Banks’ approach to COVID-19: Being data-driven and being human

As this crisis develops, banks are not merely bystanders. They have a major role in ensuring that the economy has enough liquidity it needs to survive the economic downturn and to facilitate a sustained recovery afterwards.

Assessing the current situation, the Bangko Sentral ng Pilipinas (BSP) decided to cut the interest rate on the overnight reverse repurchase (RRP) facility by 50 basis points to 2.75%, effective 17 April 2020. This is the third rate cut on RRP this year to hopefully stimulate the slowing economic engine in the business unusual scenario.

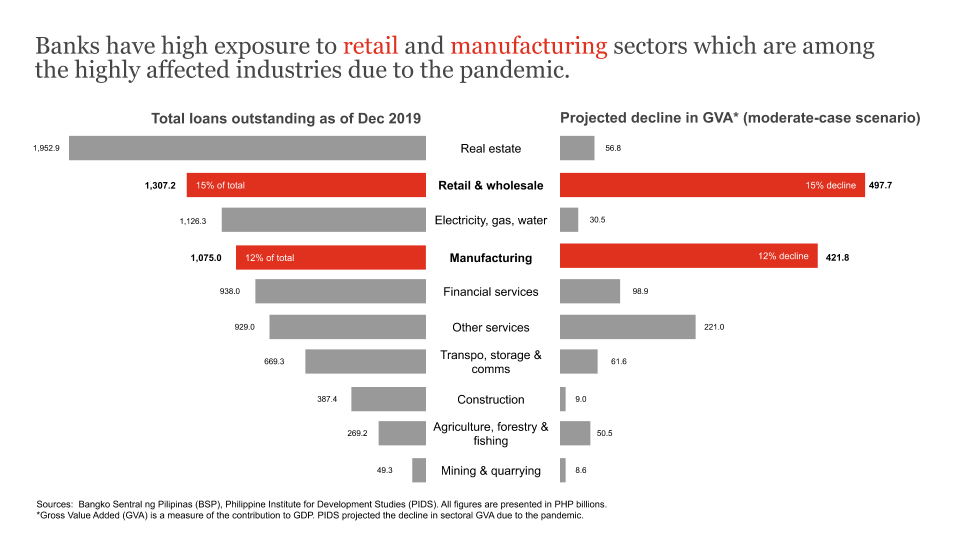

The BSP has responded quickly to the looming crisis, especially in enabling cheap new credit. However, banks are still left with significant exposures in vulnerable sectors. Figure 1 shows that banks have significant loans outstanding to retail & wholesale (PHP1.3 trillion or 15% of total outstanding loans) and manufacturing (PHP1.0 trillion or 12% of total outstanding loans) sectors as of December 2019. These sectors are also the ones that are highly affected by the pandemic. The Philippine Institute for Development Studies (PIDS) projected that in the moderate-case scenario, the sectoral Gross Value Added (GVA) of retail & wholesale and manufacturing sectors would decline by PHP497.7bn or 15% and PHP421.8bn or 12%, respectively.

Figure 1

On top of this exposure, banks are also faced with the human aspect of mitigating the crisis ‒ keeping their relationships warm with their stakeholders, especially their clients whose businesses’ and families’ futures may be at stake.

In these aspects, the banks’ key focus areas in time of COVID-19 may be simplified into two: (1) enhancing credit risk management effectively through data analytics and (2) fostering an emphatic and inclusive customer service.

Enhancing credit risk management effectively through data analytics

The cash flow of businesses and consumers may be affected by decreased consumer demands due to community quarantines, employee layoffs, and disrupted business operations. Without effective action by the regulators and the banks, the non-performing loans may rapidly rise as borrowers struggle to pay their principal and interests.

This struggle is not just expected to happen in the future. It is happening now. According to the BSP, the gross non-performing loans (NPL) of banks increased by almost 20% to PHP246.0bn at end-March from PHP205.9bn a year ago. The NPL ratio climbed to 2.21%, which is the highest recorded ratio for the comparable month in the past three years.

Figure 2

Given BSP’s immediate action in ensuring liquidity in the economy through decreased lending rates and reserve requirement, the pressure is on for banks to operationalize such measures. While the intention of the government is to provide support, banks would need to immediately scale their operations to manage worsening credit positions of existing borrowers and accommodate possible increase in new credit due to lowered interest rates.

In managing risks for both existing and new credit, banks need to be data driven. These are two, among the many ways, in which banks can manage credit risk in a data-driven manner amid the crisis:

- Build a dynamic credit decisioning framework and credit scores that incorporate the potential impact of the pandemic. The traditional credit scoring developed by banks pre-COVID-19 may need to be remodelled to take into account the potential impacts of pandemic. However, given the material uncertainty, banks need to consider multiple scenarios1 as they refresh their credit scores or credit decisioning guidelines. These scenarios include:

Epidemiological scenarios: How will the pandemic behave in certain areas in the country?

Macroeconomic scenarios: How will the economy rebound in the crisis? Will the output (economic) path be V-shape, U-shape, or W-shape? How will macroeconomic variables such as inflation, interest rates, or output growth move in the next months, quarters, or years?

- Borrower-specific scenarios: How will the pandemic and macroeconomic scenarios affect the credit worthiness of new and existing borrowers?

Developing these credit scores and scenarios that incorporate the potential impact of COVID-19 may be done in-house or can be entrusted with professional organizations that are adept with data analytics and have robust industry experience.

Targeted approach in redesigning loan terms or products for existing borrowers. The potential impact of the pandemic would not only be different among sectors but even among borrowers within sectors. In redesigning the terms for existing borrowers, the intervention can be targeted to individual accounts by considering borrower-specific characteristics and circumstances such as age, employment status, industry employed in, credit history, COVID-19 cases in their province/city, among others. A similar approach can be done to corporate clients. For example, the allowance for suspension of payments for a borrower owning a brick-and-mortar restaurant in Quezon City may be different from a borrower with an online food delivery business in Cavite. While these borrowers belong to the same industry (food and beverage), they have different business models and are situated in different areas. Machine learning models used for “clustering” debtors may enable this targeted approach in redesigning terms in an efficient manner.

These data-driven approaches may not only help the bank keep high quality loans — these may also serve as the banks’ key differentiator in keeping and attracting clients that would trust their service.

Fostering an emphatic and inclusive customer service

In this crisis, the human element of business and banking relationships is still relevant, if not more. People may feel frustrated given limited access to multiple necessities and vital services such as banking. They are eager to build trust with their respective service providers that they will not be left in the dark.

To make sure that we keep client relationships healthy and customer-service managed, here are some steps that banks may want to consider:

- Proactively reach out and offer training to customers who are not familiar with online banking. This pandemic has pushed banks to significantly go digital. However, not all customers will be able to make an easy transition. If banks have access to their customers’ mobile numbers, they can proactively reach out and help them activate their online banking accounts or even perform basic online banking functions such as checking their balance.

- Combine human and digital touchpoints in attending to customer concerns and needs. Banks should extend personal service beyond personal interactions. This means being able to help address customer concerns in multiple channels ‒ be it through the bank, subject to social distancing measures, or online chats. While banks may certainly use online chatbots or off-the-shelf responses in extending support beyond the limits of the branch, they should prioritize live online interactions (i.e. video chat) if resources permit.

- Train customer service personnel to better prepare them in interacting with borrowers with dignity and respect during this stressful time. Customer personnel may undergo training to ensure that interactions with customers are grounded on empathy, understanding, and human connection during the pandemic. Customers will remember businesses who have been with them in the good times but will entrust those who have taken care of them even in the bad.

COVID-19 is undoubtedly a challenging situation to banks, given their role in stabilizing the economic engine. As more banks turn to data-driven solutions to manage credit risk, they must not forget that numbers alone would not help their most important stakeholders ‒ their customers ‒ to be at peace.

This pandemic provides a unique opportunity for banks to build strong, trust-based relationships by making customers feel heard, accommodated, and understood. By being data-driven while putting human connection at the center, banks can better live their commitment of helping the whole economy rise from this historic challenge.

1 Scenarios are inspired from Gwynne, S., O’Kelly, R., Sommer, M., Dedeaga, C. (2020). Five Actions For Corporate Banks In Response To Covid-19. Oliver Wyman.

Research support by Cristina Joy Salonga, a core member of the PwC Data and Analytics team.

Contact us

Weddy Anne Diamada

Deals and Corporate Finance Senior Manager, PwC Philippines

Tel: +63 (2) 8845 2728