Pathfinder-inward investor services

Overview

Are you planning to set up a business in Rwanda?

Investors often look to PwC for advice and implementation assistance when they want to set up businesses in Rwanda.

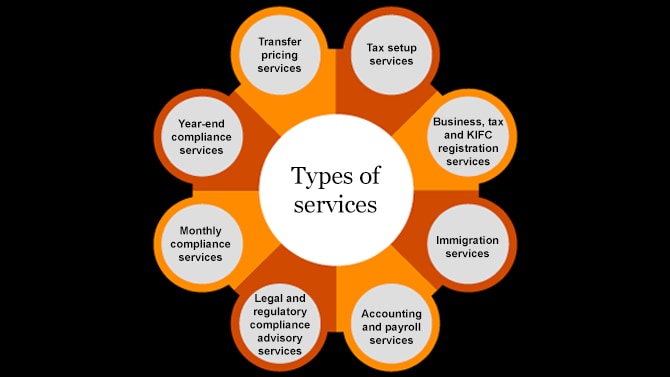

Our specialist Pathfinder team helps investors navigate the practical aspects of legal and regulatory framework, compliance requirements and also support investors evaluate incentives available to them e.g Kigali International Finance Centre (KIFC) membership when setting up a business in Rwanda. The diagram below summarises some of the services offered by our Pathfinder team.

Issues you may be facing

- How to navigate the practical aspects of legal and regulatory framework,

- Compliance requirements and

- Evaluation of incentives available to you e.g Kigali International Finance Centre (KIFC) membership when setting up a business in Rwanda.

How we can add value

- Tax setup advice

- Business, tax and KIFC registration

- Immigration services

- Accounting and payroll services

- Legal and regulatory compliance advisory services

- Monthly compliance services

- Year-end compliance services

- Transfer pricing services

Tax setup advice

We advise on initial structuring of your investment, profit repatriation options, tax incentives, legal, regulatory, taxation and administrative environment and compliance matters.

Business, tax and KIFC registration

We can assist you with: registration of a company or a branch; activating your tax registration with the RRA; registration of the entity with the RSSB; and support you with registration with KIFC.

Immigration services

We can assist you with work permits and Visa applications and renewals/ extensions as well as Alien ID registrations for your foreign employees and their family members.

Accounting and payroll services

Accounting services includes the following: preparing your accounting records; preparing monthly management accounts; preparing year end financial statements; and preparing audit schedules. Our payroll services advising on the tax due on benefits provided; and providing advice on tax equalization and hypothetical tax calculations.

Legal and regulatory compliance advisory services

Our Legal and regulatory compliance advisory services include: regulatory compliance, business establishment, company secretarial services, labour law advice, trainings, internal business reorganisation, joint ventures and M&A.

Monthly compliance services

Our monthly compliance services include: preparing monthly VAT and WHT computations; filing monthly VAT and WHT returns; and paying monthly VAT and WHT.

Year-end compliance services

Our year-end compliance services will include preparing the CIT computation, filing the CIT return with the RRA and filing the annual return with the Office of the Registrar General.

Transfer pricing services

Our transfer pricing services include:review of the TP documentation; assistance with the preparation of the TP policy; benchmarking of intercompany transaction; and benchmarking of interest income.