{{item.title}}

Watch video

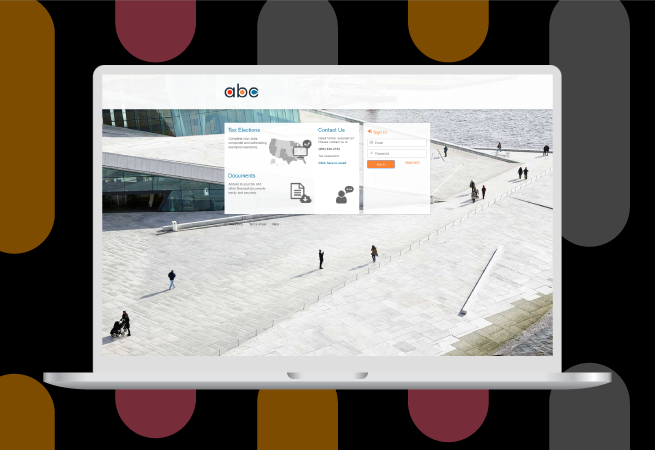

Securely post tax documents and allow investors to log in directly to the portal. An intuitive wizard can help partners navigate complex state rules and make informed individual tax elections.

Streamline tax onboarding, document delivery, plus composite and withholding waiver election processes—in one solution. Partner information is summarized for you and can connect to PwC’s tax preparation tools.

Access our tax and technology knowledge with support from a dedicated team—available to you and your partners. Customize the portal with your branding to help provide a more seamless experience to investors.

Take your tax form collection process to the next level with our tax onboarding module that helps improve the investor experience and can help provide you with better data.

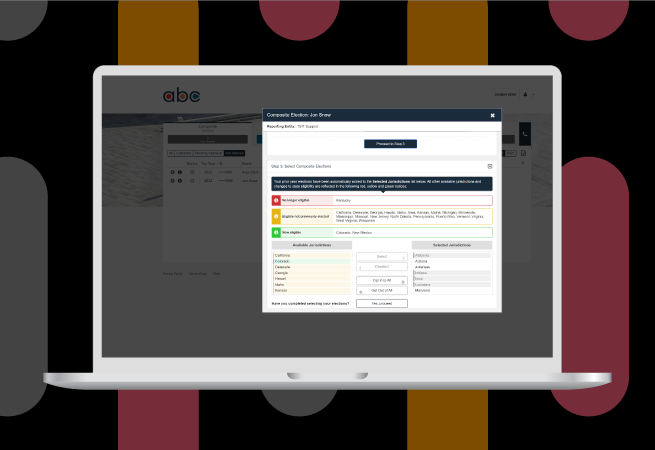

Gather a partner’s elections based on state eligibility rules for residency and entity type. The composite module reports out the aggregated elections you can utilize in compliance processes.

Partners can elect exemption from state withholding in jurisdictions not already elected for composite purposes (if activated), based on state-specific eligibility rules.

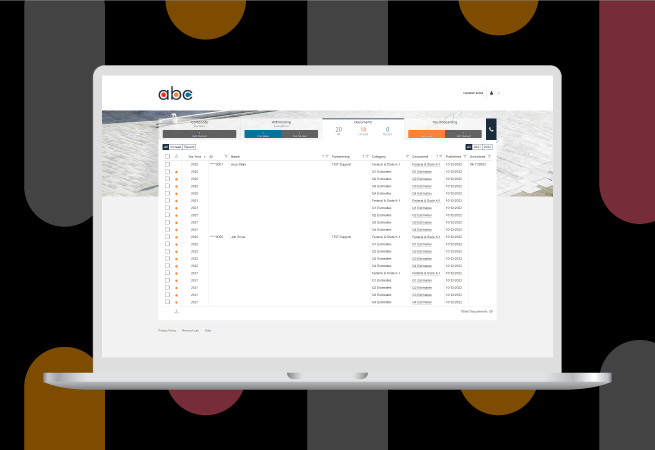

The document delivery module can help provide partners real-time access to their Federal and State K-1s, along with other tax documents.

Our interactive dashboards provide your investors with near real-time analytics on their federal and state tax footprints, helping them to make more informed tax planning decisions.