Auto finance

For decades, the automotive finance industry has been ready for change. Could it finally be here?

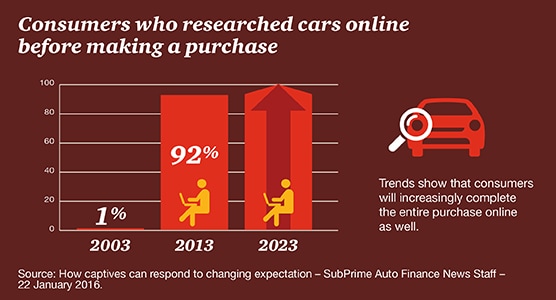

While many business fundamentals remain the same, other aspects of the industry are transforming at the fastest pace in decades. For years, a familiar group of established captives and lenders have dominated the industry based on buy rates, credit risk appetite and dealer service. Instead, a new group of alternative lenders and alternative transportation providers (led by business strategies more akin to Silicon Valley start-ups) are disrupting the status quo. By putting the consumer back in the driver's seat, they are empowering consumers with innovative mobility and transparent financing alternatives. Technology is redefining the automotive sales and finance landscapes.

The evolution of such mobility and financing options coupled with increasing regulatory oversight, operational risk management and consumer expectations are dramatically changing the rules of the road, forcing industry participants to redefine and adapt to their business approaches.

How PwC can help

- Strategy

- Risk management

- Regulatory compliance

- Auditing and accounting

- Operations

- Technology

- Customer experience

- Mergers and acquisitions

Strategy

As megatrends converge they have the potential to create a perfect storm that requires careful navigation. As a result, we are now seeing leading auto lenders and dealer groups revisiting their business strategies and seeking ways to prepare for these challenges and embrace related opportunities. PwC, with its broad experience in understanding industry disruption and megatrends, is best placed to assist executives in developing effective business strategies. The following examples demonstrate how PwC assists our clients:

- Strategic vision: Assisting with the development, validation, and analysis of forward looking strategy, growth objectives and plans whether as a new market entrant or established participant.

- Collections: Customer segmentation and dialer strategies to enhance collections efficiency and effectiveness.

- Dealer segmentation and scoring: Analysis of dealer performance and tiering to recommend ideal dealer segmentation to ensure competitiveness.

- Pricing: Design, review and implementation of pricing elasticity and optimization models. Product strategies: Developing and reviewing product strategies that launch efficiently and yield effective results, product launch implementation and management.

- Target operating model: Assessment, design and governance of organizational operating models.

- Social: Alternative data and social media analytics and marketing strategies.

Risk management

In a world of greater complexity, uncertainty and accelerating change, monitoring and managing risk is a strategic imperative. How an organization monitors, manages and mitigates risk can have direct impacts to the bottom line. We assist our clients with identifying, evaluating, monitoring and responding to the full spectrum of risks in the lending environment including credit risk, market risk, compliance risk, operational risk and reputational risk. The following examples demonstrate how PwC assists our clients:

- Risk assessments: Risk analyses on specific functional areas or processes such as originations, credit and collections.

- Third-party risk management (TPRM): Program diagnostics to identify gaps against leading practices, transformational roadmaps, TPRM office design and execution, technology enablement and third-party assessments.

- Cybersecurity: Lending-specific risk assessments, cybersecurity risk governance frameworks and threat inventory and analysis

- Governance frameworks: Design, establish and review risk governance structures and organizations

- Reporting evaluations and enhancements: Review board and management risk reporting for appropriate level of oversight

- Controls: Designing and implementing internal controls frameworks, performing process reviews and measuring effectiveness.

- Policies and Procedures: Assisting clients with establishing and enhancing policies and procedures across the functional spectrum.

Regulatory compliance

PwC helps clients understand regulatory developments, comply with regulatory requirements, and establish best practices for managing regulatory risk. Our objective is to work with our clients to minimize the costs and disruptions associated with regulatory compliance while maximizing the competitive and strategic opportunities that exist alongside regulatory change. The following examples demonstrate how PwC assists our clients:

- Mock regulatory examinations: Conduct pre-regulatory examination readiness assessments and post examination remediation.

- Regulatory compliance reviews: Analyze compliance program against leading practices for CFPB, FTC, RESPA/TILA, HMDA, QM/ATR, QRM, Basel III, Reg AB, SOX, etc.

- Consumer complaints: Review and/or develop complaint management system.

- Cost reduction: Identify opportunities within compliance management program to lower regulatory compliance costs.

- Technology infrastructure: Perform gap analysis to identify potential technology enhancements, including CMS evaluations to meet regulatory requirements.

- Reporting: Develop robust reporting suite to provide board and leadership with seamless oversight over regulatory compliance.

- Privacy: Identify and implement safeguards to protect sensitive and confidential consumer information to remain in regulatory compliance.

For more information on services, visit PwC’s US Financial services regulatory practice

Auditing and accounting

Finance organizations are asked to respond to ever more complex regulatory, reporting and disclosure requirements in an era of cost containment. Finance leaders are under pressure to quickly operationalize complex standards and develop robust reporting that enables enhanced analysis and decision making. The following examples demonstrate how PwC assists our clients:

- Auditing and attest: Financial statement and compliance auditing (RegAB, USAP, etc) using auditing best practices and in consideration of the latest developments.

- Accounting advisory: Technical accounting advice on US GAAP and IFRS, technical and practical implementation analyses.

- Valuation/Modeling: MSR valuation, model validation and model risk assessments.

- Tax services: state and local taxes, transfer pricing, tax effectiveness, deferred tax assets, FATCA.

- Internal audit: Support through outsourcing or co-sourcing of testing, organizational review.

For more information on services, visit PwC’s US Audit and assurance services

Operations

Consumer finance organizations are facing unprecedented demands and challenges as they strive to meet heightened expectations from customers, investors and regulators while managing costs to generate profitable growth. A successful transformation journey requires a trusted partner who has deep industry knowledge, proven track records in servicing operations and innovative approaches. The following examples demonstrate how PwC assists our clients:

- Process improvement and design: Identifying opportunities to improve processes based on leading practices.

- Default management process improvement: Developing comprehensive, cost-effective and customer-centric default processes that are compliant with today's growing regulatory environment.

- Repossession and settlements: Designing models to identify opportunities for settlement vs. repossession.

- Dealer management: Assessing dealer management strategies including dealer ranking, dealer performance, pricing and incentives.

- Vehicle remarketing strategy: Identifying effective partnerships and inventory management strategies to profitably remarket vehicle inventory.

- Call center management: Assessing call center operations to identify cost reduction opportunities and optimize staff utilization.

- Operational capacity assessment: Assessing resource capacity management and assisting with development of dynamic capacity planning initiatives and tools.

- Outsourcing and offshoring analysis: Assessment of current operations and strategic alternatives for in-house operations.

- Operational and cost benchmarking: Cost studies and benchmarking performed on KPIs and costs for the loan lifecycle

- Policies and procedures: Development and review of operational process documentation

Technology

As the software industry pushes towards concepts such as cloud-based services, big data, private-label branding, and rule-based automation, CIOs and CTOs face decisions as to the strategic direction they will take their company's technology. The following examples demonstrate how PwC assists our clients:

- Software/Vendor selection assessment: Reviewing project requirements, budget, software capabilities/vendor skillsets, resource availability and timeline constraints to assist with the selection process.

- Technology roadmaps: Developing strategic roadmaps for software retirement/development, identifying gaps and providing insight into industry practices.

- Business and technical requirements: Development of requirements for origination, servicing, accounting and other servicing system RFPs, demonstrations and implementations.

- Implementation support: Project management, data mapping, system conversion, testing and other forms of implementation support.

- Reporting & business intelligence: Designing, documenting and implementing data warehouses and/or big data concepts, business intelligence frameworks, data analytics, reporting, scorecards and management dashboards.

Customer experience

Lending institutions are under pressure to understand and respond to the array of emerging regulations developed to create more focus on the customer. Understanding the customer's preferences and addressing their needs efficiently are essential to having a successful customer-centric strategy. PwC can assist in discovering customer insights and turning those insights into actionable intelligence; helping our clients comply with regulatory requirements and also exceeding their customer's expectations. The following examples demonstrate how PwC assists our clients:

- Understanding your customers: Customer journey mapping, voice of the customer strategy development, customer experience strategic assessments, persona development.

- Customer analytics: Lifetime value analysis, lost customer root cause analysis, customer segmentation.

- Customer-centric program evaluation: Program metrics, performance scorecards and management dashboard development.

- Customer complaints: Assessing complaint management maturity, strategic assessments; leveraging complaints to enhance customer experience strategy.

For further reading

Consumer Lending Experience Radar 2015

Mergers and acquisitions

As advisors across the industry, we have developed benchmarking and perspectives on leading practices which we leverage when assisting our clients evaluate acquisitions, divestitures and strategic alliances. Our services span the deal lifecycle from strategy development and target evaluation, through due diligence and execution, to post-acquisition integration. The following examples demonstrate how PwC assists our clients:

- Strategy: Extracting maximum value from merger, acquisition and divestiture activities. Objective advice on value propositions and synergies.

- Due diligence: Financial and operational due diligence work on consumer finance companies and divisions.

- Benchmarking and cost analysis: Benchmarking the cost base and operating models of newly created entities versus industry competitors.

- Post-acquisition integration: Leverage operational and technology expertise to effectively evaluate and integrate technologies and operations.

- Pre-acquisition logistics and planning: Integration program setup and support, including roadmaps, gap analyses and contingency planning.

Contact us

Paul Griggs

PwC US Senior Partner, PwC US

In an era of reinvention, many companies are looking to transform while also building greater trust with their stakeholders. Our purpose and strategy get at the heart of both. Alongside our incredible team, I look forward to building on the firm’s success to serve our clients in new ways and deliver on our purpose.

Peter Pollini

Financial Services Industry Leader, PwC US