Making a choice — for good

Before the enactment of the Tax Reform for Acceleration and Inclusion (TRAIN) bill, the income tax of self-employed and/or professionals was subject to graduated rates of 5-32%. In addition, these individual taxpayers were liable to pay percentage tax even if their gross annual receipts were less than the value-added tax (VAT) threshold of P1,919,500. This was in accordance with Section 116 of the Tax Code, which states that,”any person whose sales or receipts are exempt under Section 109(V) of this Code from the payment of VAT and who is not a VAT-registered person shall pay a tax equivalent to three percent (3%) of his gross quarterly sales and receipts…”

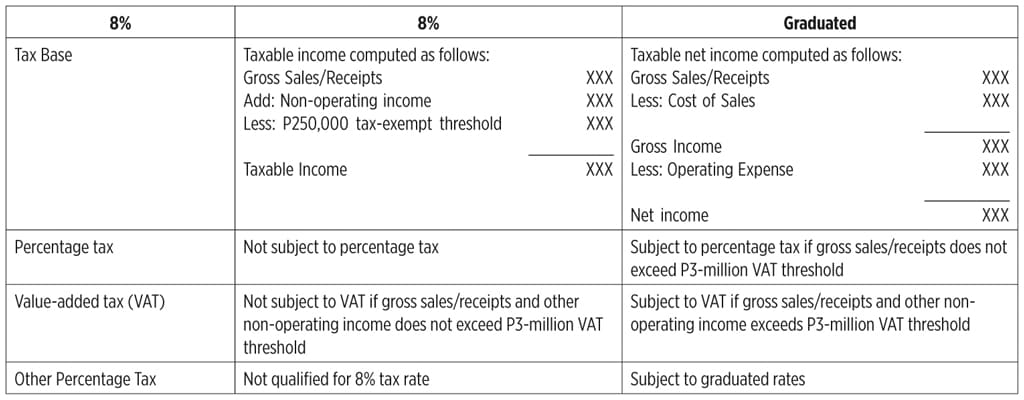

However, with the recent passage of the TRAIN law as implemented by Section 3(C) of Revenue Regulations No. 8-2018, self-employed individuals and/or professionals are now given a choice as to the tax rate to be applied to determine their income tax liability. There are, however, certain considerations that need to be observed before a taxpayer can choose which tax rate to apply. One of the considerations is the new VAT threshold (now increased from P1,919,500 to P3,000,000 per year). If the gross sales/receipts and other non-operating income does not exceed the VAT threshold, the individual taxpayer who is practicing his profession or earning income purely from self-employment, shall have the option to avail of either:

- The graduated income tax rates, under Section (24)(A)(2)(a) of the Tax Code, as amended; OR

- The eight percent (8%) tax on gross sales or receipts and other non-operating income in excess of P250,000, in lieu of the graduated income tax rates under Section 24(A) and the percentage tax under Section 116 under the Tax Code.

A taxpayer who opts to be taxed at 8% is not required to attach Financial Statements (FS) when filing his annual income tax return.

It is important to note that the individual taxpayer must signify his intention to avail of the 8% income tax rate either in the 1st Quarter Percentage and/or Income Tax Return, or in the initial quarter return of the taxable year upon commencement of a new business/practice of profession; otherwise,the taxpayer shall be considered as having availed of the graduated rates. The option to select the flat rate of 8% (or graduated rates) is irrevocable for the taxable year, and no amendment of the option shall be made during the taxable year after the choice is made.

However, if the gross sales/receipts and other non-operating income exceeds the VAT threshold during the taxable year, the individual’s income tax shall be computed using the graduated income tax rates even if he initially selected the 8% income tax rate. In such case, the 8% income tax rate paid in the previous quarters shall be allowed as tax credit. Consequently, the taxpayer shall be subject to business taxes, such as percentage tax and VAT, in addition to income tax.

On the other hand, when a non-VAT taxpayer (i.e., one who has not breached the P3-million VAT threshold) opts to be taxed under the graduated income tax rates, he shall continue to pay the required percentage tax under Section 116 of the Tax Code.

In terms of documentation, a taxpayer who opts for the 8% tax rate needs to accomplish BIR Form No. 1905 (Application for Registration Information Update/Correction/Cancellation) to effect the end date for his VAT or percentage tax registration, and as such, he is no longer required to file VAT or percentage tax returns. If a non-VAT taxpayer is unable to timely update his registration, he shall continue to file a “zero” or NIL percentage tax return with a notation that he is availing of the 8% income tax rate option for the taxable year. In the case of a VAT taxpayer, he will not qualify to avail of the 8% tax rate until he de-registers for VAT.

If the taxpayer earning income from self-employment or practice of profession opts to be taxed at graduated rates or has failed to signify the chosen option of 8%, the tax base shall be the net income.

The option to choose the 8% income tax rate is not available to taxpayers whose business income is subject to Other Percentage Tax.

With the passing of these rules, I would like to believe that the government achieved its objectives to promote a balanced, equitable, progressive and simplified tax system for individual taxpayers. Now that policy prerequisites and conditions have been laid down, the choice is yours.

The views or opinions expressed in this article are solely those of the author and do not necessarily represent those of Isla Lipana & Co. The content is for general information purposes only, and should not be used as a substitute for specific advice.

Contact us

Tax-Client Accounting Services Senior Manager, PwC Philippines

Tel: +63 (2) 8845 2728