2023 M&A overview

The year 2023 was a testament to strategic ingenuity as companies embarked on acquisitions and divestments to either enhance their portfolios or optimize their operations.

Despite the initial challenges of high interest and inflation rates, the business landscape responded with resilience. The latter part of the year saw a promising shift with high deal values in October that soared to US$412bn. While there was a modest dip in the total number of global deals, the global M&A space flourished, especially in the fourth quarter. The energy sector emerged as a prominent player, underscored by the landmark US$65.3bn merger between Pioneer Resources and ExxonMobil Corp.

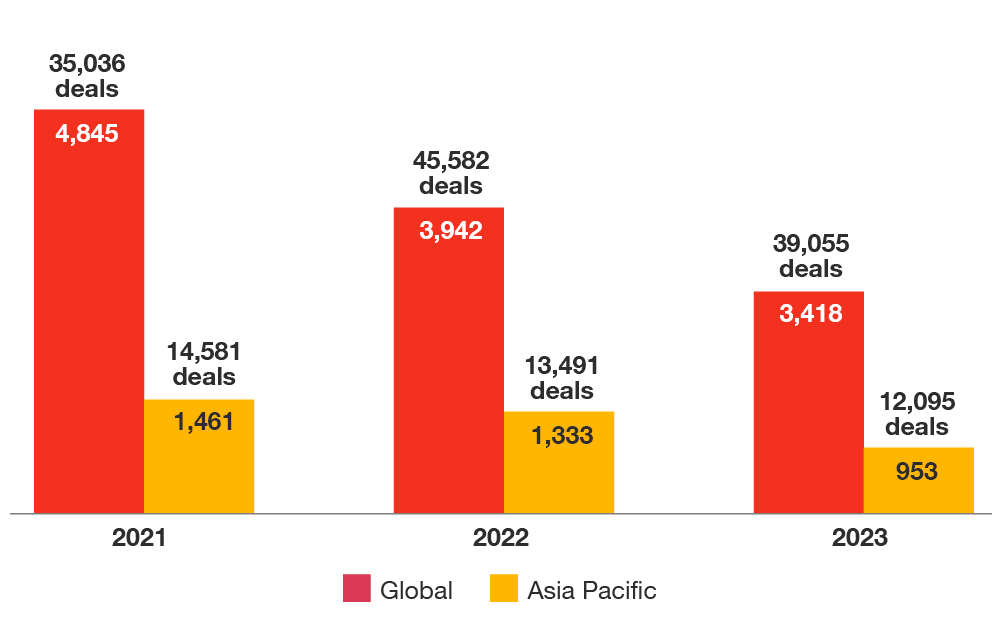

Asia Pacific remained a strong region for deals, despite lower volumes, thanks to lucrative deal performance in sectors such as industrials, automobiles, and healthcare. Deals in the Asia Pacific region were around 30% of the global deal count in 2023, with Southeast Asia contributing the largest deal in the region through the acquisition of VinFast Auto by Black Spade Acquisition for US$23.1bn.

The thriving sectors in the 2023 deal landscape in Southeast Asia and the Philippines offer valuable insights into the expected developments over the coming years, supported by cross-border investments and modernization efforts. The technology, renewable energy, and telecommunication sectors are experiencing significant growth, driven by government initiatives to foster industry expansion.

These initiatives attract foreign expertise through inbound deals, and enable outbound deals, to facilitate business expansion strategies. Collaboration among these thriving sectors plays a crucial role in scaling up production processes, driving growth in emerging economies, enhancing supply chain capabilities, and implementing advanced manufacturing technologies and techniques.

Source: Mergermarket, ION Analytics, S&P Global

M&A highlights in 2023

Asia Pacific deal activity

Geopolitical factors have shifted international business deal trends in Asia Pacific. Business transactions involving China, the United States, and Canada decreased by 34%, totaling US$8.9bn. On the other hand, other countries in the region, like Japan, are witnessing a rise in international agreements. The US$22bn joint development deal between the United States' Merck & Co and Daiichi Sankyo is seen as a positive indication of growing confidence among foreign investors.

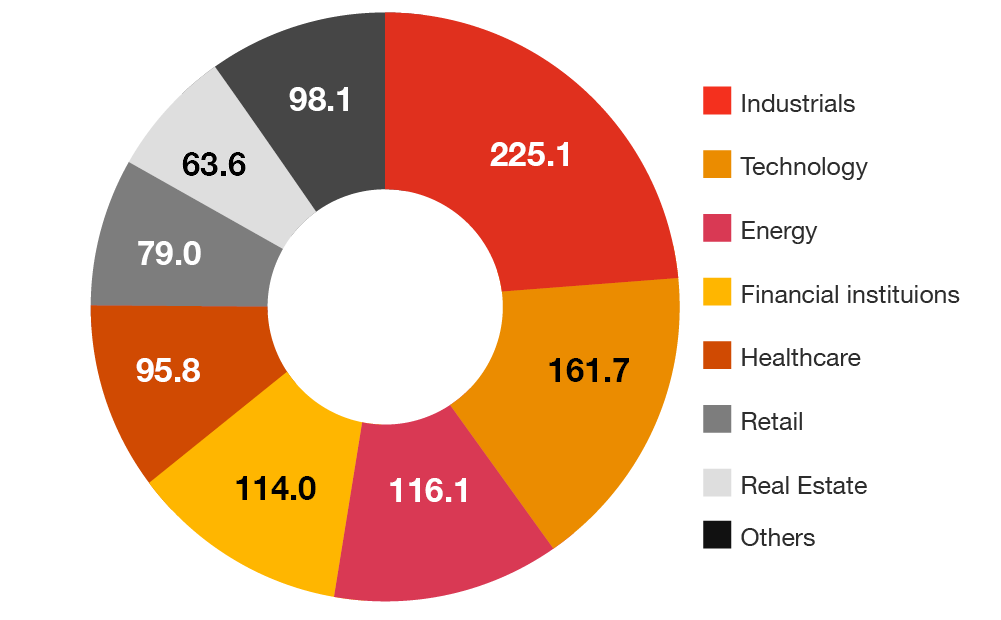

Strong sector performance

Individual sector M&A performance in the Asia Pacific defied expectations and remained robust throughout the year. The healthcare sector had an impressive total deal value of US$95.8bn. Meanwhile, the automotive industry experienced an 80.1% surge in deal volume that can be attributed to the rapid rise of electric vehicle production. Not only has it captured the attention of industry giants like Volkswagen and Stellantis, but it has also lured them into the Chinese market.

Source: Mergermarket, ION Analytics, S&P Global

Deal volume and value globally and in Asia Pacific

(Deal value in US$bn)

2023 Asia Pacific deal value per industry

(in US$bn)

Renewable energy development

There is a pressing need for power infrastructure in the Asia Pacific region as about 56.3% of the region's infrastructure needs are related to power, according to the Asian Development Bank.

Vietnam and Singapore are taking bold steps towards a greener future, aiming to make a significant portion of their energy portfolio renewable by 2030. These ambitious plans not only address environmental concerns but also attempt to reduce dependence on fossil fuels and the impact of climate change. Other exciting developments are underway such as Indonesia's Perusahaan Listrik Negara signing 14 agreements to transition away from coal plants and embrace cleaner energy sources. The Philippines is also making strides in renewable energy with the acquisition of SP New Energy Corp. by MGen Renewable, which can significantly boost the contribution of renewables to the country’s energy mix.

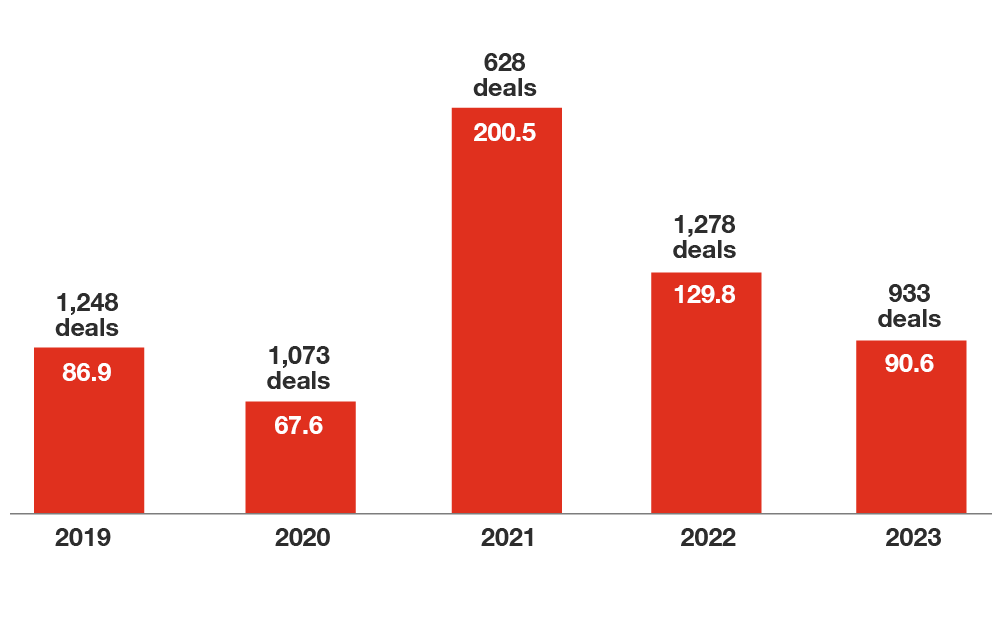

Southeast Asia

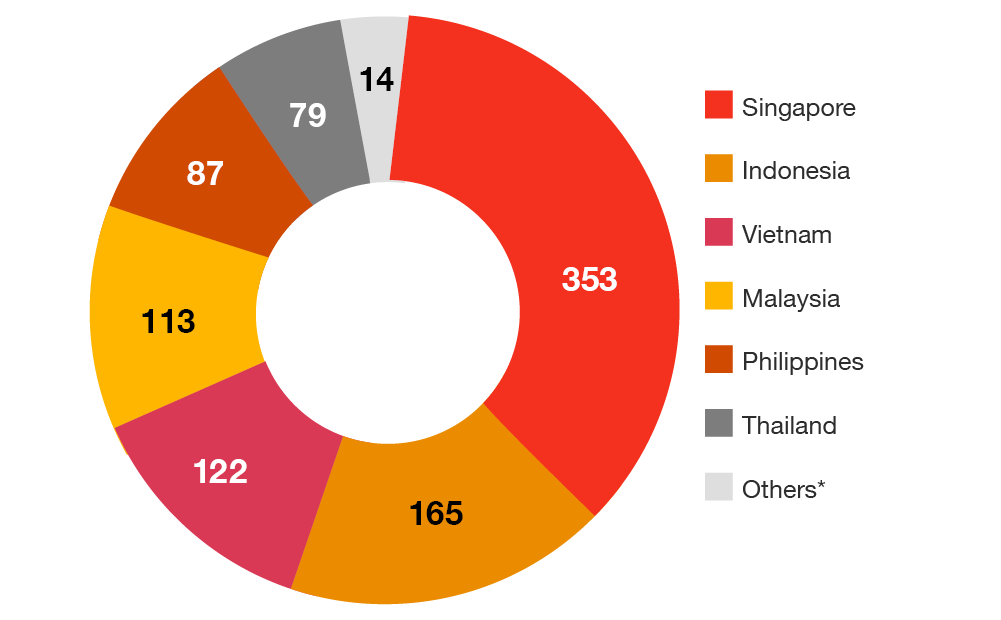

The year 2023 was a promising one for Southeast Asian (SEA) M&A, as the region surpassed pre-pandemic levels in both total deal volume and value. The region achieved its highest average deal size in three years, with around US$10.3bn per deal. Singapore, Indonesia and Vietnam took the lead with each participating in more than 110 deals, driving M&A activity in the region.

Moreover, with game-changing reforms such as Vietnam's Law on Investment and the Philippines’ Foreign Investment Act, the region has attracted the interest of foreign buyers. Southeast Asia has become an enticing destination for international players seeking expansion opportunities. As a result, SEA M&A activity is poised to remain strong, promising an exciting future as the region becomes a hub of dynamic business growth and innovation.

Key highlights for 2023

Source: Mergermarket, White & Case, ION Analytics

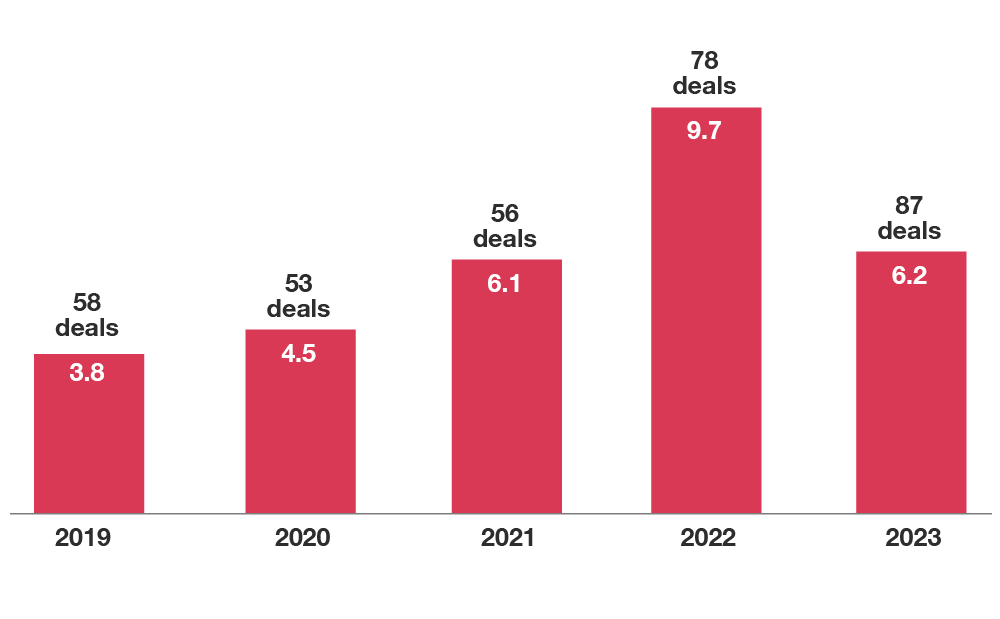

Deal volume and value in Southeast Asia

(in US$bn)*

Deal volume in Southeast Asia

*Includes Cambodia, Laos, Myanmar, and Timor-Leste

Notable deals in Southeast Asia

| Announcement date | Target company | Bidder company | Target country | Deal size (US$ billions) |

Sector |

| 11 January 2023 | Esso (Thailand) pcl | Bangchak Corp pcl | Thailand | 1.9 | Energy & Natural Resources |

| 3 February 2023 | Halcyon Agri Corp Ltd | China Hainan Rubber Industry Group Co Ltd | Singapore | 1.3 | Consumer & Retail |

| 27 February 2023 | Vietnam Prosperity Joint Stock Commercial Bank | Sumitomo Mitsui Financial Group Inc | Vietnam | 1.5 | Financial Institutions |

| 6 April 2023 | Indihome | PT Telekomunikasi Selular | Indonesia | 1.4 | Communications, Media & Entertainment |

| 12 May 2023 | VinFast Auto Ltd | Black Spade Acquisition Co | Singapore | 23.1 | Industrials |

| 27 June 2023 | PT Medan Binjai Toll | Indonesia Investment Authority | Indonesia | 1.4 | Transportation |

| 18 July 2023 | Paysense Pte Ltd | MIH PayU BV | Singapore | 6.9 | Financial Institutions |

| 2 August 2023 | Coca-Cola Beverages Philippines Inc | Aboitiz Equity Ventures, Inc.; Coca-Cola Europacific Partners plc | Philippines | 1.8 | Consumer & Retail |

| 16 August 2023 | Pavilion Energy Pte Ltd | Undisclosed | Singapore | 1.5 | Energy & Natural Resources |

| 24 August 2023 | UMW Holdings Bhd | Sime Darby Bhd | SIME | Malaysia | 1.2 | Industrials |

| 10 November 2023 | Ramsay Sime Darby Health Care Sdn Bhd | Columbia Asia Healthcare Sdn Bhd | Malaysia | 1.3 | Healthcare |

| 11 December 2023 | PT Tokopedia | Beijing Douyin Information Service Co Ltd | Indonesia | 1.5 | Technology |

| 22 December 2023 | Singapore Life Holdings | Sumitomo Life Insurance Co Ltd | Singapore | 1.2 | Financial Institutions |

Source: Mergermarket

Hot sectors in Southeast Asia

- Technology

- Industrials

- Consumer and retail

- Energy and natural resources

- Financial services

Technology

Technology continues to be a key sector for M&A activity in Southeast Asia, with over 200 deals announced in 2023. Among the standout transactions was the acquisition of PT Tokopedia, an Indonesian e-commerce company, by Beijing Douyin Information Service Co Ltd. The move was propelled by Beijing Douyin's ambition to bolster the e-commerce presence of their popular social media platform, TikTok, in Indonesia.

Notably, companies such as Alibaba and TikTok Inc. have shown interest in expanding their digital media and entertainment investments as the region’s e-commerce sector is expected to achieve revenues of US$186bn by 2025.

Industrials

The industrials sector is one of the region’s most active in terms of M&A, with over 140 deals. With a growing demand for electric vehicles and manufacturers looking to capture market share, several major deals were completed in 2023. Most notably, Black Spade’s acquisition of VinFast Auto for US$23.1bn is seen as the region's largest deal of the year. VinFast, with its connection to Black Spade, aims to further expand in the United States and establish itself as a major player in the country’s electric vehicle market.

Consumer and retail

The consumer and retail sector in Southeast Asia is experiencing significant activity, particularly in the food and beverage segment. Notably, the Philippines and Singapore saw some of the largest deals in this sector, with companies such as Coca-Cola, Don Papa Rum, and Carlsberg South Asia strategically entering the expanding consumer market in the region.

With a rapidly growing middle class and increasing disposable income in the region, there is a strong demand for a wide range of products and services among consumers. Furthermore, the emergence of e-commerce and digital platforms has created new avenues for businesses to connect with consumers, further stimulating growth and innovation in this sector.

Energy and natural resources

With over 100 deals in 2023, the energy and natural resources sector is one of the most active M&A markets in Southeast Asia. As governments and private businesses look to meet global clean energy targets, over US$8.6bn in investments were made in the past year.

Currently, the sector is driven by deals in the wind and solar energy segment, with notable transactions such as Nusasiri pcl’s acquisition of Wind Energy Holding Co. Moving forward, companies involved in battery storage systems are expected to grow in response to the increasing demand for electric vehicles.

Financial services

The Southeast Asian financial institution sector recorded a total deal value of over US$17.0bn in 2023. With the region’s highest GDP per capita, Singapore saw the most number of deals in the sector with 28, followed by Indonesia and Vietnam. Notably, one of the sector’s largest deals was the acquisition of Singapore Life Holdings by Sumitomo Life Insurance Co Ltd for US$1.2bn. The transaction was set in motion as Sumitomo’s life insurance business looks to expand their foothold in Singapore.

Source: Mergermarket, Reuters, Businesswire, The Business Times, Sumitomo

The Philippines

M&A in the Philippines

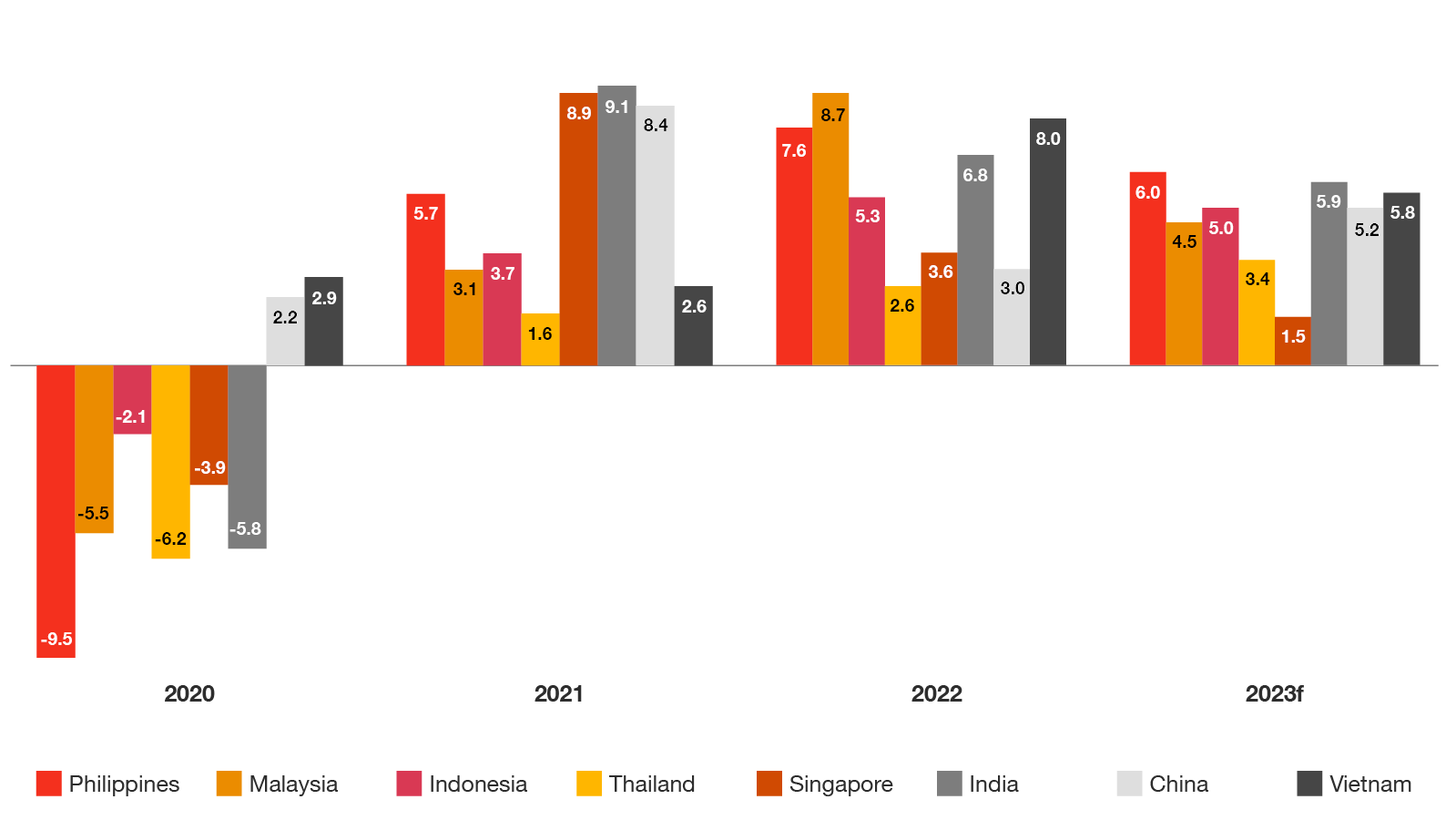

The Philippines has emerged as one of the most dynamic and rapidly growing markets in Southeast Asia. In the third quarter of 2023, the country achieved an impressive GDP growth rate of 5.9%, showcasing its robust economic performance. With the government projecting a full-year growth rate of 5.6%, driven by strong consumer spending and increased foreign direct investments, the future looks promising for the Philippines.

Despite the challenges posed by the global capital markets, foreign investors are recognizing the vast opportunities that lie within the telecommunications, energy and healthcare sectors of the country. The Philippines has established and implemented progressive laws, including the Public-Private Partnership Act, the Foreign Investments Act and the Retail Trade Liberalization Act, which have not only stimulated foreign investments but also attracted inbound investment, fueling the country’s economic growth.

Key highlights for 2023

Source: Mergermarket, IMF

Deal volume and values in the Philippines

(in US$bn)*

GDP growth rate in SEA countries (in %)

Philippine M&A

As a part of the Southeast Asian M&A landscape, the Philippines had 87 deals for 2023. Throughout the year, the country’s energy & natural resources sector witnessed the highest number of deals at 18. Majority of the deals in this sector were driven by the shift to more sustainable and renewable energy in the country, as seen in the growing investments in clean energy and the government’s initiative to achieve its green energy targets. Alongside the renewable energy sector, the country’s standout industries include consumer & retail, financial services, industrials and technology sectors. M&A transactions under these sectors were primarily propelled by the country’s improving economic growth, expansion plans of companies, and government initiatives such as the Retail Trade Liberalization Act and Common Tower Policy.

Top sectors

Based on deal count

Energy & natural resources

Financial services

Technology

Consumer & retail

Industrials

Source: Mergermarket

Notable deals

Announcement date |

Target |

Bidder |

Deal size (in US$m) | Sector

|

| 5 January 2023 | Bank of the Philippine Islands | Robinsons Retail Holdings, Inc. | 353.1 | Financial Services |

| 17 January 2023 | Don Papa Rum | Diageo plc | 473.2 | Consumer & Retail |

| 16 March 2023 | PLDT Inc. (1,012 telcom towers in Luzon) | Frontier Tower Associates Philippines; Pinnacle Towers Pte Ltd |

220.7 | Telecommunication |

| 27 March 2023 | The Podium West Tower and The Podium Mall | BDO Unibank Inc | 147.4 | Real Estate |

| 26 April 2023 | Mico Equities (100% Stake) | House of Investments, Inc. | 162.5 | Financial Services |

| 27 April 2023 | Metro Pacific Investments Corp. | First Pacific Co Ltd; Mitsui & Co., Ltd.; GT Capital Holdings, Inc.; Metro Pacific Holdings Inc; Japan Overseas Infrastructure Investment Corporation for Transport & Urban Development ; Mit Pacific Infrastructure Holdings Corp; MIG Infrastructure Holdings Inc | 874.2 | Financial Services |

| 2 June 2023 | Top Frontier Investment Holdings, Inc. | Far East Holdings Inc | 194.2 | Consumer & Retail |

| 5 June 2023 | AREIT, Inc. | Ayala Land, Inc.; Northbeacon Commercial Corp; Ayalaland Malls Inc | 399.2 | Real Estate |

| 2 August 2023 | Coca-Cola Beverages Philippines Inc | Aboitiz Equity Ventures, Inc.; Coca-Cola Europacific Partners plc | 1,800.0 | Consumer & Retail |

| 12 October 2023 | Solar Philippines | Manila Electric Company; MGen Renewable Energy | 279.6 | Energy and Natural Resources |

Looking ahead: The path for the Philippines

Industries to watch

- Telecommunications

- Renewable energy

- Construction

- Logistics

- Financial services

Telecommunications

The telecommunications sector revenues are expected to grow from US$5.6bn in 2024 to US$6.6bn by 2029, driven by the strong initiatives of the Department of Information and Communications Technology (DICT) and National Telecommunications Commission (NTC). In an effort to enhance the digital infrastructure of the Philippines, the DICT allocated US$960m in 2022 to be spent over the next three years on the National Fibre Backbone and the Accelerated Fibre Build. Additionally, the amendments to the Public Service Act (PSA), which allows 100% foreign ownership of telecommunications companies, will introduce new opportunities and competition for both existing and new players in the industry.

Renewable energy

Similar to its Southeast Asian counterparts, the Philippines’ renewable energy sector will continue to be a key driver in the M&A space in the coming years. In 2023 alone, the country had 18 deals in this sector, totaling a disclosed deal value of US$678m. Additionally, businesses have been given an incentive to utilize and produce their own renewable energy through Memorandum Circular (MC) 2023-006. Signed in October 2023, the MC states that companies with self-financed energy efficiency projects are entitled to the income tax holiday incentive and duty exemption on importation of capital equipment, raw materials and spare parts or accessories. With a favorable regulatory environment and M&A activities led by major domestic companies, the country's renewable energy capacity is projected to increase from 8.0 gigawatts in 2023 to 27.2 gigawatts by 2029.

Construction

The Philippine construction industry is estimated to grow by 8.4% and reach a market size of US$64.4bn in 2023. This growth is mainly driven by new infrastructure projects.

Over the next three years, the construction industry is expected to continue growing at an annual rate of 8.6% until 2027. The government aims to make significant investments, equivalent to 5–6% of the GDP, in infrastructure development over the medium term.

Logistics

The Philippine logistics industry is projected to experience significant growth, with an expected increase of 3.3% in road freight volumes and 11.1% air freight volumes in 2024. In the coming years, road freight volumes will be driven by the completion of new infrastructure projects such as the Davao City Bypass tunnel and the Bataan-Cavite Interlink Bridge.

Likewise, air freight volumes are expected to reach 380.2 thousand tons in 2024, supported by projects such as the rehabilitation of Ninoy Aquino International Airport and the construction of a new Bulacan airport. Overall, through improved infrastructure, the Philippine logistics sector is forecasted to achieve revenues of PHP1.2 trillion by 2027.

Financial services

Despite industry challenges such as high interest and inflation rates that may inhibit the viability of financing solutions, the prospect for growth and modernization in the financial services sector remains high. Deal performance in this sector stood at an impressive total value of US$1.5bn in 2023, which amounts to around 24% of the country’s total deal value.

With banking assets estimated to increase by 14% in 2023, the growing adoption of online banking continues to be a pertinent factor in driving modernization in the industry. It is expected that online banking will reach a penetration rate of 24% of the country’s population by 2024. Digital payments are also expected to increase over the coming years, with a total revenue of US$40.2bn by the end of 2024.

Source: Fitch Solutions, Mordor Intelligence, Mergermarket, Philippine News Agency, Globaldata, Business World, Philstar, Rappler, Statista.

Outlook beyond 2023

Key takeaways

The year 2023 marked a promising period for M&A in the Philippines, driven by progressive investment policies and strong performances in key industries. Looking ahead, new infrastructure projects, advancements in telecommunications, and a shift towards environmentally friendly energy sources will pave the country's path to greater growth. These factors, combined with investor-friendly policies like the Public Service Act and amendments to the Foreign Investment Act, will position the Philippines as a hotspot for thriving M&A activity, presenting exciting opportunities for strategic partnerships and success.

Subscription

Join our mailing list

Contact us

Vice Chairman and Tax Managing Partner, PwC Philippines

Tel: +63 (2) 8845 2728

Mary Jade T. Roxas-Divinagracia, CFA, CVA

Deals and Corporate Finance Managing Partner, PwC Philippines

Tel: +63 (2) 8845 2728

Karen Patricia Rogacion

Deals and Corporate Finance Partner, PwC Philippines

Tel: +63 (2) 8845 2728

Lance Kenneth Lawrence Tiu

Deals and Corporate Finance Senior Associate, PwC Philippines

Tel: +63 (2) 8845 2728

Joaquin Antonio Augusto Ermitano

Deals and Corporate Finance Senior Associate, PwC Philippines

Tel: +63 (2) 8845 2728

Martin Fidel Orendain

Deals and Corporate Finance Associate, PwC Philippines

Tel: +63 (2) 8845 2728

Ianne Gwen Toledo

Deals and Corporate Finance Associate, PwC Philippines

Tel: +63 (2) 8845 2728