Year-end M&A report

This year, economies continued to recover from the pandemic as countries started to fully open schools, businesses and institutions with little to no restrictions. However, the global economy faced new headwinds that disrupted the M&A space across all regions. Dealmakers faced several challenges as the cost of doing business was affected by geopolitical pressures and global supply chain issues that resulted from the Russia-Ukraine War. High inflation and interest rates also created financial concerns for dealmakers as companies reported lower profit margins due to high costs. These factors heightened the persisting uncertainties from the pandemic in global markets. The new conditions drove the business leaders to adapt and develop new strategies to win in the market.

Although deals slowed down in major markets like North America, Europe and China, multinational companies sought new market opportunities and refocused their investments in the emerging regions, such as the developing countries in Asia-Pacific (APAC). One such deal is the acquisition of Hong Kong-based Baring Private Equity Asia Group Ltd by Sweden’s EQT Holdings BV. As part of EQT’s current strategic priority to expand in the region, the US$7.4bn transaction is one of the largest M&A deals in APAC for 2022.

The Asia-Pacific region

Despite bearish conditions in the Western M&A market, APAC’s share in deal value grew from 22.7% in 2021 to 25% or US$849.6bn as of December 2022. Technology-related deals contributed 21% of the total cross-sector M&A activities in APAC as companies are now pressured to transform their business and quickly adapt to changing consumer preferences, digital disruptions and ESG issues. APAC companies have since switched their focus to domestic M&A deals to avoid regulatory delays from outbound activities.

Share of domestic deals in APAC region

(in deal value)

In the APAC region, investor confidence grew with the gradual lifting of COVID-19 restrictions. Global financial institutions have since shifted interests to Southeast Asia as multinational corporations have started divesting from China. Such decisions are part of their strategy to address regulatory uncertainties in the country, which include the Zero COVID policy that halted Chinese businesses and foreign investments.

Southeast Asia

Major deals in Southeast Asia in 2022

| Bidder/Joint Venture Partner |

Target | Announcement date | Deal size (in US$ millions) |

Sector |

|---|---|---|---|---|

| United Overseas Bank Limited | Citi (Consumer business in Indonesia, Malaysia, Thailand, Vietnam) | January 2022

|

3,652 | Financial Services |

| Blackstone Group Inc. | Interplex Holdings Pte. Ltd. | January 2022 | 1,600 | Industrials & chemicals |

| HLN Technologies Limited | BINEX Singapore Pte. Ltd. | January 2022 | 1,477 | Agriculture |

| Sembcorp Marine Limited | Keppel Offshore & Marine Limited | April 2022 | 3,806 | Industrials & chemicals |

| Big Data Exchange | Indosat Tbk, PT | May 2022 | 6,579 | Telecoms, media & technology |

| Seroja Investments Limited | Open-pit nickel mines in the North Konawe region of Sulawesi, Indonesia | May 2022 | 1,979 | Energy, mining & utilities |

| Energem Corp | Graphjet Technology Sdn Bhd | August 2022 | 1,497 | Industrials & chemicals |

| San Miguel Equity Investments, Inc. | Eagle Cement Corporation | October 2022 | 1,874 | Industrials & chemicals |

| Treasure Global Investments Ltd., Mach Energy Hongkong Ltd. | Bumi Resources Tbk, PT | October 2022 | 2,646 | Energy, mining & utilities |

| PTC, Inc. | ServiceMax, Inc. | November 2022 | 1,460 | Telecoms, media & technology |

Source: Mergermarket

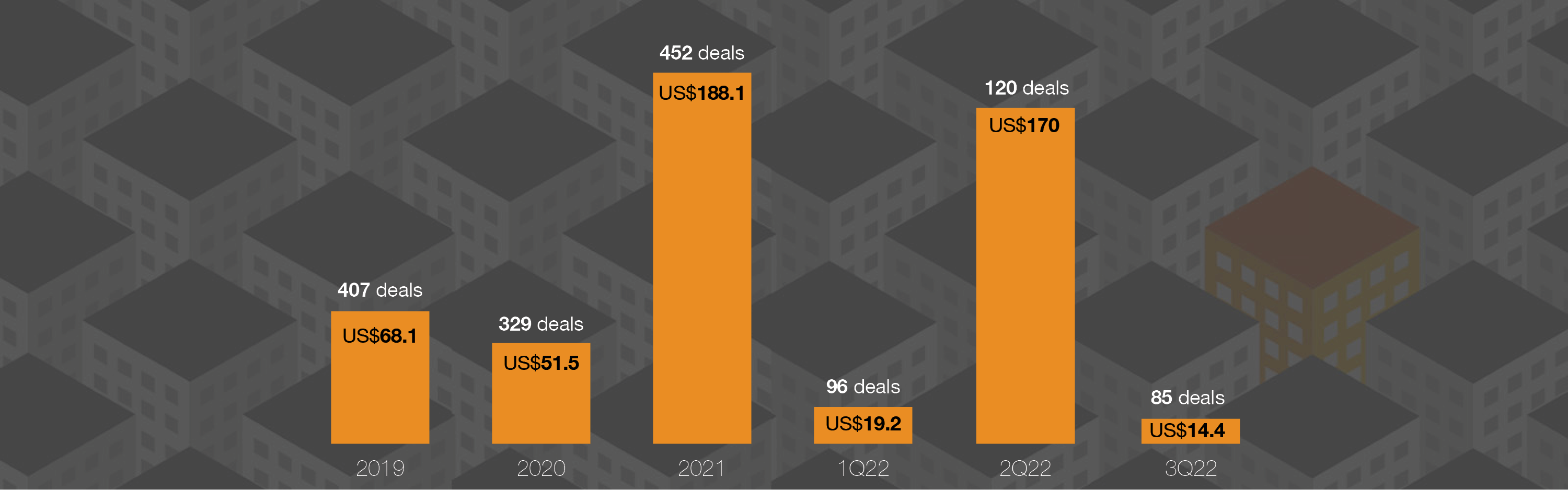

Many investors have taken an interest in Southeast Asian markets as companies move from China and other APAC countries to reduce labor and manufacturing costs. In the first quarter of 2022, total deal value in Southeast Asia was US$19.2bn across 96 deals, recording a 20% growth from last year. By the end of the third quarter, total deal value amounted to about US$200bn from nearly 300 deals.

Total deal value and volume in Southeast Asia

(US$ in billions)

Source: Mergermarket

*based on quarterly and annual reports

*2Q22 is based on an estimate from Mergermarket

Top sectors in Southeast Asia

The telecommunications, media and technology sectors were the most active based on M&A volume, driven by the high business-to-business demand for data and software services. Dealmakers in the region continue to seek more efficient and digitized solutions to better utilize data assets and infrastructure, such as telco towers, for commercial gains. Other active sectors include energy, mining & utilities, industrials & chemicals, and financial services, with the focus on the emergence of renewable energy and industrial metals.

Countries with the highest number of M&A deals in the region were Singapore, Malaysia and Indonesia. The first two have been at the forefront of the region’s M&A space over the years, as two of the most active bidders in other Southeast Asian countries.

Across the region’s major deals in 2022, dealmakers primarily engage in M&A activities to:

- Refocus on existing businesses

- Expand to attractive and emerging markets

- Adapt to the changing business environment

Refocus on existing businesses

Recent changes from the pandemic, high global inflation and the increasing cost of doing business have pushed the leaders to rethink their strategies moving forward. To earn higher margins, several multinational companies have divested foreign subsidiaries and redirected their capital to their core businesses. One such deal was the 100% sale of Citigroup's consumer business in Indonesia, Malaysia, Thailand and Vietnam to United Overseas Bank Limited, a leading bank in Singapore. The US$3.7bn deal is a part of Citigroup’s strategic refresh to exit consumer banking across 14 markets in Asia, Europe, the Middle East, and Mexico. The exit also includes the company’s Philippine consumer banking arm and Citicorp Financial Services & Insurance Brokerage Philippines, Inc, which were acquired by Union Bank of the Philippines for PHP72bn as announced in 2021. The purchase price includes the net asset value of the business at PHP26.7bn, plus a premium of PHP45.3bn. Citigroup’s consumer banking business in Taiwan, on the other hand, will be acquired by Singapore-based investment company DBS Group Holdings Limited for US$3.4bn.

While several businesses redirected their focus, other companies made acquisitions to complement their current business portfolio. The investment arm of Philippine conglomerate San Miguel Corporation, San Miguel Equity Investments, Inc., announced in October 2022 the acquisition of Eagle Cement Corporation, which will expand its current cement business. With a deal size of US$1.9bn, the transaction is the highest-valued deal in the Philippines for 2022.

Expand to attractive and emerging markets

New markets, such as innovative retail, food delivery and logistics services, were formed as consumer and business behaviors rapidly changed over the past years. Companies have since sought opportunities to enter such markets or establish their presence in emerging industries, such as e-commerce, robotics, biotechnology and other tech-related industries. Notably, the US$6.6bn acquisition of Indosat Tbk, PT by Big Data Exchange (BDx) will allow BDx to enter the Indonesian market. Through a joint venture, the company will tap Indonesia’s growing need for a higher level of global data center facilities, serving multiple industries which include financial services, telecommunications, and government organizations.

Another noteworthy deal is the US$1.6bn investment of Blackstone Group Inc. in Interplex Holdings Pte. Ltd. to enter the target’s key markets in 13 countries, such as electric vehicles (EVs) and future mobility, healthcare, and digital infrastructure.

Adapt to the changing business environment

Other business leaders in the region have made substantial changes in their companies due to the unpredictability of the global environment. One such deal is the merger between Sembcorp Marine Limited and Keppel Offshore & Marine Limited (Keppel O&M), which has a deal value of US$2.0bn. To better face the volatile macroeconomic conditions, the potential synergies with Keppel O&M will help Sembcorp Marine, as the surviving entity, handle market uncertainties and compete against global players. Sembcorp Marine will benefit from its expanded business segments of renewables, new energy, and cleaner O&M solutions.

The Philippines

The Philippines remains one of the more robust countries for dealmakers. The country ranked 83rd in the 2022 Global Opportunity Index — a report that measures the country’s investment landscape. Investors seem to be drawn to the Philippines’ resilient service-centered economy and strong domestic demand.

Total deal value and volume in the Philippines

(US$ in billions)

Source: Mergermarket

*YTD 2022 comprises announced M&A deals from Mergermarket with the Philippines as the target’s deal dominant geography

*YTD 2022 = as of December 15, 2022

Major deals in the Philippines in 2022

| Bidder/Joint Venture Partner |

Target | Announcement date | Deal size (in US$ millions) |

Sector |

|---|---|---|---|---|

| Sumitomo Mitsui Financial Group, Inc., Sumitomo Mitsui Banking Corporation | Rizal Commercial Banking Corporation | January 2022 | 465 | Financial Services |

| San Miguel Corporation | Eagle Cement Corporation | April 2022 | 1,874 | Industrials & chemicals |

| Axiata Group Berhad, edotco Group Sdn Bhd | Smart Communications Inc. (Smart and Digitel of 2,973 towers) | April 2022 | 800 | Telecoms, media & technology |

| SM Investments Corporation | AllFirst Equity Holdings | April 2022 | 306 | Energy, mining & utilities |

| DigitalBridge Group, Inc., EdgePoint Infrastructure | Smart Communications Inc. (Smart and Digitel of 2,934 towers) | April 2022 | 667 | Telecoms, media & technology |

| PhilTower Consortium Inc. | Globe Telecom Inc. (1,350 telecommunication towers) | September 2022 | 341 | Telecoms, media & technology |

| AIA Group Limited | MediCard Philippines Inc. | September 2022 | 350 | Pharma, medical & biotech |

| Frontier Tower Associates Philippines; Pinnacle Towers Pte Ltd | Globe Telecom Inc (3,529 towers) | November 2022 | 812 | Telecoms, media & technology |

| MIESCOR Infrastructure Development Corp | Globe Telecom (cellular tower assets) | November 2022 | 473 | Telecoms, media & technology |

| MUFG Bank, Ltd., Mitsubishi UFJ Financial Group, Inc., Bank of Ayudhya Public Company Limited | HC Consumer Finance Philippines | November 2022 | 423 | Financial services |

Source: Mergermarket

As the interest of Asian dealmakers towards other Asian countries increased in 2022, most inbound M&A deals in the Philippines came from China, Japan and other Southeast Asian countries. About 33 of such deals were announced as of December 2022, with local and foreign investors primarily taking notice of the economic recovery of the service sector in the country.

The reduction of mobility restrictions helped increase investor confidence as work and recreation activities gradually returned to pre-pandemic levels.

Technology and telecommunications are also among the top sectors in the Philippine M&A space, driven by the recent reforms related to the open towers regulation and the accelerated digital transformation during the pandemic. Through the guidelines issued for telecommunications by the Department of Information and Communications Technology (DICT), the government has allowed all antennas, transmitters, receivers and other components of cell towers in the private sector to be open for shared ownership across all mobile network operators and related companies. These policies have allowed major telecom companies to commercialize their towers as a part of their strategy to their fund expansion plans.

Deals in the Philippine tech and telecom sectors include five of the largest M&A acquisitions of the year, involving telecom giants Smart Communications, Inc. (Smart) and Globe Telecom, Inc. (Globe). To reach its goal of having 1,500 new towers in the coming years, Smart agreed to sell and lease back its 5,907 towers for US$1.5 billion. The asset deals include transactions with Axiata Group Berhad and edotco Group Sdn Bhd for US$800 million, as well as with DigitalBridge Group, Inc. and EdgePoint Infrastructure for US$667 million.

Globe, on the other hand, will also sell and lease back its 7,059 towers for US$1.6bn to PhilTower Consortium Inc., Frontier Tower Associates Philippines, Pinnacle Towers Pte Ltd., and Miescor Infrastructure Development Corp. Proceeds from the separate transactions will help fund Globe’s network expansion program.

While most industries struggled due to supply chain disruptions, financial institutions were mostly immune as their business operations are less dependent on affected commodities, such as oil and minerals. Investor confidence in the sector has grown within the year as the government initiated reforms to help improve the regulatory framework of the banking, insurance and trust industries. A notable deal is the US$465mn investment of Sumitomo Mitsui Financial Group, Inc. and Sumitomo Mitsui Banking Corporation in Rizal Commercial Banking Corporation (RCBC). The transaction was a part of RCBC’s plan to expand in key customer segments and fund its investments in digital technology, cyber security and human resources.

The acquisition of the 100% stake in HC Consumer Finance Philippines by MUFG Bank, Ltd., Mitsubishi UFJ Financial Group, Inc., and Bank of Ayudhya Public Company Limited is also one of the major deals this year. With a deal value of US$423mn, the transaction will strengthen MUFG’s business in Southeast Asia through a collaborative approach with partner banks.

Other notable sectors in the country that are seeing sustained growth in M&A activities include power & energy, transportation, real estate development, and industrial manufacturing. The high number of activities in these sectors were driven by the shift from coal to renewable energy (RE), as well as the impact of rising oil prices and other related raw materials. With the country’s moratorium on coal plants declared in 2020, Philippine companies have since directed their investments in developing and innovating RE projects. Earlier this year, SM Investments Corporation (SMIC) entered the RE market through the 81% acquisition of Allfirst Equity Holdings Inc. for US$306mn. The deal is as part of the company’s commitment as a catalyst of development in Filipino communities.

2023 outlook and new policies in the Philippines

As the country’s regulations continue to adapt to further support M&A activities, public and private companies are capitalizing on this opportunity to expand and grow their businesses. Although the pandemic negatively impacted several companies, it also provided opportunities to build their capacity, restructure, and expand and grow their businesses. Private companies were forced to be open to investors to survive and finance their operations. Likewise, public companies either sold some of their assets or equity stakes to raise funds for their operations.

Dealmaking in the country will continue to be driven by both public and private companies. As the Philippine economy continues to open, post-pandemic acquisition opportunities are anticipated to take place for private companies. Public company takeovers will continue to be mostly negotiated and contractual for some acquisitions of stakes in listed companies.

The changing regulatory landscape may also present opportunities for companies and the country. As some amendments promote foreign investments in the country, these also allow full foreign ownership of certain companies in selected industries. Laws that will further drive foreign investments in the country include the Retail Trade Liberalization Law, Foreign Investment Act, and Public Service Act.

- Promotes the creation of foreign companies

- Increases foreign investment and the creation of public service companies

- Encourages Public-Private Partnerships (PPP)

- Creates balance in the M&A ecosystem

- Emphasis on ESG reporting and sustainable financing

Promotes the creation of foreign companies

The amendments in Republic Act (RA) 11595, also known as the Retail Trade Liberalization Law, reduce the minimum paid-up capital requirements for foreign retail enterprises from PHP30m to PHP25m. The law also removes the requirement for a certificate of pre-qualification to the Philippine Board of Investments and lowers the investment requirement. From having a minimum investment of US$830,000 per store, a registered retailer engaged through more than one physical store is now required to have approximately US$200,000.

Increases foreign investment and the creation of public service companies

RA 11659, also known as the Public Service Act, allows 100% foreign ownership of public services in the Philippines, provided also that it meets the criteria and definition of “critical infrastructure” as classified under the law. Such ownership can only be in selected industries such as telecommunications, railways, airports, expressways, and shipping industries as these will be considered public services. Companies controlled or acting on behalf of a foreign government or foreign state-owned enterprises may not directly or indirectly own and control more than 50% of the capital and voting rights of the public service company. With RA 11659, the definition of “public utility” has also been limited to distribution and transmission of electricity, petroleum and petroleum products pipeline transmission systems, water pipeline distribution systems and wastewater pipeline systems, seaports and public utility vehicles.

Encourages Public-Private Partnerships (PPP)

To help accelerate infrastructure development in the country, the Marcos administration is encouraging local government units (LGUs) and the private sector to pursue PPPs. As of August 2022, there were over 70 projects in the pipeline with an estimated project cost of over PHP2.3 trillion. To further encourage PPPs, the government recently amended the Build-Operate-Transfer law by including all three branches of the government in the definition of Material Adverse Government Action, allowing private companies to recover funds from the public sector partner. The revisions currently address the private sector’s concerns and further clarify some provisions in the previous law. The newly issued IRR will also create balance between private and public sector interest towards meeting the development goals of the Philippines. PPP projects in the pipeline include the privatization of the Ninoy International Airport; creation of Central Luzon Link Expressway (CLLEX) Phase 1, North Luzon Expressway East Phase II, and Metro Cebu Expressway; and the improvement and operation of Kennon Road.

Creates balance in the M&A ecosystem

After two years of having a temporary threshold of PHP50bn, the Philippine Competition Commission (PCC) set a new threshold for M&A transactions. M&A activities involving a party with a size of PHP6.1bn and a transaction size of PHP2.5bn will have to undergo further review. The new threshold might limit M&A deals in the country, but can level the playing field in the market.

Emphasis on ESG reporting and sustainable financing

To further support sustainability initiatives, the Securities and Exchange Commission (SEC) has started to give more emphasis on ESG products and encourage sustainable business practices. The government agency introduced new and innovative investment products such as social and sustainability bonds. The SEC also issued the Sustainability Reporting Guidelines for Publicly Listed Companies (PLC), as it intends to mandate PLCs to adopt sustainability reporting.

Hot sectors in the Philippines for 2023

The government and businesses are having a positive outlook for the upcoming year. With the current changes in regulations, deals with foreign investors are expected to increase. More businesses will be leaning towards sustainability practices as more consumers are now aware of the importance and benefits of being sustainable. As the situation in the Philippines slowly goes back to normal, businesses will continue to normalize their operations and pursue their expansion plans.

The year 2023 is expected to enjoy higher investor confidence in emerging industries, particularly in telecommunications, renewable energy, insurance, logistics and agriculture. With the expanding 5G connectivity, major companies will continue commercializing their assets to fund network expansion plans. The Philippines is estimated to require up to 4,000 new towers every year according to independent operator EdgePoint Infrastructure. Renewable energy firms, on the other hand, are expected to further increase their investments in alternative energy because of the country's moratorium on coal plants and the declining sources of coal.

Foreign investors have also eyed the insurance industry, with the recent discussions between the Philippine Insurers and Reinsurers Association (PIRA) and companies representing capital firms from Korea, Thailand and Japan. With the incoming increase in the minimum capital requirement changes from PHP900m to PHP1.3bn, PIRA has noted that M&A has become a major option for some insurers who will be unable to comply.

In the logistics sector, the market is expected to reach PHP1 trillion by 2024 driven by the government’s plans to expand the logistics capacity in the country. Such plans include the National Logistics Strategy, which has mapped out 455 priority infrastructure projects in the private sector for the industry. Dealmakers will also seek investments in agriculture following the emergence of agribusinesses and agricultural innovations, such as data-driven farming and automation.

Amid the rising inflation rate, food security issues and continuing geopolitical concerns, the Philippines is expected to grow gradually next year. The country’s growth will be driven by the amendments made by the government to further attract investments, initiatives from the government and national agencies to support the public and private sectors, and improvement of the business framework to align with international standards.

The recent disruptions have taught us to be adaptable and resilient. They have also shown us the growing importance of dealmaking in order to survive and thrive during challenging periods. To remain relevant and stay ahead of the competition, businesses need to consider how they can reinvent their operations, products and services. M&A activities will be a crucial factor in this transformation as they enable business to innovate and achieve exponential growth.

References:

Asia Pacific M&A Highlights (2022). Retrieved from www.futurecfo.net

BakerMcKenzie Insightplus. (October 2022). Philippines: Amendments to implementing rules and regulations of the Build-Operate-Transfer Law.

BakerMcKenzie Insightplus. (January 2022). Philippines: Amendments to the Retail Trade Liberalization Act passed into law.

BakerMcKenzie Insightplus. (March 2022). Philippines: President approves law removing foreign equity restrictions on public service companies.

Bloomberg. (September 2021). Philippines Logistics Market is expected to cross Php 1 Tn by 2024: Ken Research.

Business Times. (May 2022). Seroja Investments eyes RTO with acquisition of Denway Development for up to US$2 billion

Business World Online. (April 2022). Two firms to acquire 5,907 PLDT towers for PHP77 billion.

Business World Online. (October 2022). New BOT Law IRR in effect.

Business World Online. (November 2022). San Miguel unit starts tender offer for minority shares in Eagle Cement.

Business World Online. (November 2022). National strategy for logistics industry due in December.

Company Profiles. Retrieved from www.bloomberg.com.

Department of Finance. (December 2022). Revised BOT Law IRR allowing PPP-driven economic transformation now in effect.

Divina Law. (August 2022). IRR on the Amendments to Philippine Retail Trade Law.

EQT. (October 2022). EQT combines with BPEA to capture growth opportunities in Asia.

Global M&A Trends. Retrieved from www.pitchbook.com.

HKTDC Research. (March 2022). Philippines: Government relaxes investment law to boost tech sector.

IFLR. (March 2022). M&A Report 2022: Philippines. Retrieved from iflr.com

Industry Data. (2022). Retrieved from www.fitchconnect.com.

Inhouse Community. (2022). Philippine M&A: Trends, Challenges and Opportunities.

Inquirer. (August 2022). Globe Telecom sells 5,709 towers for PHP71 billion.

Inquirer. (October 2022). MVP moves on from Naia privatization amid PPP revival.

Investment Banking Scoreboard: M&A Data. Retrieved from www.graphics.wsj.com.

M&A Data. Retrieved from www.mergermarket.com.

M&A Data. Retrieved from www.spglobal.com.

M&A Highlights. Retrieved from www.dealogic.com.

National Economic and Development Authority. (September 2022). Ph To Benefit From Financially Viable Ppp Projects With Revised Bot Law IRR. Retrieved from www.neda.gov.ph

Philippine News Agency. (September 2022). PCC sets new threshold for mergers, acquisitions notification. Retrieved from www.pna.gov.ph

Philippine News Agency. (October 2022). PPP Act eyed to boost public-private projects. Retrieved from www.pna.gov.ph

Philstar. (May 2022). Philippines e-commerce deals to hit PHP500 by 2025.

Philstar. (November 2022). Demand for telco towers on the rise.

Philstar. (December 2022). More foreign insurers eye presence in Philippines.

PortCalls. (November 2022). DTI launching National Logistics Strategy in Dec.

Reuters. (September 2022). Dealmakers eye China divestments, rise of India and SE Asia as M&A pipeline shrinks.

Reuters. (September 2022). Funds flock to Southeast Asian startups as China loses sheen

Rimon Law. (August 2022). Energem Corp. announces signing an agreement to purchase Graphjet Technology.

Sembcorp Marine. (October 2022). Sembcorp Marine to effect proposed combination with Keppel O&M via a direct acquisition with improved terms

The Manila Times. (September 2022). Marcos pushes for more PPP projects.

The Manila Times. (June 2022). New laws to attract more investors.

World Bank. (December 2022). Philippines Economic Update: Bracing for Headwinds, Advancing Food Security.

World Bank. (June 2022). Philippines Economic Update: Strengthening the Digital Economy to Boost Domestic Recovery.

Contact us

Mary Jade T. Roxas-Divinagracia, CFA, CVA

Deals and Corporate Finance Managing Partner, PwC Philippines

Tel: +63 (2) 8845 2728

Karen Patricia Rogacion

Deals and Corporate Finance Partner, PwC Philippines

Tel: +63 (2) 8845 2728

Deals and Corporate Finance Senior Associate, PwC Philippines

Tel: +63 (2) 8845 2728

Ianne Gwen Toledo

Deals and Corporate Finance Associate, PwC Philippines

Tel: +63 (2) 8845 2728