Corporate Tax Flow

Although many areas of finance and taxes have already been fully or partially automated by companies in Slovakia, corporate income tax (CIT) calculations are still mostly prepared manually. Many companies use self-drafted calculations in Excel, with separate workings outside the calculation and many additional manual steps. CIT return forms are often typed manually on the web portal of the financial administration.

In contrast, the overall market trend is moving towards automation:

- Digitalisation and automation in all tax areas. The aim is a single data input while using this data for multiple reports and years.

- Many countries, including Slovakia, have declared their goal to adopt Cooperative Compliance in future. The concept brings advantages and benefits to taxpayers whose tax affairs and processes are under control and well documented.

- Data archiving is needed to be compliant, which requires transparency, accessibility and tracking.

How we can help

Tax and Business Assurance teams at PwC Slovakia have developed a solution which automates end-to-end CIT compliance.

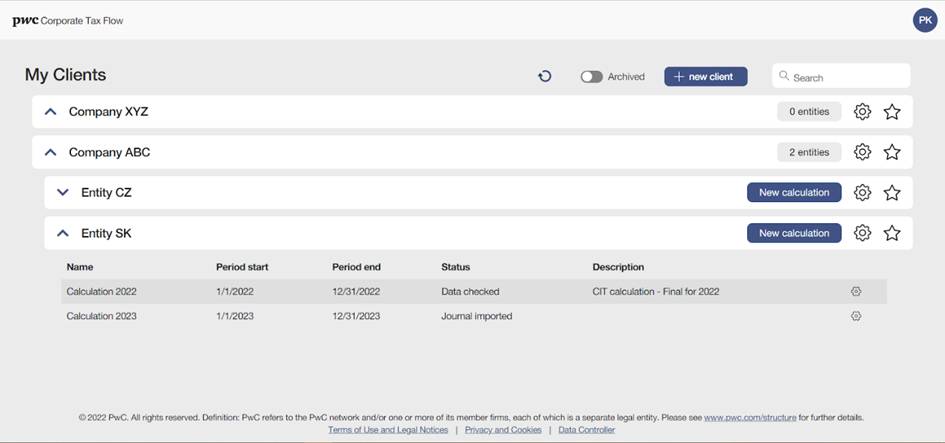

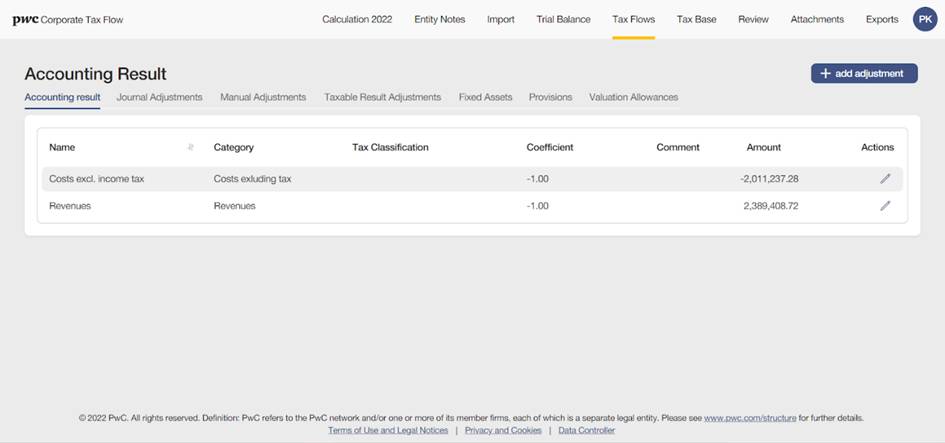

Corporate Tax Flow is a web application which uses a single user friendly environment during the whole CIT compliance process. Corporate Tax Flow collects all information on source data, tax adjustments, comments, approvals and outputs in one package.

The solution can be used in the year-end CIT compliance process, tax provisioning and monthly tax estimates. Roll-forward functions, automated updates of tax adjustments based on updated financial data, and account tagging ensure automated, fast and transparent CIT return preparation. The data can be archived and used in the future to trace adjustments made.

Corporate Tax Flow

Corporate Tax Flow is now accessible for you as software as a service.

Benefits of the solution

The main differentiators of the Corporate Tax Flow compared to traditional CIT calculation preparation are as follows:

- Tax adjustments are calculated at a transactional level, i.e. all accounting entries for the tax period are available for further analysis in Corporate Tax Flow (compared to general ledger balances adjustments used in the past). This approach provides transparency and a full audit trail of changes. A transactional approach is in line with the tax authorities approach to tax audits, and saves time when preparing files for tax auditors. We believe it will be an essential element of cooperative compliance in the future.

- Tagging of accounts automatically identifies items which are tax non-deductible by nature.

- Automatic update of adjustments and reports in the event of changes to source data. You do not need to update items increasing and decreasing tax base, these are linked to the source data and updated automatically.

- Several automated cross-checks and analytical controls are implemented.

- Internal and public comments to tax adjustments and transactions allow you to make a note of items for your internal reference which may not be visible for external users (e.g. tax advisors, auditors, tax inspection).

- Several levels of access rights ensure that changes are locked for editing once approved by the authorised person.

We are still working on the development and enhancements to Corporate Tax Flow. We will be adding the following features:

- Roll-forward functionality - the solution will propose tax adjusting items for accruals and valuation allowances based on the trial balance and a previous period CIT calculation.

- Deferred tax calculation linked to CIT calculation based on a classification of temporary vs permanent tax adjusting items.

Example of the solution

Pricing

EUR 5,000 / entity*

* The basic price can be adjusted based on your access to the tool, cooperation with PwC during preparation of the CIT return, your involvement in the testing process and other criteria. Please contact us for a tailored fee quote for your company.