The role of the finance function grows more varied and demanding by the year and has never been more challenging.

PwC has vast experience in helping its clients formulate an appropriate approach to introduce finance function changes. With our help, finance function will start to mutually influence control elements, costs and efficiency in direct relation to the business strategy and at the same time will help create a structure and culture that reacts to changing environment.

We assist our clients in improving efficiency and productivity of financial and accounting sectors. Our knowledge and experience in finance and accounting as well as our organisational and technical knowledge can help improve basic competence in processing and reporting as well as enforce the finance function in supporting business decisions and organisation strategy development.

Vasyl Karavan

Partner

What do we specialize in?

Benchmarking and Finance function strategy development

- Assessing the Company’s current performance against similar companies of comparable scale and complexity, which gives a Company a clear understanding where it should focus its efforts while reshaping a finance function.

- Providing help in creation of vision for a finance function that supports the Company’s corporate strategy’s implementation, as well as corresponds to the functional strategies of other corporate divisions (IT, HR, Purchases).

- Developing target operating model that encourages interaction and creates the right conditions for change in the age of rapidly evolving technology and shifting consumer behaviour.

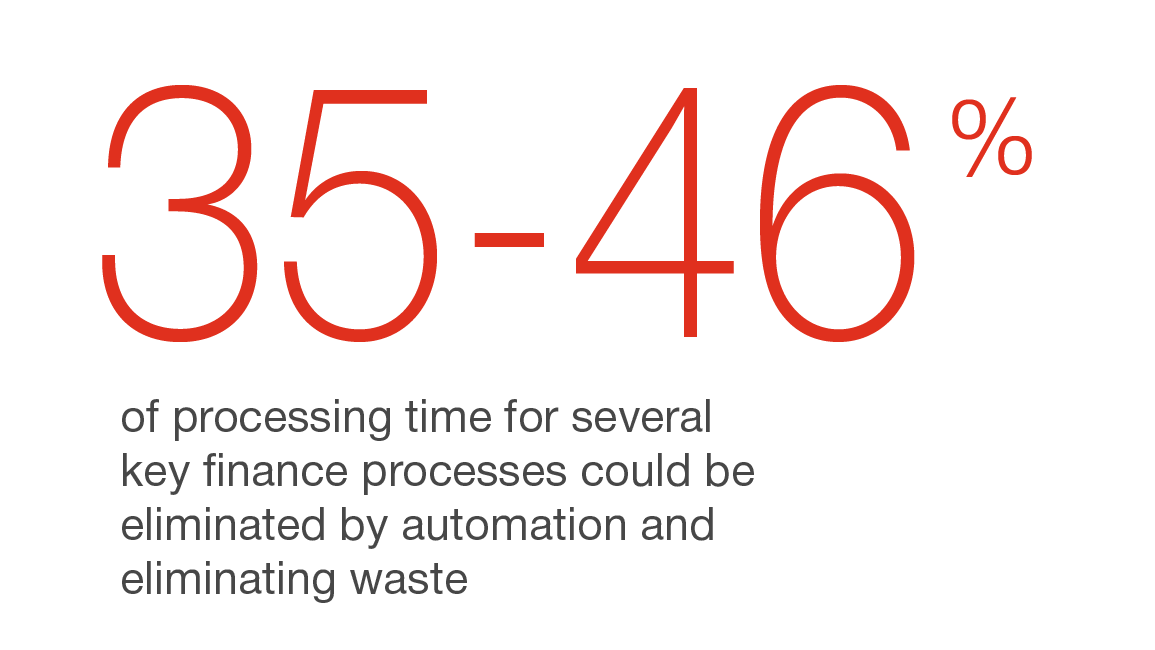

Finance function diagnostics and transformation

- Performing 360° diagnostics of the Company's finance function to assess its current status, including how it compares to best practices.

- Reviewing the finance function controlling standards, processes, data, organisation, human resources as well as systems and basing of this, developing streamlined financial function structure.

- Developing sound finance business processes.

- Assessing and reshaping key performance indicators (KPIs), services, metrics and integration points.

- Evaluating key competencies, developing the most appropriate functional and organisational structures.

- Modelling finance function on the basis of best practices consistent with strategic and operational goals.

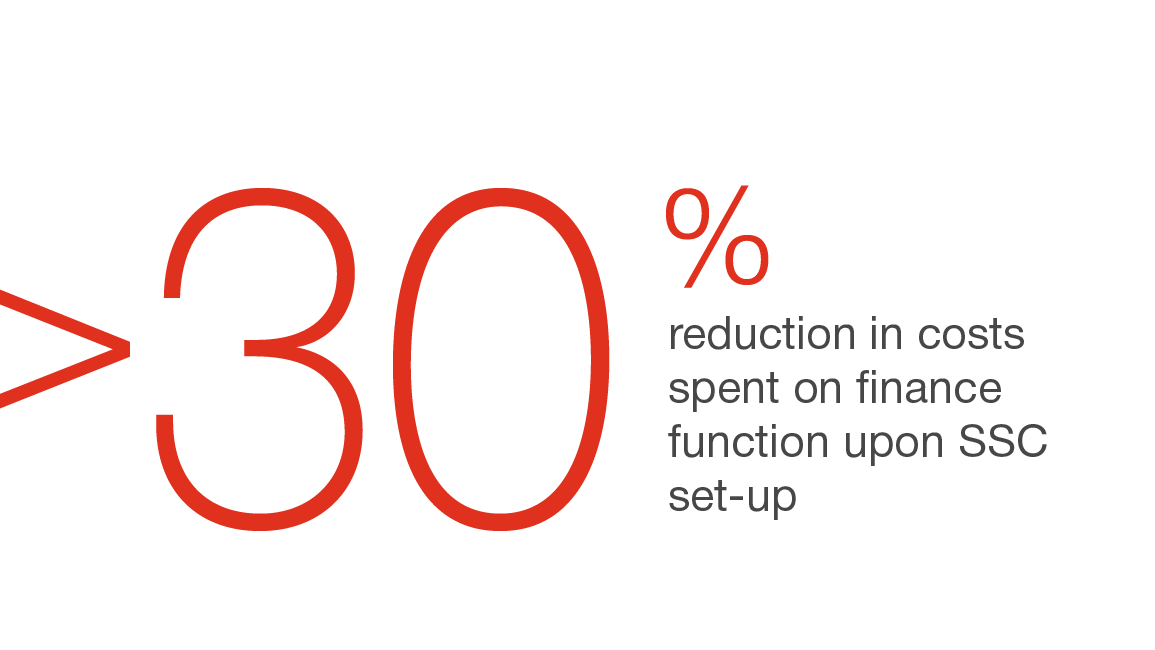

Finance Shared Services and Outsourcing

- Development of SSC strategy, which corresponds to the Company’s long-term strategy and goals.

- Performing feasibility study and creating an SSC operating model framework, including recommendations on the location, organisational structure, process split, technology and SLA/OLA.

- Developing an SSC implementation plan, which includes detailed SSC operating model elements, performance indicators and detailed structure for calculating SSC staffing.

- Creating an approach for the Companies’ move to SSC, as well as a general transition plan with clearly shown strategy, communication channels, IT solutions, training plans and materials for staff, supporting in SSC implementation.

- Optimising implemented SSC operating model and processes.

- Performing HealthCheck to assess the maturity of existing SSC organisation and identify improvement opportunities.

Financial planning, budgeting, forecasting and management reporting

- Designing / optimising budgeting, forecasting and planning processes, models and procedures.

- Developing management reporting models.

- Defining objective, responsibility and effectiveness of business processes assessment system.

- Developing Company’s strategy implementation measurement models in relation to KPIs (e.g. Balanced Scorecard).

- Advising on development of data model concepts and architecture of applications that support the control and reporting of results. Assistance in the analysis and selection of systems supporting result management.

- Developing and implementing value creation measurement system.

Treasury optimization

- Performing detailed analysis of the Company’s current treasury model comparing it to the best practices, and developing a target operating model with the indication of the treasury’s role, functions and level of centralization.

- Examining the Company’s current cash / liquidity management model, and developing improvements for the liquidity forecast system, process of raising finance, corporate rules and regulations.

- Developing a detailed payment calendar implementation plan, assisting in selecting IT solutions for the automation of a treasury function.

- Analyzing the impact of financial risks on the Company’s operations, and advising on the implementation of the financial risk hedging strategy and mechanisms.

Accounting, consolidation and financial reporting performance improvement

- Developing and implementing methodology of reporting system.

- Developing and implementing methodology of transition to IFRS or other accounting standards (restatement and consolidation of financial statements).

- Defining functional requirements for IT systems specifically tailored and customised to your business needs, adapting and developing accounting and IFRS reporting procedures / regulations to the changes in IT systems.

- Introducing own methodology developed in house to shorten the period of time required to prepare financial and management statements and to improve their quality.

SmartClose

- Accelerating the closing process in order to achieve more timely and accurate financial and/or management reporting.

- Optimization of methodological approaches, development of policies and procedures.

- Support in implementation of IT solutions.

- Streamlining organisational structures and SmartClose processes.

Finance business partnering

- Analyzing a current state and role of the Company’s finance function.

- Developing an ambitious model of finance business partnering which is aligned with the Company’s strategy and goals.

- Preparing a detailed description of business partner profile applicable to the Company’s finance function, ensuring it is actually focused on the right things.

- Creating a roadmap for the Company to achieve a role of business partner, providing support during the transition process.

Finance IT implementation

- Performing detailed analysis of IT solutions used by the Company’s finance function, defining inefficiencies in IT systems and their integration.

- Advising on adoption of new and innovative technological solutions to Finance which will help the Company’s finance function achieve its goals, increase efficiency, reduce costs, and dramatically improved analytical capabilities.

- Transform the Company’s finance function operating model to be in line with the new IT software implementation.

Contact us