With sanctions landscape evolvement it becomes more crucial for financial institutions to ensure that their sanctions’ screening systems are well-functioning and can help with identification and prevention of transactions involving sanctioned entities and individuals. To ensure the efficiency of the sanctions’ screening systems a regular testing should be conducted.

Testing of a sanctions’ screening system is a complex process that requires a data selection, preparation and formatting, test execution, results matching and test results further evaluation.

We at PwC have taken our extensive experience with sanctions’ testing and built an easy to use Sanctions Testing tool that accelerates such testing process. We use this web-based tool on client engagements, and also offer it to our clients as a subscription or licence product, so they can use it to test their sanctions’ screening system whenever they feel the need.

How do I know that my sanctions' screening filter is working correctly?

The challenge of today

Financial institutions need to have a nuanced understanding of their sanctions screening filter performance in order to identify the level of risk that they may face.

The impact of analytics

Ability to continuously test the filter on real sanctioned names gives financial institutions more clarity as to their potential exposure to risk.

The bottom line

Test results allow the financial institution to perform further optimization of the filter and increase its efficiency.

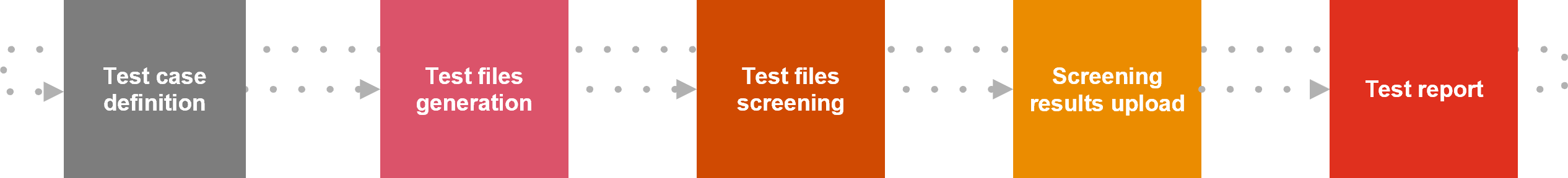

Our approach

Design a tailored test case that includes all the key relevant lists, entity types and fuzzy algorithms

Generate test data containing sanctioned terms in required transaction and customer formats

Process the test data through organization’s sanctions filter and further upload to the sanctions’ testing tool

Analyse the performance of you filter and it’s KPIs through multiple dimensions

Development of recommendations on addressing identified issues and re-testing the filter afterwards

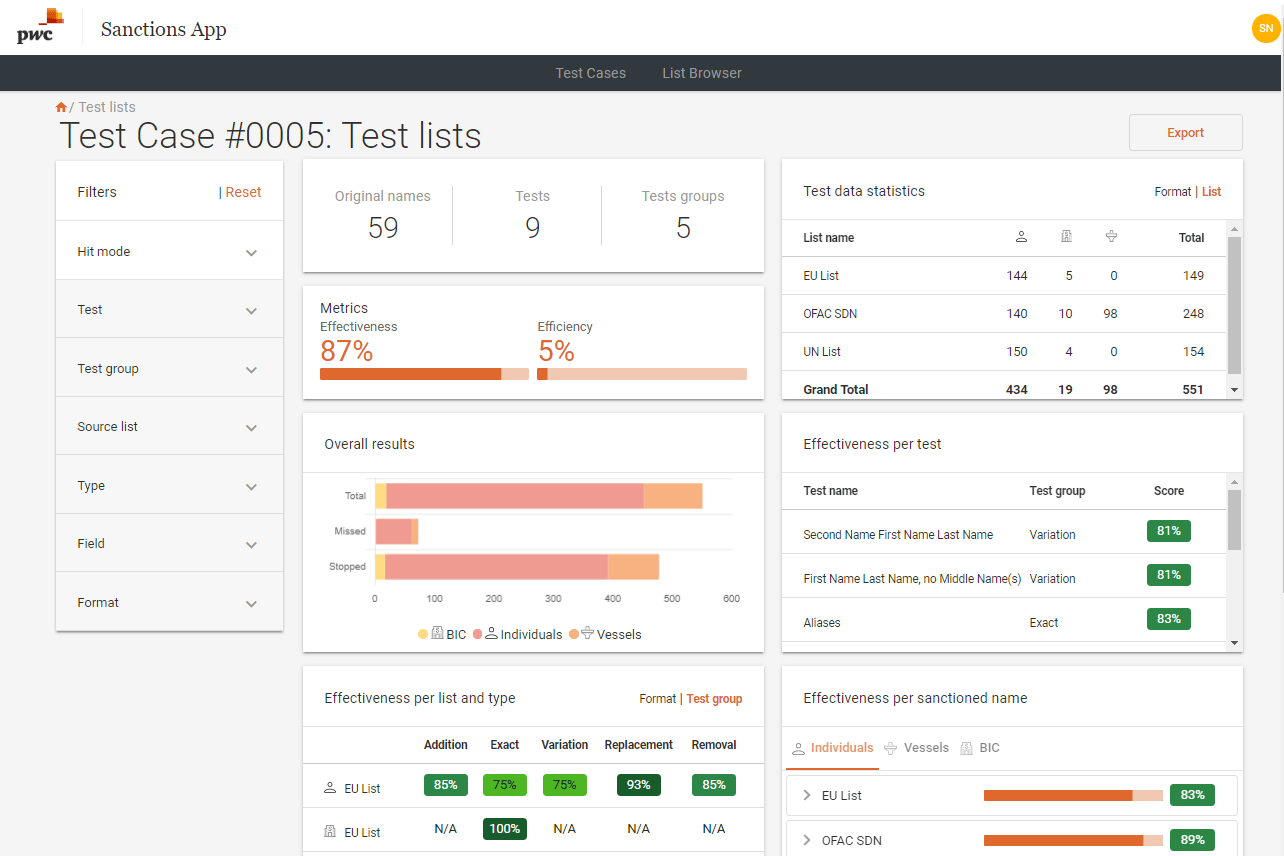

Illustrative Case Study

Experience the tool

Through the use of our tool, we were able to bring value by identifying many different problems that occurred in the tested sanctions' screening system, such as:

- List Management issues where the lists were not being updated correctly or an incremental update was missed;

- Very high effectiveness in exact matching, but very poor performance on even the slightest derivation of the sanctioned name;

- Improper configuration of screening formats where fields were screened only for individual names whereas entity names could appear in those fields as well;

- Issues in the screening of names that contained special characters such as apostrophes or plus signs, or names containing more than five words.

Contact us

Oleksii Vengerskyi

Senior Manager, Forensic Services, PwC Czech Republic

Tel: +420 739 344 766

Andriy Tretyak

Director, Forensic and Financial Crime Leader, PwC in Ukraine

Tel: +380 44 354 0404

Vadym Romaniuk

Senior Manager, Head of Banking and Finance practice, Attorneys' Association "PricewaterhouseCoopers Legal", Ukraine

Tel: +380 44 354 04 04