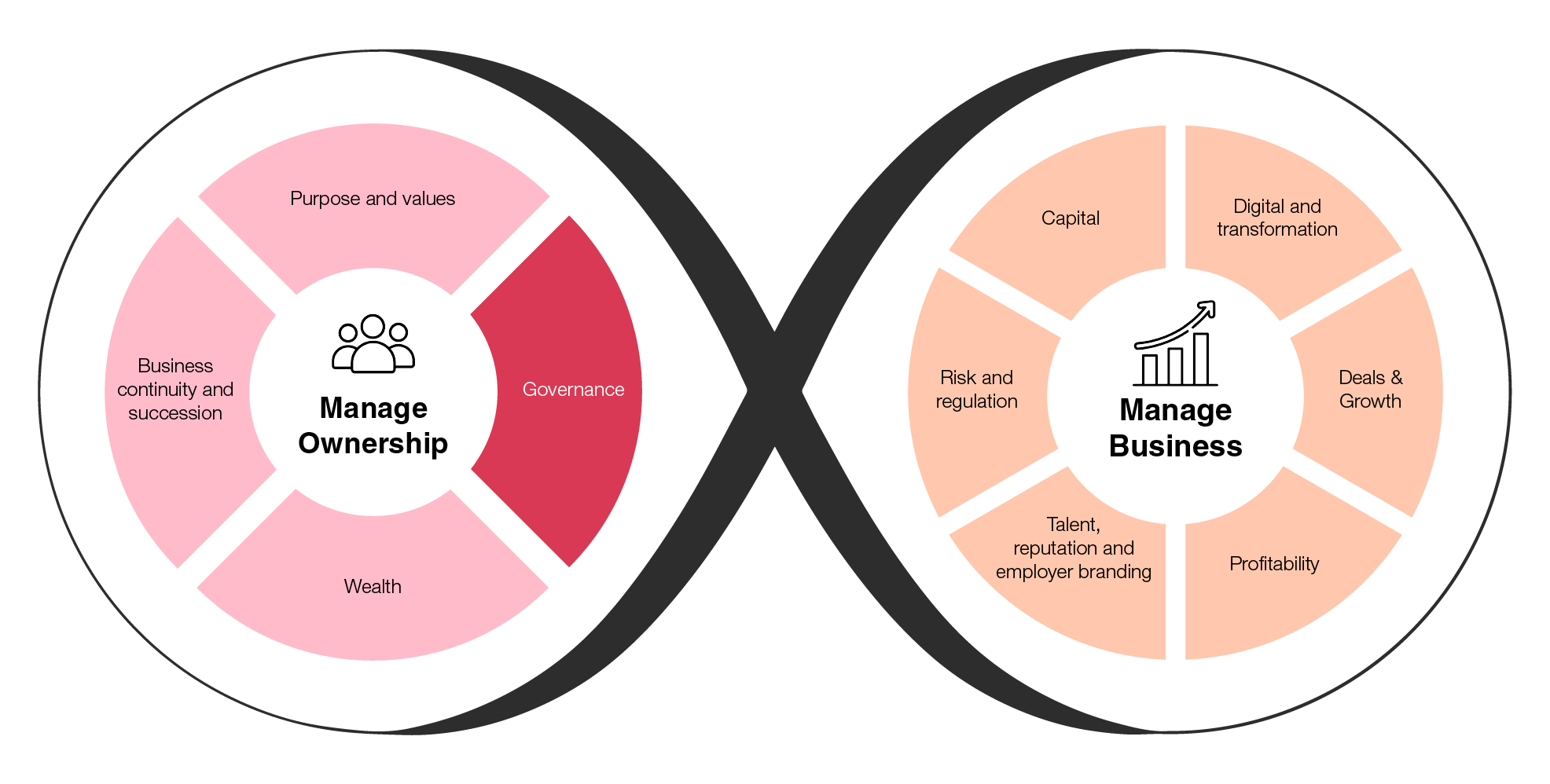

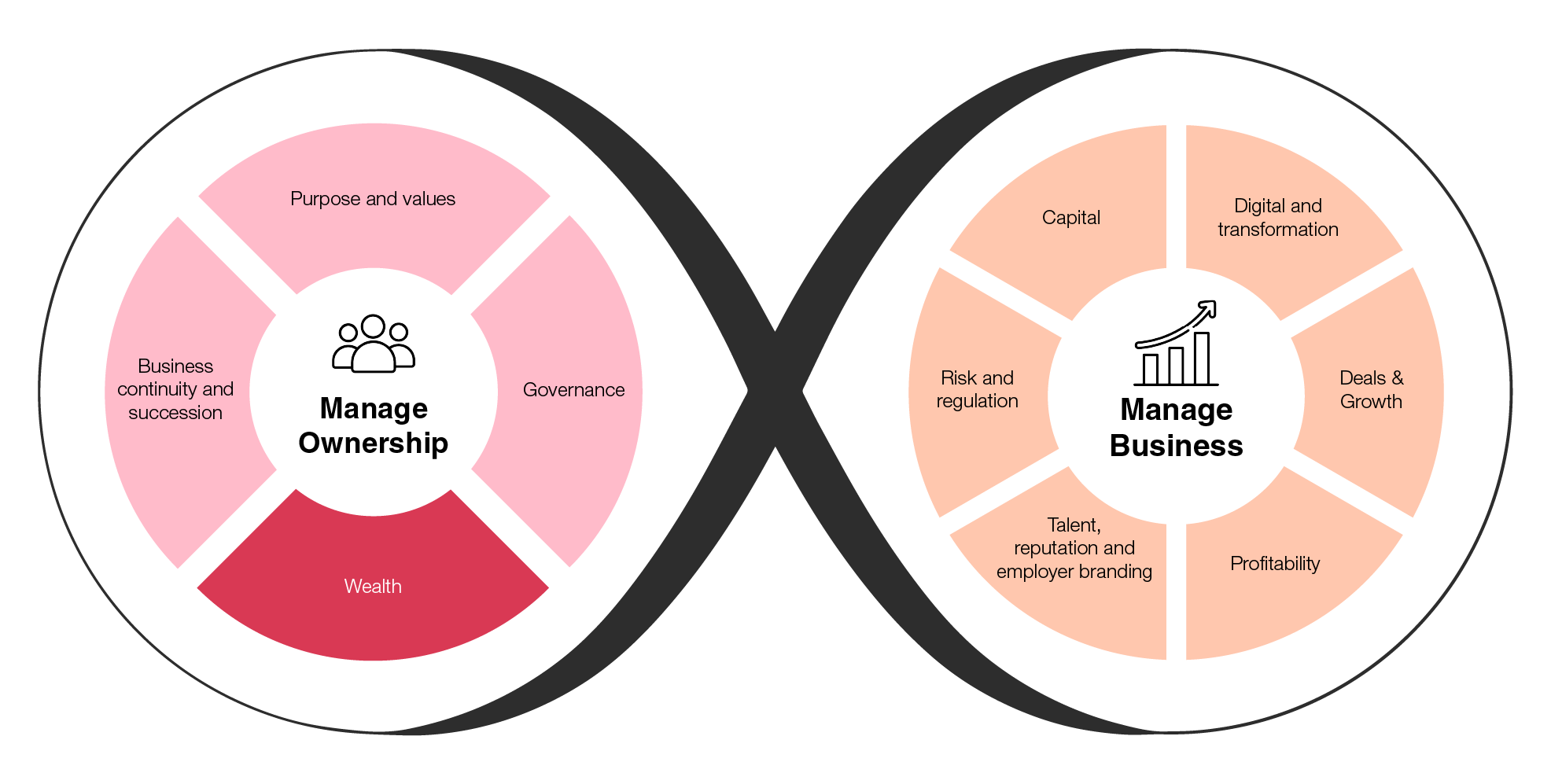

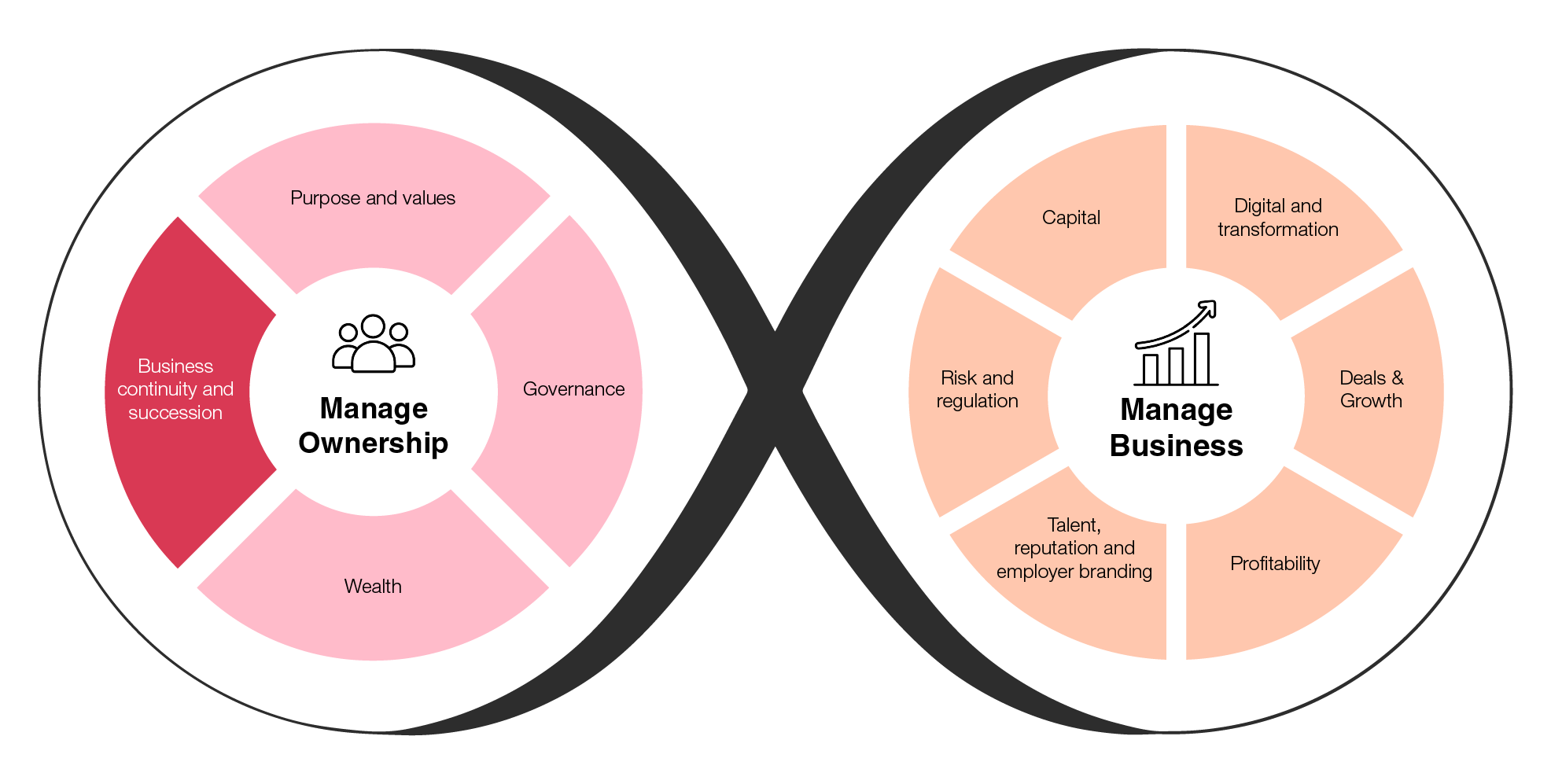

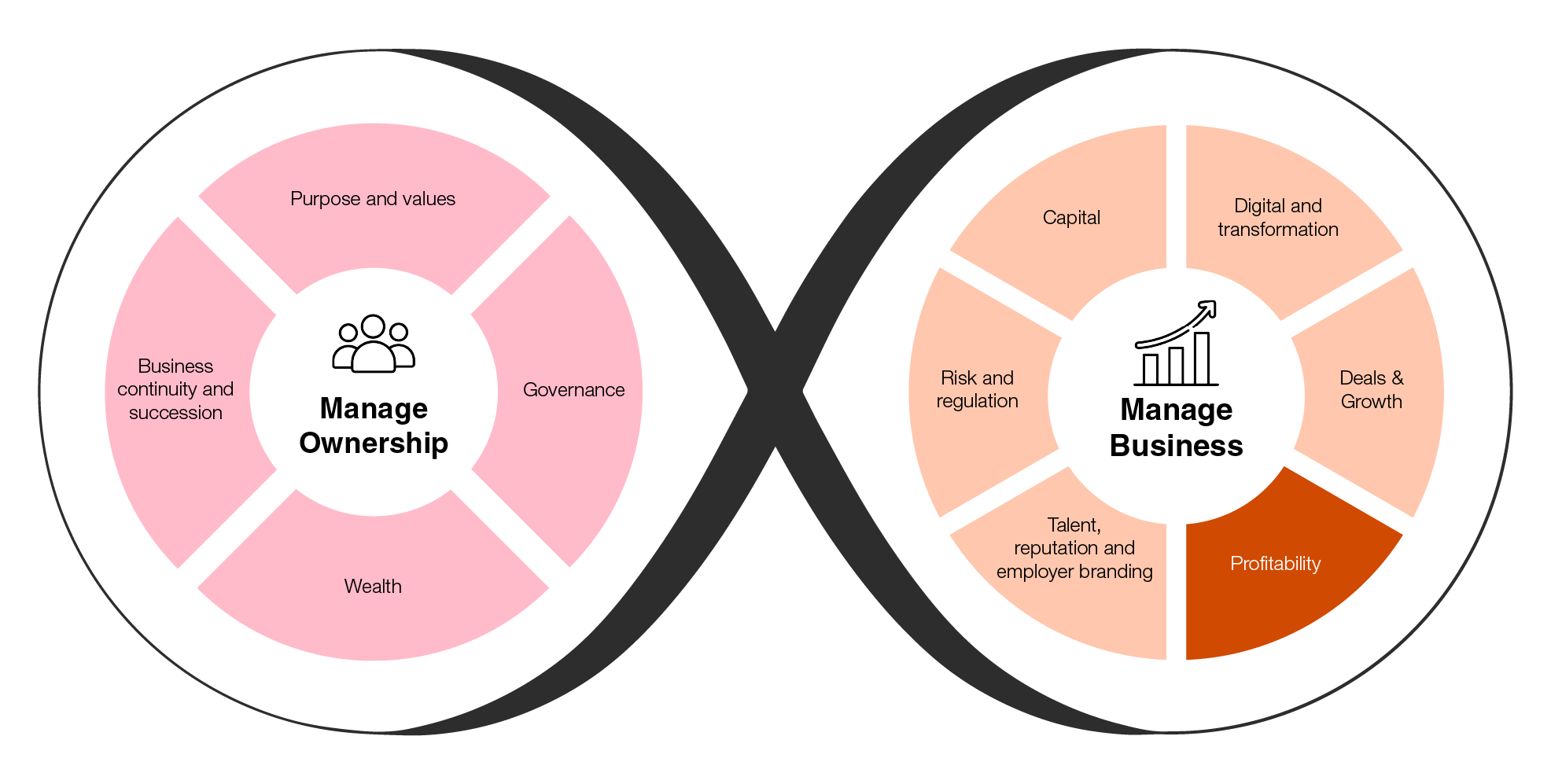

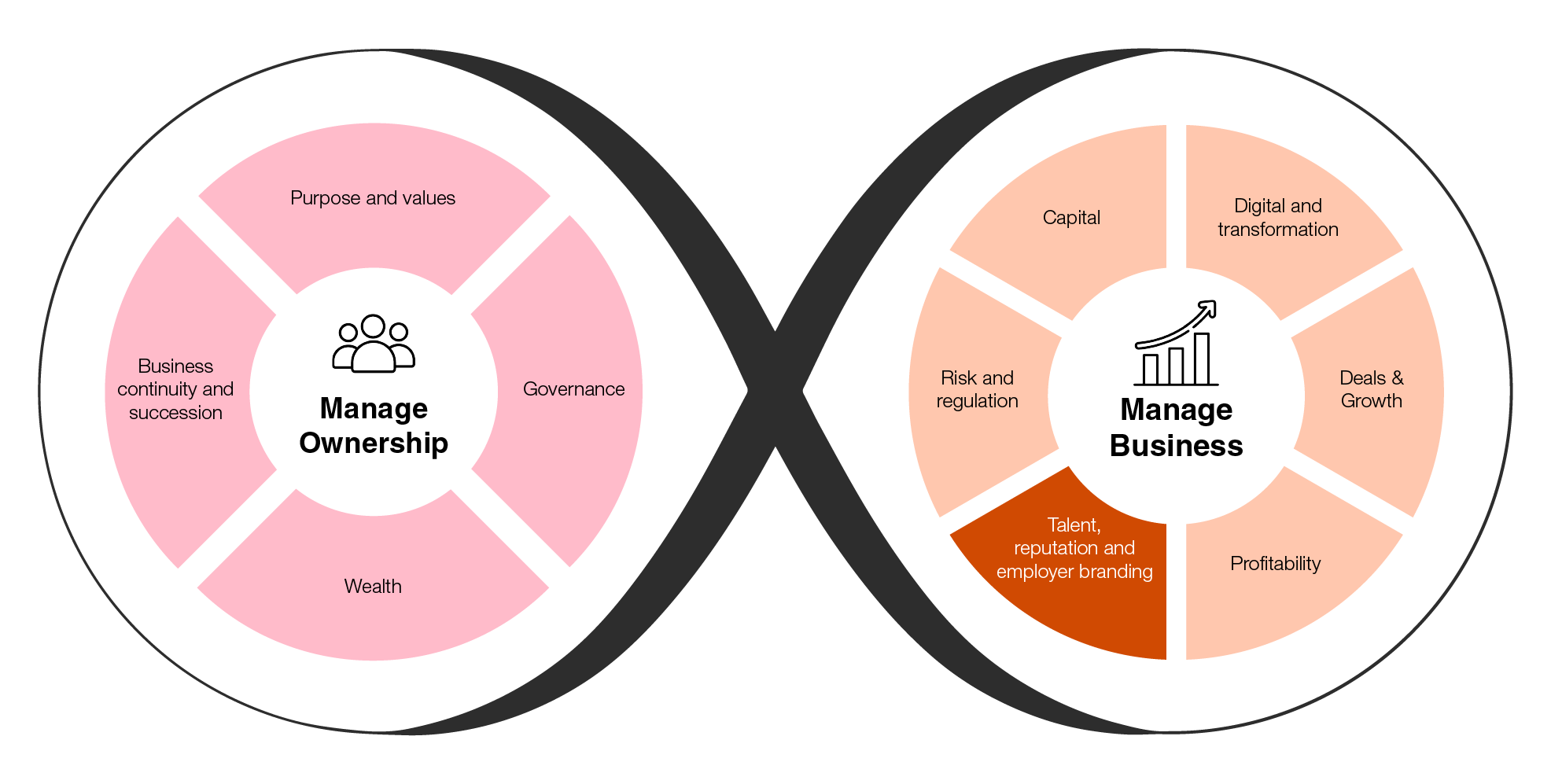

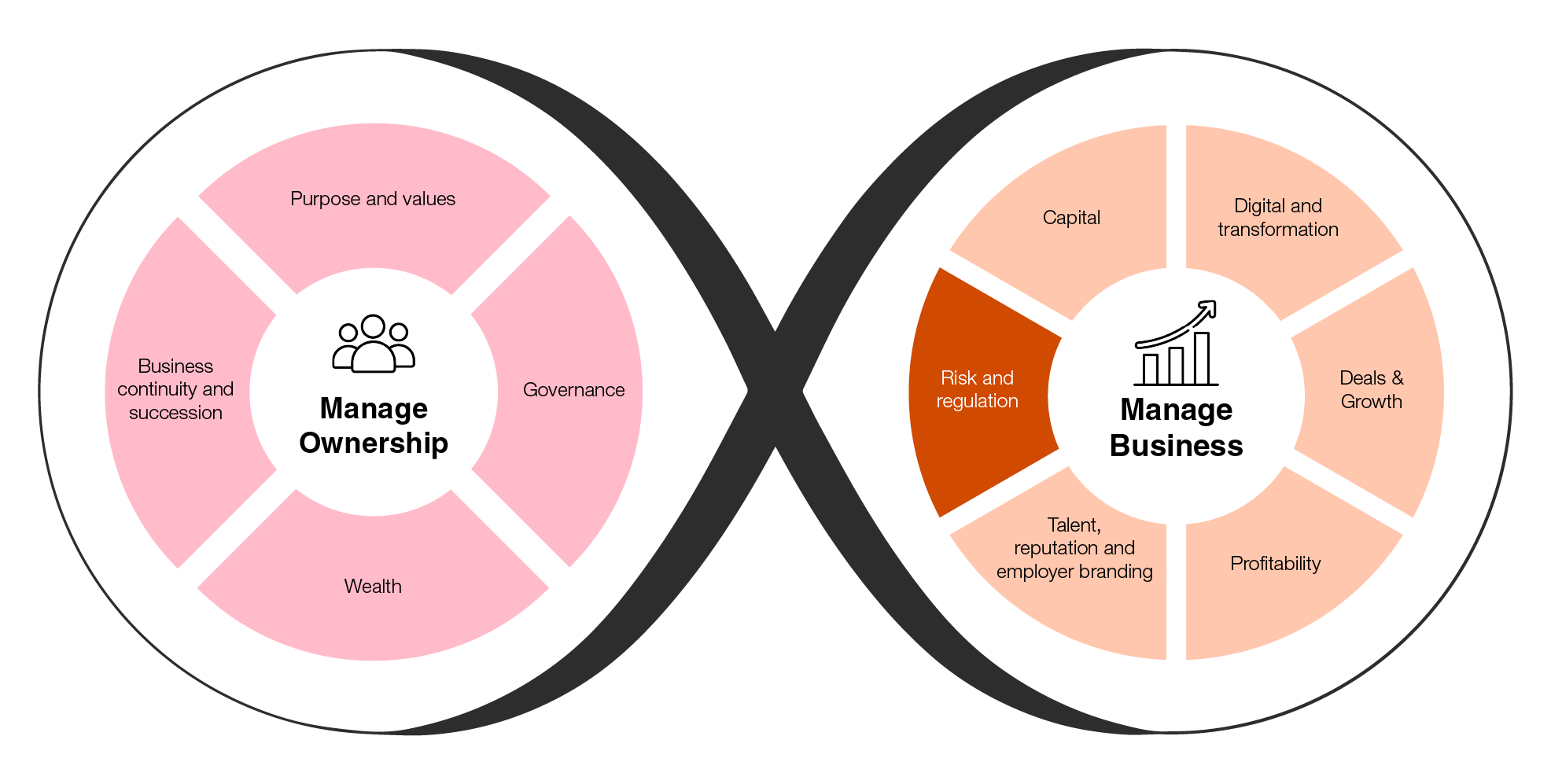

Whether you are a fully fledged family business owner or entrepreneur setting up a family office, the Owner’s Agenda will help you to address the two key interrelated issues that you must manage every day: ownership dynamics and business success. It addresses both sets of issues in a consistent, integrated and joined-up way, reflecting the fact that you sit at the heart of each of them, and that your agenda encompasses both.

The diagram below illustrates how the Owner’s Agenda balances and reconciles your family and business strategies. The infinity loop shows how the two sets of issues are entwined and constantly interacting with each other.

Within the loop, the “manage ownership” circle on the left shows four of the key challenges that we can help you identify and address relating to your ownership strategy. And the “manage business” wheel on the right, shows the main issues that we can help you consider in creating the right strategy to drive and manage growth systematically.

These can be a major competitive differentiator for your family business if properly activated.

We strongly believe in ‘The values effect’ – the inherent competitive edge that family businesses possess compared to their non-family owned counterparts. This brings family businesses an enormous opportunity to generate real gains from their values and purpose, by adopting an active approach that turns these intangible attributes into valuable assets.

We can help you identify your shared purpose and define, codify, communicate and embed your values.

In this context we also help with:

This encompasses governance both of the business and also of family matters. For your family business to flourish and grow sustainably, you need both to be right.

Corporate governance focuses on the control and leadership of the business and the roles of the various parties involved in managing it. Family governance deals with the dynamics, roles and relationships within the business-owning or shareholding family.

In general, the larger the family business and the higher the number of family members involved, the more vital it becomes to put structures in place to ensure the needs and aspirations of all family shareholders are met.

The team can help you set up the right family governance for your business by developing and providing closely tailored solutions in areas including:

Formalising business relationships between family members

Creating a family advisory board

Developing a family employment policy

Drafting a family constitution

Managing, protecting and growing wealth and family wealth, both for current and future generations.

Owners of successful family businesses need a strategy for protecting their personal wealth and structuring it for growth. This need is all the more pressing today, given the emergence of a global financial ecosystem characterised by increasing complexity and often duplicative tax regimes.

Here are just some of the typical issues and areas we can help our clients navigate:

Helping to achieve a smooth and well-managed succession to the next generation.

Succession isn’t simply an event, but a process that must be planned carefully.

An effective business continuity or succession process must focus on areas ranging from leadership and ownership to values and purpose to wealth management and stewardship.

The below “manage business” section highlights six main business areas that you must address as a family business owner to generate and manage sustainable growth.

Keeping pace with the move across all industries to digital operating and business models. Today, innovation and digital transformation are key for the long-term success of any business.

Digitalisation can deliver a wide array of benefits to family businesses – including helping them strengthen their competencies, optimise internal processes, become more customer-centric, improve decision-making and achieve durable competitive advantage.

We support our clients in areas such as:

While sustainable growth can be achieved in many ways, in a family business it is key to ensure that the chosen strategy is the right fit in terms of long-term vision, control, values and readiness to embark on the growth journey.

We support our clients in areas such as:

For most businesses, profit is a means to an end: that of fueling future growth and innovation, while also – more importantly – pursuing the business’s long-term purpose and ambitions. Profit is also important to keep the family motivated in owning the business.

Setting profit goals is – in part – a fundamental exercise in promoting family cohesion, by bringing together the family owners and the management of the business to ensure that decisions around profitability reflect the family’s long-term goals and values, yet are also taken within a realistic business context.

When it comes to profitability we help our clients navigate:

Attracting, retaining and developing high-quality talent that can drive the business forward while remaining aligned with the owning family's values and ambitions.

Winning the war for talent is one of the most pressing challenges for all businesses – but for family businesses the issues it involves are especially complex. On the one hand, they need to nurture and manage their family members, including the next generation. On the other, they must attract, retain and develop the right non-family talent who will add value to the business, while ensuring that this talent’s ambitions, style, mindset and entrepreneurial spirit are aligned with those of the owning family.

Here are just a few of the typical issues in the talent domain our people can help with:

Managing risk and complying with regulation in ways that mirror the underlying values of your family and business.

What really matters is understanding and breaking down the kind of risks your business faces and identifying the best strategies to mitigate them.

A further factor is that the world is changing rapidly and radically, triggering new risks and tighter regulation that can create scenarios which are both unexpected and hard to deal with.

Our holistic approach to managing risk and regulation spans areas ranging from advisory services to more technical offerings, and includes:

Maintaining a robust financial base for the family business while considering the opportunities to tap into new sources of capital.

With our deep knowledge of capital markets,private equity and capital management, we can offer expert and objective advice on the tools and techniques available for managing and growing your finances to achieve your growth objectives. Among the various aspects of managing capital, we can help with:

As your trusted advisors, PwC can help your family business manage ownership and growth at every stage, by providing support with family governance, succession planning and business continuity, next generation education and transition, private wealth management and family offices, philanthropy, values and purpose and more. No matter where your business is on its journey to success, we can be at your side with the insights and solutions you need to stay fit for growth and moving forward at the right pace.

{{item.text}}

{{item.text}}