Private Wealth Services

We have a keen multi-disciplinary appreciation of the dynamics of private wealth and family business.

Building your legacy for tomorrow

Managing wealth for individuals and families has become increasingly complex and international, transcending nations and territories. The need for high-quality advice and a strategy to protect and sustain personal and family wealth is high. This is due to an unprecedented set of tax and regulatory changes, an ever-changing economic landscape and the automatic exchange of information between tax authorities and institutions.

Our Private Wealth and Family Business Team wants to journey with you as you protect your wealth and put in place a stable and compliant succession plan. As your trusted advisors, we can guide you as you manage ownership and growth of your business at every stage, providing you support with:

- Family governance

- Succession planning

- Next-Generation education and transition

- Private wealth management

- Setting up Family Offices and foundations, and more.

Moving you forward at the right pace

No matter where your business is on its success journey, we can be at your side with the insights and solutions you need to stay fit for growth at the right pace. We have brought together the relevant specialists who understand the tailored needs of wealthy individuals and business owners.

They can provide innovative, practical and robust advice in a way you will be able to understand and enable you to grow. You will have access to PwC’s unsurpassed global network of advisory and tax professionals and a truly integrated service for you and your family, often acting as a single point of contact for all your global compliance and tax needs.

We have a keen multi-disciplinary appreciation for the varied dynamics of wealthy clients and family businesses. We apply this knowledge to help you build on the positive aspects of your private wealth and family business. We also empower you to be in a position to anticipate and mitigate risks by ensuring that your wealth structures are efficient for regulatory purposes.

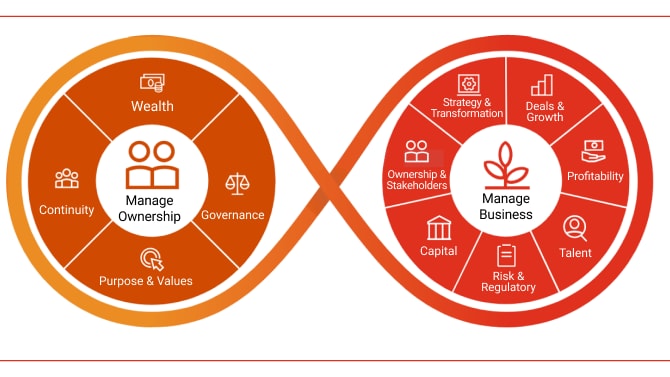

The Owner’s Agenda illustrates our approach to developing both your ownership and business strategies.

The Owner's Agenda

At PwC, our approach to understanding what is most important to you and your business is called “The Owner’s Agenda”. This framework is designed to assist you in developing both your ownership and business strategies in a consistent and integrated way, reflecting that you sit at the heart of each of them, and that your agenda encompasses both.

No matter where you are on your business journey, our team is at your side translating our unique vantage point and perspective into real insights that can help you succeed. We are built around you to find new opportunities and reshape the future of your business together.

How you approach your ownership strategy is key to business success and longevity but also family cohesion and happiness.

Achieving the right level of sustainable growth is an especially complex undertaking for family businesses, because of the need to consider not just the business’s goals but also those of the family.

What sets us apart and how we can help

We step inside your agenda to understand where you want your business to evolve. From there, we assemble the right team to fit the needs of your business and take it further. We also invest in understanding what’s collectively driving your decisions by surveying thousands of family business owners and interviewing hundreds of private business CEOs every year.

Family Offices

The managerial and administrative needs of high-net-worth families can be extensive, ranging from tax and estate planning to managing trusts and foundations. A family office can help meet those needs, tailoring the breadth and depth of its services to a given family requirements. We will advise you on setting up and operating your family office.

Foundations and Philanthropic Investments

There is a growing desire among individuals and companies to give back to the community. We can help you find the most effective and tax efficient way of doing that. Intelligent structuring of your philanthropic efforts maximises the good that you can do. A foundation, for instance, can be an efficient philanthropic structure and a key part of your broader wealth and business strategy.

Wills and estates

Without proper planning, estate and inheritance taxes can significantly reduce the amount of wealth available for future generations. It is important to routinely review your estate and gift plans to address changes in tax laws and to ensure your wishes remain accurately reflected.

Lifestyle and unique investments

Ownership of yachts and planes, classic cars and works of art bring unique tax issues in many jurisdictions. Tax efficient ownership via limited liability companies, companies, holdCos, trusts or other vehicles should be considered.

Succession planning

The longevity of a family business depends on early ongoing succession planning. Communicating the results of that planning to family members and other key stakeholders in a timely fashion will increase the likelihood that the business and its value will endure well beyond leadership transition. We are looking to help businesses last through generations.

Tax and Investment planning

In this atmosphere of prevailing uncertainty and global economic interdependencies, it’s important to have an investment strategy that will keep you progressing steadily while also letting you remain flexible enough to capitalize on new opportunities when they arise

Environmental, Social & Governance

ESG is changing our world and has gone beyond ticking boxes. It’s about making a difference - for your business and our world. It is about creating sustained outcomes that drive value and fuel growth, whilst strengthening our environment and societies. ESG is more than a responsibility. It’s a mindset and an opportunity for growth. However, knowing where to start can be overwhelming. Let us help you create value through ESG.

Contact us

Esiri Agbeyi

Partner | Private Clients & Family Business Leader, PwC Nigeria

Tel: +234 (1) 271 1700