Several internal and external factors can plunge a company into financial distress resulting in declining earnings, liquidity and cash-flow blockages etc. and ultimately threaten corporate survival.

Our team specializes in providing services to troubled and under-performing businesses, stakeholders and lenders.

Providing corporate analysis and independent business reviews

Helping with insolvency - administrations, liquidations and receiverships

Aligning corporate structures and business objectives

Delivering financial and operational restructuring solutions

Identifying and divesting non-core operations

Designing and executing controlled exits - country or industry withdrawals

Maximizing value through working capital benchmarking

Managing debt advisory and creditor negotiations

Of further interestRecievables financing enhancing working capital performance (UK)

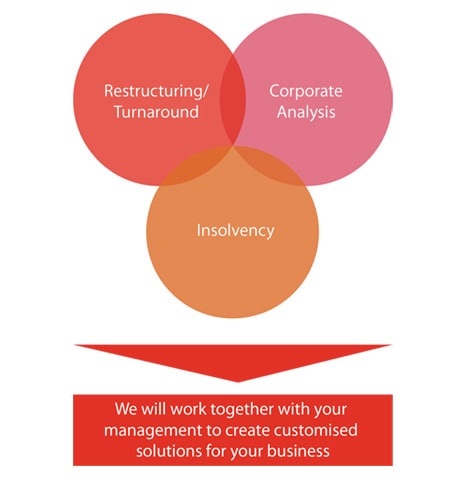

Our service overview

- Restructuring/Turnaround

- Corporate analysis

- Insolvency

Restructuring/Turnaround

Restructuring

For under performing companies, we deliver restructuring solutions designed to build a platform for swift recovery and sustained future success. We thoroughly assess all revitalisation options; develop a plan of action in partnership with management, creditors and other stakeholders; and mobilise the resources required for effective implementation. Our professionals utilise PwC's deep and broad industry knowledge and local knowledge in planning complex, cross-border restructurings.

Business regeneration

Our experienced teams help underperforming businesses plan and implement recovery strategies quickly and efficiently. This may involve moving forward on several fronts—crisis intervention, stabilisation and stakeholder communication; generating quick wins and reducing working capital; designing and implementing a value-recovery plan.

Optimised exit services

When external and/or internal pressures dictate withdrawal from a country, industry, company, market or brand, PwC can assist in optimising value by helping you design and execute a controlled exit plan—sell, fix and sell, wind-down. Our proven methodology optimises shareholder returns, mitigates delays and obstacles, and minimises disposal/divestment costs.

Distressed mergers and acquisitions

For business stakeholders experiencing pressure on profitability, cash flow and/or the balance sheet, we maximise value through the sale of shares or business and assets within a tight timeframe using a combination of corporate finance, restructuring, insolvency and tax skills and techniques. PwC has an accelerated disposal methodology that delivers substantial value over and above what is usually recovered in an unplanned insolvency situation, which may be the next alternative outcome.

Corporate analysis

Independent business reviews

When a company is underperforming, is in distress, or is in crisis, our first step is to undertake an in-depth and tailored assessment of the situation and resources. Our rapid and rigorous review process scrutinises financial performance, operating dynamics, asset deployment, and management issues—and then identifies a range of options.

Non-performing loan sales and analysis

We advise banks and other financial institutions on the disposal or purchase of non-performing loans. Our services include conducting financial due diligence and portfolio reviews, preparing information memoranda on asset valuations and disposal options, identifying potential investors, and facilitating sale negotiations and deal completion.

Corporate simplification

When an existing corporate structure no longer meets a business' objectives, we will work with you to identify surplus entities, release capital, reduce operating costs, and achieve a leaner, more transparent corporate structure. Our tailored approach addresses critical issues, minimises risk, and helps ensure a smooth transition to a streamlined operating model.

Insolvency

Executor/corporate insolvency

We can advise and assist with the winding down of companies. We can act as receivers, receiver managers or liquidators.