The pandemic has shaken up businesses across all sectors and industries. While companies focus their efforts on recovering from business losses and adapting to the new normal of doing business, maintaining robust tax controls and policies should remain a priority. With the government’s need to raise more revenue through tax reform programs and heightened tax enforcement measures, compliance with the tax rules has never been more important.

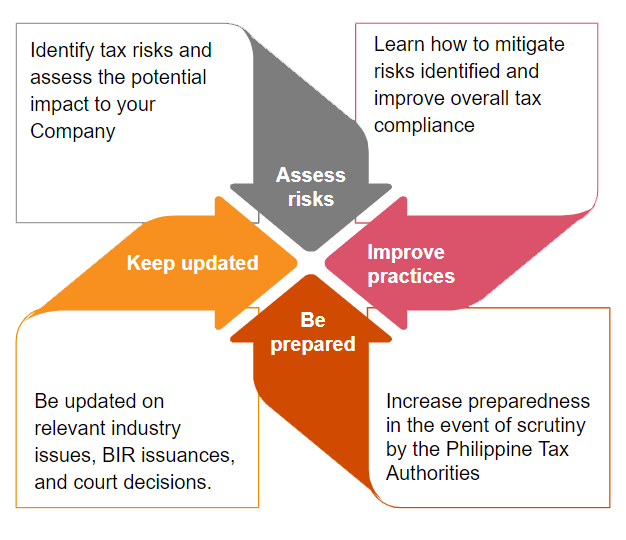

To provide a comprehensive picture of your tax position, our Virtual Tax Health Check offers a deep insight on your tax practices that would help you assess and mitigate potential risks, improve tax compliance, and stay current with the evolving tax rules.

3-step Tax Health Check approach

We shall perform our tax health check following a simplified 3-step approach.

How can PwC help?

We aim to understand your business and guide you through the nuances of tax rules with the help of tax professionals who have extensive experience in your industry.

Contact us

Vice Chairman and Tax Managing Partner, PwC Philippines

Tel: +63 (2) 8845 2728