2024 M&A overview

In 2024, the mergers and acquisitions (M&A) landscape was marked by a cautious yet hopeful recovery, with global deal value rising by about 8.3% compared to the previous year. Despite political complexities and macroeconomic challenges such as inflation and fluctuating interest rates, the market saw several significant transactions. Key deals included Synopsys' US$33.6 billion acquisition of Ansys and Mars Inc.'s US$36.1 billion purchase of Kellanova. Private equity activity also gained momentum, bolstered by ample available capital and falling interest rates. The technology and energy sectors performed well, spurred by innovations in Artificial Intelligence (AI) and strategic mergers.

North America and Europe led M&A activity, with North America experiencing a 16.5% increase in deal value, primarily involving US companies, and Europe reporting a 7.4% increase in deal value driven by major deals in the UK, Germany and France.

In the Asia Pacific (APAC) region, several key sectors showed strong growth potential, particularly industrials, technology and consumer & retail. The region accounted for a substantial 27.1% of the global deal count in 2024, emphasizing its critical role in the global economy and its appeal to investors worldwide.

As regulatory and political landscapes shift and economic conditions stabilize, the APAC M&A market is set for a resilient and adaptive future, with sectors like industrials and technology leading the way. The re-election of Donald Trump in the United States has introduced new dynamics to the M&A scene, with his administration's trade and regulatory policies potentially reshaping cross-border deals and influencing corporate strategies. These changes underscore the region's ability to drive global M&A activity, even amidst economic uncertainties.

Source: Mergermarket, S&P Capital IQ

M&A highlights in 2024

Asia Pacific deal activity

In 2024, the Asia Pacific region showcased a dynamic M&A landscape, setting a promising foundation for 2025. While overall deal values fell by 6.9% compared to 2023 due to a slow start, the latter part of the year saw a surge in activity, with several countries experiencing notable growth. China took the lead with a deal value amounting to US$278.1 billion. Japan, India and Australia also made significant strides, driven by anticipated economic improvements and favorable interest rates. These positive trends position the Asia Pacific region for a robust recovery and vibrant M&A activity in the upcoming year.

Strong sector performance

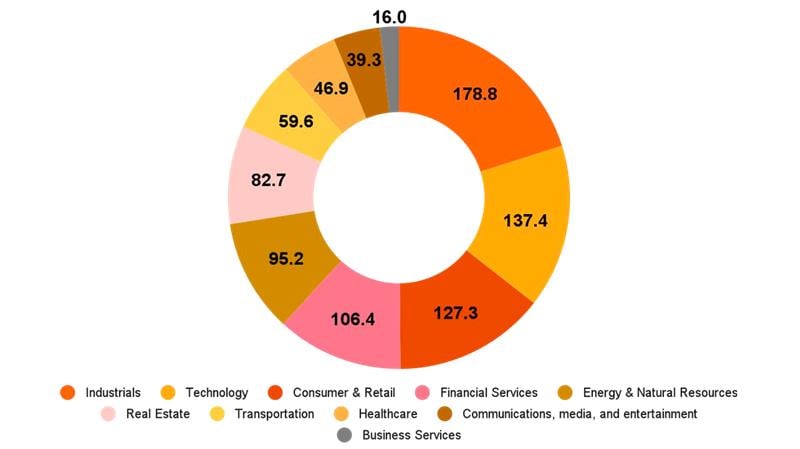

In 2024, the Asia Pacific region had over 11,000 deals, with a total disclosed value of US$889.4 billion. The consumer and retail sector achieved a total deal value of US$127.3 billion. This sector and region included the world's largest transaction: the acquisition of Seven & i Holdings Co., Ltd. by Alimentation Couche-Tard Inc. for US$58.4 billion. The proposed transaction is distinguished as the largest foreign acquisition of a Japanese company to date.

Source: Mergermarket, Philstar, S&P Capital IQ, Asia Business Law Journal

Deal volume and value globally and in Asia Pacific

(Deal value in US$ billions)

2024 Asia Pacific deal value per industry

(in percentage)

Southeast Asia

Southeast Asia strengthened its global M&A presence in 2024, maintaining robust deal activity across various sectors. Singapore led in both deal value and volume, with Indonesia and Malaysia also experiencing significant activity.

In Vietnam, reforms like the amended Vietnam Investment Law were introduced to streamline administrative procedures, reduce restrictions and expand foreign ownership limits in critical sectors. Concurrently, the Philippines pursued regulatory updates to enhance transparency and streamline foreign investment processes, particularly in energy and infrastructure projects.

Technology and renewable energy remained key drivers of M&A activity, fueled by digital transformation and the region's commitment to decarbonization.

Key highlights for 2024 |

||

US$84.5 billionDeal value |

849Deal volume |

Media & EnergyStrong sector performances |

2024 Deal value in Southeast Asia

(in US$bn)

2024 Deal volume in Southeast Asia

*Others include Laos, Cambodia, Myanmar and Brunei Darussalam

Notable deals in Southeast Asia

| Announcement date | Target company | Bidder company | Target country | Deal size (US$ billions) |

Sector |

04 March 2024 |

Power Station (1,278 MW Ilijan power plant) |

Meralco PowerGen Corp, Aboitiz Power Corp |

Philippines |

2.2 |

Energy & natural resources |

15 May 2024 |

Malaysia Airports Holdings Bhd |

Global Infrastructure Management LLP |

Malaysia |

2.8 |

Transportation |

18 June 2024 |

STT GDC Pte Ltd |

KKR & Co Inc |

Singapore |

1.3 |

Technology |

16 July 2024 |

Intouch Holdings pcl |

Gulf Energy Development pcl |

Thailand |

3.3 |

Communications, media & entertainment |

16 July 2024 |

Advanced Info Service pcl |

Gulf Energy Development pcl and others |

Thailand |

6.3 |

Communications, media & entertainment |

18 July 2024 |

Fraser & Neave Ltd |

Thai Beverage pcl |

Singapore |

2.1 |

Consumer & retail |

29 July 2024 |

TS Global Holdings Pte Ltd |

Tata Steel Ltd |

Singapore |

2.1 |

Industrials |

16 August 2024 |

PropertyGuru Group Ltd |

EQT Partners Hong Kong Ltd |

Singapore |

1.2 |

Technology |

16 August 2024 |

Siam City Cement pcl |

Ratanarak Group |

Thailand |

1.2 |

Industrials |

27 August 2024 |

Property Portfolio |

Warburg Pincus LLC, Lend Lease Group |

Singapore |

1.2 |

Real estate |

18 September 2024 |

Power Station (7 Geothermal Working Area) |

PT Medco Energi Internasional Tbk and others |

Indonesia |

1.8 |

Energy & natural resources |

28 October 2024 |

PT Medan Binjai Toll |

PT Rafflesia Investasi Indonesia |

Indonesia |

1.4 |

Transportation |

26 November 2024 |

PT Yupi Indo Jelly Gum |

Affinity Equity Partners (HK) Ltd |

Indonesia |

1.2 |

Consumer & retail |

29 October 2024 |

DigitalLand Holdings Ltd |

Coatue Management LLC and others |

Singapore |

1.2 |

Technology |

05 December 2024 |

Suntec Real Estate Investment Trust |

Aelios Pte Ltd |

Singapore |

4.8 |

Real estate |

09 December 2024 |

Mets Logistics, Inc. |

Growtheum Capital Partners |

Philippines |

0.1 |

Logistics - Cold storage |

Source: Mergermarket

Hot sectors in Southeast Asia

- Technology

- Industrials

- Consumer and retail

- Financial services

- Energy and natural resources

Technology

Southeast Asia's technology sector continued to lead the region in M&A activity, achieving a deal value of US$11.1 billion across 184 transactions, with significant focus on AI data center infrastructure. Among the notable deals was KKR and Singtel’s investment in ST Telemedia Global Data Centres which is valued at approximately US$1.3 billion, emphasizing the region's expanding telecom and data center infrastructure.

While Singapore, traditionally a leader in tech M&A, is experiencing a slight shift in volumes, it remains a key hub for digital and tech deals. Deal activity in these sectors is expected to rise with ongoing AI innovations continuing to grow.

Source: Deal Street Asia, APAC, Mergermarket, Business Times

The Philippines

Philippine M&A

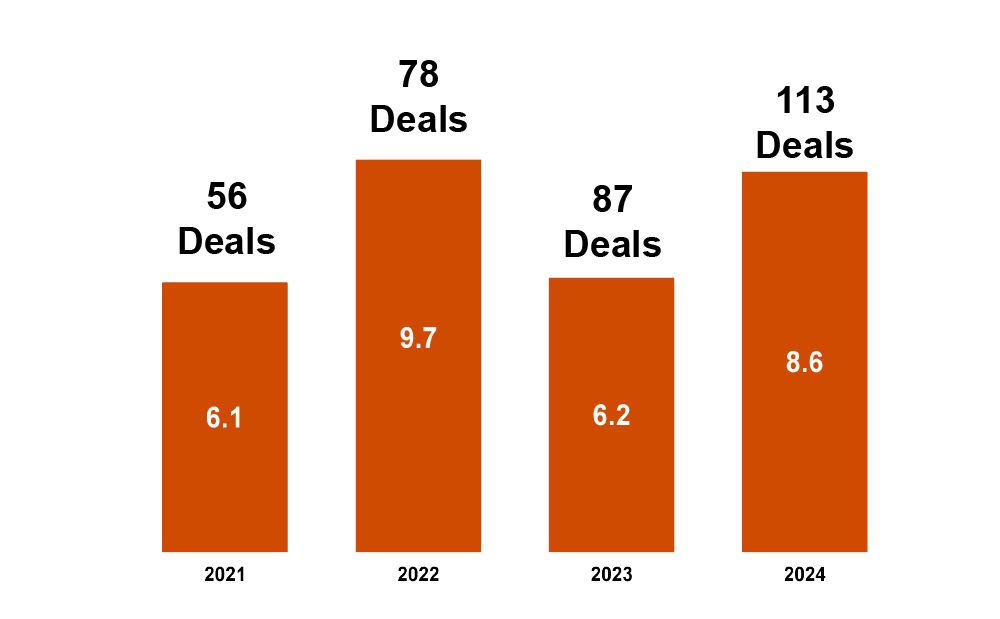

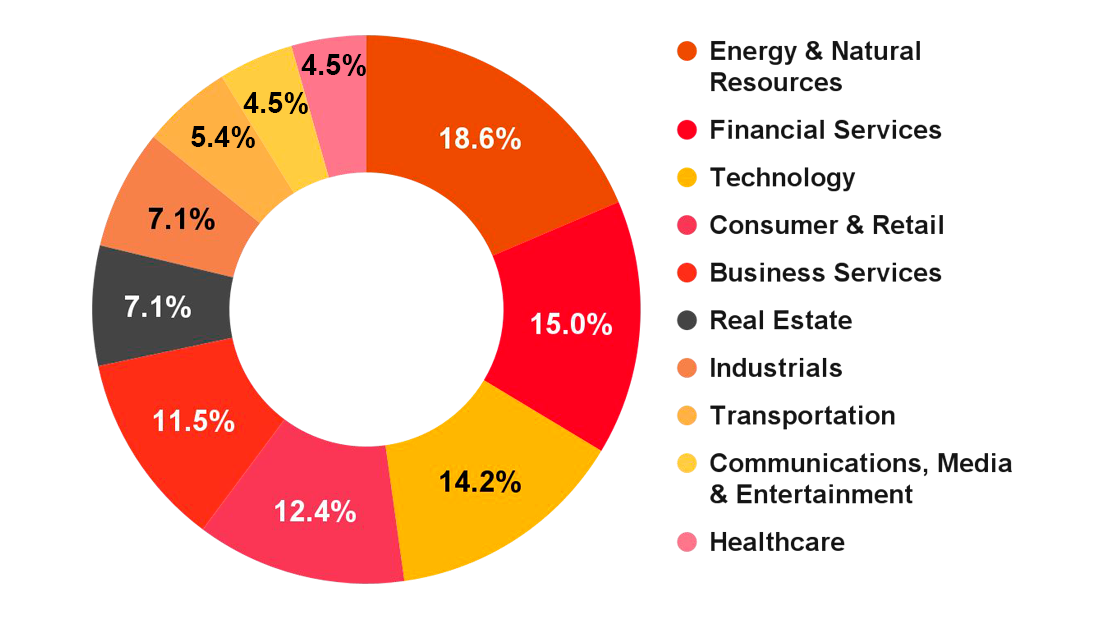

In 2024, the Philippine M&A landscape demonstrated strong performance, achieving a total deal value of US$8.6 billion across 113 transactions. The energy and natural resources sector led in dealmaking activity with 21 transactions, driven by renewable energy investments such as Terra Solar Philippines’ solar power expansion and Meralco PowerGen’s renewable energy infrastructure projects, underscoring the push for green energy. Other leading sectors included technology, financial services, real estate and consumer and retail.

The Build, Better, More Infrastructure Program (BBM), launched as the successor to the Build, Build, Build initiative, has been pivotal in accelerating infrastructure projects nationwide. This program, which includes 198 flagship projects estimated at PHP8.8 trillion, focuses on prioritizing investments in transport systems, urban development and resilient infrastructure. By supporting a pipeline of large-scale projects, the program continues to attract both foreign and local investors. A notable transaction is DMCI Holdings’ US$740 million acquisition of CEMEX Holdings Philippines, which aligns with efforts to enhance construction capacity and advance infrastructure development goals.

The financial services sector is expanding, driven by digital transformation and financial inclusion efforts. Digital payment systems, fintech integration and consumer banking innovations are transforming the industry, with the Digital Payments Transformation Roadmap of the Bangko Sentral ng Pilipinas (BSP) driving faster adoption. Additionally, the growing demand for e-commerce, retail banking and investment solutions highlights the sector’s role in enabling inclusive economic growth.

Top sectors

Based on deal count

Energy & natural resources

Financial services

Technology

Consumer & retail

Real estate

Source: Mergermarket, CPBRD

M&A in the Philippines

Regulatory reforms, such as the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act, have introduced tax incentives and encouraged foreign investment in the energy and telecommunications sectors. Additionally, the CREATE MORE Act, enacted on 11 November, aims to streamline processes; support micro, small and medium enterprises (MSMEs); and foster innovation among small businesses. These reforms are designed to enhance competitiveness and promote participation across key industries.

The National Fiber Backbone Project, led by the Department of Information and Communications Technology (DICT), has been crucial in enhancing nationwide connectivity. This initiative accelerates the deployment of high-speed internet infrastructure, facilitating digital transformation in telecommunications, e-commerce and financial technology. It has also attracted significant investments in sectors that depend on robust digital networks, such as IT services and fintech.

Key highlights for 2024 |

|

36.9% increaseTotal deal value from 2023 |

29.9% increaseDeal volume compared to 2023 |

Source: Mergermarket, BusinessMirror, BusinessWorld

Deal volume and values in the Philippines

(US$, in billions)

Values for the healthcare and communications, media & entertainment sectors are undisclosed

2024 Deal volume by sector in the Philippines

Notable deals in the Philippines

Announcement date |

Target company |

Bidder Company |

Deal size (in US$millions) | Sector

|

12 February 2024 |

Property Portfolio |

AREIT Inc. |

510.7 |

Real estate |

04 March 2024 |

Multiple Power Plants |

Meralco PowerGen Corp, Aboitiz Power Corp. |

2,200.0 |

Energy & natural resources |

25 April 2024 |

CEMEX Holdings Philippines Inc. |

DMCI Holdings Inc. |

740.1 |

Industrials |

13 May 2024 |

Property Portfolio |

MREIT Inc. |

227.6 |

Real estate |

18 May 2024 |

Roxas Holdings Inc. |

Leandro Leviste (Private Individual |

160.3 |

Consumer & retail |

02 August 2024 |

Globe Fintech Innovations Inc. |

Ayala Corporation |

394.7 |

Financial services |

02 August 2024 |

Globe Fintech Innovations Inc. |

Mitsubishi UFJ Financial Group Inc. |

393.0 |

Financial services |

06 September 2024 |

Terra Solar Philippines |

Actis LLP |

600.0 |

Energy & natural resources |

23 October 2024 |

I Squared Capital Advisors (US) LLC |

Philippine Coastal Storage & Pipeline Corp |

346.0 |

Energy & Natural Resources |

04 November 2024 |

DITO CME Holdings Corp |

Summit Telco Corp Pte Ltd | 272.8 |

Technology |

09 December 2024 |

Mets Logistics, Inc. |

Growtheum Capital Partners |

121.0 |

Logistics - Cold storage |

Looking ahead: The path for the Philippines

Industries to watch

- Energy and natural resources

- Real estate

- Technology

- Financial services

- Industrials

- Consumer and retail

Energy and natural resources

The Philippines' energy and natural resources sector exhibited strong M&A performance, achieving a total deal value of US$3.7 billion across 21 significant transactions in 2024. This growth was largely driven by investments in solar and wind projects. A notable transaction was Aboitiz Power Corp.’s US$2.2 billion acquisition of multiple power stations, aligning with its strategy to expand generation capacity and meet increasing energy demand while also focusing on sustainable energy and enhancing power supply reliability.

Renewable energy initiatives bolstered the sector's growth, particularly through the Department of Energy's (DOE) Green Energy Auction Program (GEAP), which streamlined bidding for clean energy capacities. The Philippine Energy Plan (PEP) further enhanced M&A attractiveness through its focus on energy security and infrastructure modernization.

Source: Mergermarket, Department of Energy, Philippine Energy Plan, Fitch Solutions, Philippine Statistics Authority, DICT, Philippine News Agency, Bangko Sentral ng Pilipinas, BusinessWorld, Reuters, Philippines Department of Trade and Industry

Outlook beyond 2024

Key takeaways

Looking ahead, new infrastructure projects, advancements in telecommunications and a shift towards environmentally-friendly energy sources are set to drive the country's growth. These developments, coupled with investor-friendly policies like the CREATE MORE Act and regulatory reforms that encourage foreign participation in sectors such as energy and telecommunications, position the Philippines as a hotspot for thriving M&A activity. This environment offers exciting opportunities for strategic partnerships and success, particularly in sectors like renewable energy, real estate, technology and financial services.

The year 2024 was a promising period for M&A in the Philippines, fueled by progressive investment policies and strong performances in key industries. The technology sector saw significant M&A activity, driven by digital transformation in cloud computing and IT services. Additionally, the country continues to show potential in integrating AI across various industries, with organizations expressing interest in these technologies despite existing digital skills gaps.

Subscription

Join our mailing list

Contact us

Karen Patricia Rogacion

Deals and Corporate Finance Partner, PwC Philippines

Tel: +63 (2) 8845 2728

Joaquin Antonio Augusto Ermitano

Deals and Corporate Finance Senior Associate, PwC Philippines

Tel: +63 (2) 8845 2728

Lance Iverson Ching

Deals and Corporate Finance Associate, PwC Philippines

Tel: +63 (2) 8845 2728

Ma. Lucia Gabrielle Ramos

Deals and Corporate Finance Associate, PwC Philippines

Tel: +63 (2) 8845 2728