{{item.title}}

{{item.text}}

{{item.text}}

Leverage real estate as a strategic asset for your business

The competitive business environment has forced organizations to rethink their real estate portfolios and operating models to help improve footprints and enhance location decisions. As a result, companies are able to streamline operations and help increase sales potential, attract and retain top talent, and improve workforce productivity.

This holistic approach demands a transformative process that requires adept management, often highlighting significant inefficiencies in the real estate portfolio that can result in a competitive disadvantage.

Real estate strategy and technology services are a core competency of PwC. We have a global network of over 1,000 real estate professionals around the world. Our team has extensive experience helping organizations formulate an approach that is aligned with their overarching strategy, with special consideration given to the intersections of people, technology, and their built environment. We support our clients through each phase of the real estate life cycle - from strategy to execution.

We can help you reduce ongoing real estate costs to reinvest in your business. With real estate costs often being one of the largest costs for an organization, it is a strategic asset that can be leveraged to control opex, develop talent strategy, and help meet ESG goals.

A successful real estate strategy can reduce your occupancy costs, helping you free up dollars to reinvest into other parts of your business. PwC has helped our clients achieve potential cost avoidance, savings or adjustment through the following levers:

Assess current state

Data, reporting, & technology

Right-sized portfolio

Target operating model

We start by asking “where?”

Our location intelligence professionals can add geospatial science to the data and analytics equation. We use information and help create understanding in ways that aren’t often possible with traditional analytical frameworks and methods.

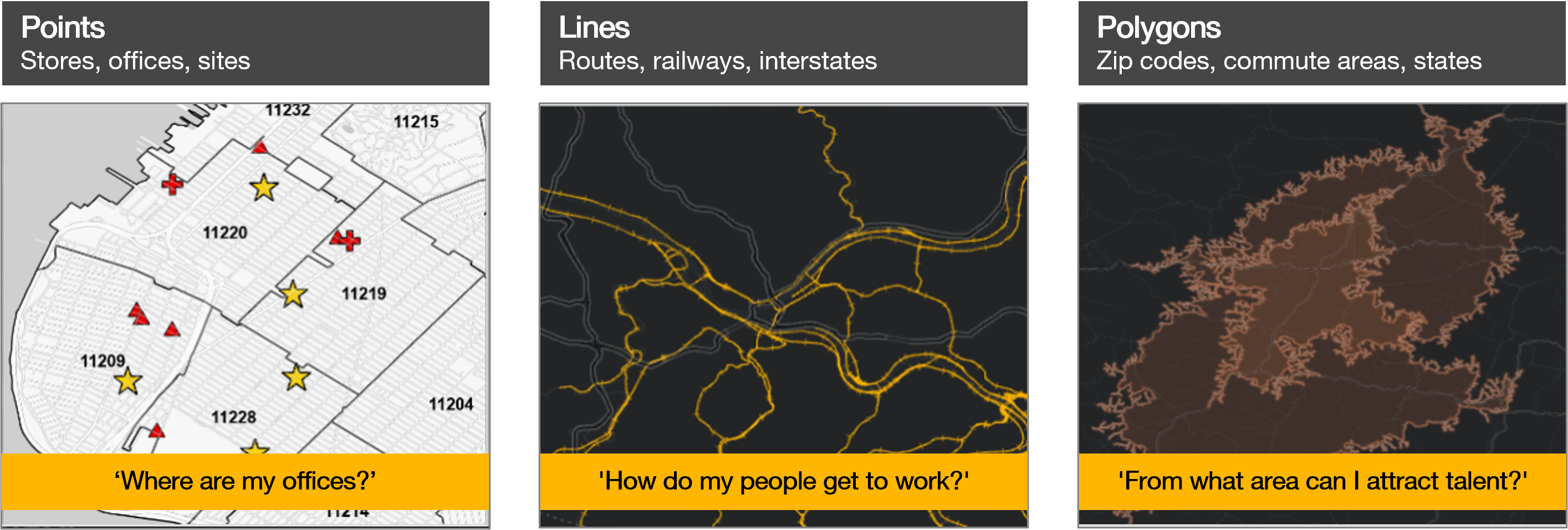

What is “geospatial?”

Spatial information is data associated with a specific geography. This capability—relating data with a place—helps unlock powerful insights.

Our team has helped hundreds of organizations make difficult location decisions—from moving the corporate headquarters, to paring down retail stores, to opening new manufacturing facilities in light of the energy transition, and much more. We have the industry-leading knowledge to help you navigate high-stakes location decisions with the clarity and confidence required to help attain management and ownership buy-in.

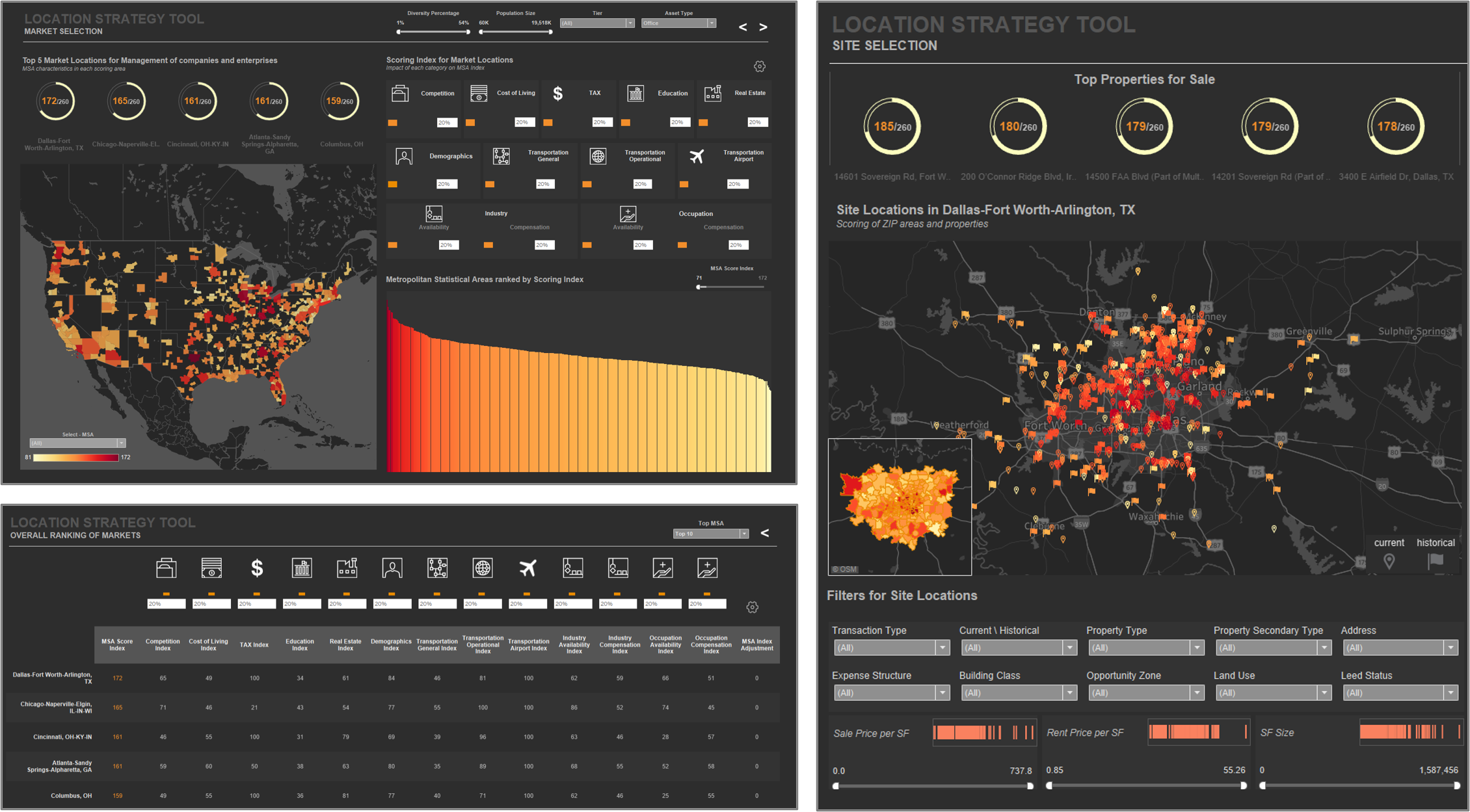

Our Location Strategy Tool

An optimal location strategy allows a company to help deliver cost-effective outcomes, to attract and retain talent and to deliver a company’s strategic vision. Making a well thought out decision rooted in quantifiable methods and integrated with relevant, accurate data can be difficult and time consuming.

Combining PwC’s industry-leading services with our tech-enabled asset location strategy tool has a proven methodology, sustainability criteria, and location strategy knowledge. We can help bring structure and order to a traditionally complex decision making process.

We can help you transform real estate into a strategic asset to grow employee engagement and provide insights on talent.

Your workplace can be an opportunity to show your employees you are listening…

83% of office workers want to work from home at least one day a week, and half of employers (55%) anticipate that most of their workers will do so long after COVID-19 is not a concern.

80% of respondents say their organization’s culture must evolve in the next five years for their company to succeed, grow, and retain the best people.

Based on our experience, we understand that your workplace strategy can be a key talent attraction and retention asset. Your workplace can also act as the physical manifestation of your culture, becoming both a “people and technology” conversation as much as it is a facilities issue.

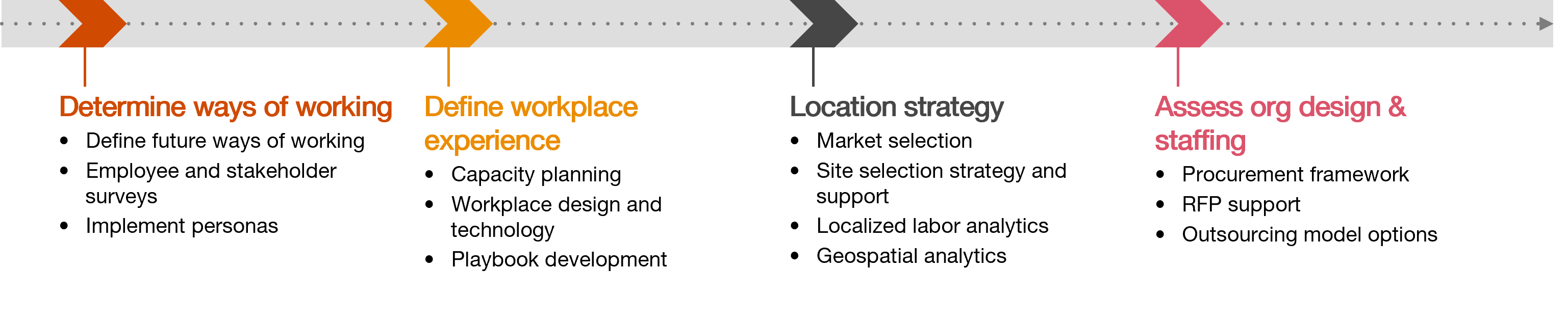

Our workplace solutions

We can help organizations answer a myriad of questions related to the workplace, workforce, and technology so you can develop a clearer vision for tomorrow.

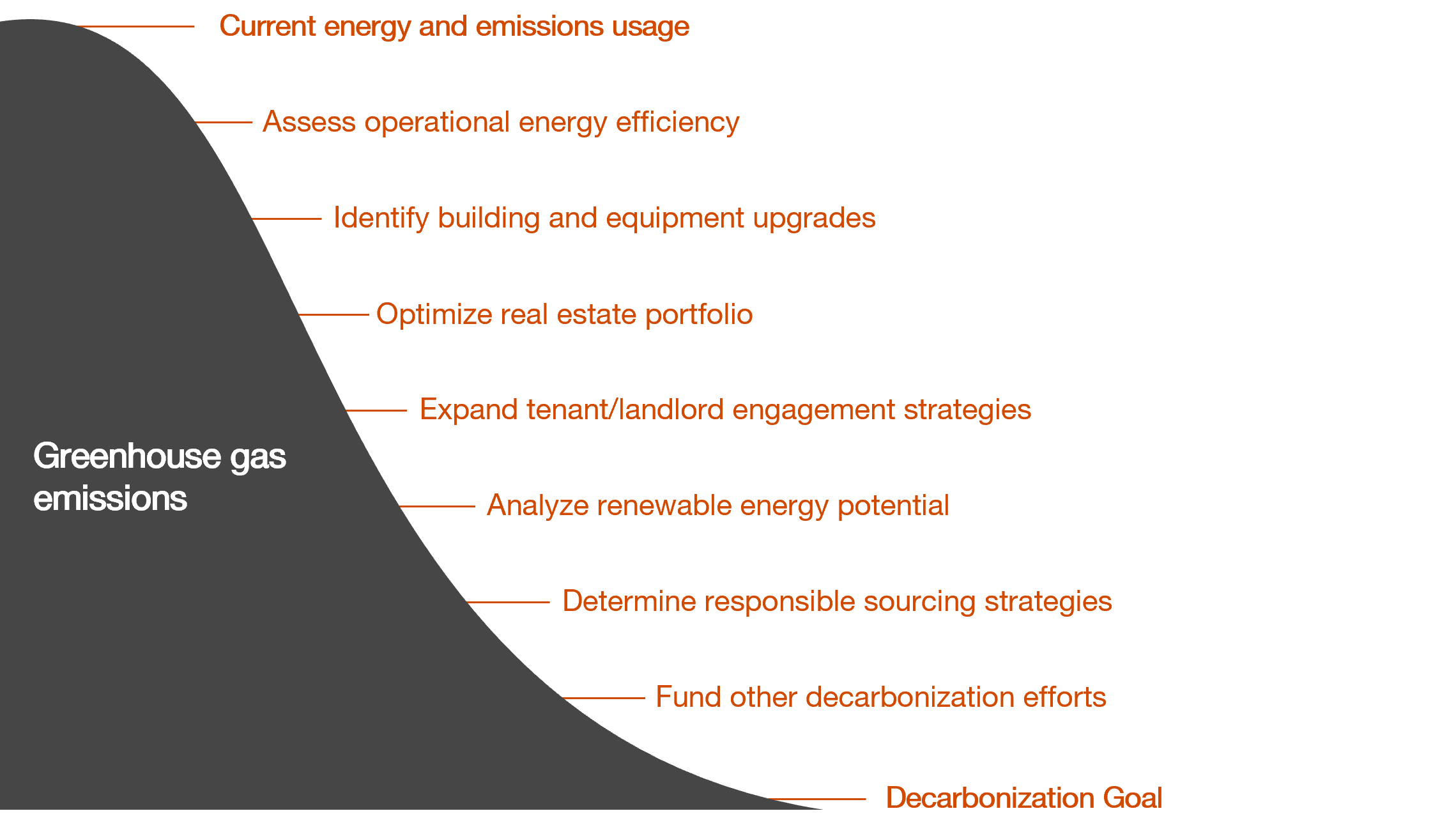

Your ESG and real estate operational goals converge. Building owners and investors can reduce buildings’ energy consumption and emissions in parallel. We have helped our clients achieve a reduction in energy use, which has helped reduce operating costs, meet investors requirements, and create a healthier workplace environment.

Our integrated team of real estate occupier, investment, energy management, and sustainability professionals can:

Sources

1. Davies, Michael. What Is The Average Utility Cost Per Square Foot Of Commercial Property? July 30, 2019.

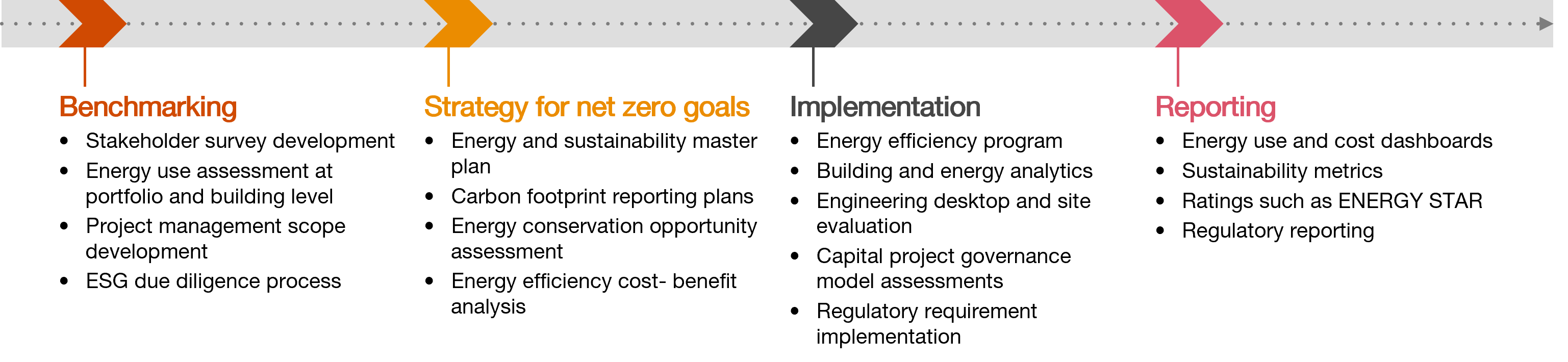

An asset or portfolio level ESG strategy across real estate could be a multistep process. We can help you build a custom approach incorporating the following levers and help you meet your ESG and decarbonization goals across real estate.

{{item.text}}

{{item.text}}

Ed Faccio

Partner, Real Estate Strategy and Technology, New York, PwC US

Erika Ryback

Partner, Real Estate Strategy and Technology, PwC US

Ken Schotl

Managing Director, Real Estate, PwC US

Principal, Real Estate Energy and Sustainability, PwC US

Kevin Fossee

Partner, Real Estate Technology, PwC US