In 2023, business leaders finally found the path towards growth and stability amidst the continuing challenges posed by the pandemic, geopolitical conflict, and macroeconomic volatility.

CEOs

%

of CEOs remain positive that their organizations will experience revenue growth in the next 12 months

%

of CEOs are confident about their industry’s prospects for the next 12 months

More businesses recovered from the pandemic, with 83% of CEOs reporting that their organizations had already rebounded. Additionally, 79% of CEOs remain positive that their organizations will experience revenue growth in the next 12 months, while 87% are certain that they will see an increase in revenue within the next three years. This optimism extends to industry prospects, with 83% of CEOs confident about their industry’s prospects for the next 12 months.

Despite the opportunities, businesses face threats from inflation (90%), macroeconomic instability (89%), cyber risks (81%), and supply chain constraints (78%). To mitigate these risks, CEOs are reducing their operating costs (54%) and diversifying their product/service offerings (49%). They are also investing in upskilling their workforce in priority areas (75%) and deploying technology (66%) in their operations.

In order for businesses to thrive, it is also crucial for the Philippine government to take an active role in supporting enterprises, promoting economic development, and removing obstacles to progress. The CEOs believe that the government’s performance in the areas of infrastructure development (62%), forging stronger relationships with other nations (64%), and promoting foreign investments (46%) has been, so far, satisfactory.

With 70% of CEOs doing business with international organizations, it is essential for the government to work towards deepening relationships with other nations. In order to further boost collaborations with other countries, the CEOs suggest that the government should improve the ease of doing business in the Philippines (89%) and improve technology and infrastructure across the country (75%).

01 CEO Pulse

CEO confidence

Key growth drivers of the Philippine economy for 2023

CEOs say that infrastructure development, domestic consumption and the BPO and services sector will be the key growth drivers of the Philippine economy in the next 12 months

Q What do you think will be the key growth drivers of the Philippine economy in the next 12 months?

Government performance

Q In your opinion, in which areas is our government performing well at the moment?

02 Global transitions and greater collaboration

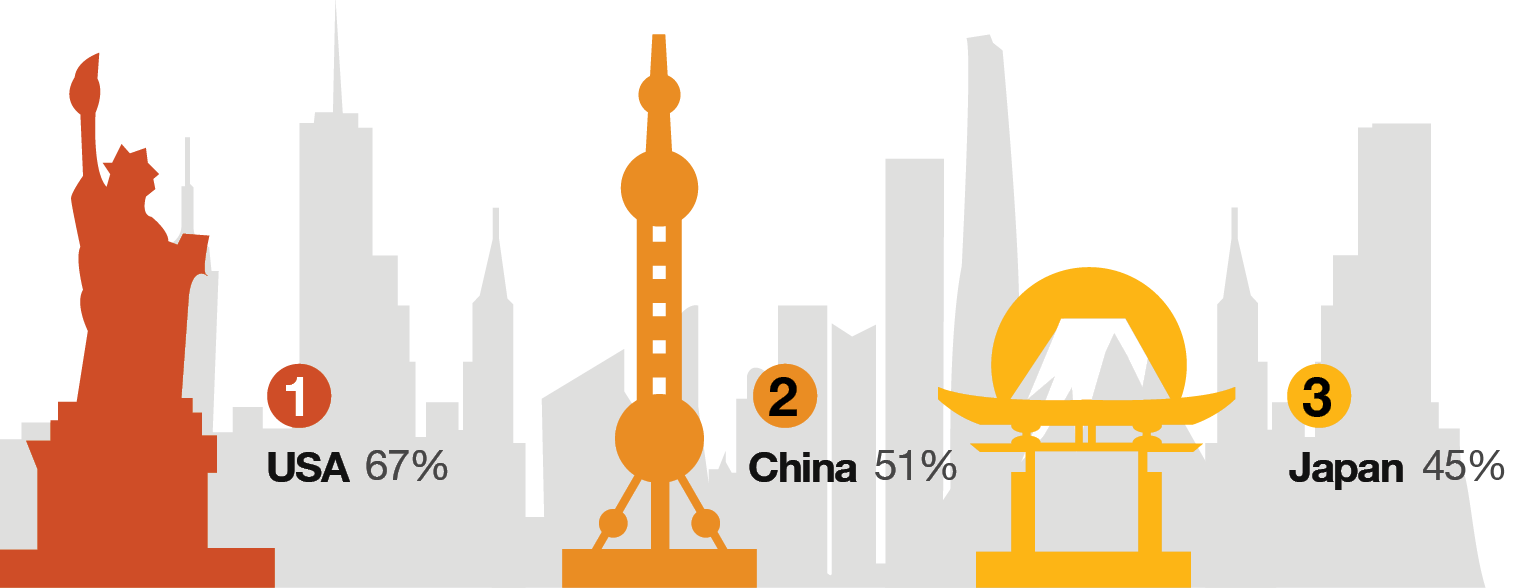

Top 3 important countries for growth

Q Which of the following countries do you consider most important for your company’s overall growth?

Global economy

In Asia, the CEOs say that Vietnam, the Philippines and Singapore are the economies that will perform well in 2023.

Q How do you believe global economic growth (i.e., global real GDP) will change over the next 12 months?

03 Shifting strategies

Pandemic recovery

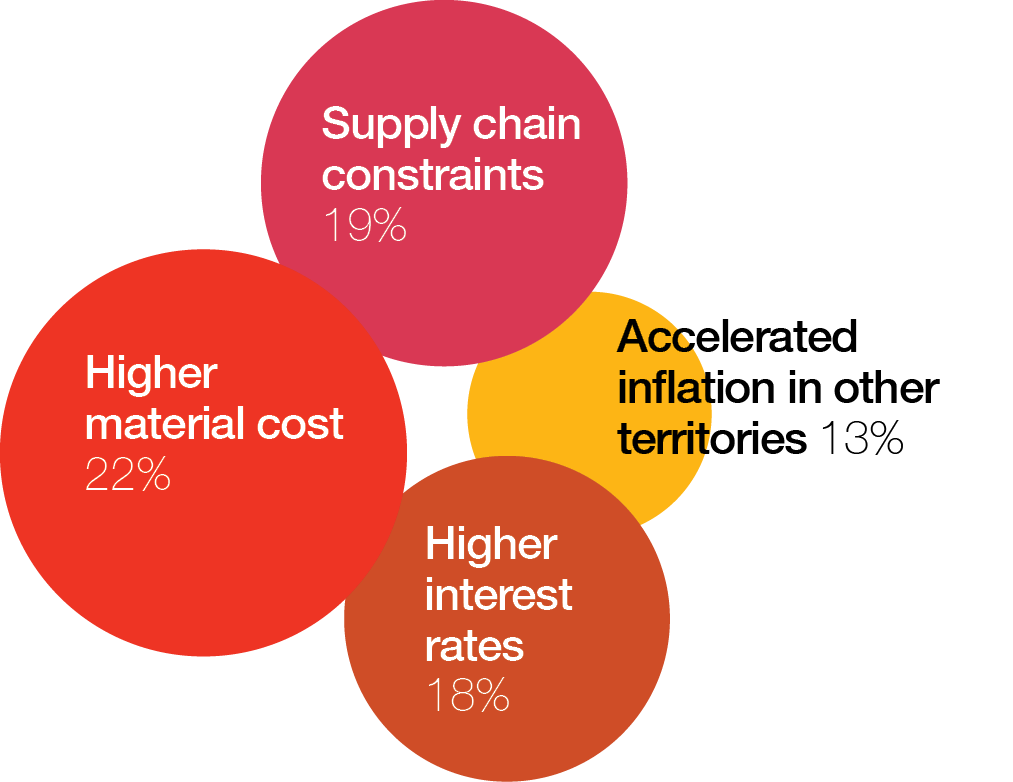

Stumbling blocks towards recovery

Q If 'no', what factors are still negatively impacting your business?

Bouncing back

62% of CEOs believe that their revenues in 2023 will be higher than they were before the pandemic.

22% of CEOs are expecting their revenues to be lower than pre-pandemic levels.

Q In your view, how will your company perform in 2023? (In terms of revenues/sales)

04 The age of unlimited possibilities

Longevity

Talent retention

"MSMEs are the Real Employment generators of the Company. Banks and Other Financial Institutions duly supported by the Government should provide more incentives, ease of obtaining loans and Ease of Doing Business should be given to them.”

"The Philippine economy has strong potential for growth. The new administration has taken significant strides towards renewing its commitment to international trade relations. I look forward to the timely implementation of policy tools and its adequate funding, and enablement of much stronger and sustainable public private partnerships.”

"We need a strong direction from top levels of government and viable policies on key issues such as ease of doing business, forging stronger relationships with other nations, and domestic policy.”

"Many employment challenges will keep depressing the purchasing power of the consumers and the economy. The government’s push for massive infrastructure spending and pull for foreign hard asset investments will help address these challenges in the next few years.”

"If the government fosters transparency and accountability and backs that up by action and commitment, the Philippines will be a tiger economy in no time, and quality of life for all will be accessible.”

"Small businesses and startups persistently encounter obstacles in catering to large enterprises. These challenges do not primarily stem from the inadequacy of our technology or solutions. Instead, they predominantly revolve around the arduous task of gaining access to key decision-makers and influencers who can leverage our offerings, coupled with the stringent procurement process requirements for engaging in business relationships.”

Philippine CEO Survey 2023

Full report

Philippine CEO Survey 2023

Highlights

Subscription

Join our mailing list

Contact us

Mary Jade T. Roxas-Divinagracia, CFA, CVA

Deals and Corporate Finance Managing Partner, PwC Philippines

Tel: +63 (2) 8845 2728

Karen Patricia Rogacion

Deals and Corporate Finance Partner, PwC Philippines

Tel: +63 (2) 8845 2728