2022 Double Tax Treaty Update

14/01/22

Ukraine is actively broadening its network of double tax treaties ("DTT") and is amending the provisions of existing ones. Below, we provide a quick overview of changes taking effect this year and what to expect next.

Changes taking effect from 01 January 2022

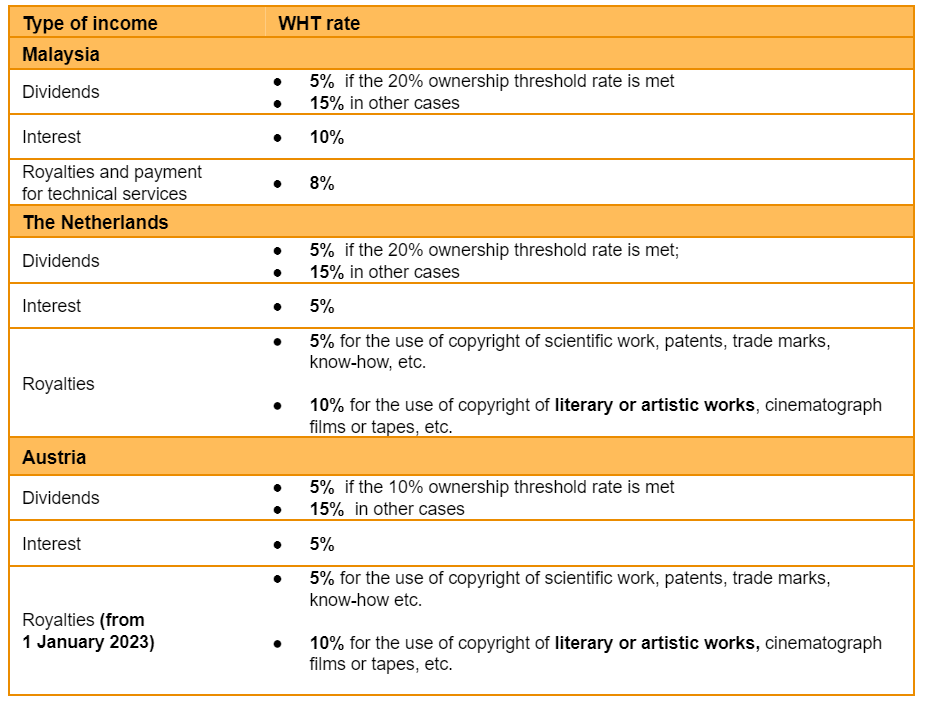

In 2021 Ukraine finalized the ratification procedure of the DTT with Malaysia and the Protocol to the DTT with the Netherlands. In addition, the Protocol to the DTT with Austria entered into force in 2021. Thus, starting from 1 January 2022, Ukrainian taxpayers should apply the following withholding tax ("WHT") rates upon making payments to their counterparties from Malaysia, the Netherlands, and Austria (except for royalties).

In addition, more countries finalized the ratification of the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting ("MLI"). Thus, the number of Ukrainian DTTs modified by the MLI is increasing. Starting from 1 January 2022, the principal purpose test ("PPT"), which is one of main MLI changes, became part of the DTTs with the following jurisdictions: Croatia, Estonia, Greece, Hungary, Pakistan.

As a reminder, the PPT stipulates that the tax authorities may deny treaty benefits, e.g. reduced WHT rates, if there are sufficient reasons to conclude that the principal purpose or one of the principal purposes of the particular transaction / arrangement was to obtain those treaty benefits.

Ratification in progress / awaiting ratification

In 2021 Ukraine ratified the Protocol to the DTT with the United Arab Emirates (“UAE”). However, the new treaty has not entered into force yet as the UAE has not completed the ratification procedures.

The new DTT with Spain is already signed, but Ukraine has not ratified it yet. In addition, the Protocols to the existing DTTs with Denmark and Qatar are waiting for both treaty countries to launch the ratification procedures.

Awaiting signings

Ukraine also plans to sign the DTTs with Oman and Sri Lanka. The respective texts of the DTTs are already approved by the Government of Ukraine for further signing.

We will continue monitoring the developments in the international tax area and keeping you updated.